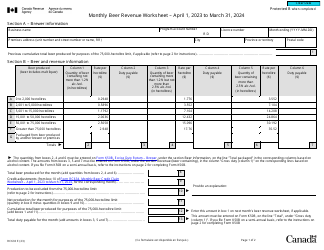

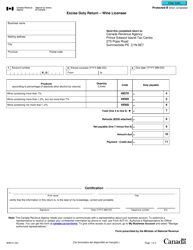

This version of the form is not currently in use and is provided for reference only. Download this version of

Form RC633

for the current year.

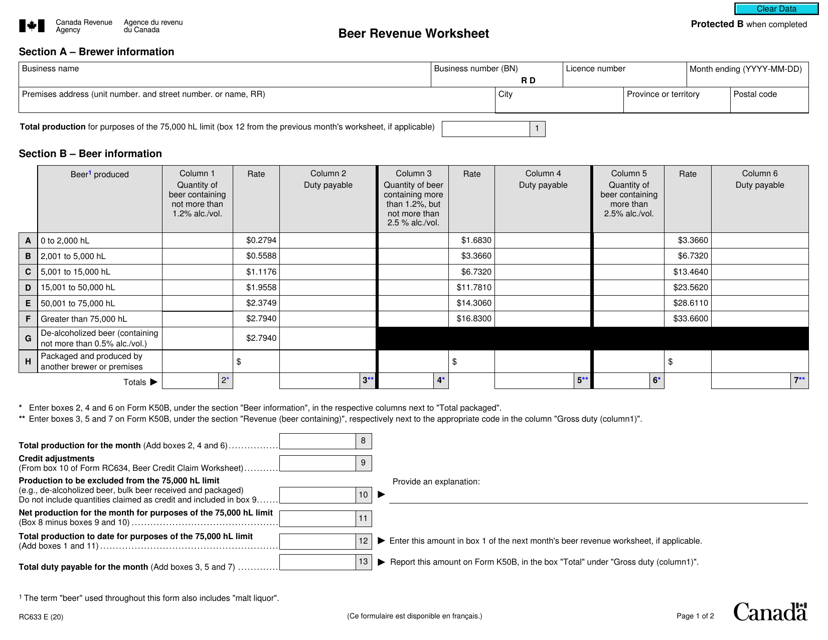

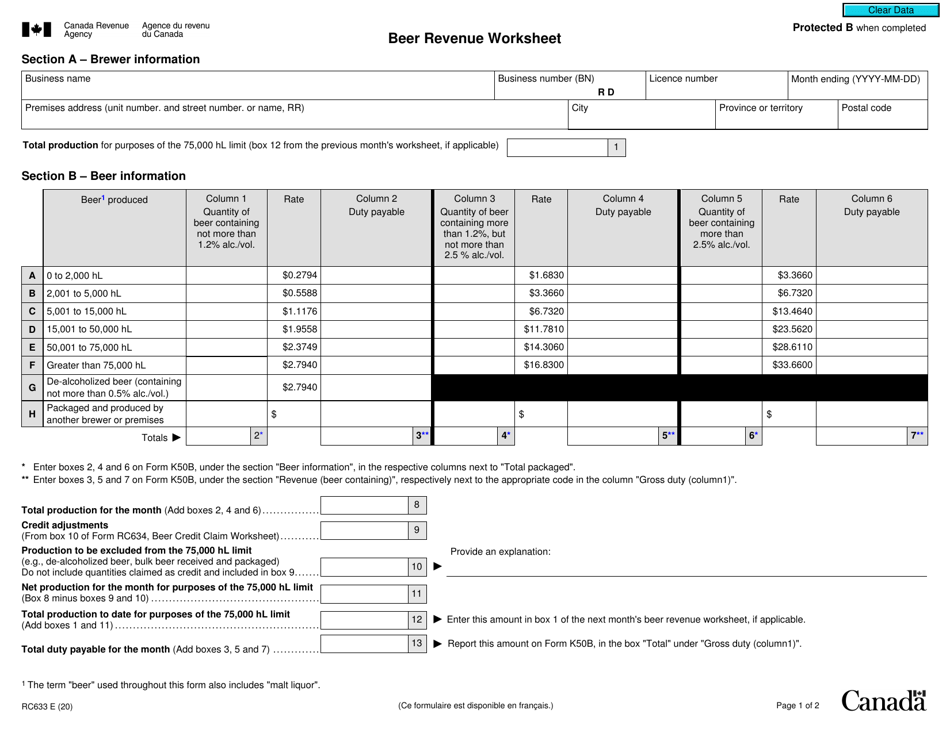

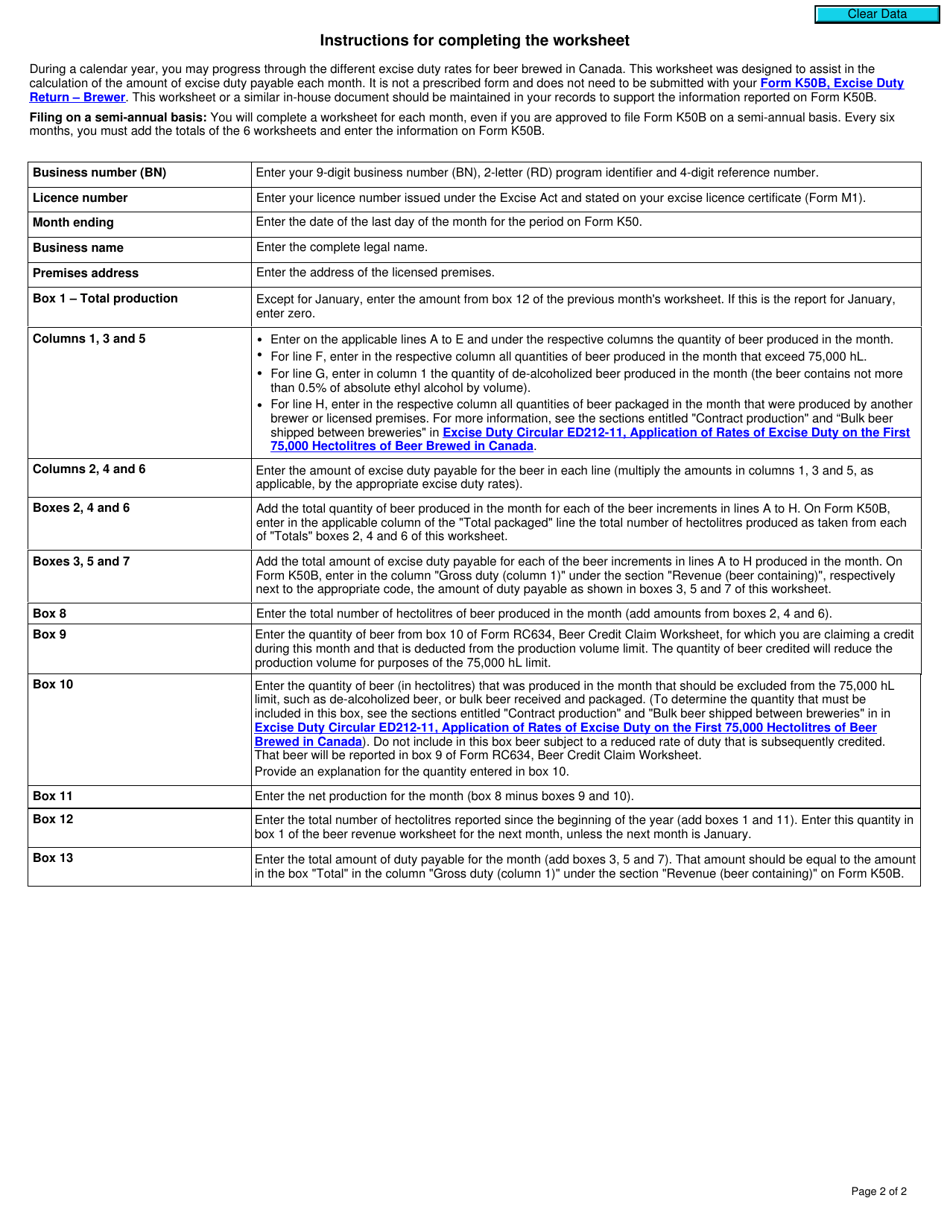

Form RC633 Beer Revenue Worksheet - Canada

The Form RC633 Beer Revenue Worksheet in Canada is typically filed by breweries and other businesses involved in the production and sale of beer.

FAQ

Q: What is the Form RC633?

A: Form RC633 is the Beer Revenue Worksheet used in Canada.

Q: What is the purpose of Form RC633?

A: The purpose of Form RC633 is to calculate the beer revenue and submit it to the Canada Revenue Agency (CRA).

Q: Who needs to use Form RC633?

A: Breweries, brew pubs, and certain other beer producers in Canada need to use Form RC633.

Q: What information is required on Form RC633?

A: Form RC633 requires information about the quantity of beer produced and the revenue generated from beer sales.

Q: When should Form RC633 be filed?

A: Form RC633 should be filed annually, within 90 days after the end of the fiscal year.

Q: Are there any penalties for not filing Form RC633?

A: Yes, there can be penalties for not filing Form RC633 or for providing incorrect information.

Q: Can I e-file Form RC633?

A: No, Form RC633 cannot be e-filed. It must be filed in paper format.

Q: Who can help me with Form RC633?

A: You can contact the Canada Revenue Agency (CRA) for assistance with Form RC633.

Q: Is Form RC633 specific to Canada?

A: Yes, Form RC633 is specific to Canada and is used for reporting beer revenue in the country.