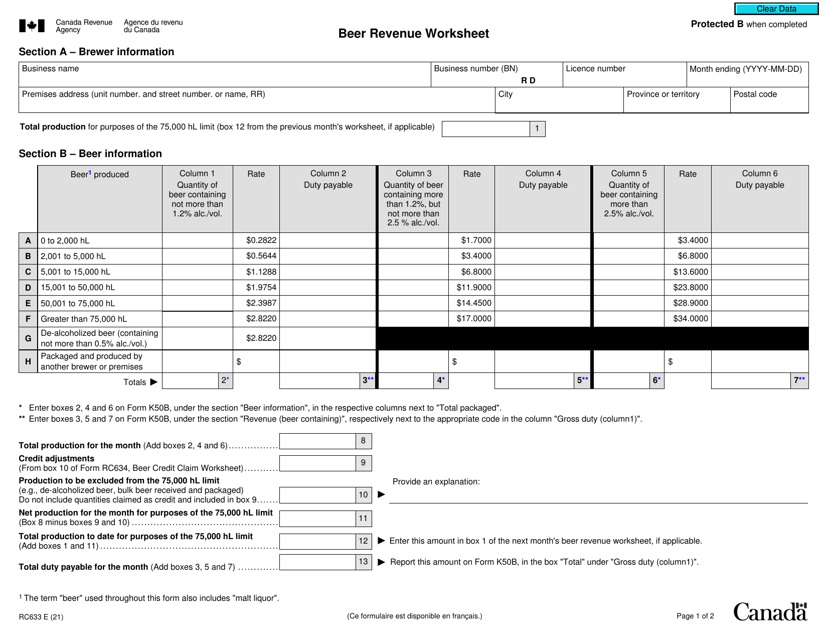

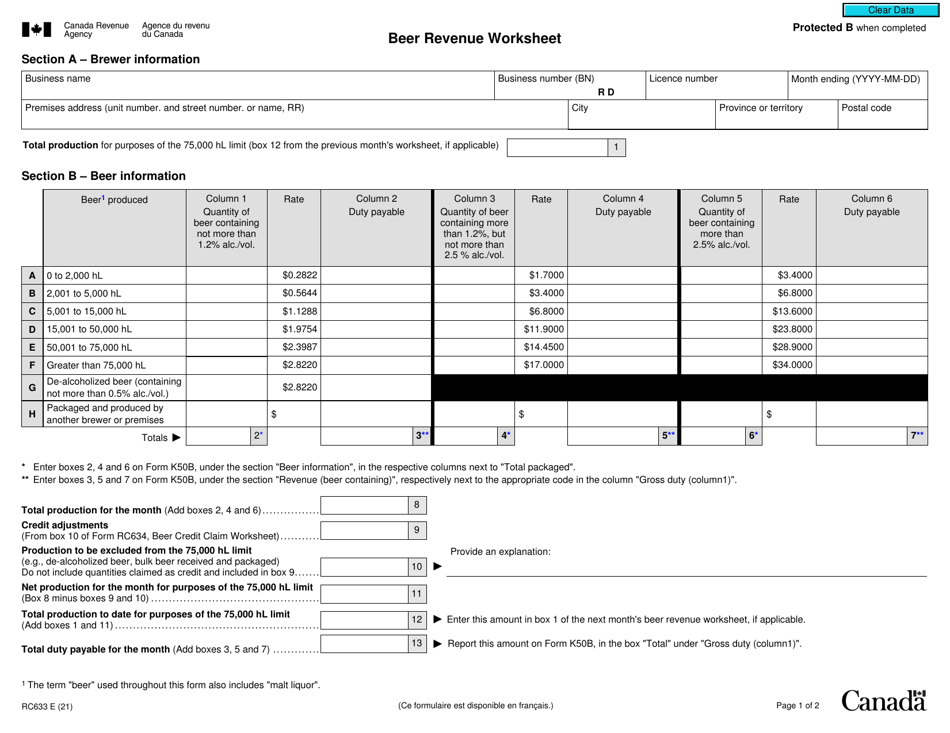

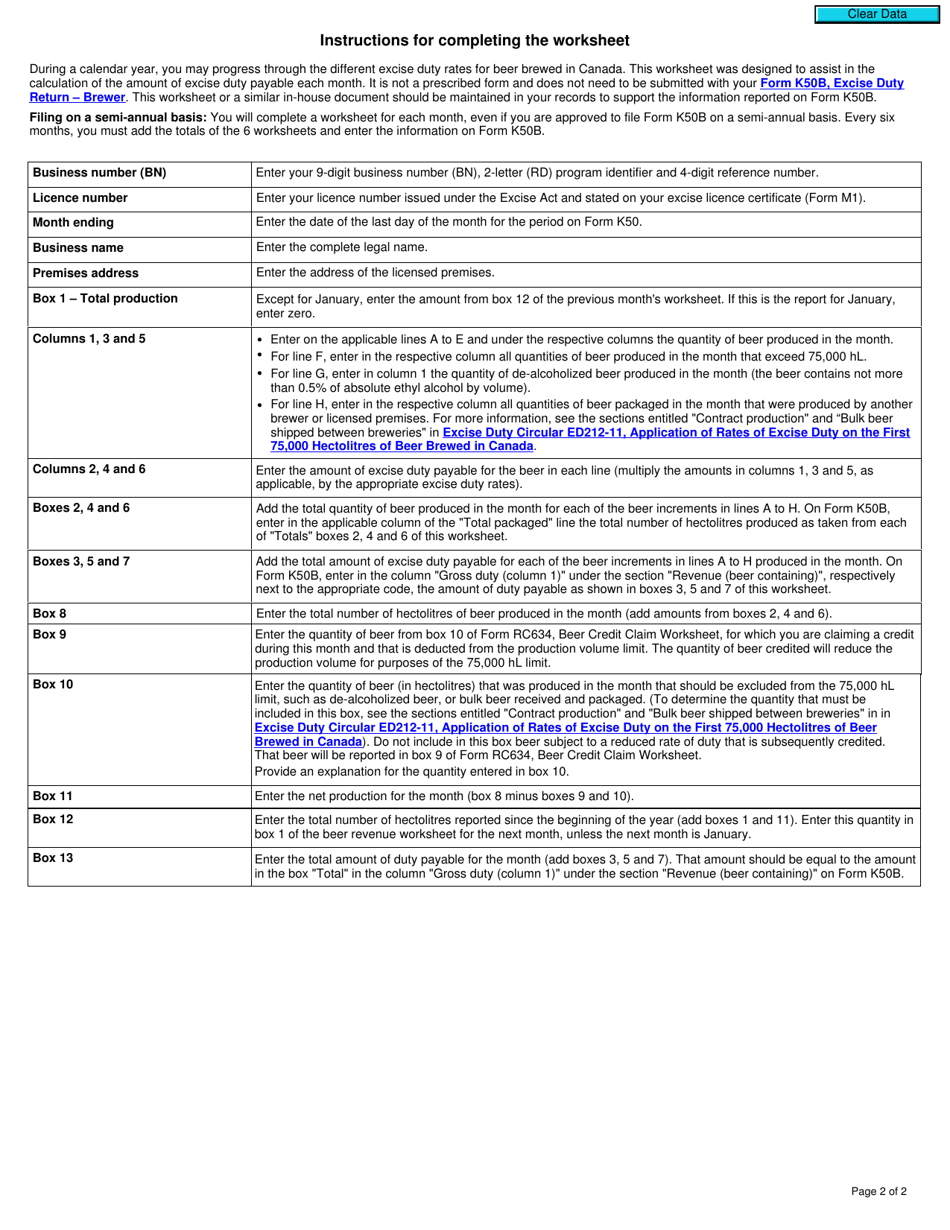

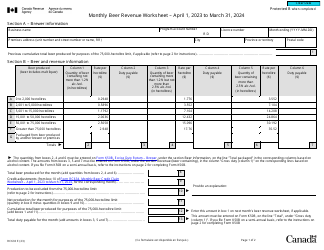

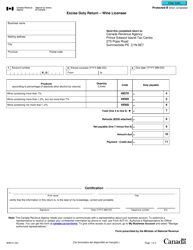

Form RC633 Beer Revenue Worksheet - Canada

The Form RC633 Beer Revenue Worksheet in Canada is used for calculating and reporting the revenue generated from beer production and sales by licensed breweries. This form helps the Canadian government track and collect excise taxes on beer.

The Form RC633 Beer Revenue Worksheet in Canada is filed by beer manufacturers and importers.

Form RC633 Beer Revenue Worksheet - Canada - Frequently Asked Questions (FAQ)

Q: What is Form RC633?

A: Form RC633 is the Beer Revenue Worksheet in Canada.

Q: Who needs to fill out Form RC633?

A: Brewers and producers of beer in Canada need to fill out Form RC633.

Q: What is the purpose of Form RC633?

A: The purpose of Form RC633 is to calculate and report the revenue from the sale of beer.

Q: What information is required on Form RC633?

A: Form RC633 requires information such as the quantity of beer sold, the price per liter, and any other applicable revenue.

Q: How often should Form RC633 be filed?

A: Form RC633 should be filed monthly.

Q: Is there a deadline for filing Form RC633?

A: Yes, Form RC633 should be filed by the last day of the month following the month being reported.

Q: Are there any penalties for late or incorrect filing of Form RC633?

A: Yes, late or incorrect filing of Form RC633 can result in penalties and interest charges.