This version of the form is not currently in use and is provided for reference only. Download this version of

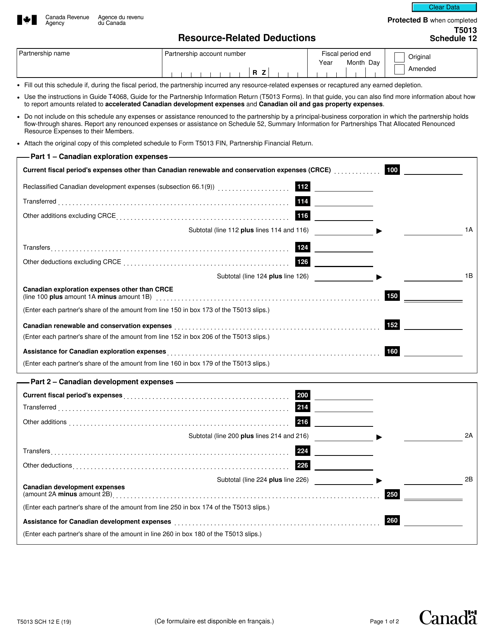

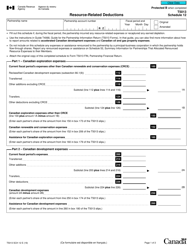

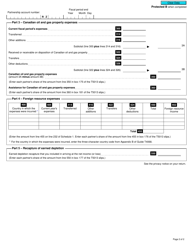

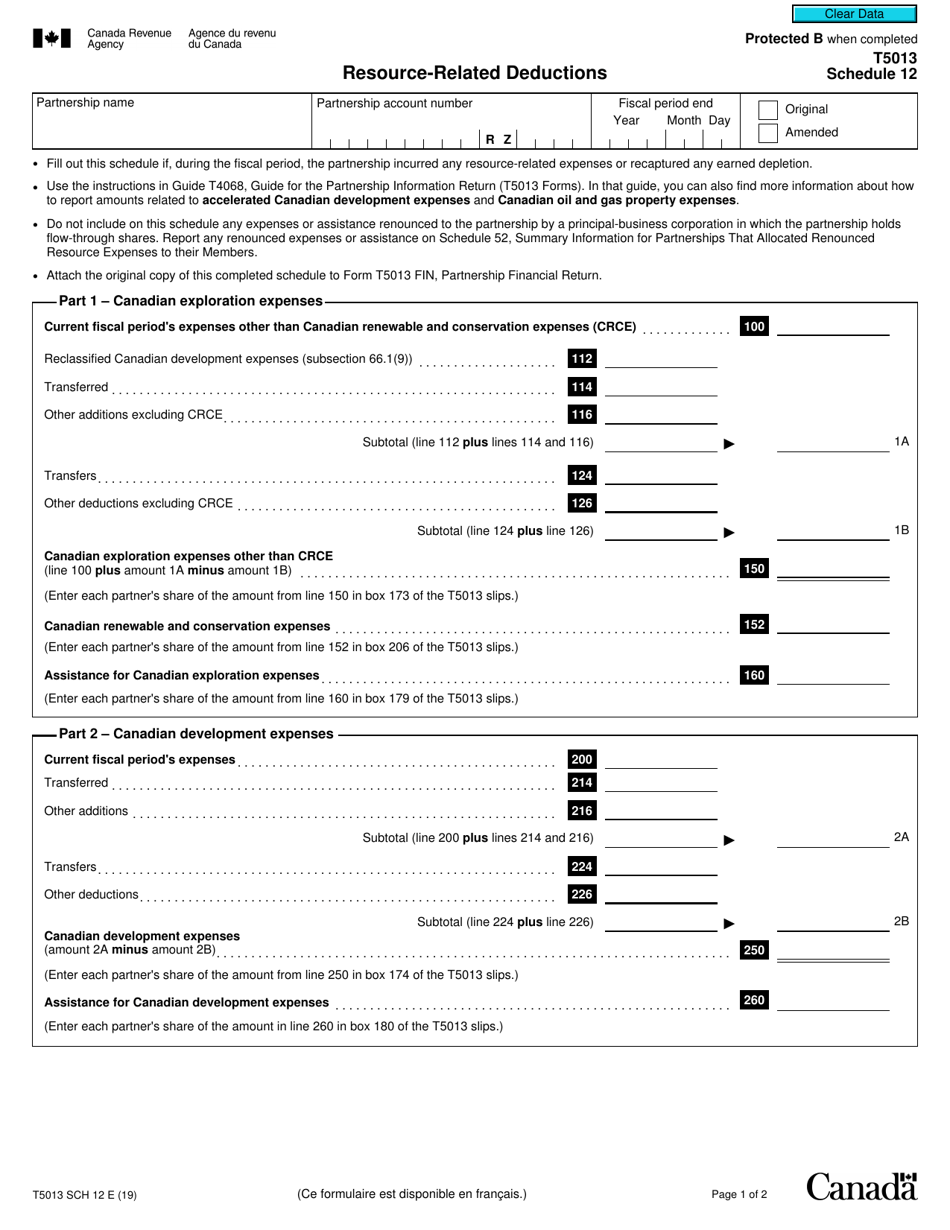

Form T5013 Schedule 12

for the current year.

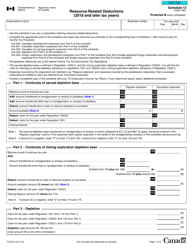

Form T5013 Schedule 12 Resource-Related Deductions - Canada

Form T5013 Schedule 12 Resource-Related Deductions in Canada is used to report deductions related to resource exploration and development expenses incurred by a partnership. These deductions can include expenses such as drilling and development costs in the oil, gas, or mining industry.

The Form T5013 Schedule 12 Resource-Related Deductions in Canada is typically filed by partnerships or trusts that earn income from resource-related activities.

FAQ

Q: What is Form T5013 Schedule 12?

A: Form T5013 Schedule 12 is a tax form in Canada used to report resource-related deductions.

Q: What are resource-related deductions?

A: Resource-related deductions are deductions that can be claimed by individuals or corporations engaged in certain resource industries in Canada.

Q: Who needs to file Form T5013 Schedule 12?

A: Individuals or corporations engaged in resource industries in Canada need to file Form T5013 Schedule 12 if they have resource-related deductions to report.

Q: How do I fill out Form T5013 Schedule 12?

A: You can fill out Form T5013 Schedule 12 by following the instructions provided by the Canada Revenue Agency (CRA).

Q: When is the deadline for filing Form T5013 Schedule 12?

A: The deadline for filing Form T5013 Schedule 12 is usually six months after the end of your tax year.