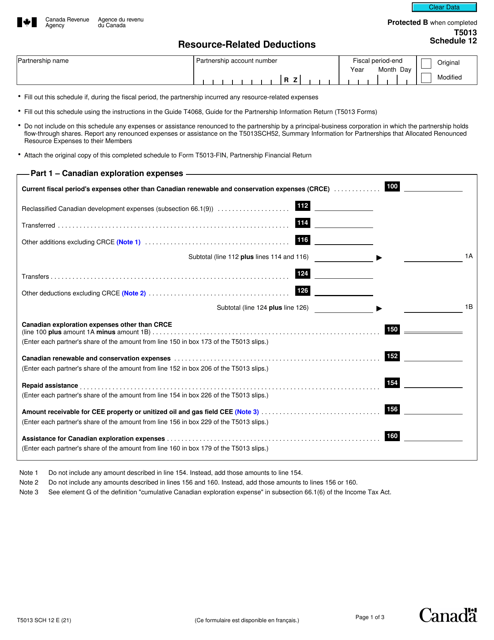

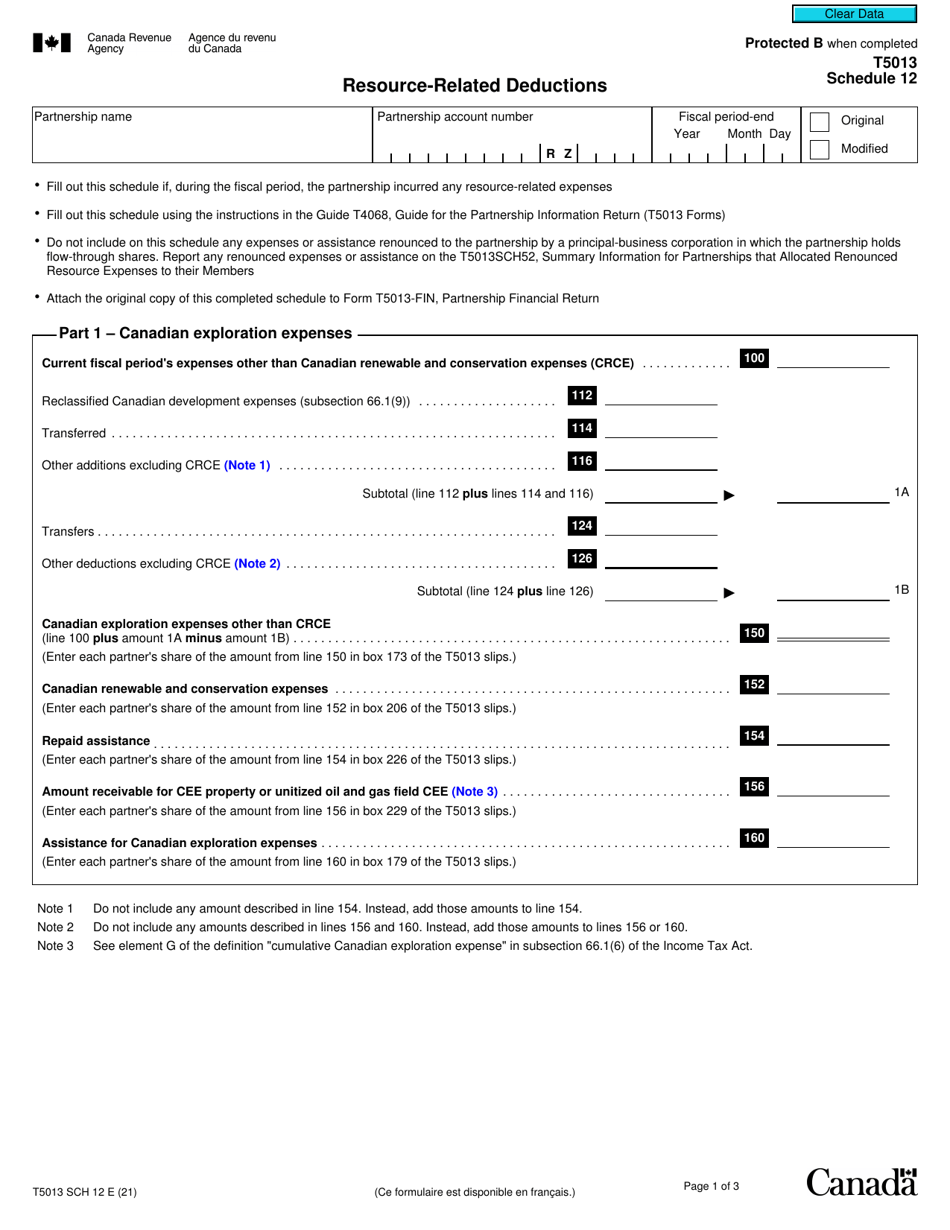

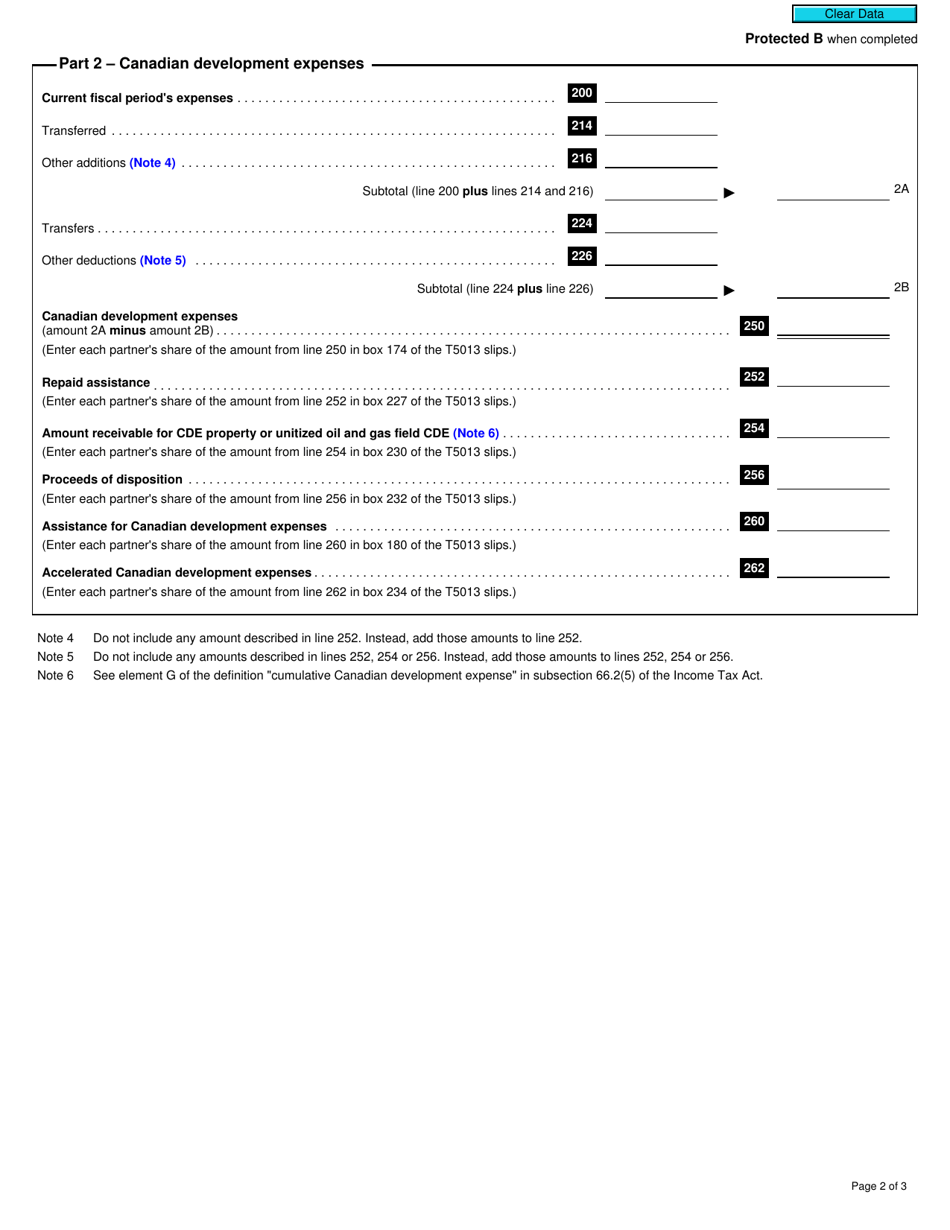

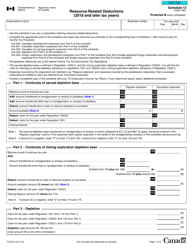

Form T5013 Schedule 12 Resource-Related Deductions - Canada

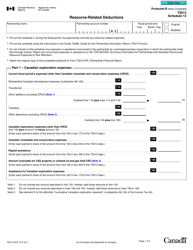

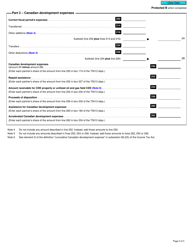

Form T5013 Schedule 12, Resource-Related Deductions, is a form used in Canada for reporting deductions related to resource activities. It is specifically used by partnerships involved in resource industries, such as oil and gas, mining, and forestry, to claim deductions related to those activities.

The Form T5013 Schedule 12 Resource-Related Deductions in Canada is typically filed by individuals or businesses that are involved in resource-related activities, such as mining, oil and gas extraction, or renewable energy production.

Form T5013 Schedule 12 Resource-Related Deductions - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T5013 Schedule 12?

A: Form T5013 Schedule 12 is a tax form used in Canada to report resource-related deductions.

Q: What are resource-related deductions?

A: Resource-related deductions are deductions related to certain resource industries, such as oil and gas, mining, and renewable energy.

Q: Who needs to file Form T5013 Schedule 12?

A: Partnerships or corporations engaged in resource activities need to file Form T5013 Schedule 12.

Q: What information is required to complete Form T5013 Schedule 12?

A: You will need to provide details about your resource activities and the deductions you are claiming.

Q: When is the deadline to file Form T5013 Schedule 12?

A: The deadline to file Form T5013 Schedule 12 is generally within six months after the end of your fiscal year.

Q: What happens if I don't file Form T5013 Schedule 12?

A: If you don't file Form T5013 Schedule 12 or file it late, you may be subject to penalties and interest charges.

Q: Can I e-file Form T5013 Schedule 12?

A: Yes, you can e-file Form T5013 Schedule 12 using the CRA's Internet file transfer service or through authorized tax software providers.