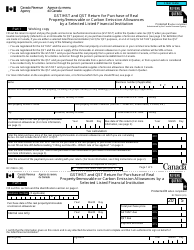

This version of the form is not currently in use and is provided for reference only. Download this version of

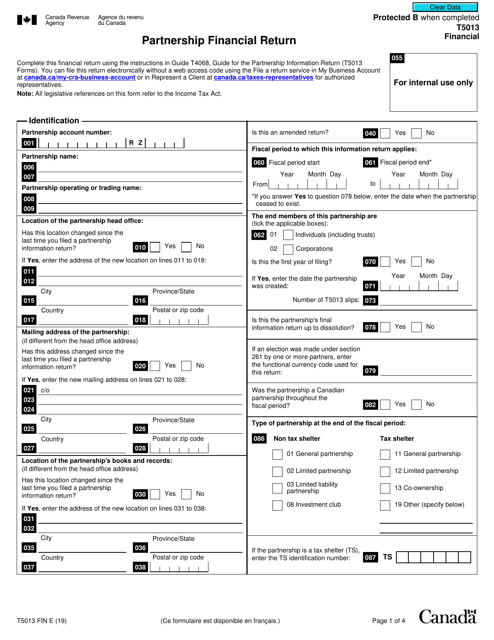

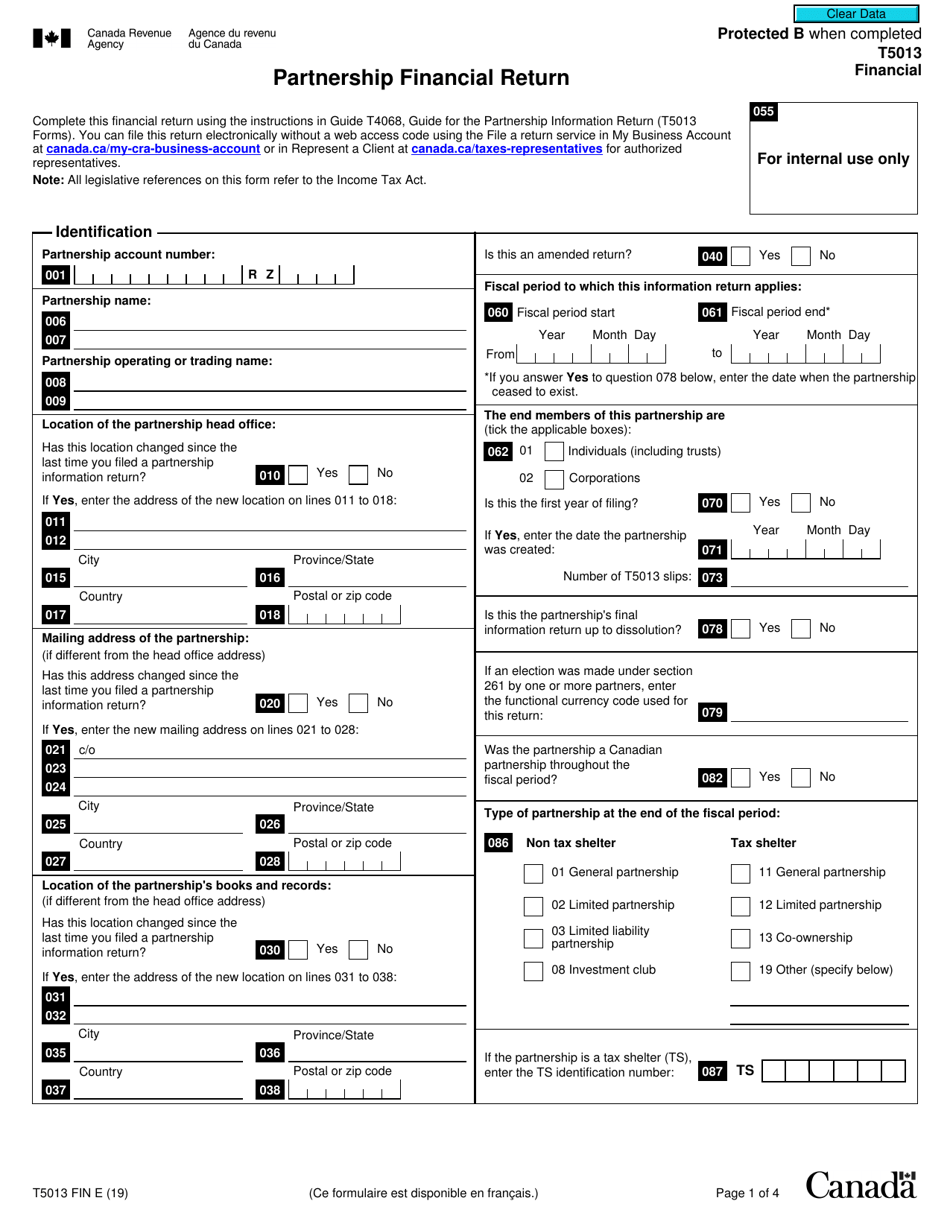

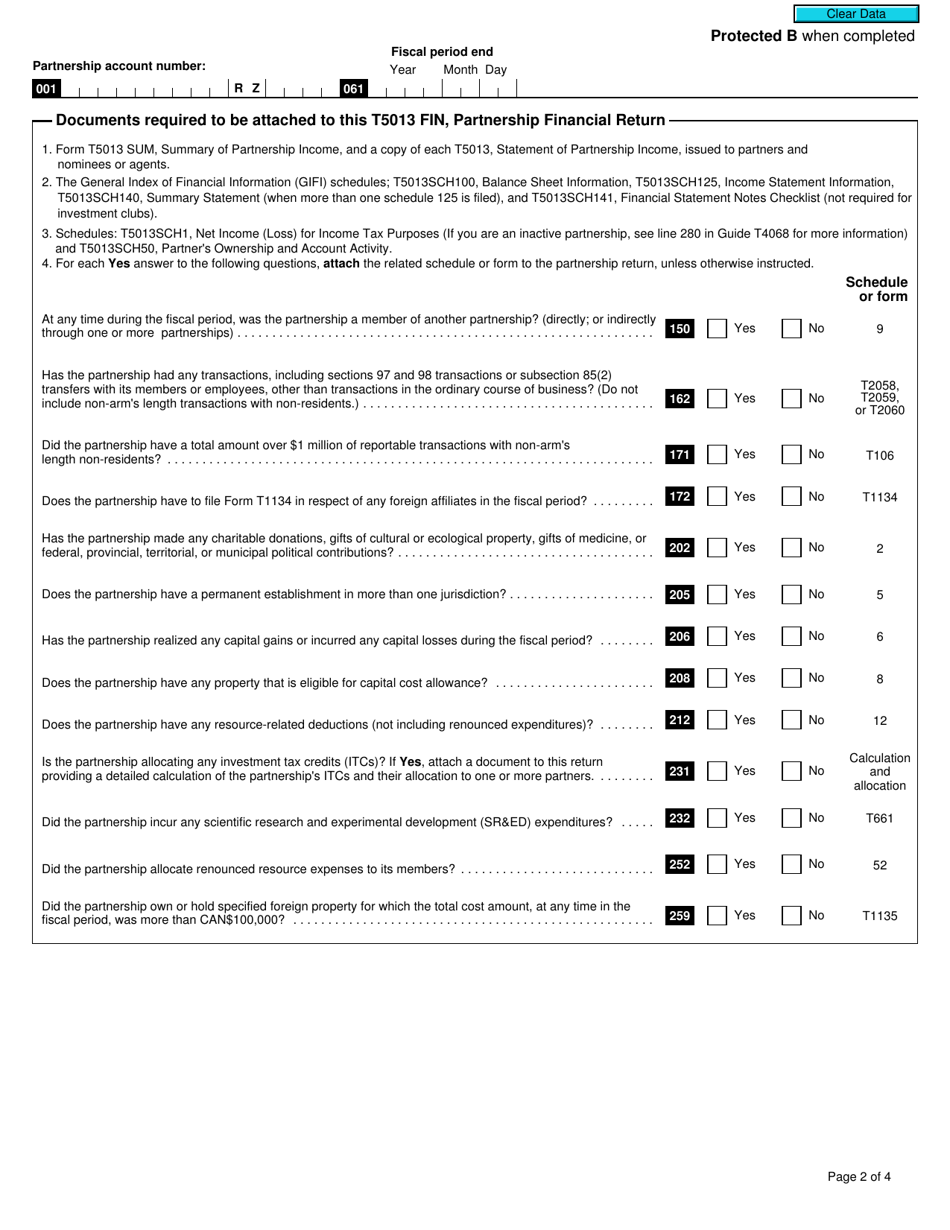

Form T5013 FIN

for the current year.

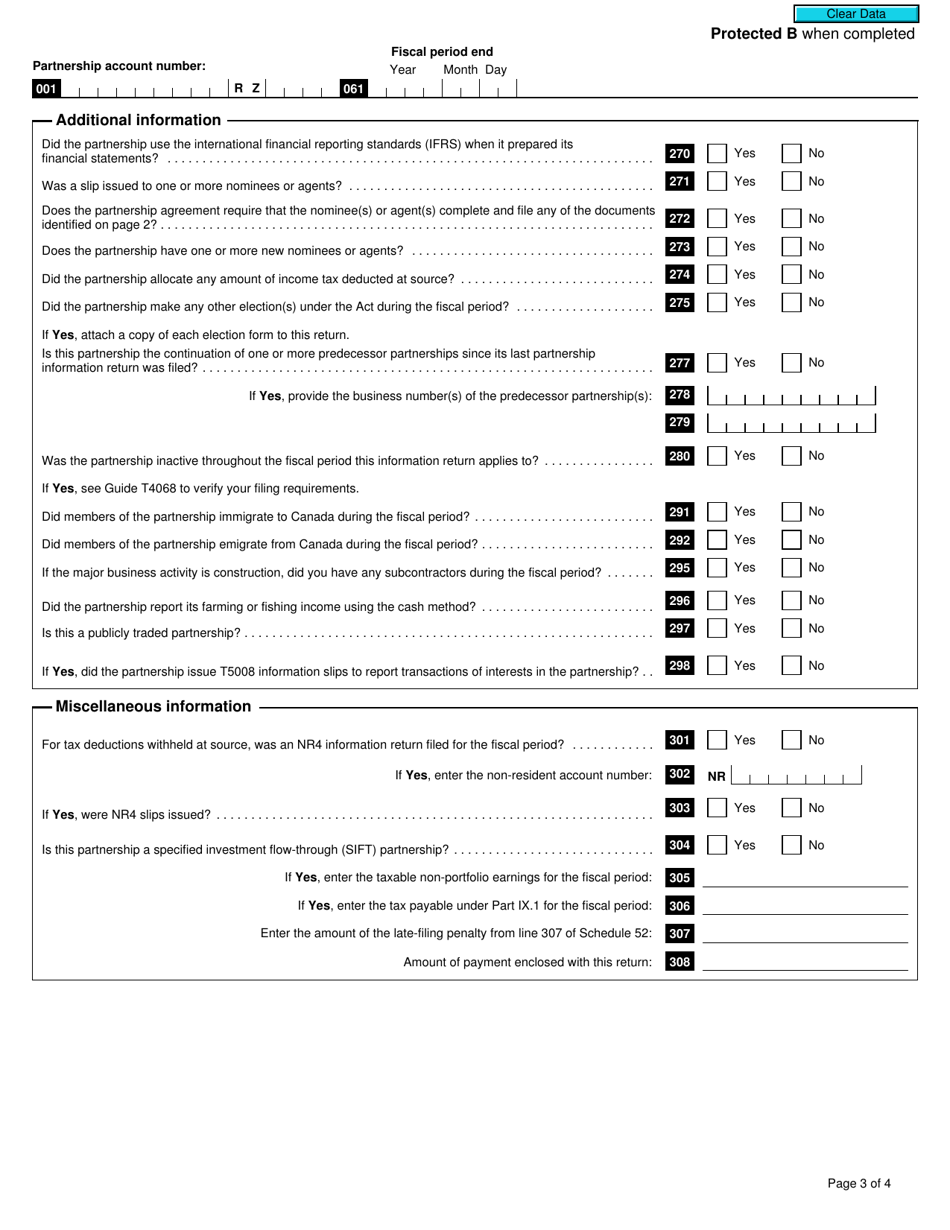

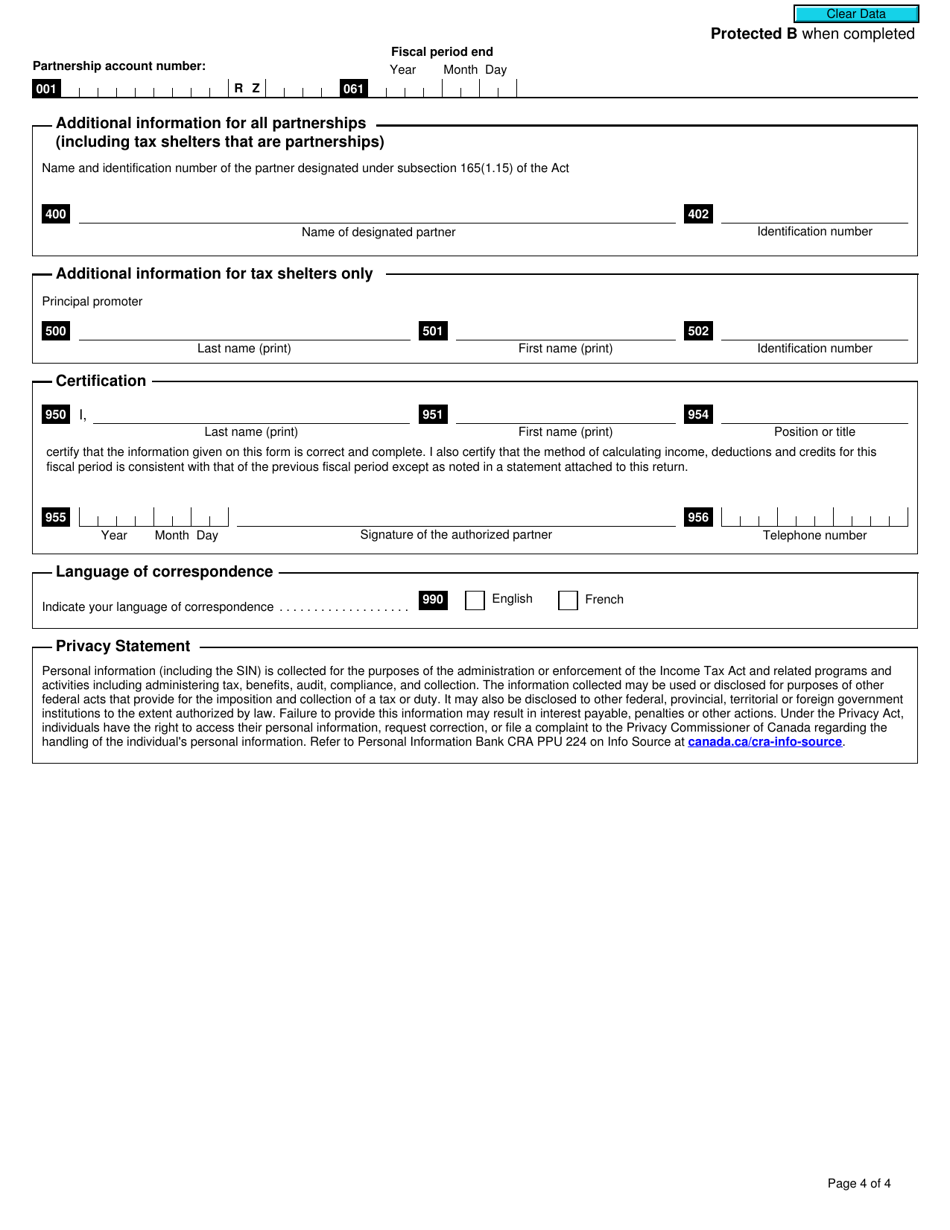

Form T5013 FIN Partnership Financial Return - Canada

Form T5013 is used in Canada to report the income, expenses, and other financial details of a partnership. It helps determine the partnership's taxable income and the share of income allocated to each partner.

The partners of a partnership in Canada are responsible for filing the Form T5013 FIN Partnership Financial Return.

FAQ

Q: What is Form T5013?

A: Form T5013 is a financial return form for partnerships in Canada.

Q: Who needs to file Form T5013?

A: Partnerships in Canada must file Form T5013 if they meet certain criteria.

Q: What information is required on Form T5013?

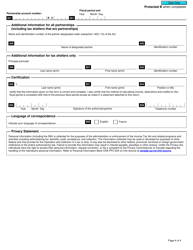

A: Form T5013 requires information about the partnership's income, expenses, and partners.

Q: When is the deadline to file Form T5013?

A: The deadline to file Form T5013 is on or before the 15th day of the 3rd month following the end of the partnership's fiscal period.

Q: Are there any penalties for late filing of Form T5013?

A: Yes, there are penalties for late filing of Form T5013, so it is important to adhere to the filing deadline.

Q: Can I file Form T5013 electronically?

A: Yes, Form T5013 can be filed electronically using the CRA's Internet File Transfer (XML) or through certified tax software.

Q: Do I need to include supporting documents with Form T5013?

A: Yes, supporting documents such as financial statements and schedules must be included with Form T5013.

Q: Can I amend Form T5013 if I made a mistake?

A: Yes, if you made a mistake on Form T5013, you can file an amended return using Form T5013A.