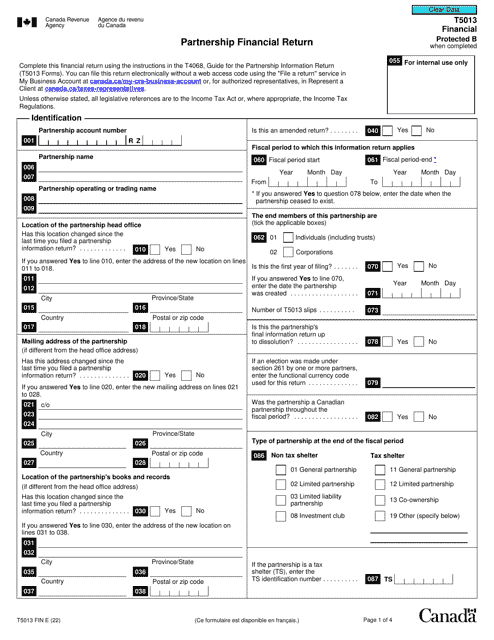

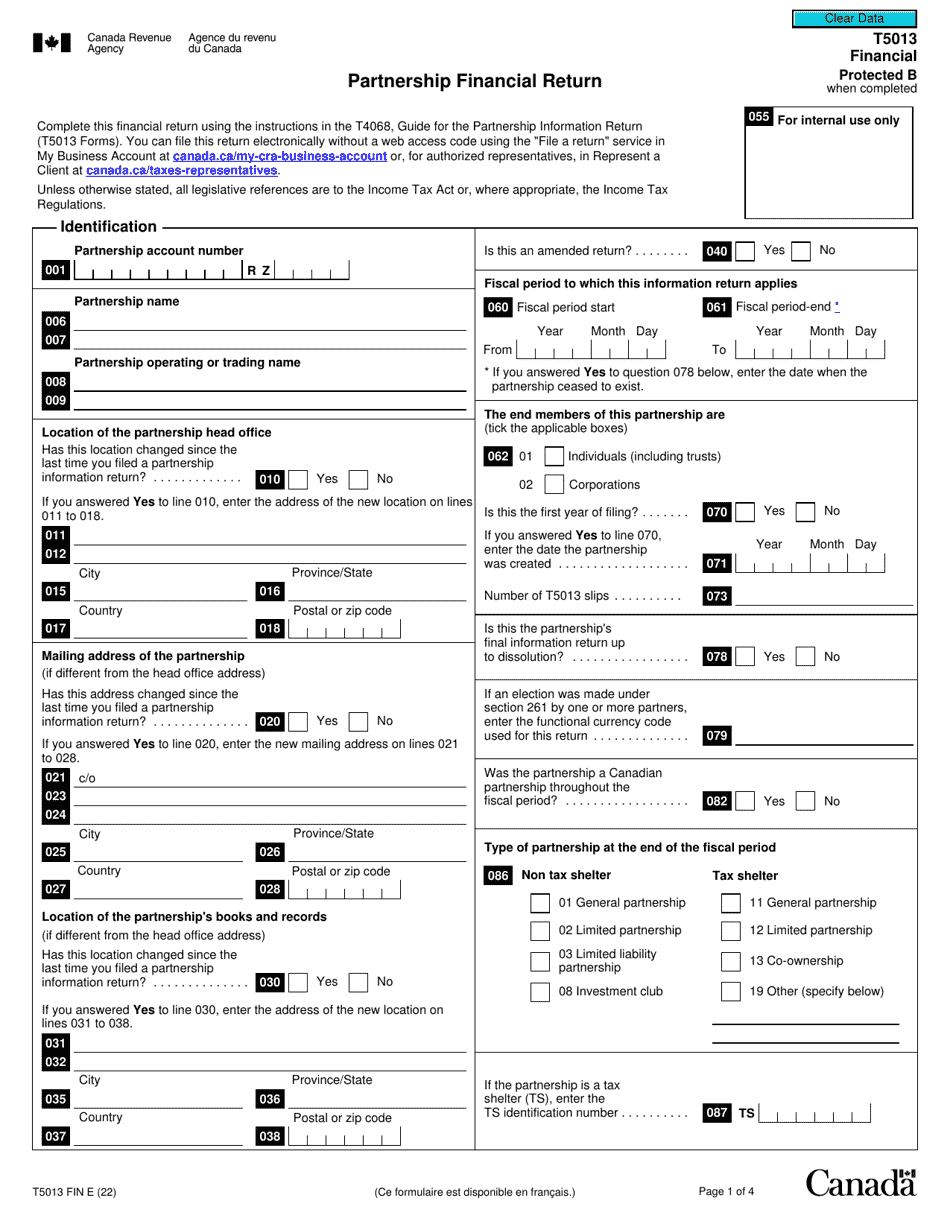

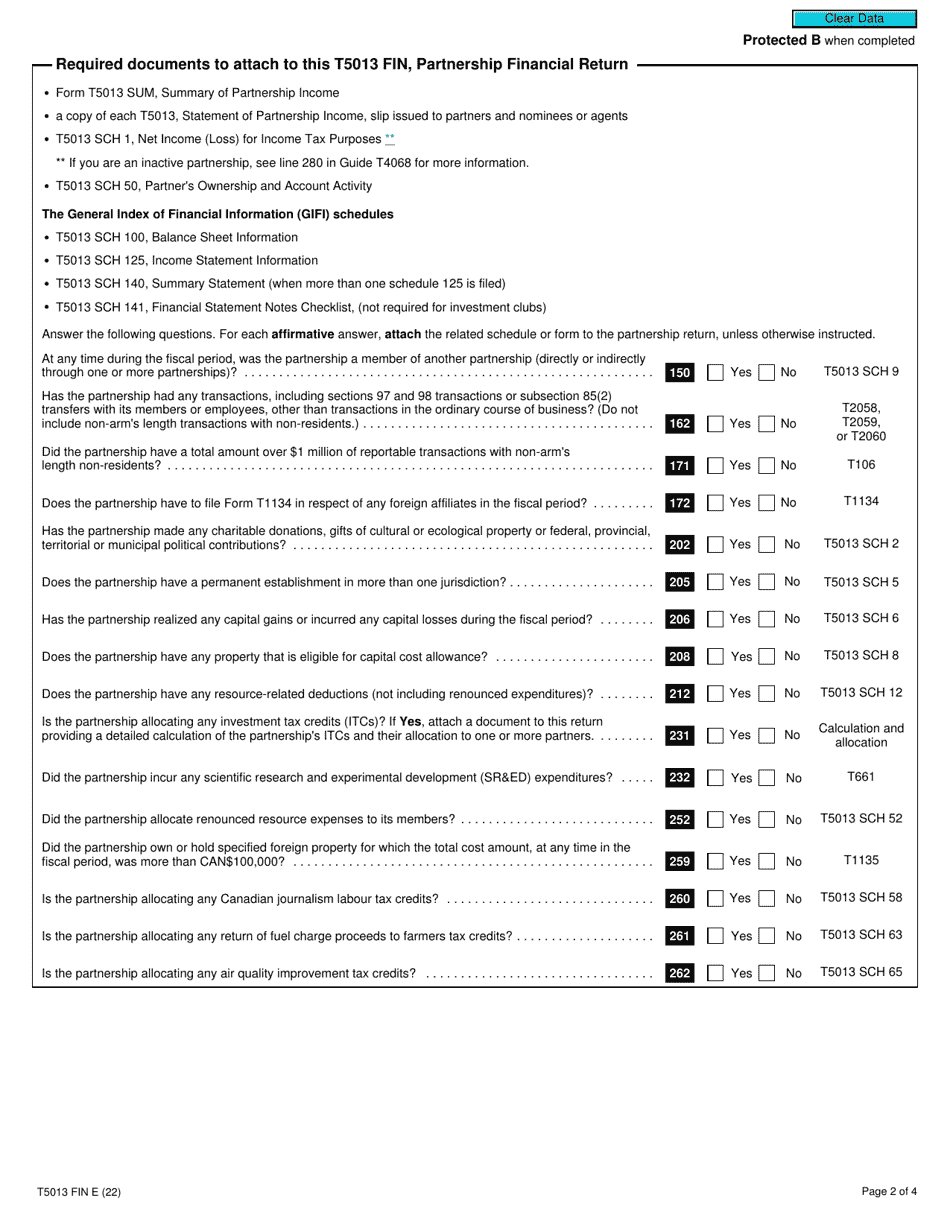

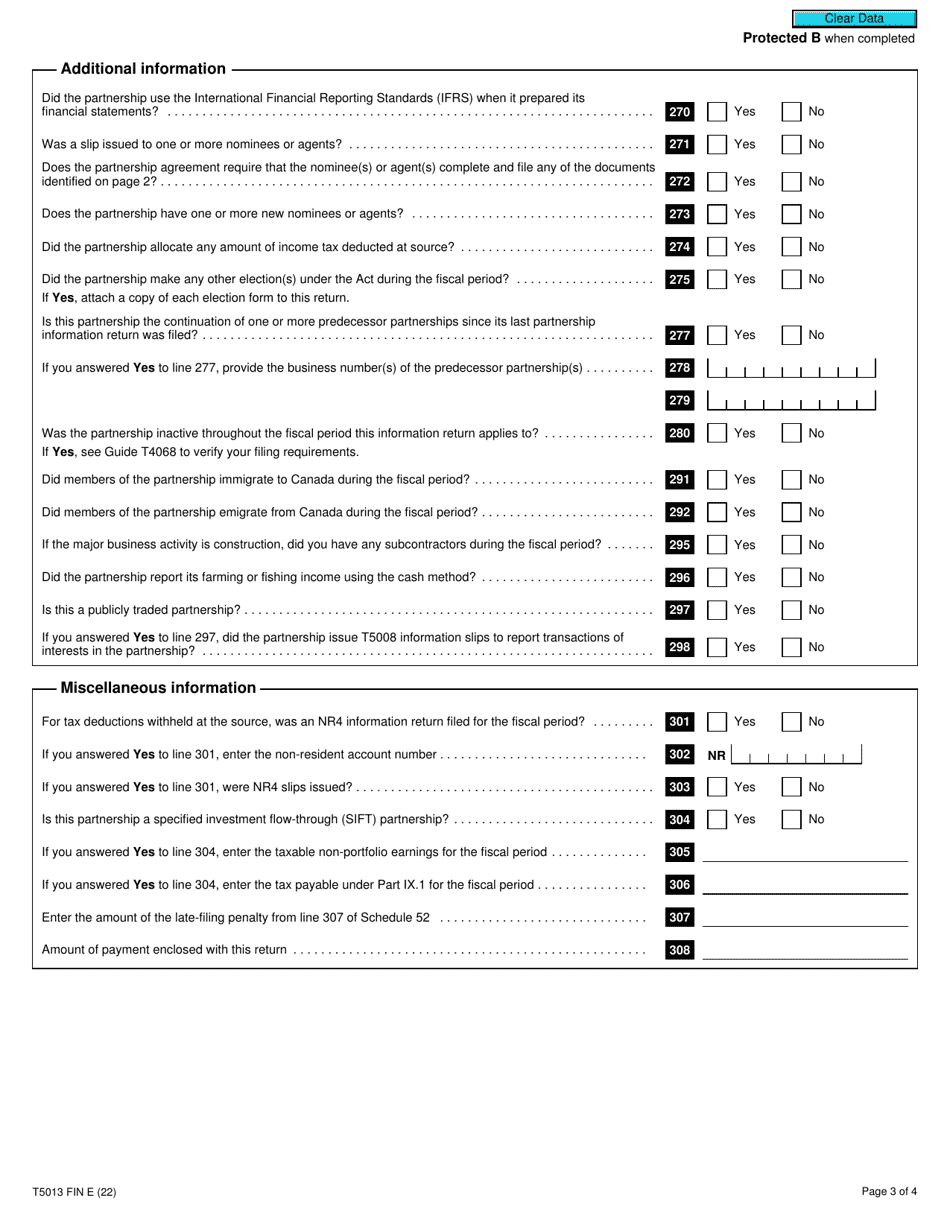

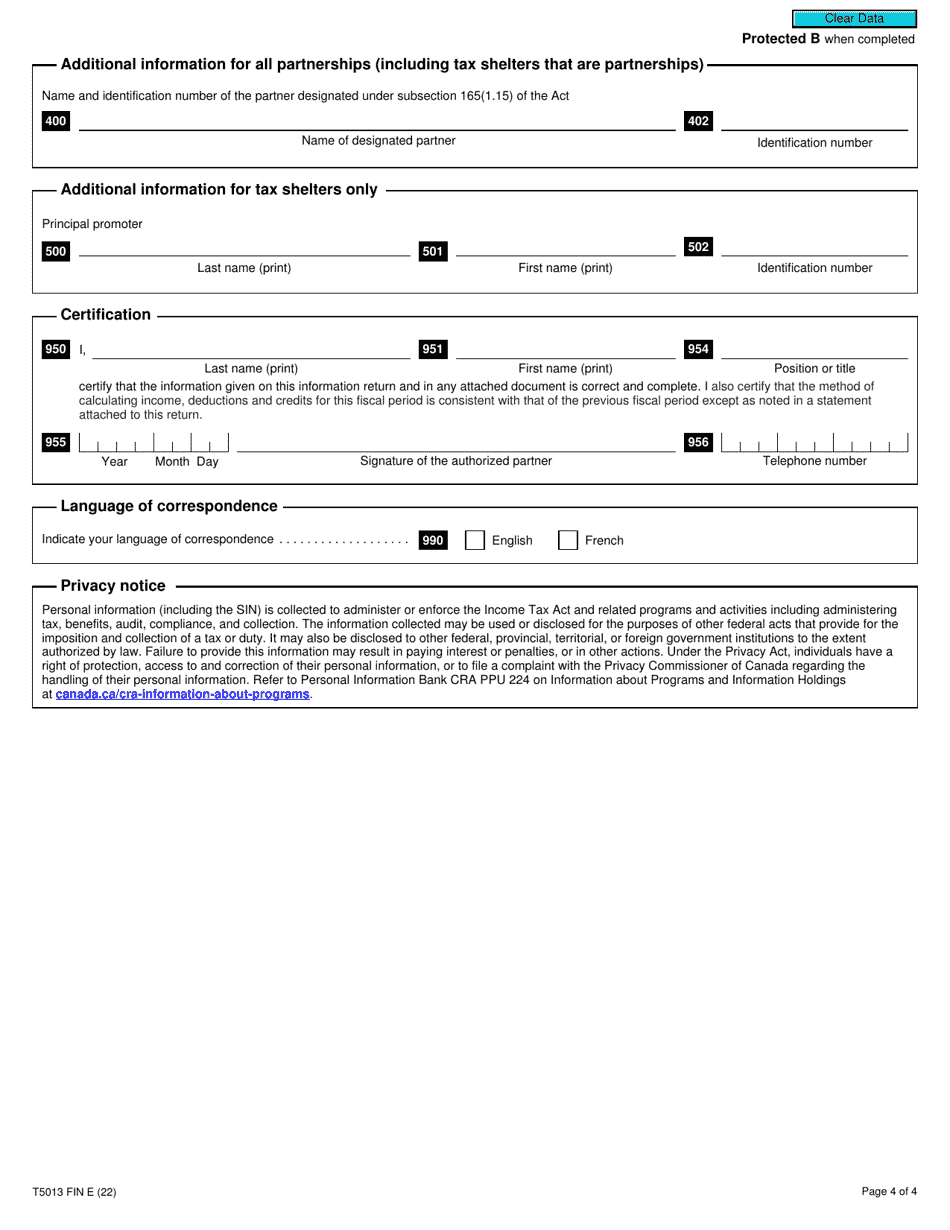

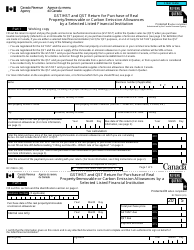

Form T5013 FIN Partnership Financial Return - Canada

Form T5013, also known as the FIN Partnership Financial Return, is used by Canadian partnerships to report their income, deductions, and other important financial information to the Canada Revenue Agency (CRA). This form helps partnerships fulfill their tax obligations in Canada.

The Form T5013 FIN Partnership Financial Return in Canada is filed by partnerships that have a fiscal period ending in the tax year.

Form T5013 FIN Partnership Financial Return - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T5013? A: Form T5013 is the Partnership Financial Return form in Canada.

Q: Who needs to file Form T5013? A: Partnerships in Canada are required to file Form T5013 if they meet specific criteria.

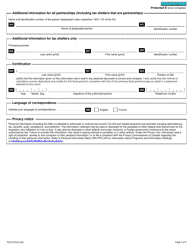

Q: What information is required on Form T5013? A: Form T5013 requires partnership financial information, including revenue, expenses, and partner details.

Q: When is Form T5013 due? A: The deadline for filing Form T5013 in Canada is typically within six months from the end of the partnership's fiscal year.

Q: How can I file Form T5013? A: Form T5013 can be filed electronically or by mail with the Canada Revenue Agency.

Q: Are there any penalties for late filing of Form T5013? A: Yes, late filing of Form T5013 can result in penalties imposed by the Canada Revenue Agency.