This version of the form is not currently in use and is provided for reference only. Download this version of

Form T2 Schedule 53

for the current year.

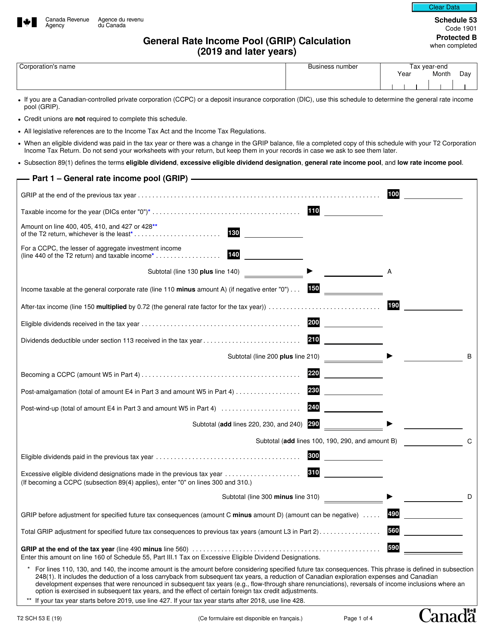

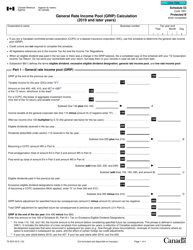

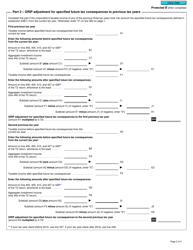

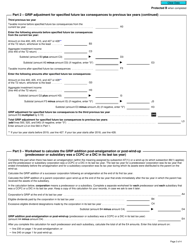

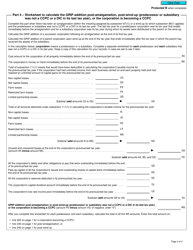

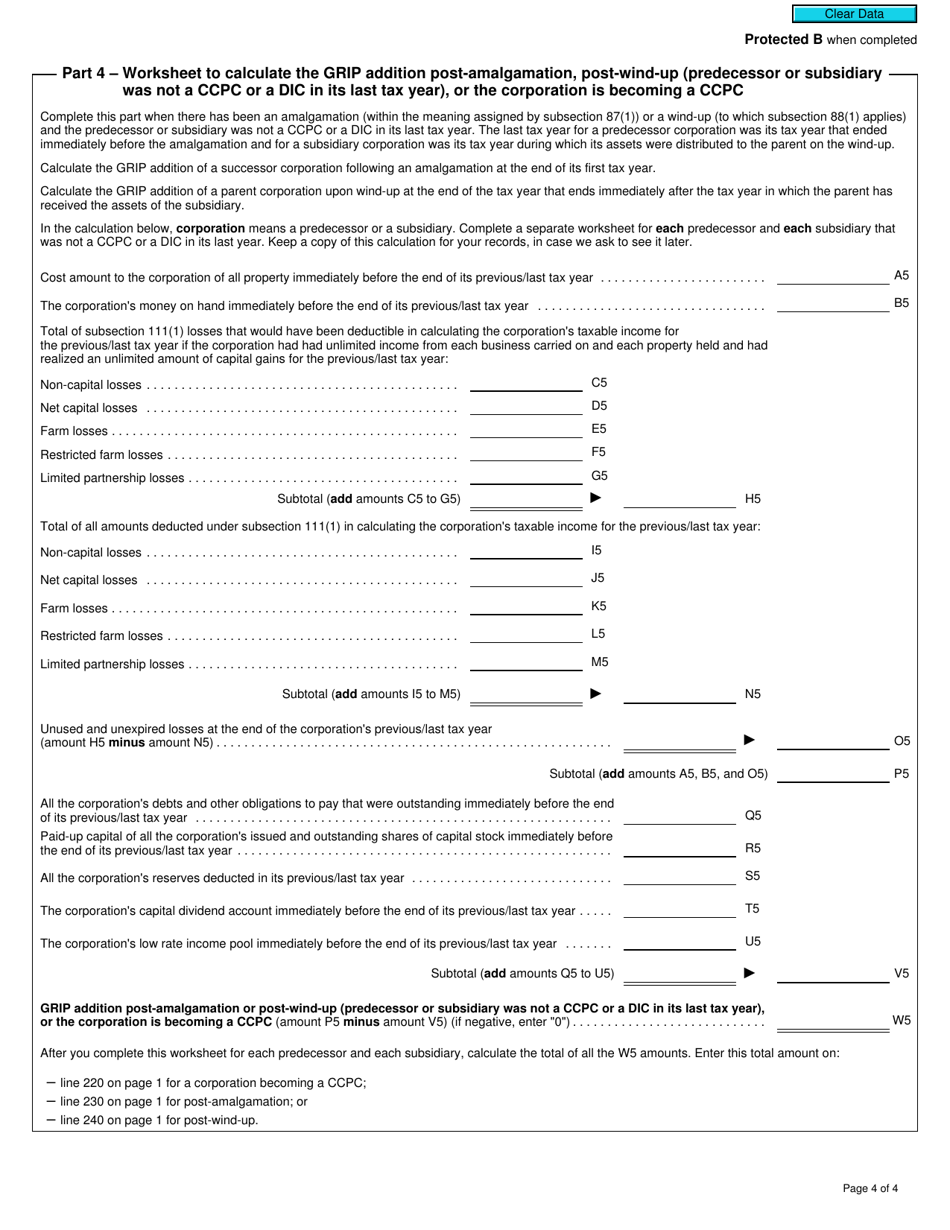

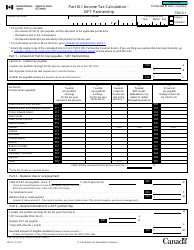

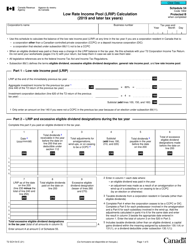

Form T2 Schedule 53 General Rate Income Pool (Grip) Calculation (2019 and Later Years) - Canada

Form T2 Schedule 53 General Rate Income Pool (GRIP) Calculation is used in Canada for calculating the GRIP balance of a corporation. The GRIP balance represents the portion of a corporation's active business income that can be paid out as dividends without incurring additional taxes. It helps corporations determine how much of their income is eligible for dividend distribution.

The corporation that has a general rate income pool (GRIP) in Canada is responsible for filing the Form T2 Schedule 53 (GRIP) Calculation for 2019 and later years.

FAQ

Q: What is T2 Schedule 53?

A: T2 Schedule 53 is the form used in Canada to calculate the General Rate Income Pool (GRIP) for tax years 2019 and later.

Q: What is the General Rate Income Pool (GRIP)?

A: The General Rate Income Pool (GRIP) is a mechanism in Canada's tax system that allows corporations to track their eligible dividends.

Q: Why is the GRIP calculation important?

A: The GRIP calculation is important because it determines the amount of eligible dividends that a corporation can pay out.

Q: What information is required for the GRIP calculation?

A: To calculate the GRIP, you need to determine the corporation's cumulative GRIP balance, the corporation's taxable income, and the corporation's capital gains deduction.

Q: Are there any specific rules or guidelines for the GRIP calculation?

A: Yes, there are specific rules and guidelines outlined by the Canada Revenue Agency (CRA) that must be followed when calculating the GRIP.