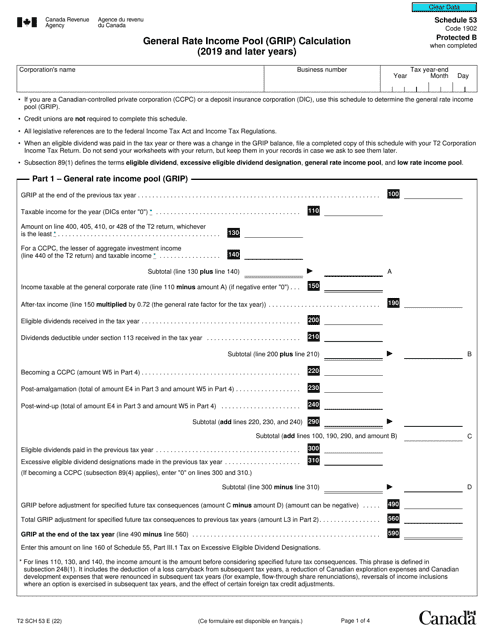

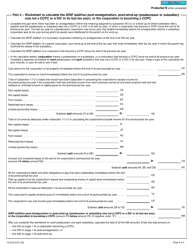

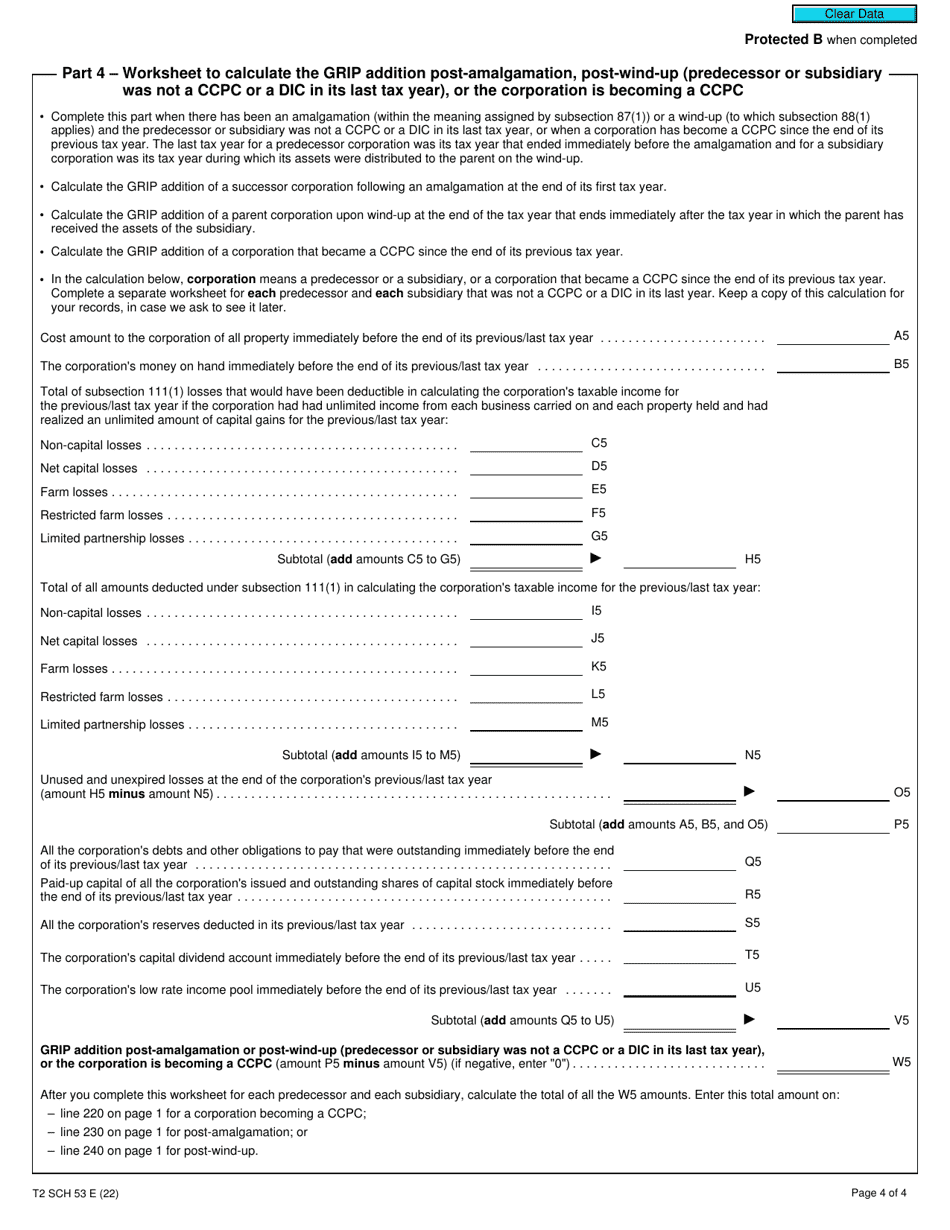

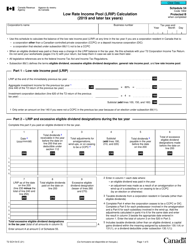

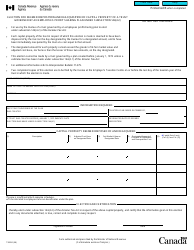

Form T2 Schedule 53 General Rate Income Pool (Grip) Calculation (2019 and Later Years) - Canada

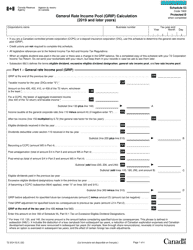

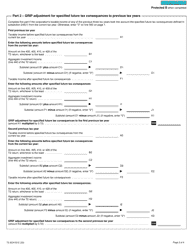

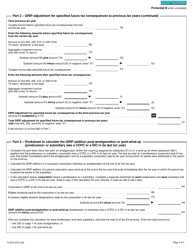

Form T2 Schedule 53 General Rate Income Pool (Grip) Calculation is used by Canadian corporations to determine the General Rate Income Pool (GRIP) for the purpose of calculating the amount of eligible dividends that can be paid out tax-free to shareholders.

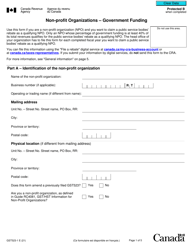

The form T2 Schedule 53 Grip Calculation is filed by corporations in Canada.

Form T2 Schedule 53 General Rate Income Pool (Grip) Calculation (2019 and Later Years) - Canada - Frequently Asked Questions (FAQ)

Q: What is T2 Schedule 53?

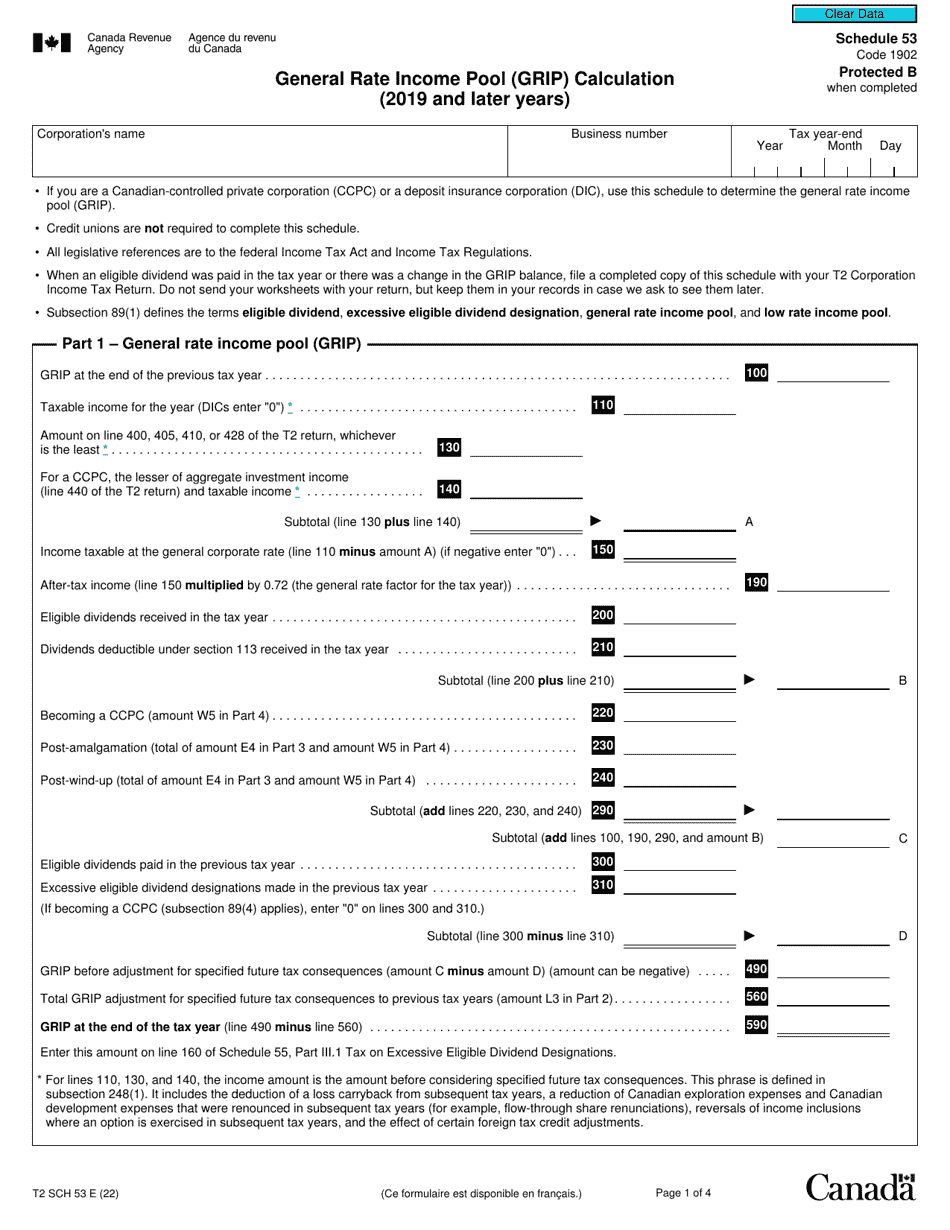

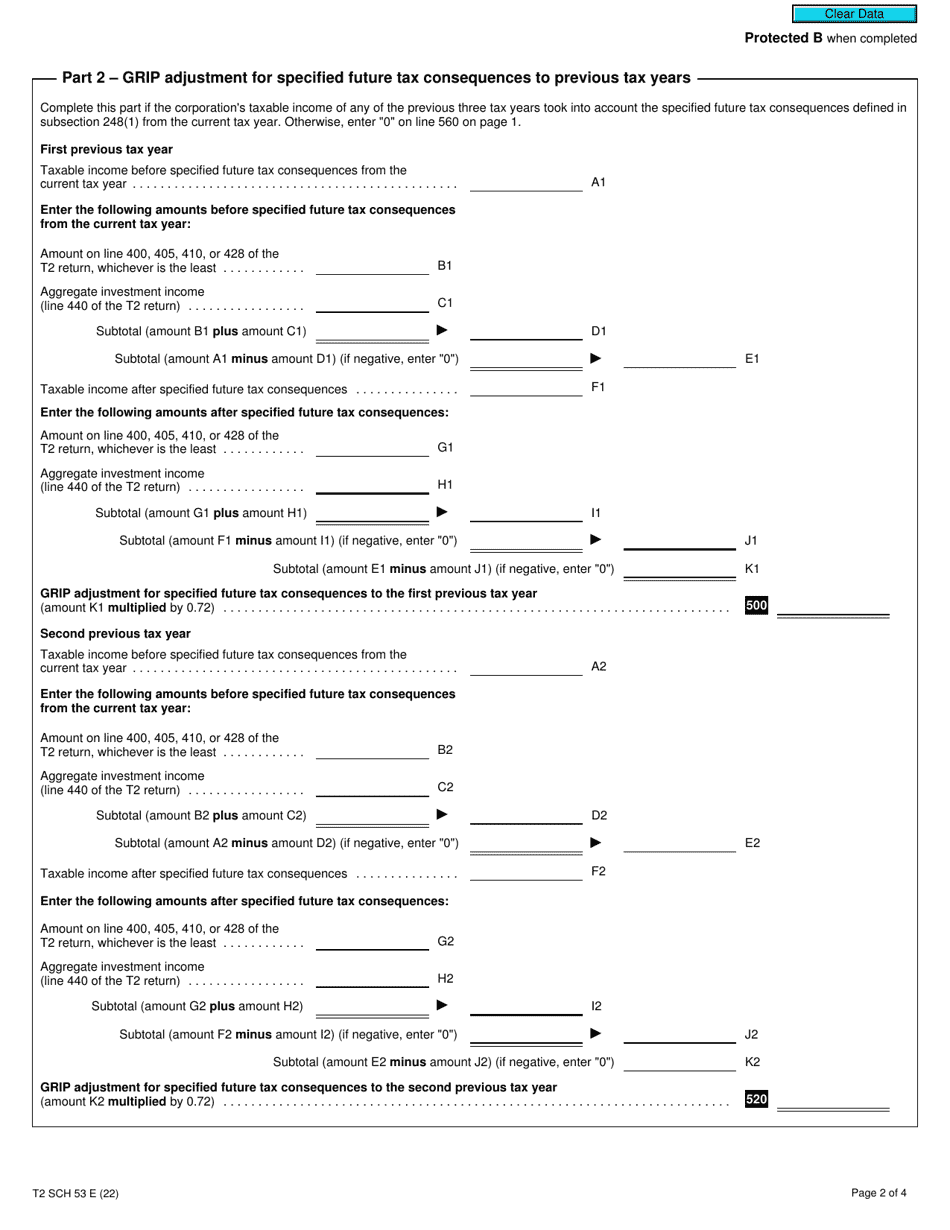

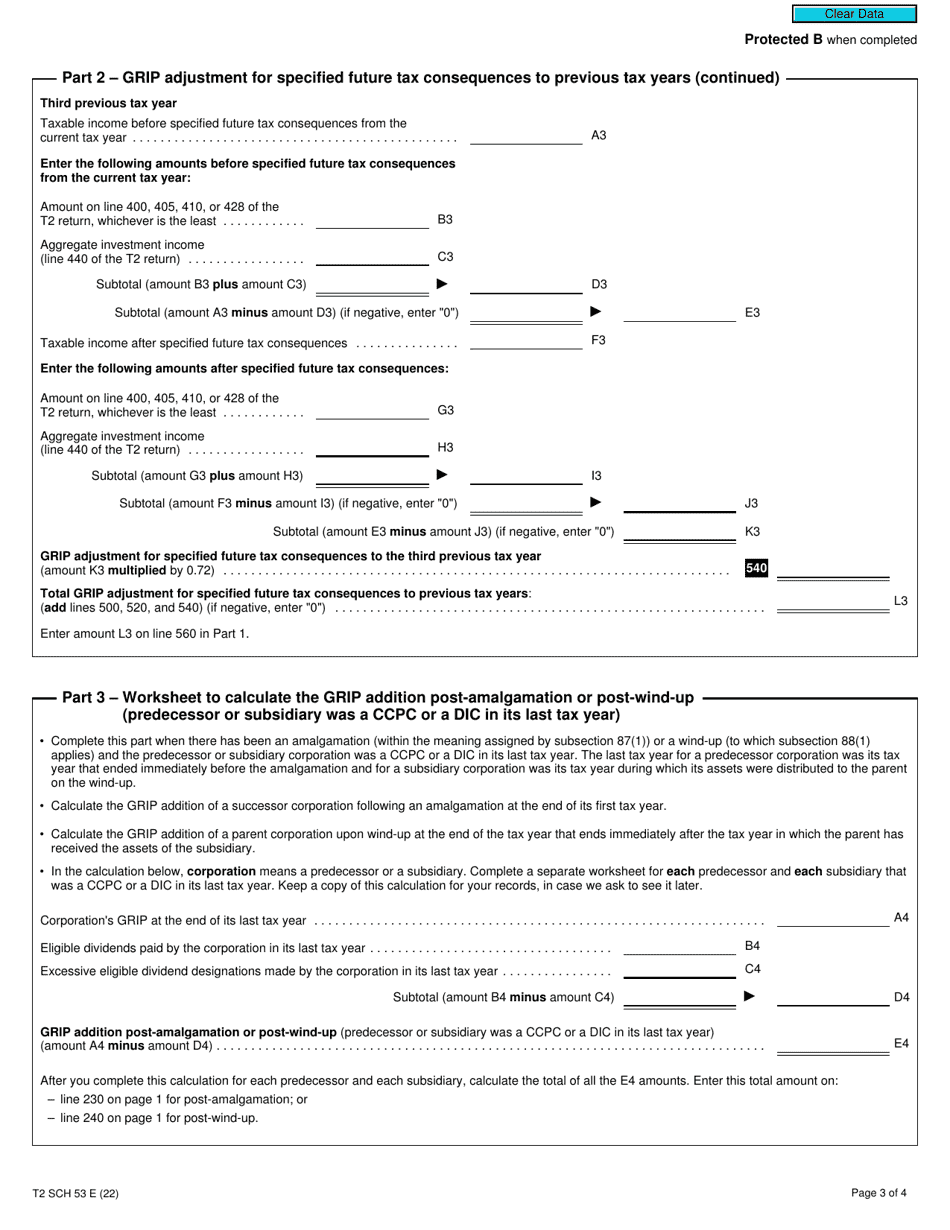

A: T2 Schedule 53 is a form used in Canada to calculate the General Rate Income Pool (GRIP) for tax years 2019 and later.

Q: What is the General Rate Income Pool (GRIP)?

A: The General Rate Income Pool (GRIP) is a calculation that determines the maximum eligible dividend a corporation can pay without incurring additional taxes.

Q: Who needs to fill out T2 Schedule 53?

A: Corporations in Canada that want to determine their General Rate Income Pool (GRIP) for tax years 2019 and later must fill out T2 Schedule 53.

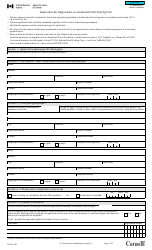

Q: What information is required to fill out T2 Schedule 53?

A: To complete T2 Schedule 53, a corporation needs to provide details about its taxable dividends, refundable dividend tax on hand, and other relevant information.

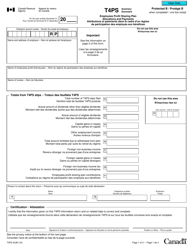

Q: Are there any specific instructions for filling out T2 Schedule 53?

A: Yes, the CRA provides instructions on how to fill out T2 Schedule 53. It is advisable to consult these instructions or seek professional assistance when completing the form.

Q: When is T2 Schedule 53 due?

A: The due date for T2 Schedule 53 depends on the corporation's tax year-end. It is generally due within six months of the end of the corporation's taxation year.