This version of the form is not currently in use and is provided for reference only. Download this version of

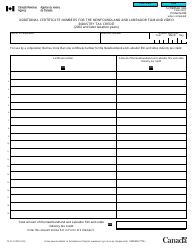

Form T2 Schedule 388

for the current year.

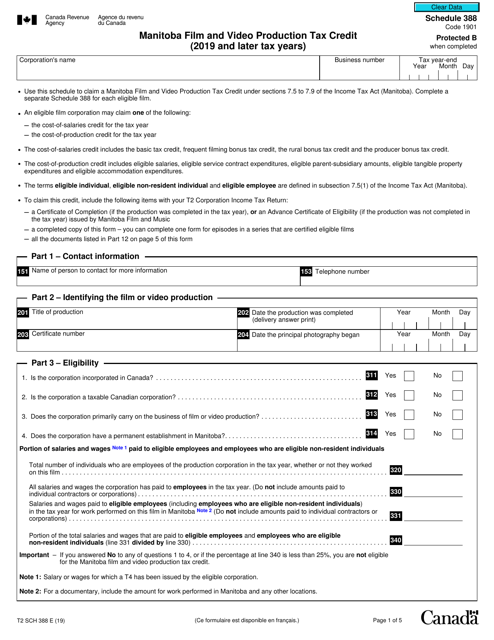

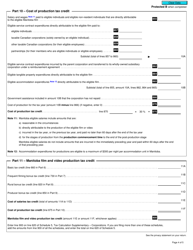

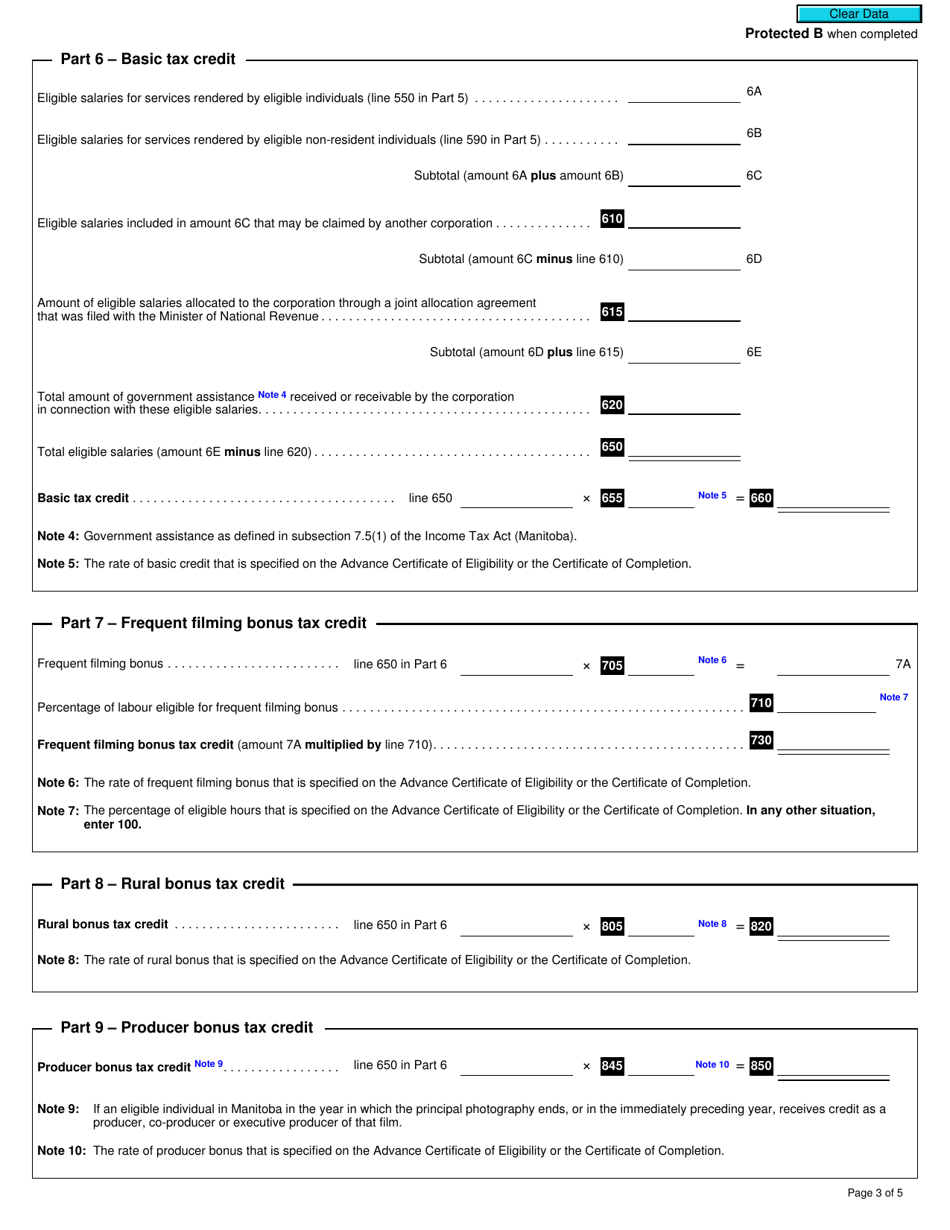

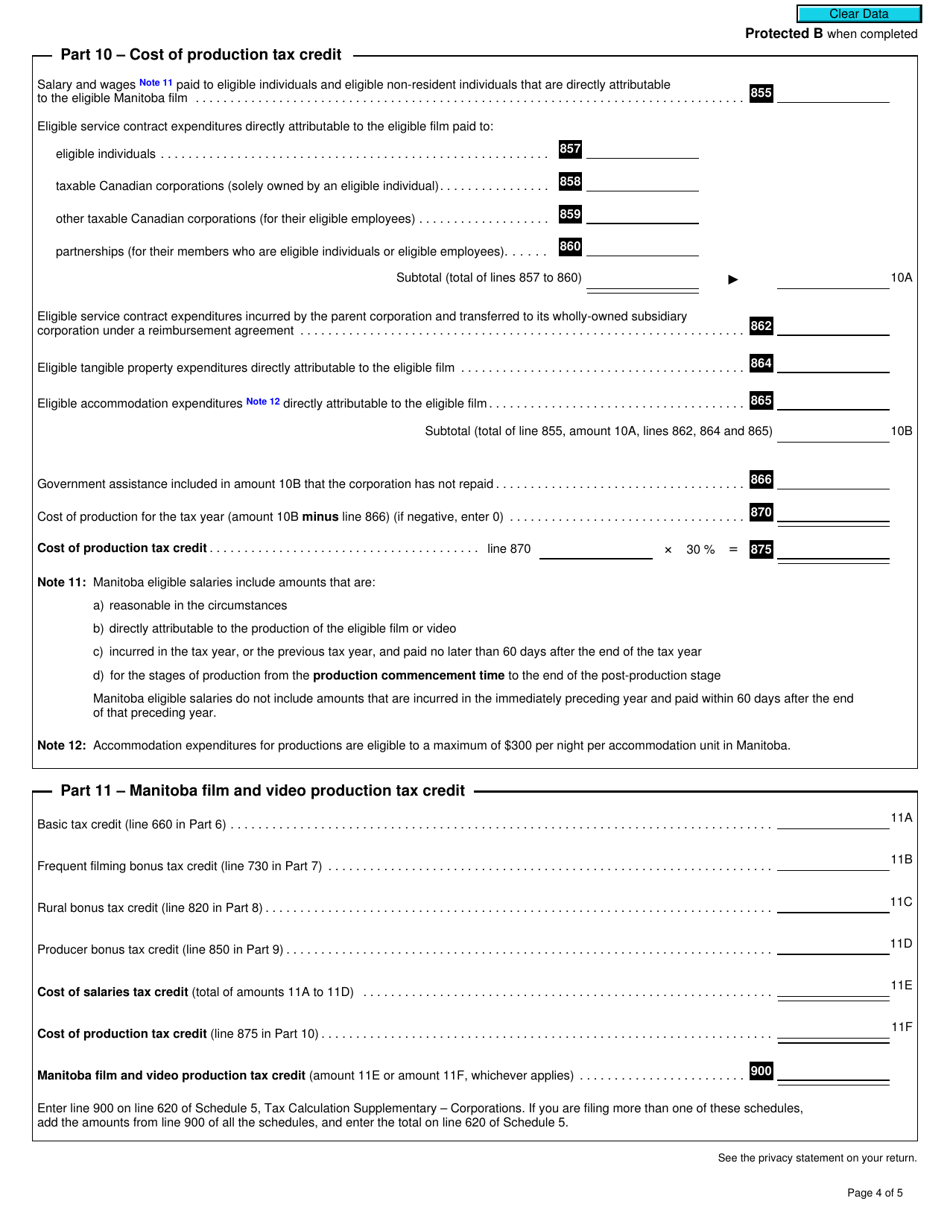

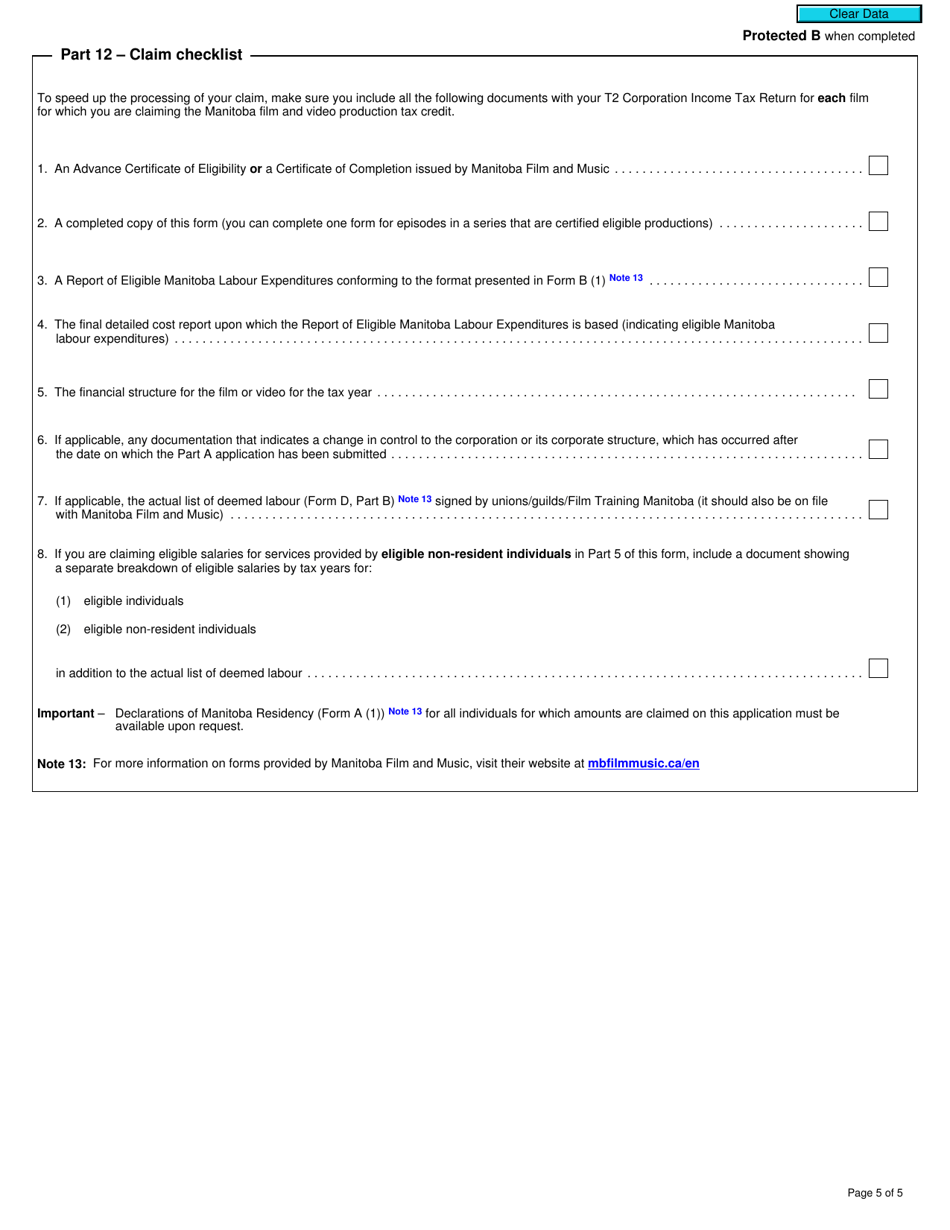

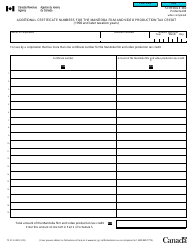

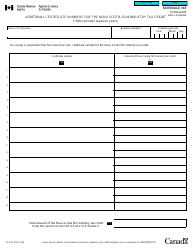

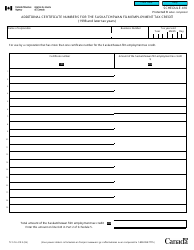

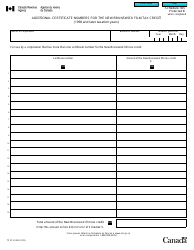

Form T2 Schedule 388 Manitoba Film and Video Production Tax Credit (2019 and Later Tax Years) - Canada

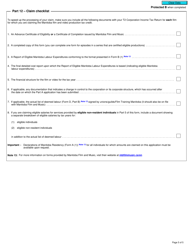

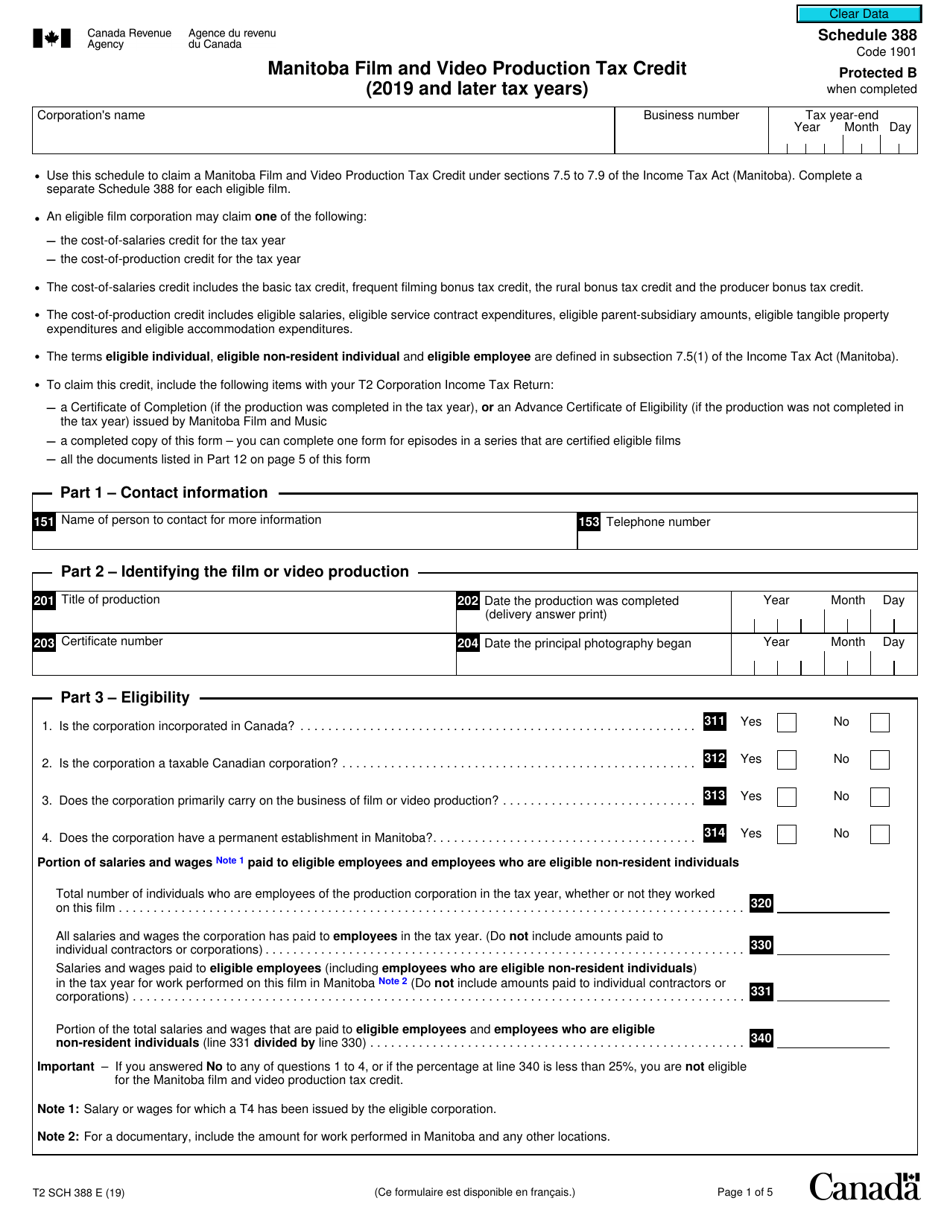

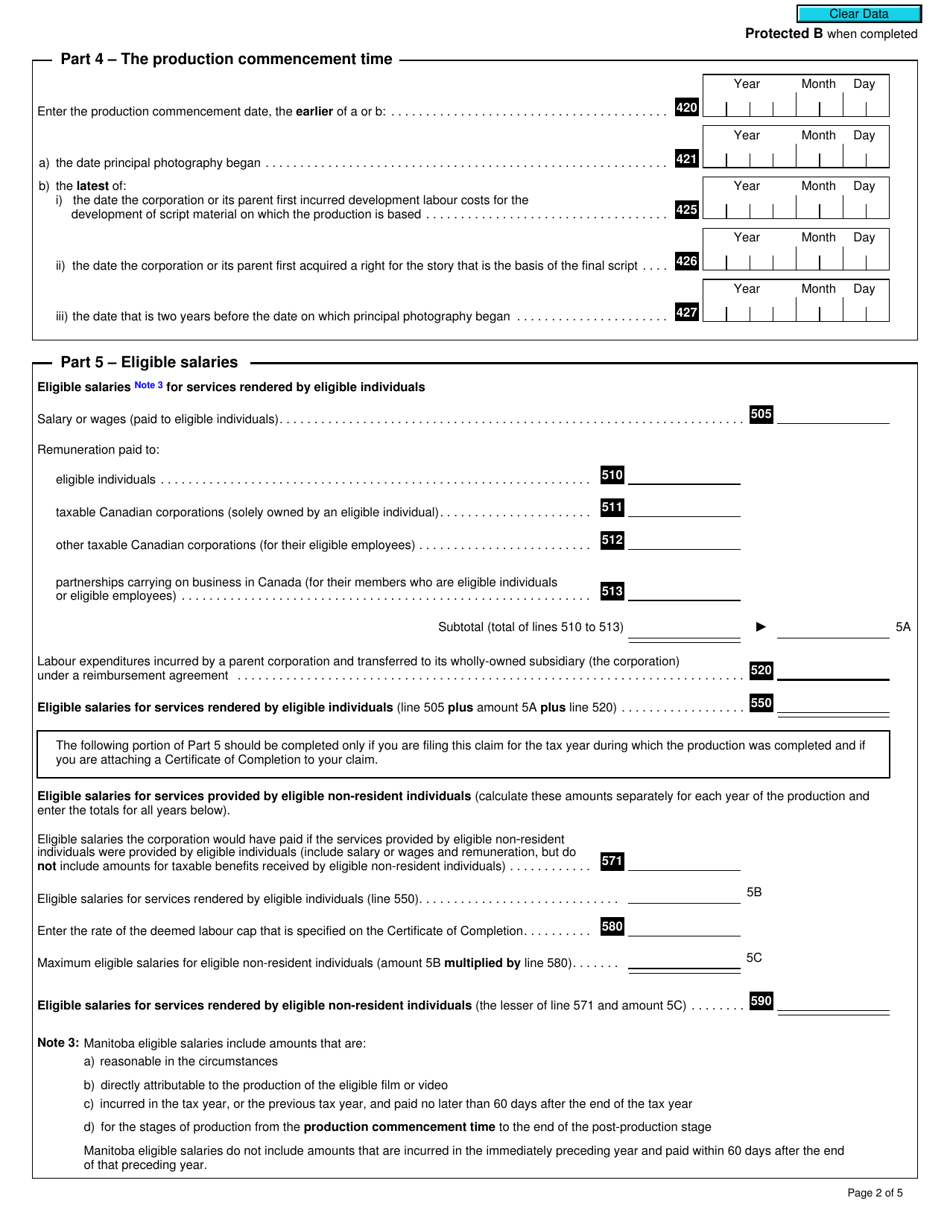

Form T2 Schedule 388 is used to claim the Manitoba Film and Video Production Tax Credit in Canada. This tax credit is available for eligible corporations that produce film or video projects in Manitoba. The form is used to calculate the credit amount that can be claimed on the corporate income tax return.

The production company files the Form T2 Schedule 388 Manitoba Film and Video Production Tax Credit in Canada.

FAQ

Q: What is Form T2 Schedule 388?

A: Form T2 Schedule 388 is a tax form used in Canada for claiming the Manitoba Film and Video Production Tax Credit.

Q: What is the purpose of the Manitoba Film and Video Production Tax Credit?

A: The purpose of the Manitoba Film and Video Production Tax Credit is to encourage film and video production in Manitoba by providing tax incentives.

Q: Who is eligible to claim the Manitoba Film and Video Production Tax Credit?

A: Eligible corporations engaged in film and video production in Manitoba can claim the tax credit.

Q: What is the timeframe for claiming the tax credit?

A: The tax credit can be claimed for tax years starting on or after January 1, 2019.

Q: What are the requirements for claiming the tax credit?

A: To claim the tax credit, the corporation must meet certain eligibility criteria and submit the completed Form T2 Schedule 388 with their corporate tax return.

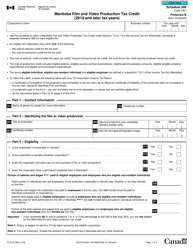

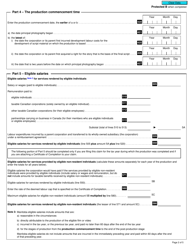

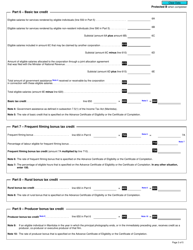

Q: How is the tax credit calculated?

A: The tax credit is calculated based on eligible Manitoba expenditures incurred during the tax year.

Q: Is there a limit to the amount of tax credit that can be claimed?

A: Yes, there are limits to the amount of tax credit that can be claimed, including a maximum annual credit limit and a per-project limit.

Q: Are there any other conditions for claiming the tax credit?

A: Yes, there are additional conditions and requirements that must be met, as outlined in the instructions for Form T2 Schedule 388.