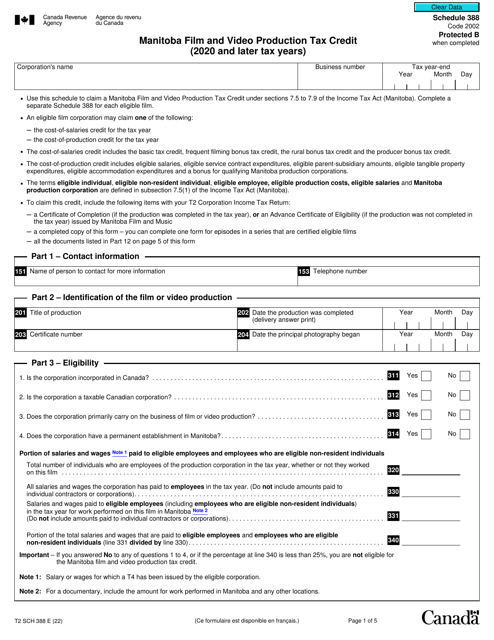

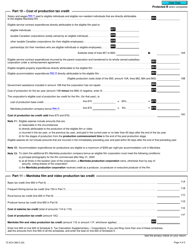

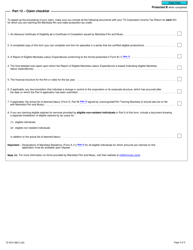

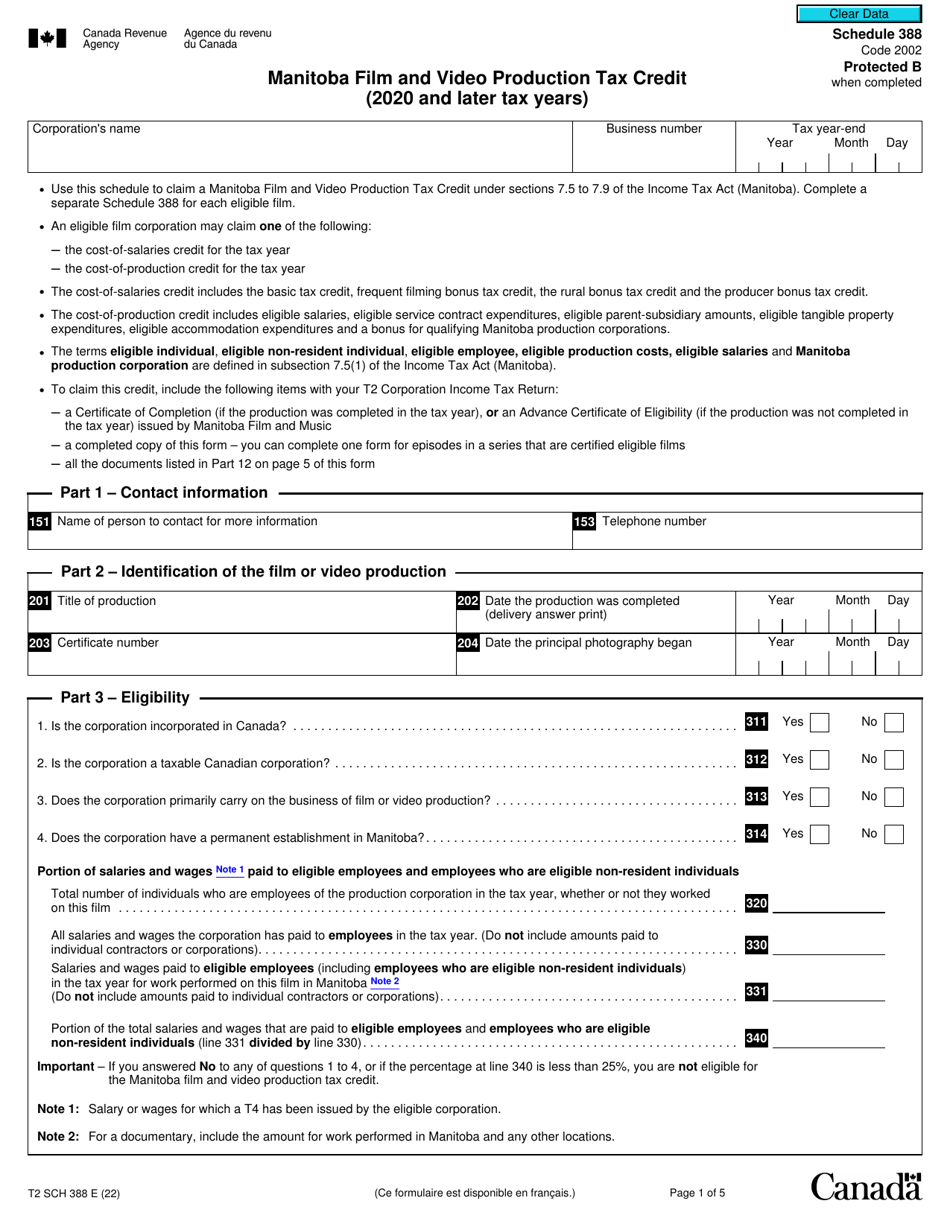

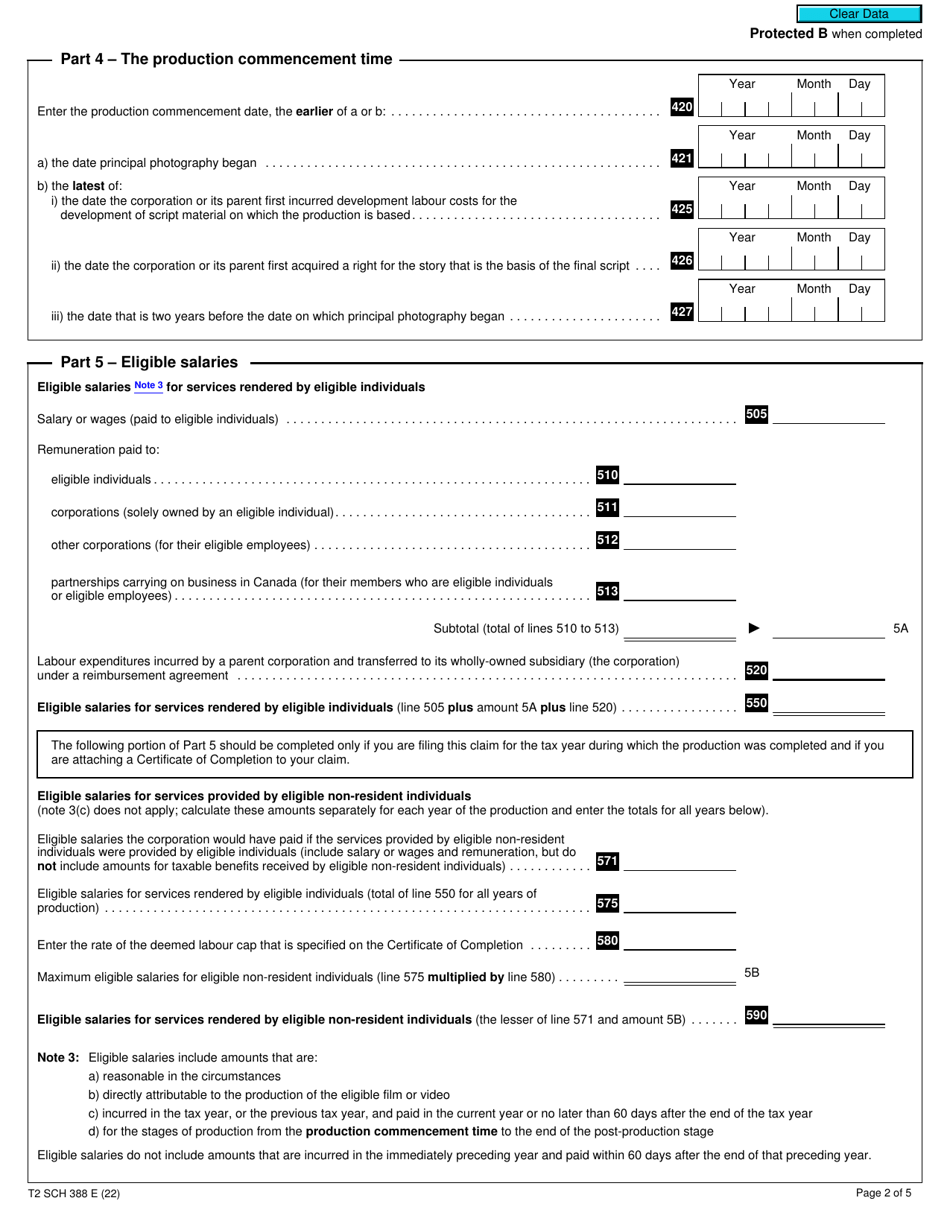

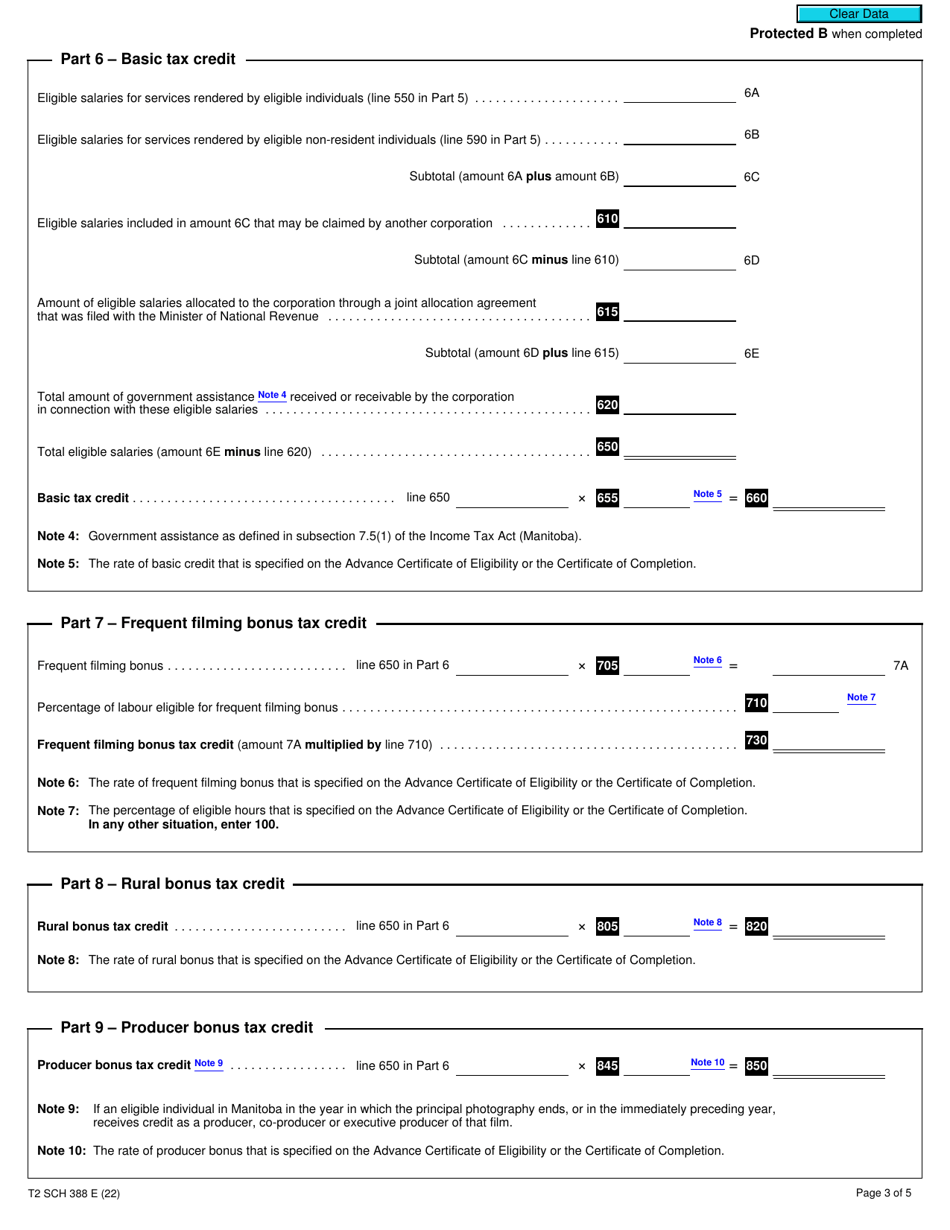

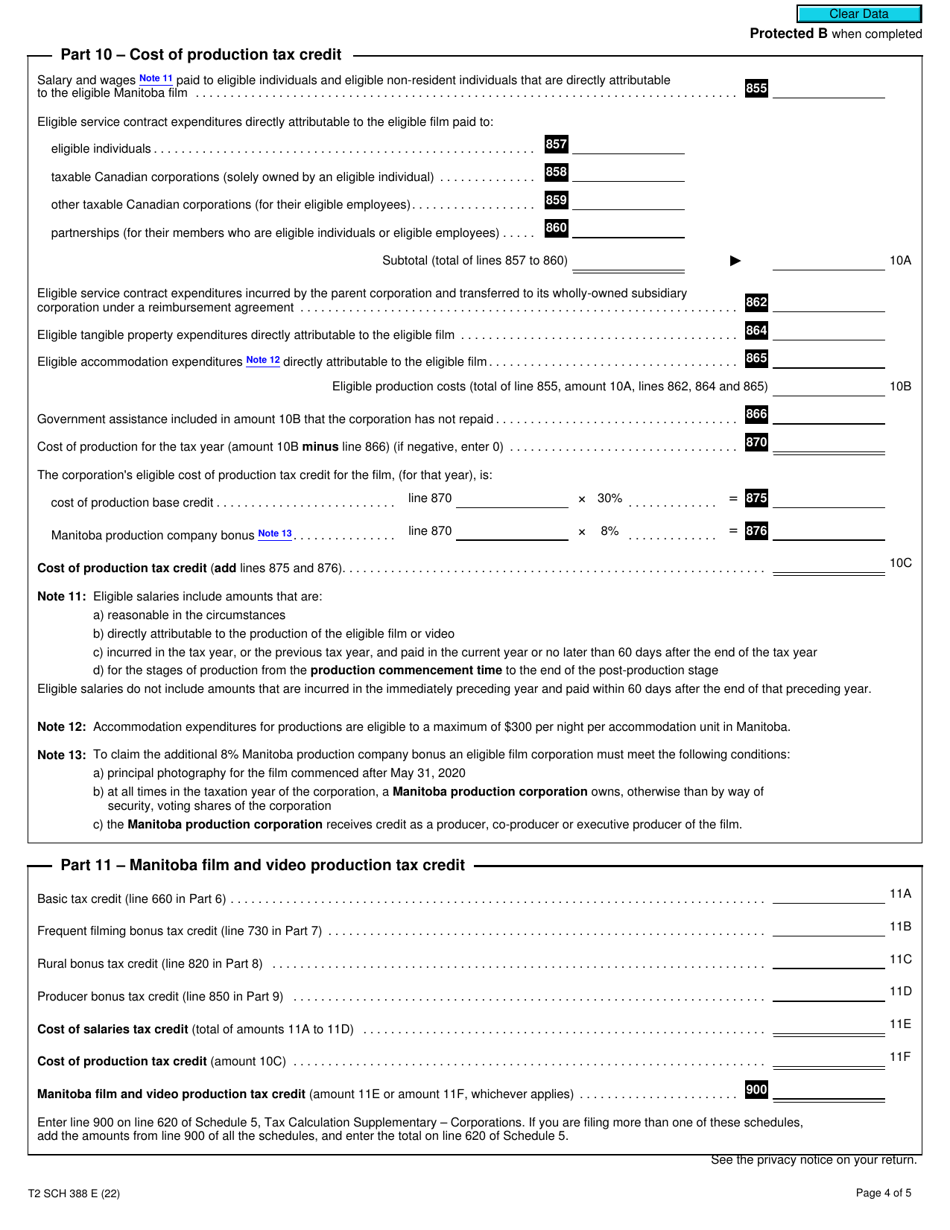

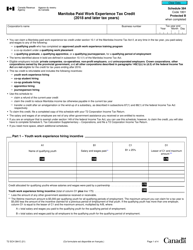

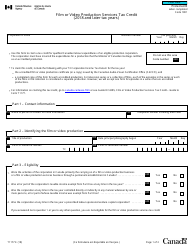

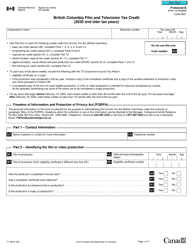

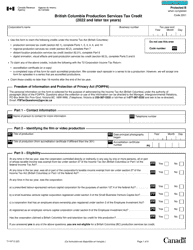

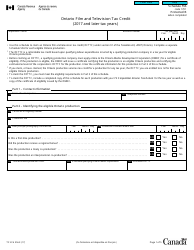

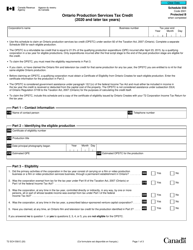

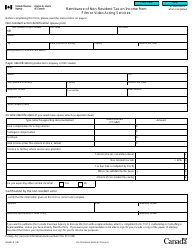

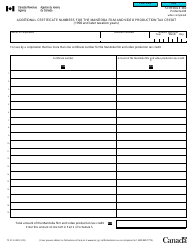

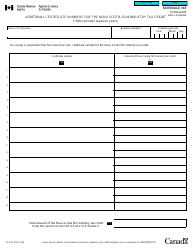

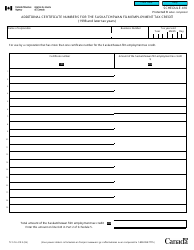

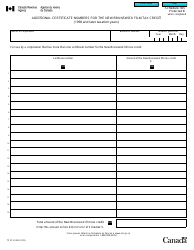

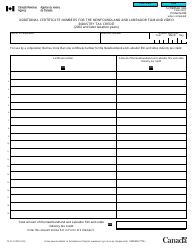

Form T2 Schedule 388 Manitoba Film and Video Production Tax Credit (2020 and Later Tax Years) - Canada

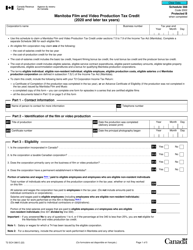

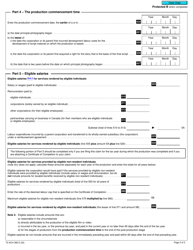

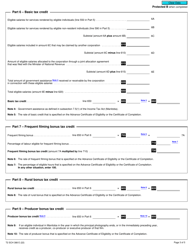

Form T2 Schedule 388 is a tax form used in Canada for claiming the Manitoba Film and Video ProductionTax Credit for the tax years 2020 and later. This tax credit is available to businesses involved in film and video production in Manitoba. It provides incentives to support and promote the local film industry in Manitoba.

The production company filing for the Manitoba Film and Video Production Tax Credit would complete the Form T2 Schedule 388.

Form T2 Schedule 388 Manitoba Film and Video Production Tax Credit (2020 and Later Tax Years) - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T2 Schedule 388?

A: Form T2 Schedule 388 is a tax form specifically for claiming the Manitoba Film and Video Production Tax Credit.

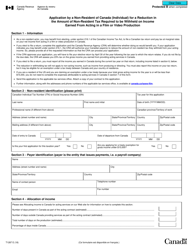

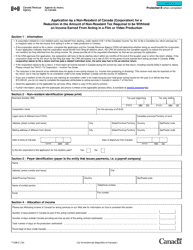

Q: Who can use Form T2 Schedule 388?

A: This form can be used by corporations that are eligible for the Manitoba Film and Video Production Tax Credit.

Q: What is the purpose of the Manitoba Film and Video Production Tax Credit?

A: The purpose of this tax credit is to promote the growth of the Manitoba film and video production industry.

Q: What tax years does Form T2 Schedule 388 cover?

A: Form T2 Schedule 388 is for the 2020 tax year and later.

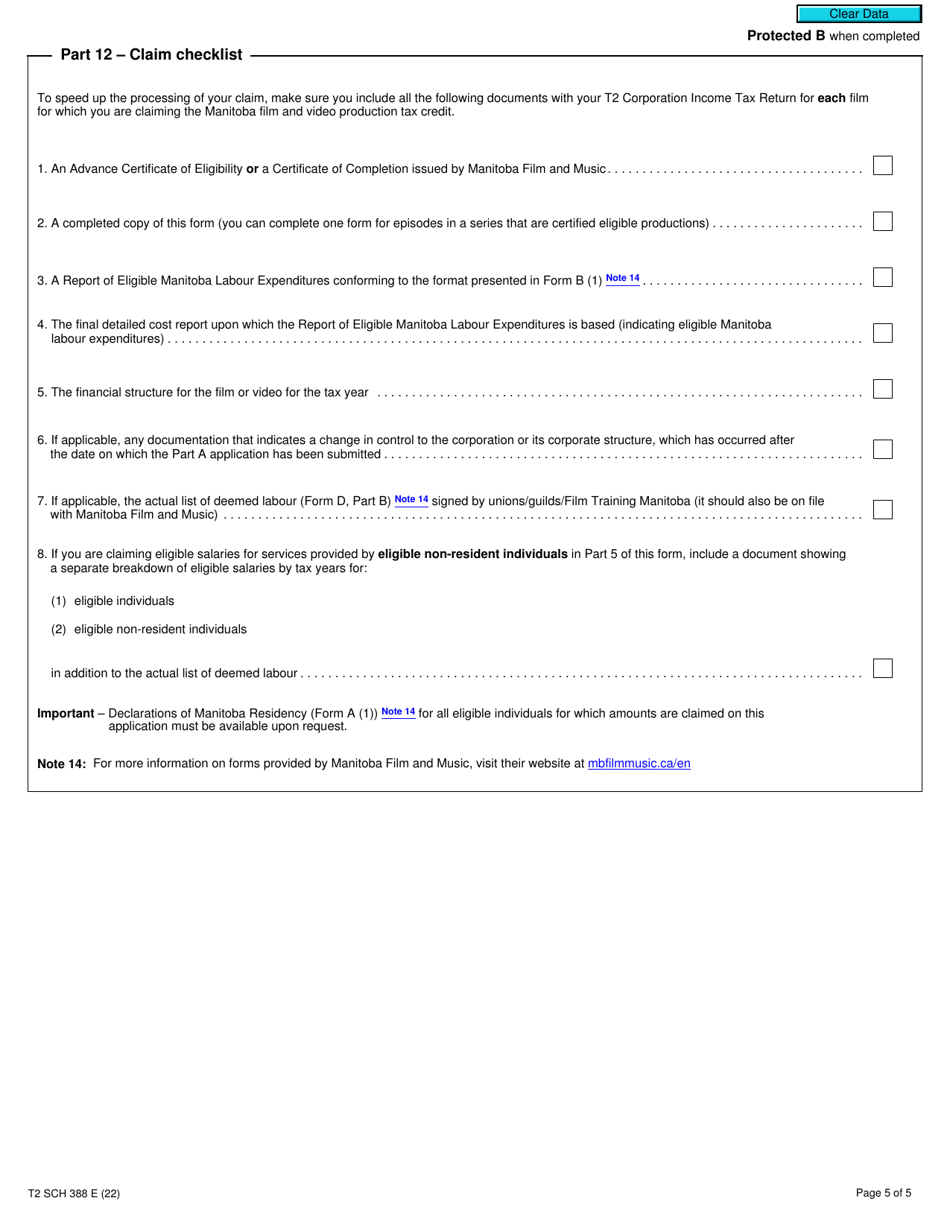

Q: Are there any other requirements or documentation needed to claim the Manitoba Film and Video Production Tax Credit?

A: Yes, there are additional requirements and documentation needed. You should refer to the official instructions for Form T2 Schedule 388 for more details.

Q: Is the Manitoba Film and Video Production Tax Credit refundable?

A: Yes, this tax credit is refundable, meaning that if it exceeds the corporation's income tax payable, the excess can be paid out as a refund.

Q: Can I claim the Manitoba Film and Video Production Tax Credit if I am an individual taxpayer?

A: No, this tax credit is specifically for corporations and cannot be claimed by individuals.

Q: Is there a deadline for filing Form T2 Schedule 388?

A: The deadline for filing this form is generally within 18 months after the end of the tax year to which it applies. However, it is recommended to check the specific deadlines set by the CRA.

Q: What should I do if I need help with completing Form T2 Schedule 388?

A: If you need assistance or have specific questions about this form, it is recommended to contact the Canada Revenue Agency (CRA) for guidance.