This version of the form is not currently in use and is provided for reference only. Download this version of

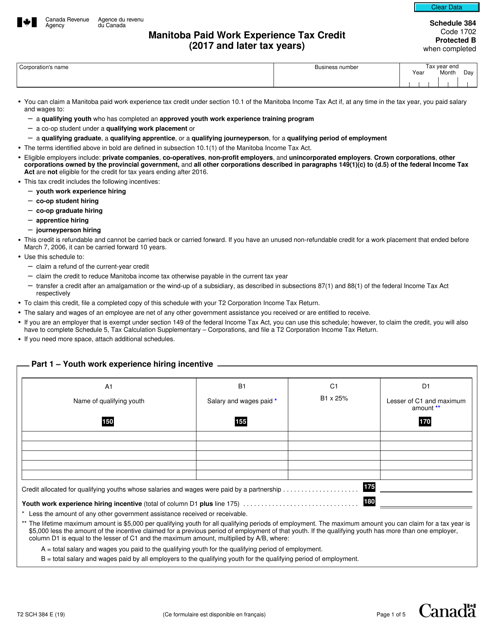

Form T2 Schedule 384

for the current year.

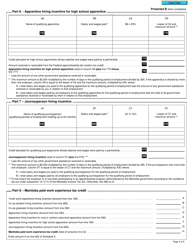

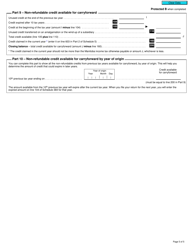

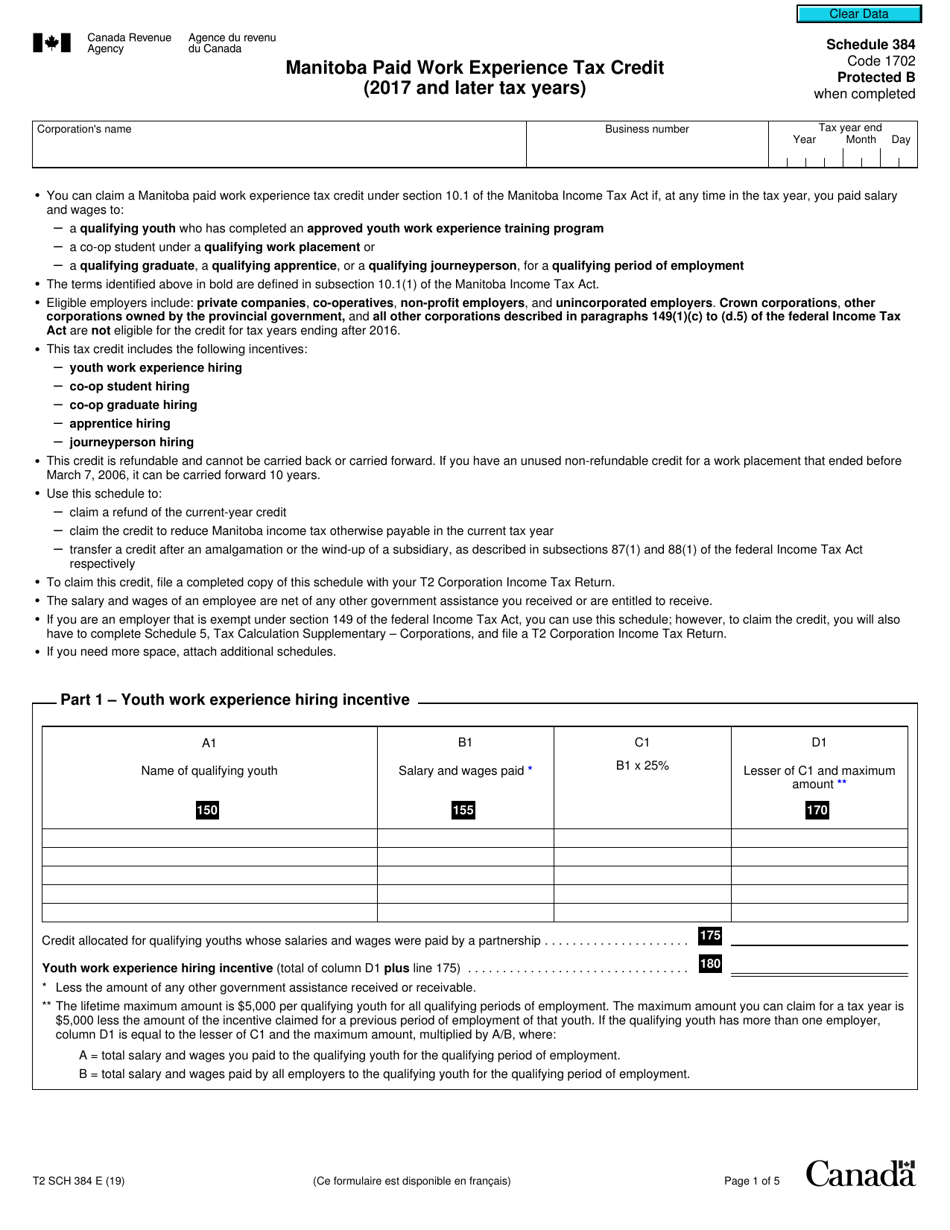

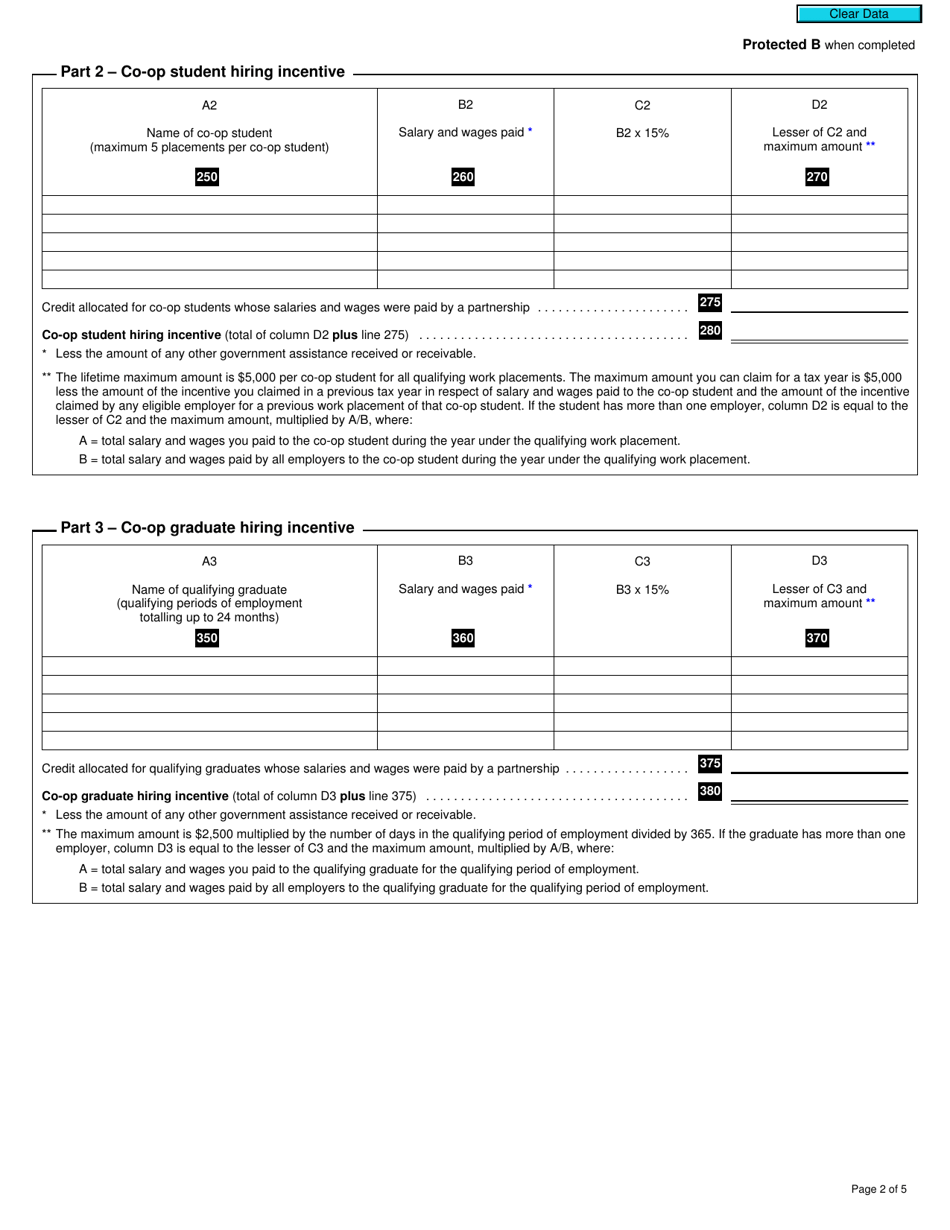

Form T2 Schedule 384 Manitoba Film and Video Production Tax Credit (2017 and Later Tax Years) - Canada

Form T2 Schedule 384 is used for claiming the Manitoba Film and Video Production Tax Credit in Canada. This tax credit is available for eligible corporations engaged in the production of eligible films or video productions in Manitoba. It is applicable for the 2017 and later tax years.

The Form T2 Schedule 384 Manitoba Film and Video Production Tax Credit is filed by eligible corporations that have incurred eligible expenditures in the production of eligible Manitoba film and video productions.

FAQ

Q: What is Form T2 Schedule 384?

A: Form T2 Schedule 384 is a tax form used in Canada for the Manitoba Film and Video Production Tax Credit.

Q: What is the Manitoba Film and Video Production Tax Credit?

A: The Manitoba Film and Video Production Tax Credit is a tax credit offered by the province of Manitoba in Canada to support film and video production.

Q: Who can claim the Manitoba Film and Video Production Tax Credit?

A: Film and video production companies that meet the eligibility requirements can claim the Manitoba Film and Video Production Tax Credit.

Q: What are the eligibility requirements for the Manitoba Film and Video Production Tax Credit?

A: The eligibility requirements for the Manitoba Film and Video Production Tax Credit include meeting certain production criteria, having an eligible Canadian production corporation, and meeting other specific requirements set by the province of Manitoba.

Q: How can I claim the Manitoba Film and Video Production Tax Credit?

A: To claim the Manitoba Film and Video Production Tax Credit, you need to complete Form T2 Schedule 384 and include it with your T2 corporate income tax return.

Q: Is the Manitoba Film and Video Production Tax Credit refundable?

A: Yes, the Manitoba Film and Video Production Tax Credit is refundable, which means that if the tax credit exceeds your tax liability, you may be eligible to receive a refund.

Q: Are there any deadlines for claiming the Manitoba Film and Video Production Tax Credit?

A: Yes, there are specific deadlines for claiming the Manitoba Film and Video Production Tax Credit. It is important to consult the official tax guides or contact the Manitoba Film and Music office for the most up-to-date information regarding deadlines.