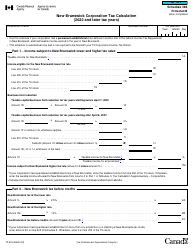

This version of the form is not currently in use and is provided for reference only. Download this version of

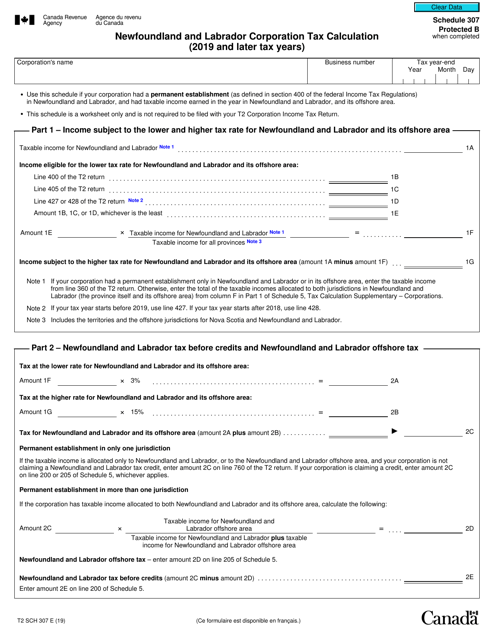

Form T2 Schedule 307

for the current year.

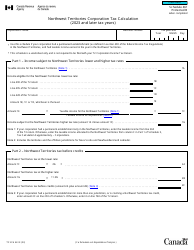

Form T2 Schedule 307 Newfoundland and Labrador Corporation Tax Calculation (2019 and Later Tax Years) - Canada

Form T2 Schedule 307 Newfoundland and Labrador Corporation Tax Calculation is used to calculate the corporation tax owed by a corporation based in Newfoundland and Labrador, Canada for the tax years 2019 and later.

The corporation that is subject to the Newfoundland and Labrador Corporation Tax files the Form T2 Schedule 307.

FAQ

Q: What is Form T2 Schedule 307?

A: Form T2 Schedule 307 is used for calculating Newfoundland and Labrador Corporation Tax.

Q: What is the purpose of Form T2 Schedule 307?

A: Form T2 Schedule 307 is used to calculate the amount of Newfoundland and Labrador Corporation Tax owed.

Q: Who needs to file Form T2 Schedule 307?

A: Corporations in Newfoundland and Labrador that are required to pay Corporation Tax must file this form.

Q: What tax years does Form T2 Schedule 307 apply to?

A: Form T2 Schedule 307 is applicable for tax years starting in 2019 and later.

Q: Are there any specific instructions or guidelines for completing Form T2 Schedule 307?

A: Yes, specific instructions and guidelines are provided on the form itself.

Q: Is Form T2 Schedule 307 specific to Newfoundland and Labrador?

A: Yes, Form T2 Schedule 307 is specific to Newfoundland and Labrador Corporation Tax.

Q: What happens if I don't file Form T2 Schedule 307?

A: Failing to file Form T2 Schedule 307 can result in penalties and interest charges.

Q: Can I e-file Form T2 Schedule 307?

A: Yes, you can electronically file Form T2 Schedule 307 using the Canada Revenue Agency's (CRA) NETFILE service.