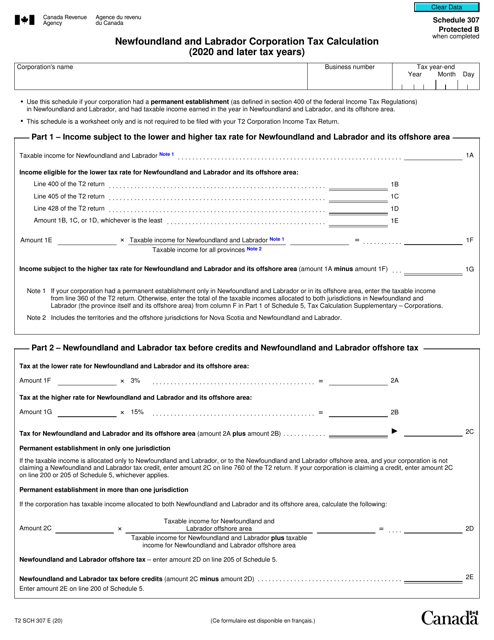

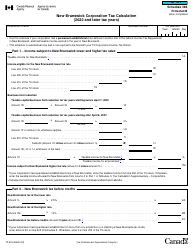

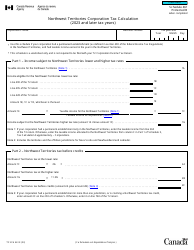

Form T2 Schedule 307 Newfoundland and Labrador Corporation Tax Calculation - Canada

Form T2 Schedule 307 is used for calculating the Newfoundland and Labrador corporation tax for Canadian corporations operating in that province. It helps businesses determine their tax liability based on their income and other factors specific to Newfoundland and Labrador.

The Newfoundland and Labrador corporations that are required to file their taxes in Canada.

Form T2 Schedule 307 Newfoundland and Labrador Corporation Tax Calculation - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T2 Schedule 307?

A: Form T2 Schedule 307 is a tax form used in Canada to calculate the Newfoundland and Labrador Corporation Tax.

Q: Who needs to file Form T2 Schedule 307?

A: This form needs to be filed by corporations operating in Newfoundland and Labrador province in Canada.

Q: What is the purpose of Form T2 Schedule 307?

A: The purpose of this form is to calculate the corporation tax owed by a company in Newfoundland and Labrador.

Q: How do I complete Form T2 Schedule 307?

A: To complete this form, you need to provide information about your company's income, expenses, and tax deductions.

Q: What happens if I don't file Form T2 Schedule 307?

A: If you don't file this form or file it late, you may face penalties and interest charges from the CRA.

Q: Do I need to keep a copy of Form T2 Schedule 307?

A: Yes, it is important to keep a copy of this form for your records in case of future audits or inquiries from the CRA.