This version of the form is not currently in use and is provided for reference only. Download this version of

Form T2203 (9414-S11) Schedule NU(S11)MJ

for the current year.

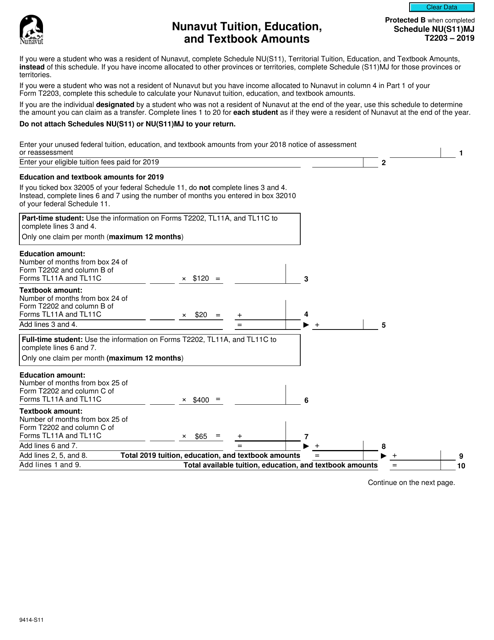

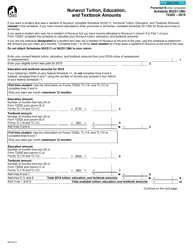

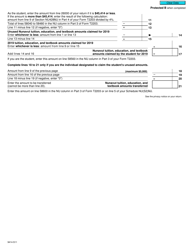

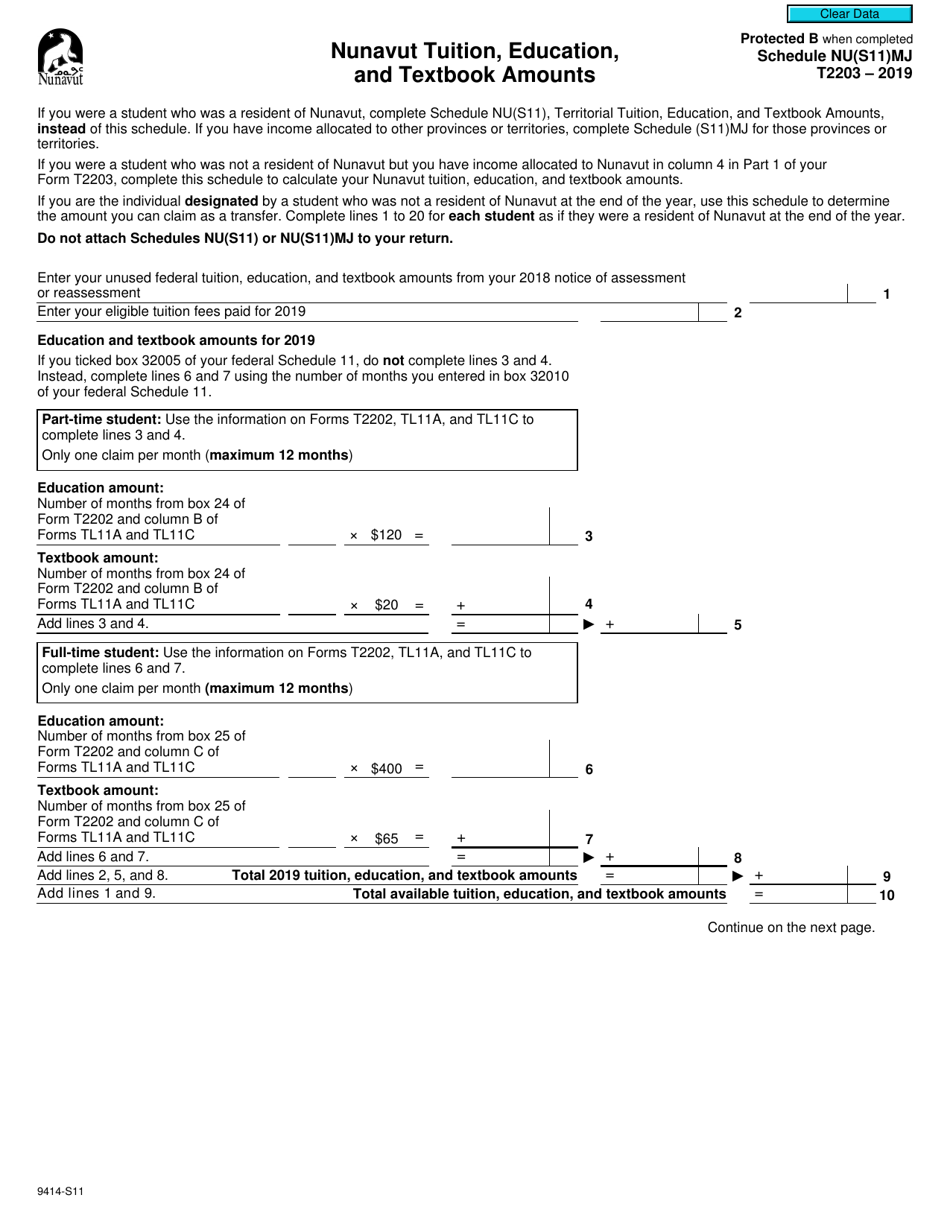

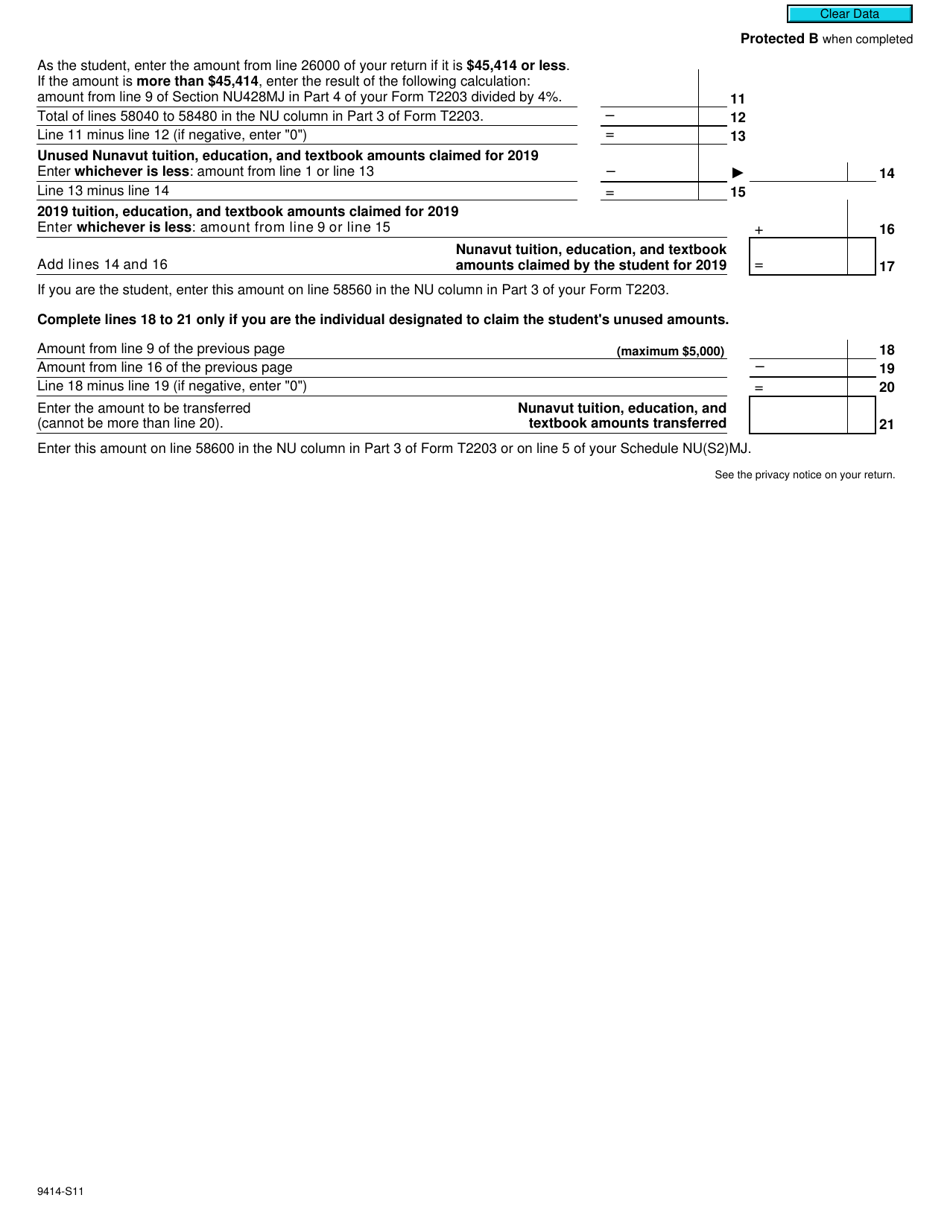

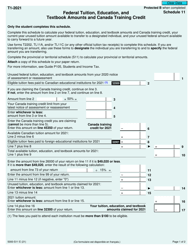

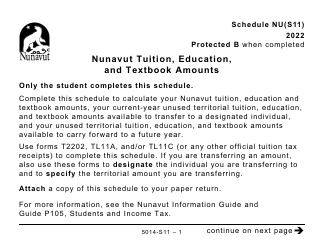

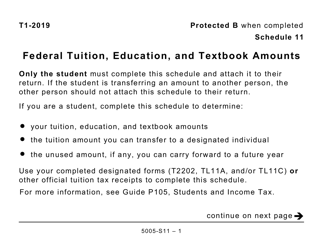

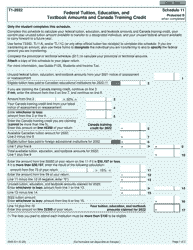

Form T2203 (9414-S11) Schedule NU(S11)MJ Nunavut Tuition, Education, and Textbook Amounts - Canada

Form T2203 (9414-S11) Schedule NU(S11)MJ Nunavut Tuition, Education, and Textbook Amounts is a tax form used in Canada for residents of Nunavut. It is used to claim educational expenses, such as tuition fees and textbook costs, as tax credits on their tax return.

Form T2203 (9414-S11) Schedule NU(S11)MJ Nunavut Tuition, Education, and Textbook Amounts in Canada is typically filed by individuals who are residents of Nunavut and are claiming tuition, education, and textbook amounts for tax purposes.

FAQ

Q: What is Form T2203 (9414-S11) Schedule NU(S11)MJ?

A: Form T2203 (9414-S11) Schedule NU(S11)MJ is a tax form used in Canada to claim Nunavut tuition, education, and textbook amounts.

Q: Who can use Form T2203 (9414-S11) Schedule NU(S11)MJ?

A: Form T2203 (9414-S11) Schedule NU(S11)MJ is used by residents of Nunavut in Canada who paid tuition fees, education, or textbook expenses.

Q: What can be claimed using Form T2203 (9414-S11) Schedule NU(S11)MJ?

A: Form T2203 (9414-S11) Schedule NU(S11)MJ can be used to claim tuition fees, education amounts, and textbook amounts paid by residents of Nunavut.

Q: How does Form T2203 (9414-S11) Schedule NU(S11)MJ work?

A: Form T2203 (9414-S11) Schedule NU(S11)MJ allows residents of Nunavut to claim tax credits for eligible tuition fees, education expenses, and textbook expenses.