This version of the form is not currently in use and is provided for reference only. Download this version of

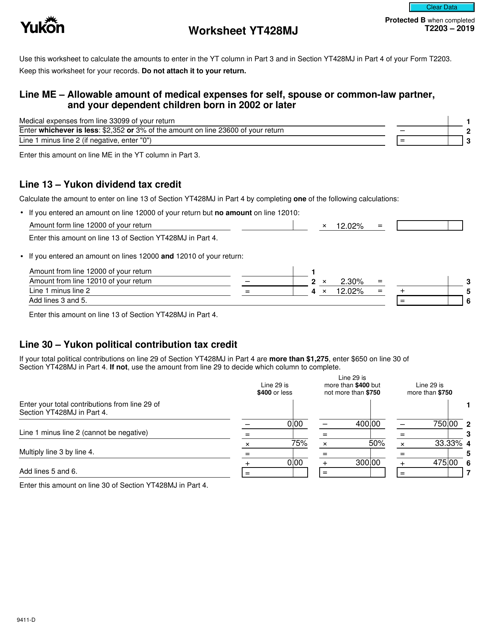

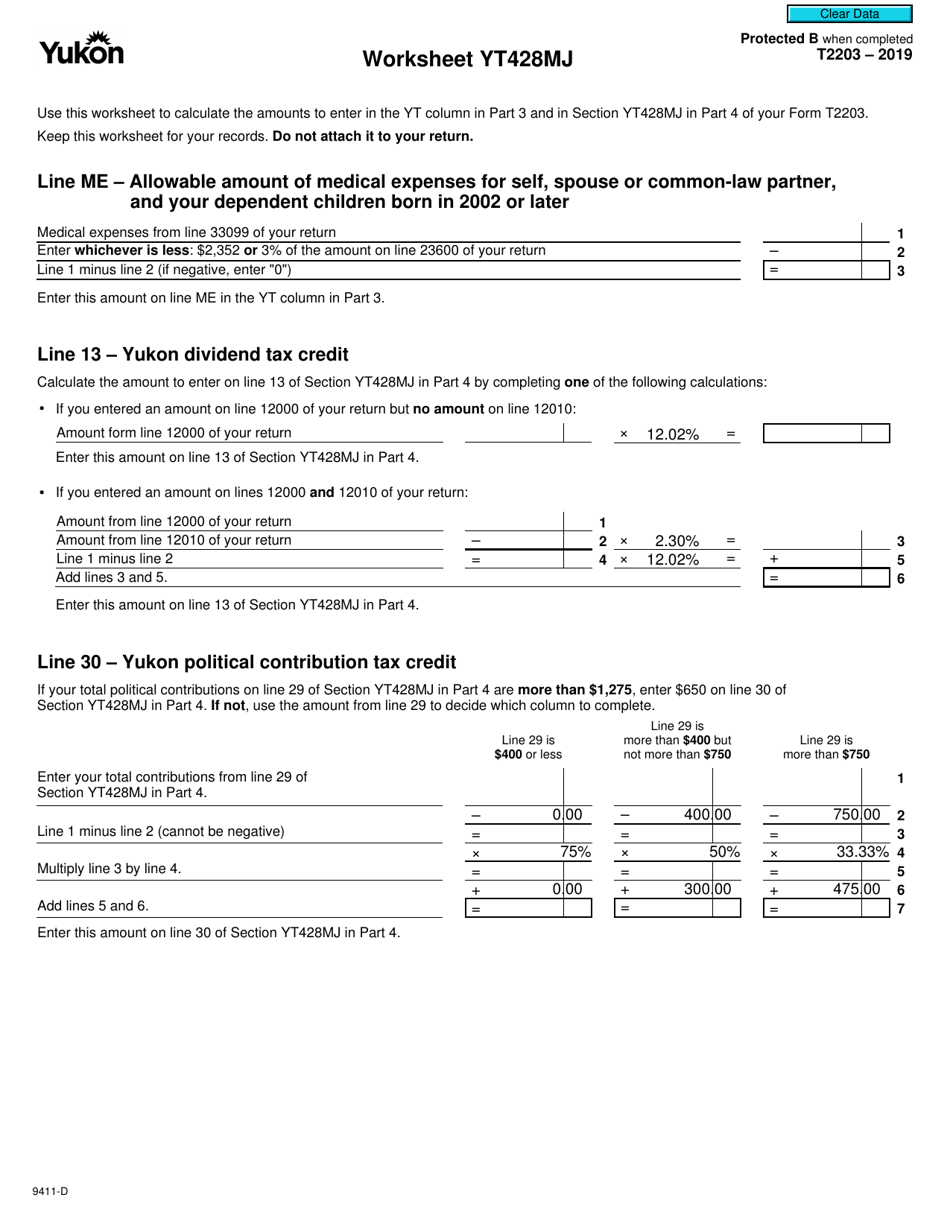

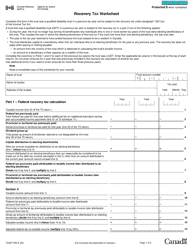

Form T2203 (9411-D) Worksheet YT428MJ

for the current year.

Form T2203 (9411-D) Worksheet YT428MJ Yukon - Canada

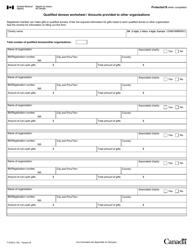

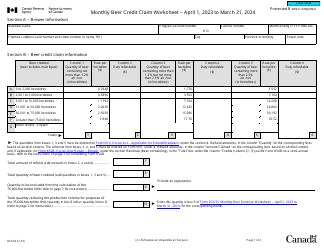

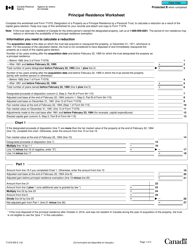

Form T2203 (9411-D) Worksheet YT428MJ is used by individuals in Yukon, Canada to calculate the territorial tax payable. It helps residents of Yukon determine the amount of tax they owe to the territorial government.

The Form T2203 (9411-D) Worksheet YT428MJ in Yukon, Canada is filed by individuals or businesses who need to report their Yukon tax information.

FAQ

Q: What is Form T2203 (9411-D)?

A: Form T2203 (9411-D) is a worksheet used for calculating the Yukon Tax on Split Income (TOSI) payable by individuals in Yukon, Canada.

Q: What is the purpose of Worksheet YT428MJ?

A: The purpose of Worksheet YT428MJ is to help individuals in Yukon calculate their tax payable on split income.

Q: Who needs to use Worksheet YT428MJ?

A: Individuals in Yukon who have split income and need to calculate the Yukon Tax on Split Income (TOSI) should use Worksheet YT428MJ.

Q: Do I need to file Worksheet YT428MJ?

A: No, Worksheet YT428MJ is a worksheet for your own calculations. You don't need to submit it with your tax return, but you should keep it for your records.