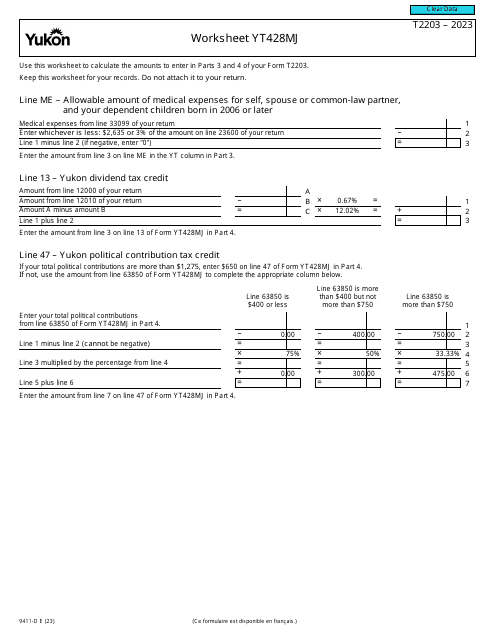

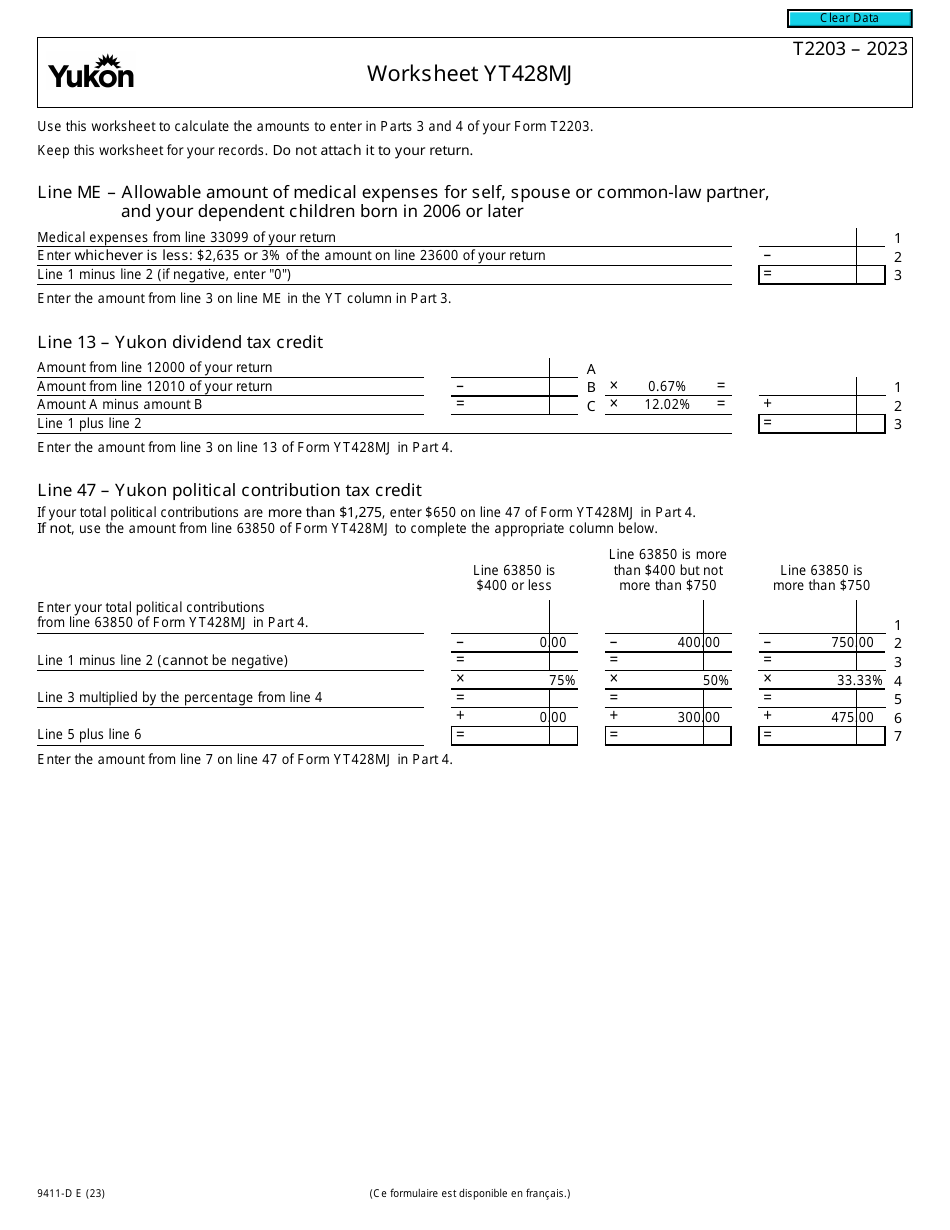

Form T2203 (9411-D) Worksheet YT428MJ Yukon - Canada

Form T2203 (9411-D) Worksheet YT428MJ is a specific form used for personal tax filing in Yukon, Canada. This form is used to calculate and report the territorial portion of certain non-refundable tax credits, such as the basic personal amount, age amount, and disability amount, which apply specifically to residents of Yukon. The purpose of this form is to ensure accurate reporting of these tax credits, taking into account the unique territorial tax rates and rules applicable in Yukon. It helps individuals in Yukon optimize their tax deductions and potentially reduce their overall tax liabilities.

The Form T2203 (9411-D) Worksheet YT428MJ Yukon is typically filed by individuals who are residents of the Yukon territory in Canada. This form is used to calculate and report the Yukon mineral exploration tax credit.

Form T2203 (9411-D) Worksheet YT428MJ Yukon - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T2203 (9411-D) Worksheet YT428MJ?

A: Form T2203 (9411-D) Worksheet YT428MJ is a tax form specific to the Yukon territory in Canada.

Q: What is the purpose of Form T2203 (9411-D) Worksheet YT428MJ?

A: The purpose of Form T2203 (9411-D) Worksheet YT428MJ is to calculate the territorial tax credits available to individuals living in Yukon.

Q: Who needs to fill out Form T2203 (9411-D) Worksheet YT428MJ?

A: Residents of Yukon who are eligible for territorial tax credits need to fill out Form T2203 (9411-D) Worksheet YT428MJ.

Q: What are territorial tax credits?

A: Territorial tax credits are tax incentives provided to individuals living in Yukon to help offset their tax liabilities.

Q: What information is required on Form T2203 (9411-D) Worksheet YT428MJ?

A: Form T2203 (9411-D) Worksheet YT428MJ requires you to provide information about your income, deductions, and other relevant details for calculating territorial tax credits.

Q: Are there any deadlines for submitting Form T2203 (9411-D) Worksheet YT428MJ?

A: The deadline for submitting Form T2203 (9411-D) Worksheet YT428MJ is usually the same as the deadline for filing your income tax return, which is April 30th of the following year.

Q: Can I file Form T2203 (9411-D) Worksheet YT428MJ electronically?

A: Yes, you can file Form T2203 (9411-D) Worksheet YT428MJ electronically if you are using a certified tax software or hiring a tax professional who can transmit your return electronically.

Q: What should I do with Form T2203 (9411-D) Worksheet YT428MJ after filling it out?

A: After filling out Form T2203 (9411-D) Worksheet YT428MJ, you should include it with your income tax return when filing.