This version of the form is not currently in use and is provided for reference only. Download this version of

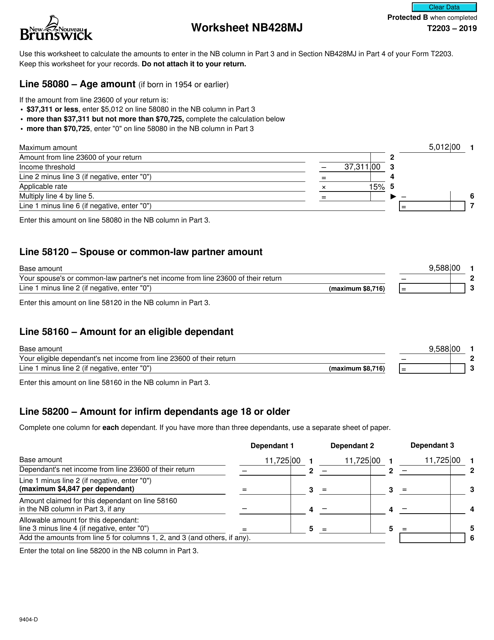

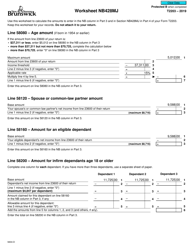

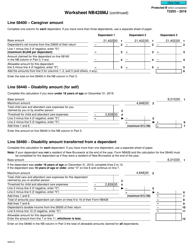

Form T2203 (9404-D) Worksheet NB428MJ

for the current year.

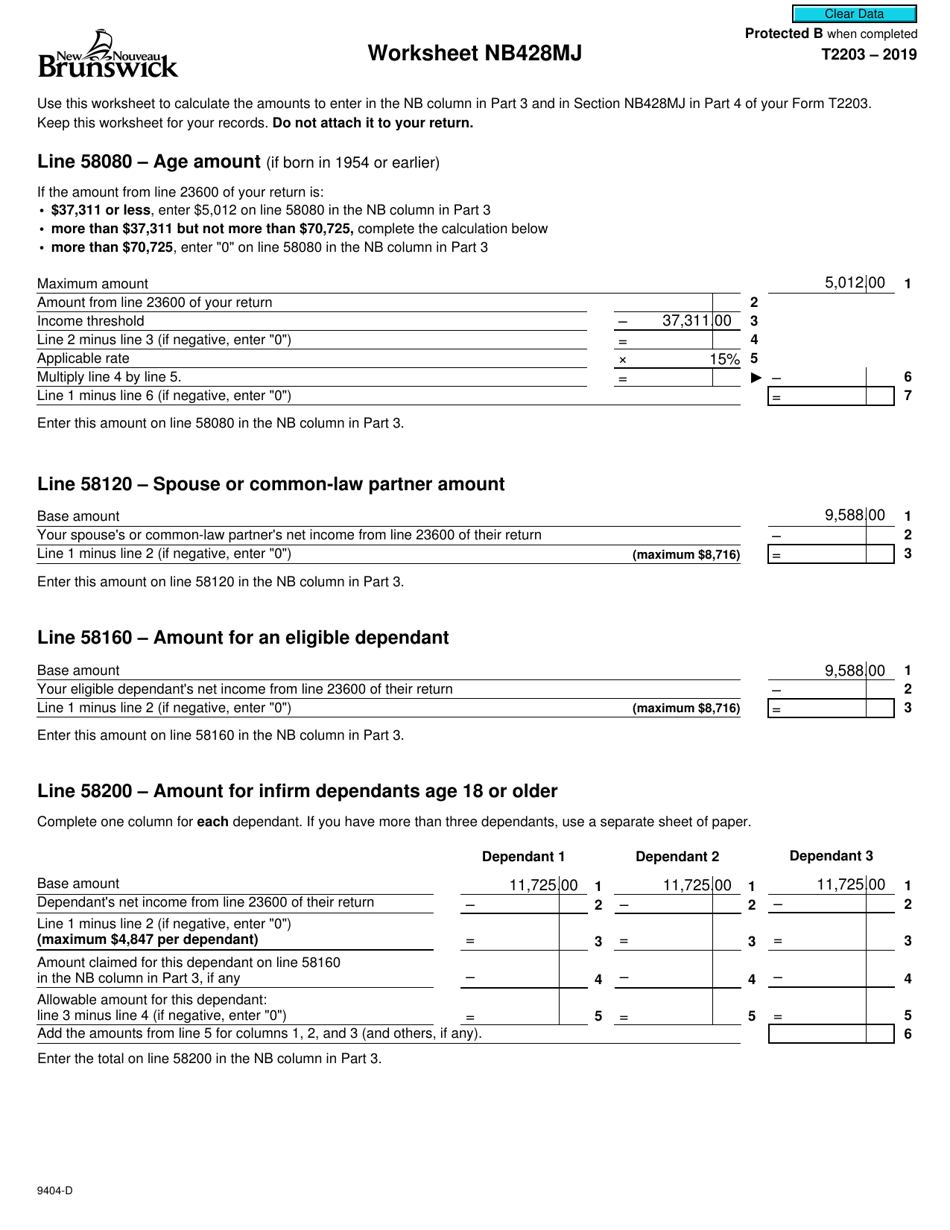

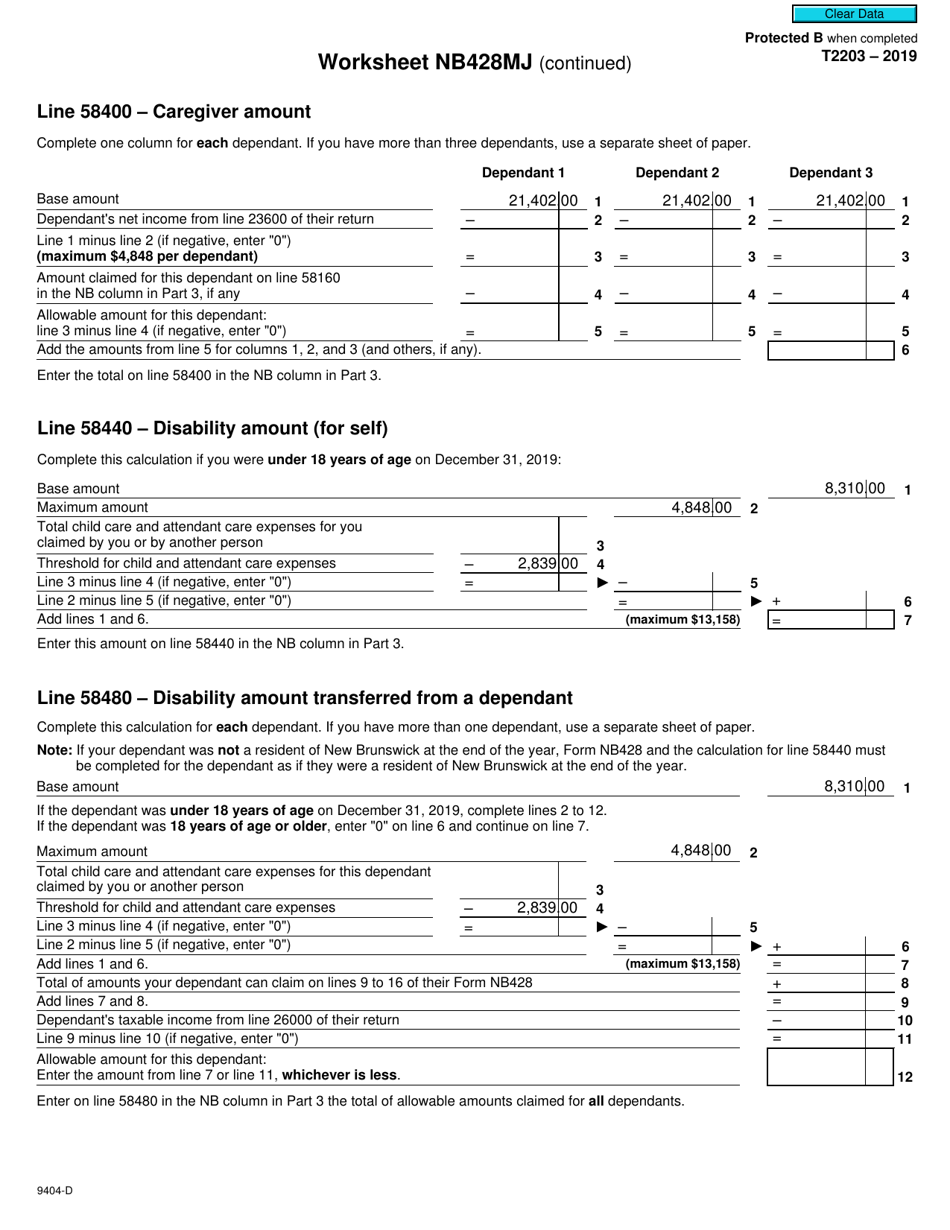

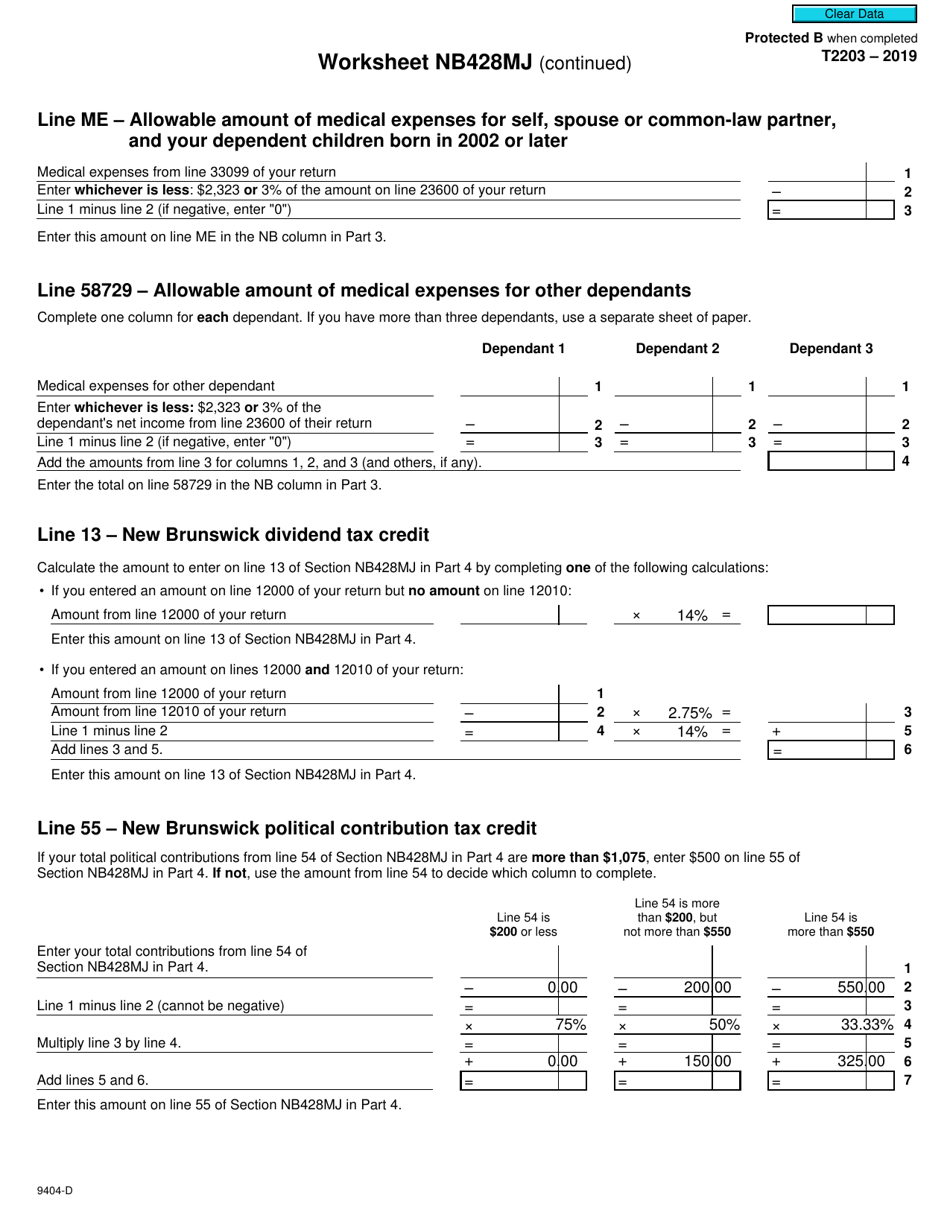

Form T2203 (9404-D) Worksheet NB428MJ New Brunswick - Canada

Form T2203 (9404-D) Worksheet NB428MJ New Brunswick - Canada is used by individuals who are residents of New Brunswick to calculate the provincial tax credits that they may be eligible for. It helps taxpayers to determine their provincial tax liability and claim any applicable tax credits or deductions specific to the province of New Brunswick.

The Form T2203 (9404-D) Worksheet NB428MJ in New Brunswick, Canada is typically filed by individuals who are claiming the New Brunswick tax credits and deductions.

FAQ

Q: What is Form T2203 (9404-D)?

A: Form T2203 (9404-D) is a worksheet specific to New Brunswick in Canada.

Q: What is the purpose of Form T2203 (9404-D)?

A: The purpose of the form is to calculate the provincial tax credits for New Brunswick.

Q: Who needs to use Form T2203 (9404-D)?

A: Residents of New Brunswick who are filing their taxes and want to claim provincial tax credits.

Q: How do I fill out Form T2203 (9404-D)?

A: Follow the instructions provided on the form and enter the required information and calculations for New Brunswick tax credits.

Q: When is the deadline to file Form T2203 (9404-D)?

A: The deadline to file the form is the same as the deadline for your Canadian income tax return, which is usually April 30th.