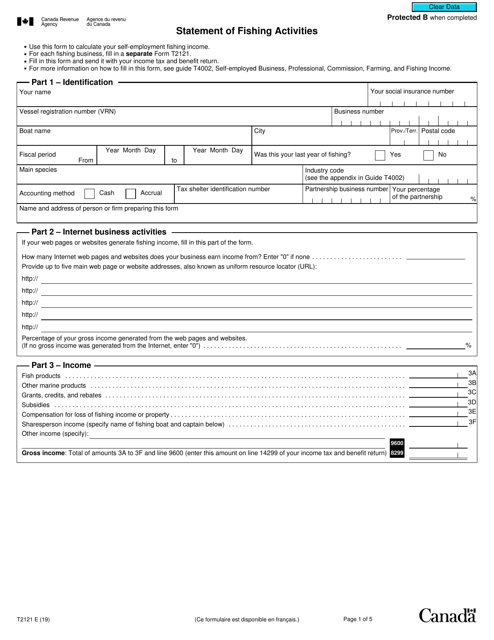

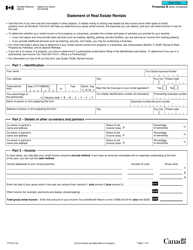

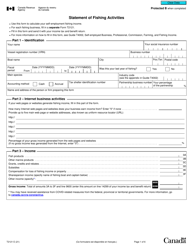

This version of the form is not currently in use and is provided for reference only. Download this version of

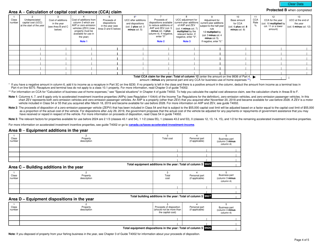

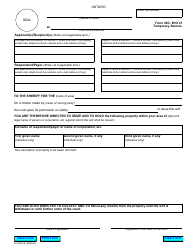

Form T2121

for the current year.

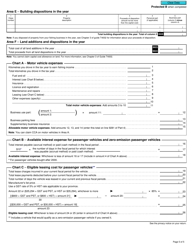

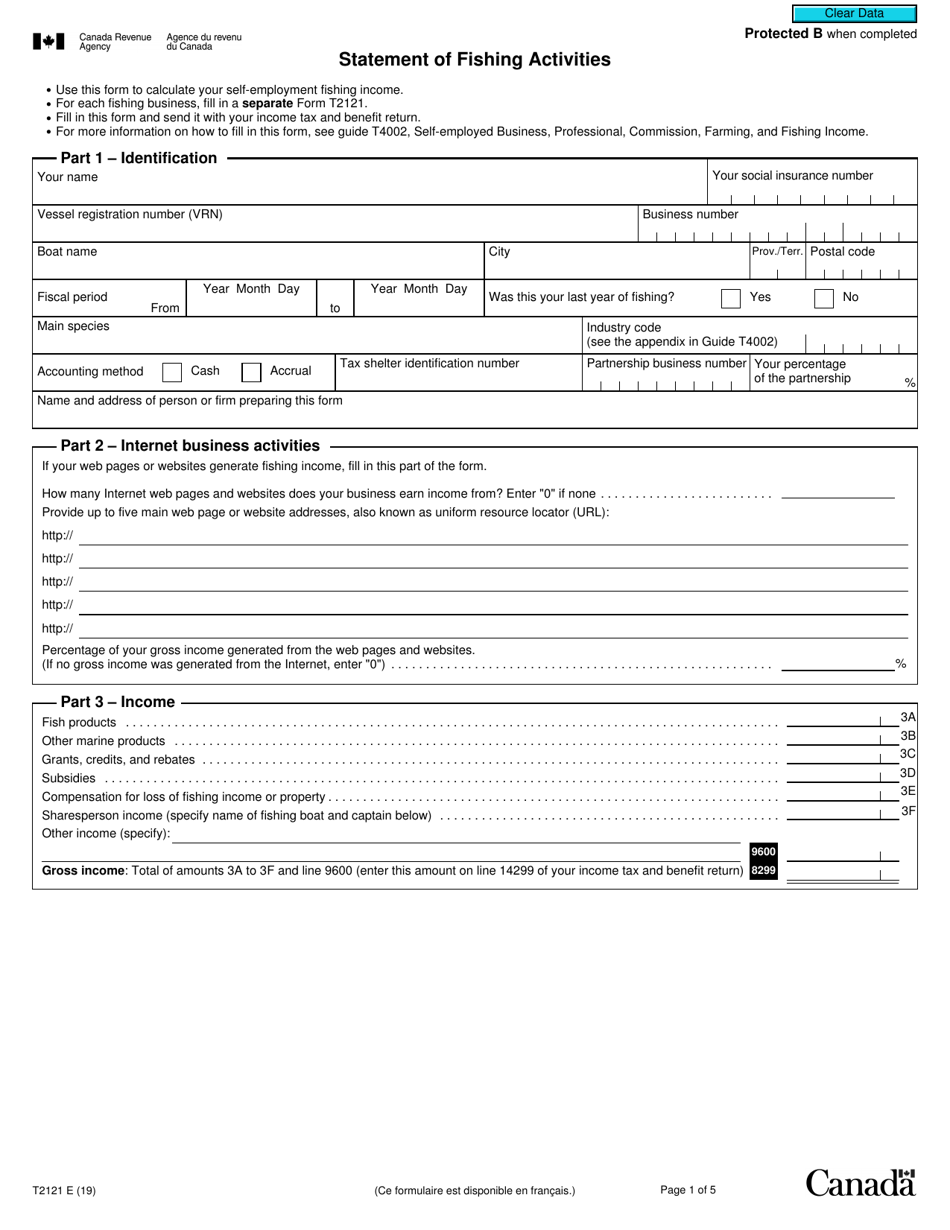

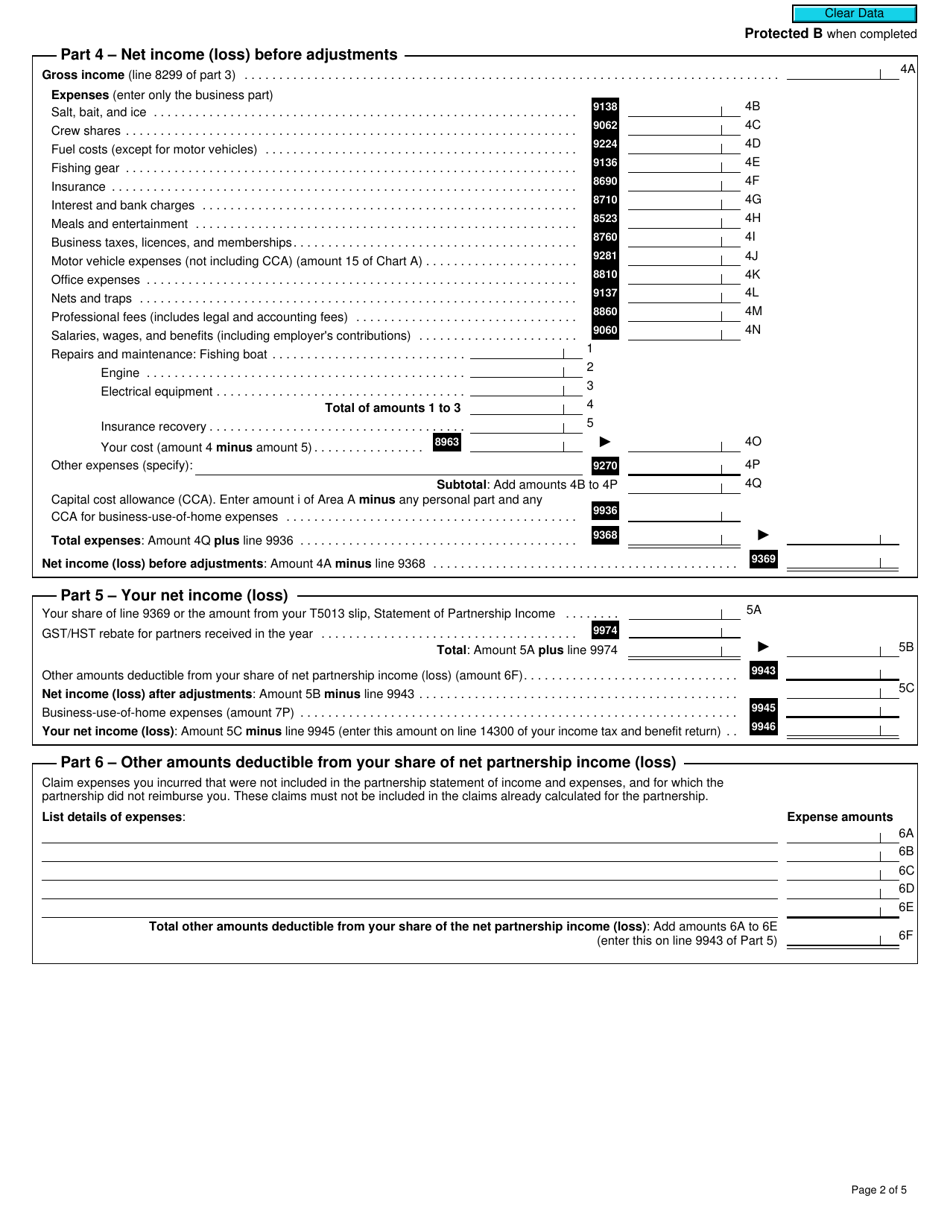

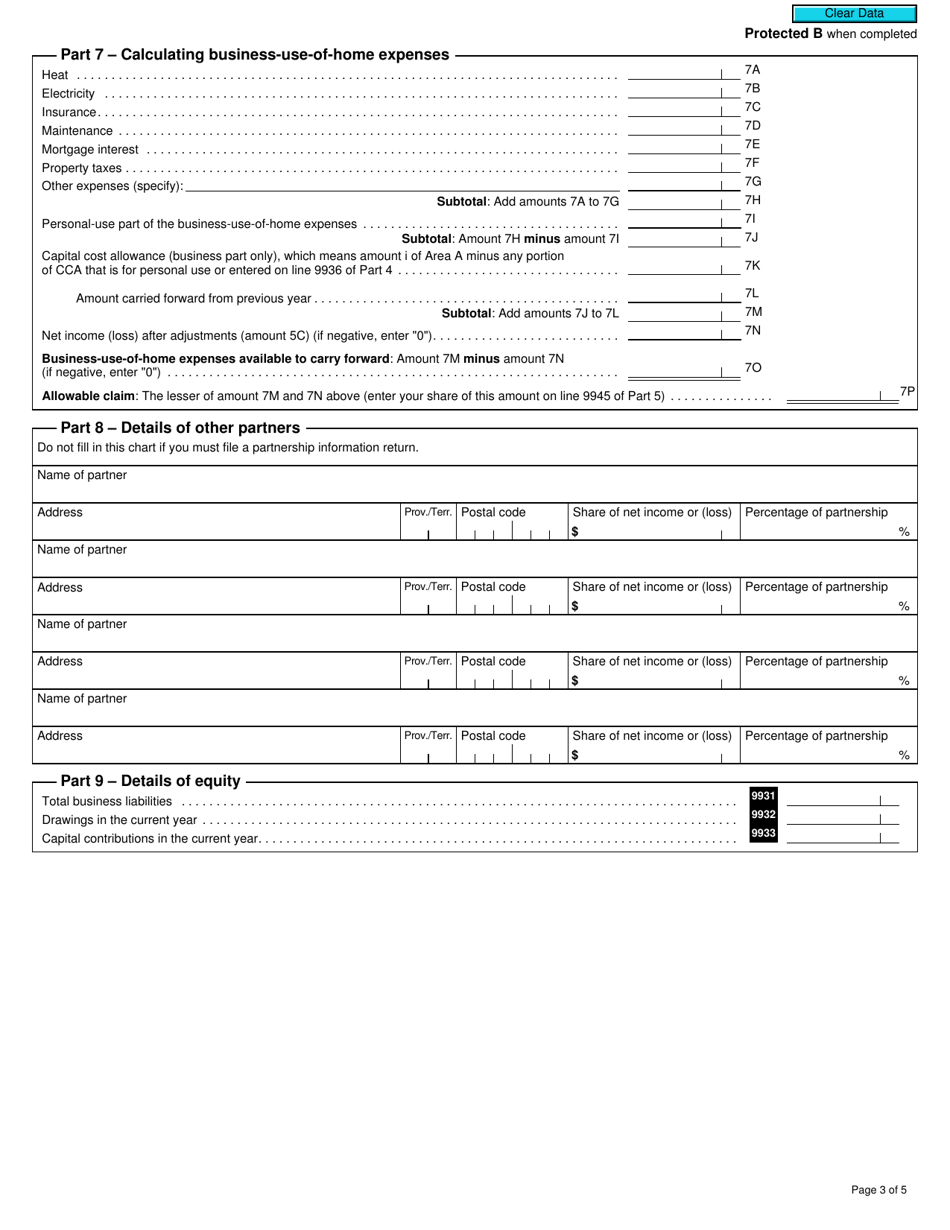

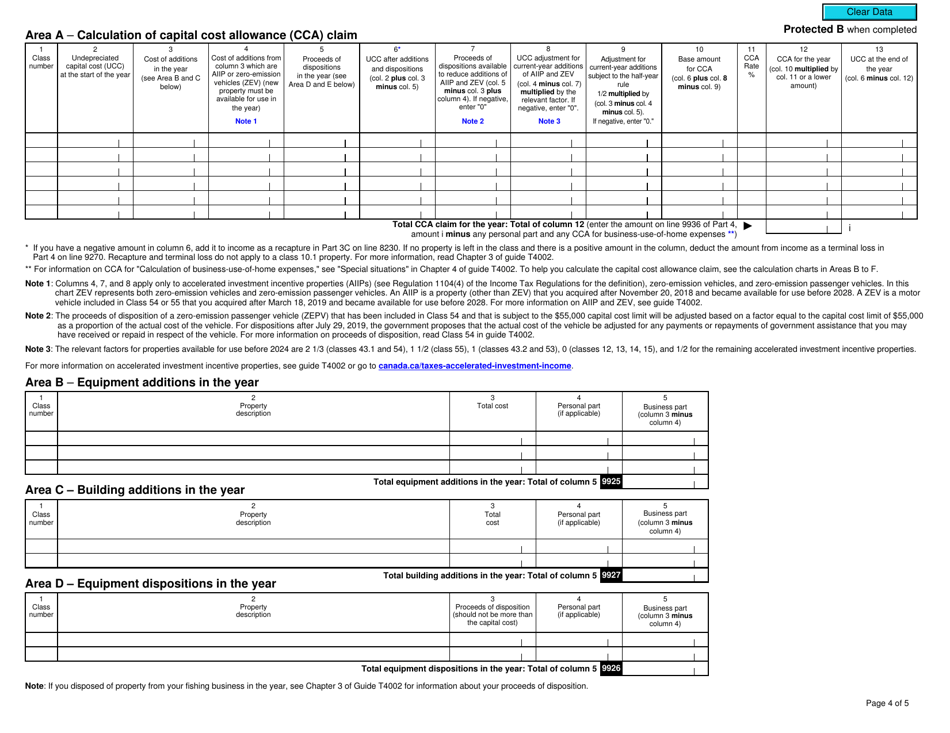

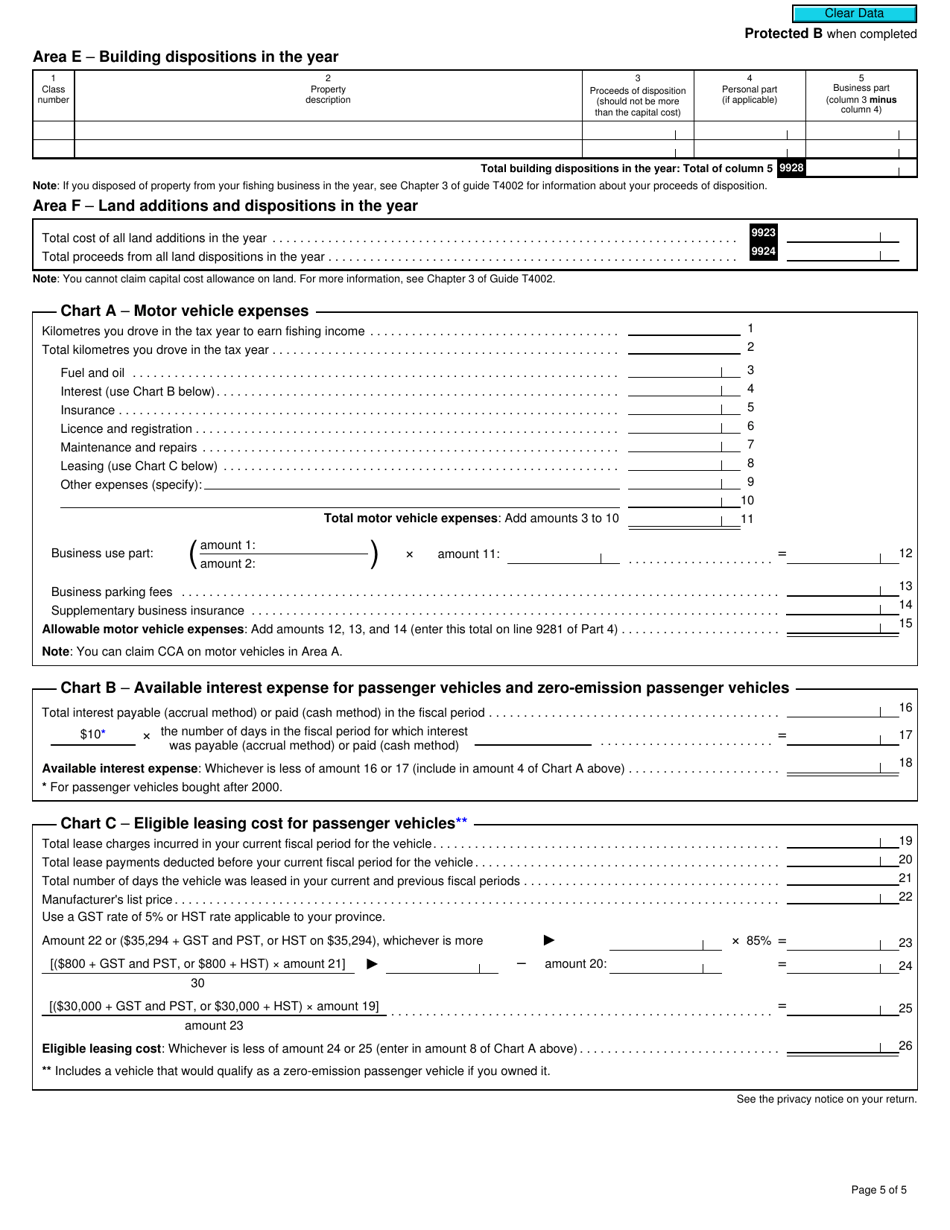

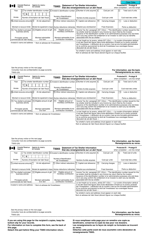

Form T2121 Statement of Fishing Activities - Canada

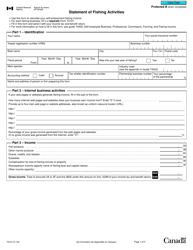

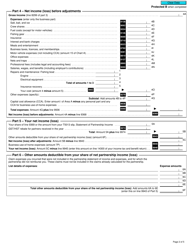

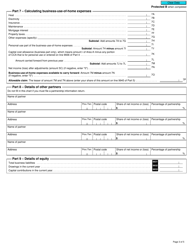

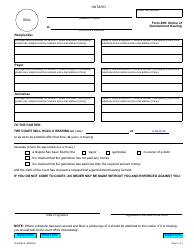

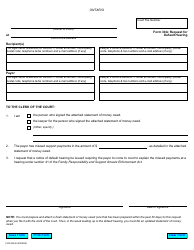

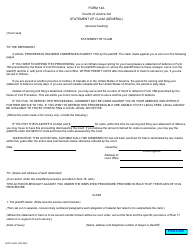

Form T2121 Statement of Fishing Activities is used by individuals in Canada who earn income from fishing activities. It is used to report the details of their fishing income, expenses, and other related information for tax purposes.

The Form T2121 Statement of Fishing Activities in Canada is filed by individuals involved in commercial fishing activities.

FAQ

Q: What is Form T2121?

A: Form T2121 is the Statement of Fishing Activities used in Canada.

Q: Who needs to fill out Form T2121?

A: Fishers in Canada who are reporting their fishing income and expenses need to fill out Form T2121.

Q: What information is required on Form T2121?

A: Form T2121 requires information about your fishing income, expenses, and deductions related to fishing activities.

Q: When is the deadline to submit Form T2121?

A: The deadline to submit Form T2121 is the same as your personal income tax return deadline, which is usually April 30th.

Q: Do I need to keep any supporting documents for Form T2121?

A: Yes, you should keep supporting documents, such as receipts and records of your fishing activities, in case the Canada Revenue Agency (CRA) requests them for verification.

Q: What if I make a mistake on Form T2121?

A: If you make a mistake on Form T2121, you can request an adjustment by contacting the Canada Revenue Agency (CRA).

Q: Are there any penalties for not filing Form T2121?

A: Yes, there may be penalties for not filing Form T2121 or for providing false information.