This version of the form is not currently in use and is provided for reference only. Download this version of

Form T2091 (IND)

for the current year.

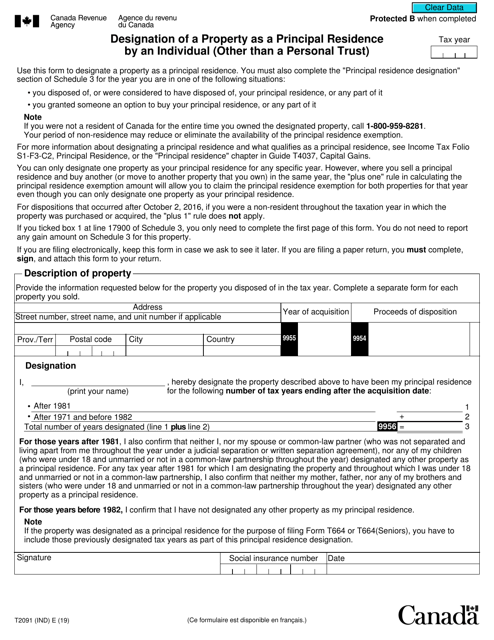

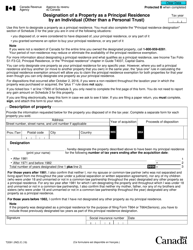

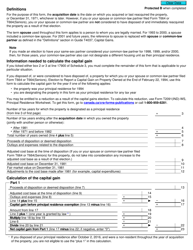

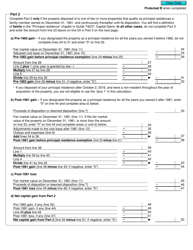

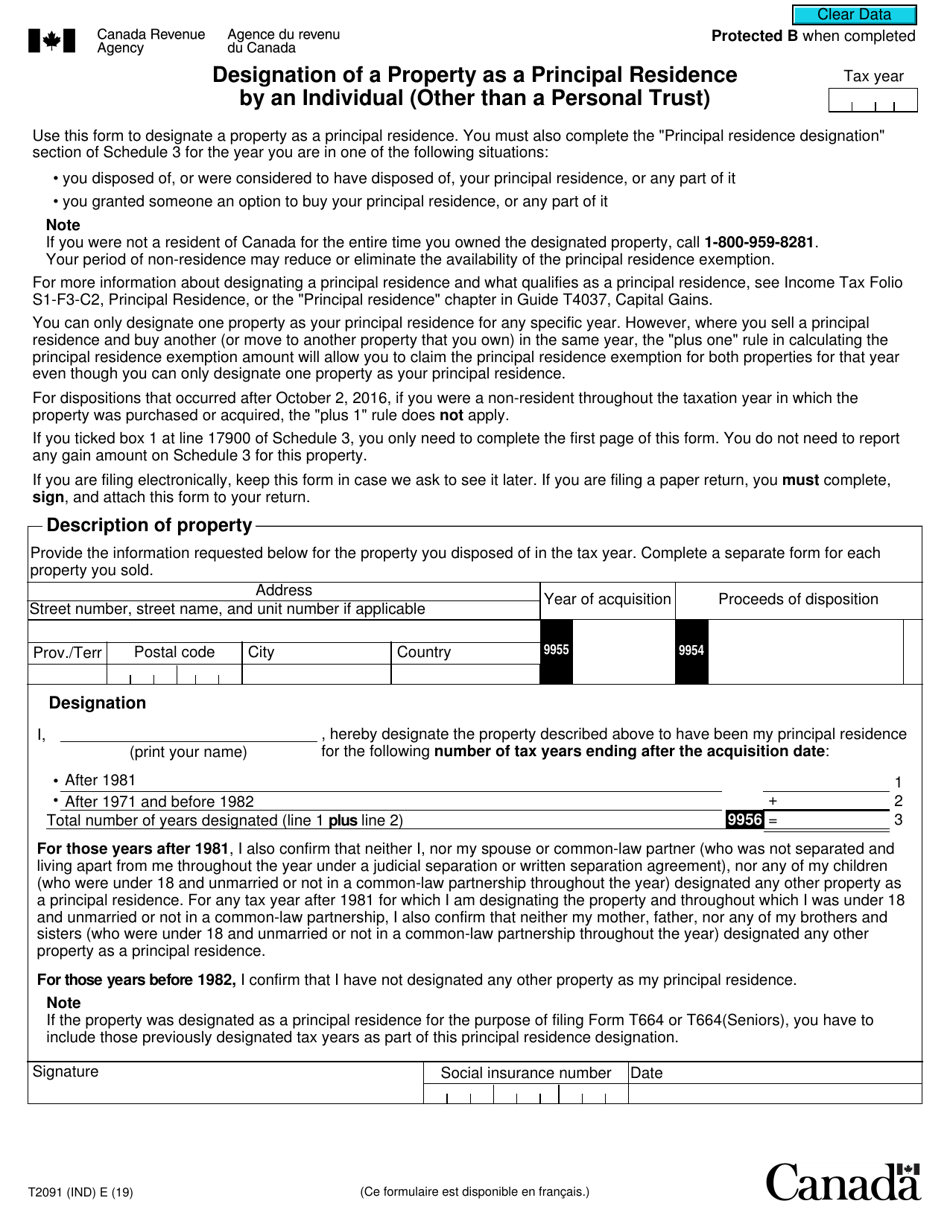

Form T2091 (IND) Designation of a Property as a Principal Residence by an Individual (Other Than a Personal Trust) - Canada

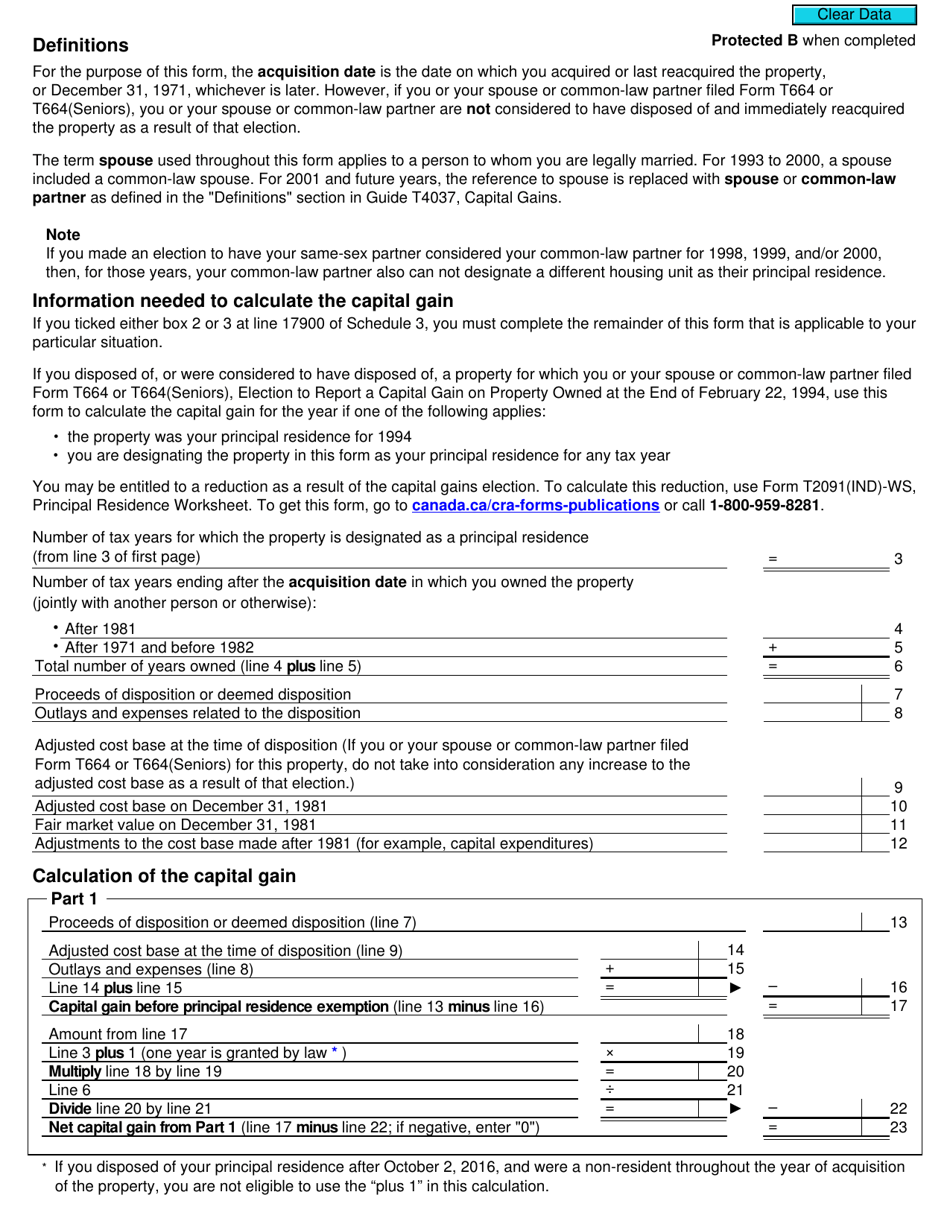

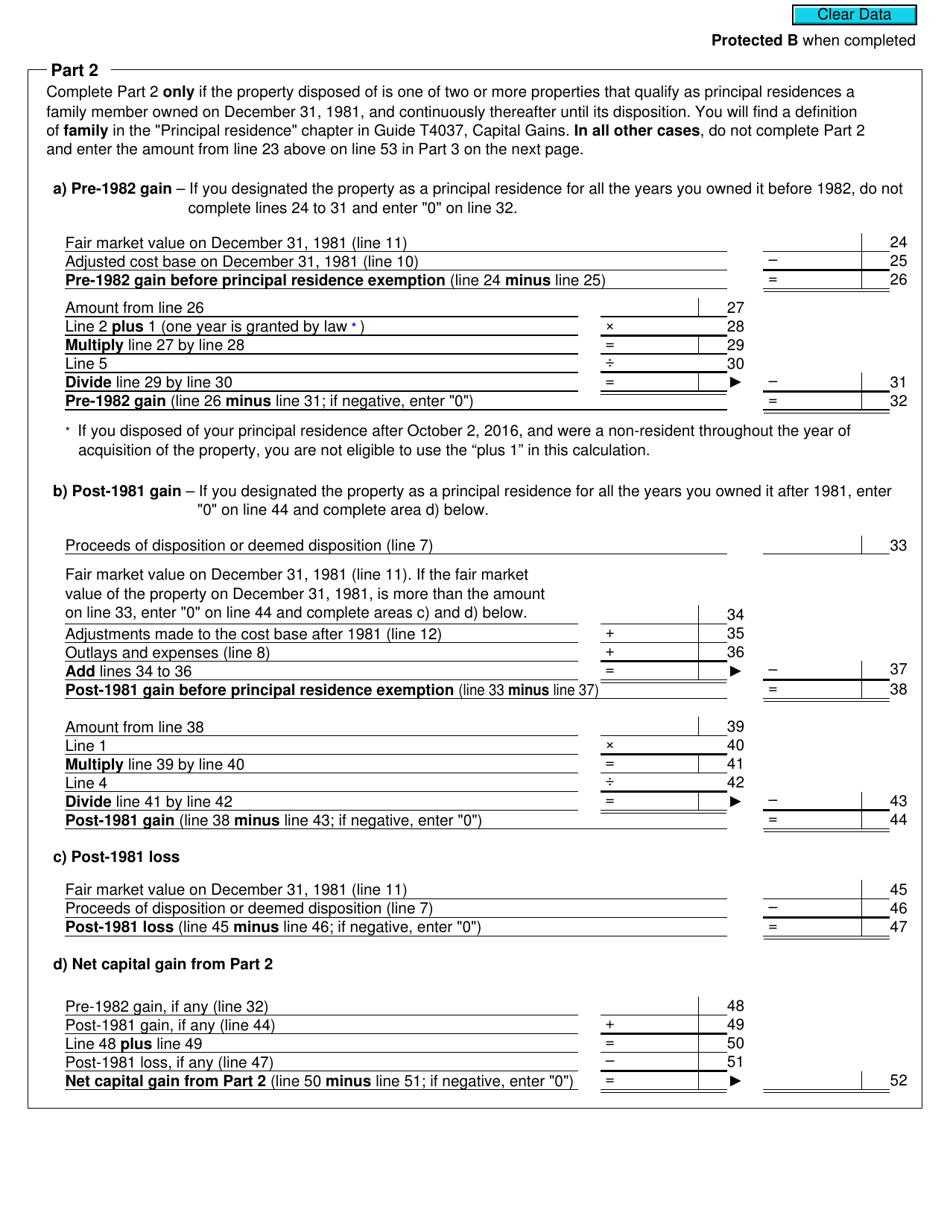

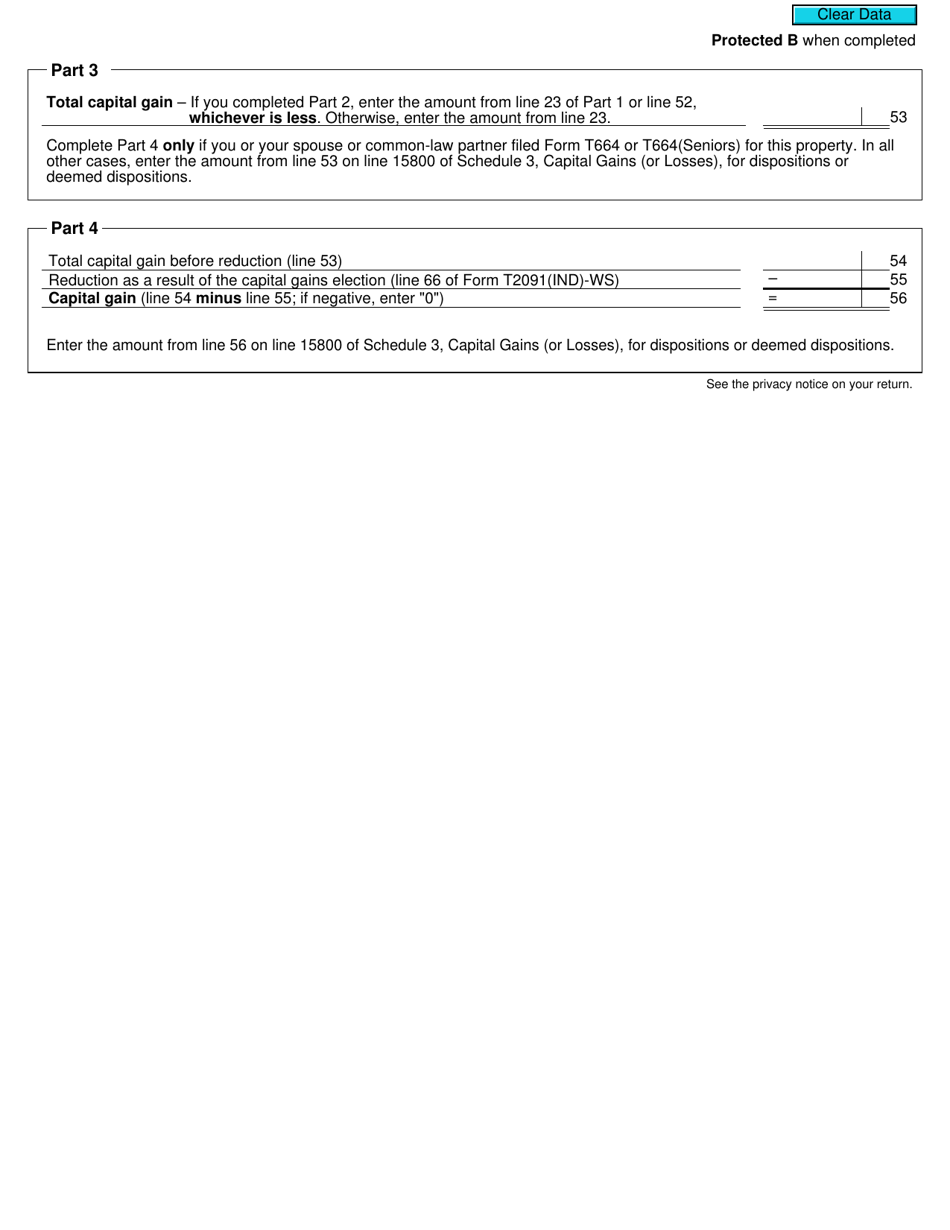

Form T2091 (IND) is used in Canada to designate a property as a principal residence by an individual (other than a personal trust). This designation is important for tax purposes, as it allows the individual to claim the principal residence exemption on their capital gains when they sell the property. It is a way to declare that a certain property is considered their main residence for tax purposes.

In Canada, individuals file the Form T2091(IND) to designate a property as their principal residence, not including personal trusts.

FAQ

Q: What is Form T2091 (IND)?

A: Form T2091 (IND) is a tax form in Canada that allows individuals to designate a property as their principal residence for tax purposes.

Q: Who can use Form T2091 (IND)?

A: Individuals (other than personal trusts) in Canada can use Form T2091 (IND) to designate a property as their principal residence.

Q: Why would I need to use Form T2091 (IND)?

A: You would need to use Form T2091 (IND) if you want to designate a property as your principal residence for tax purposes and be eligible for certain tax benefits.

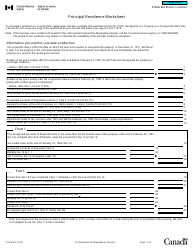

Q: What information is required on Form T2091 (IND)?

A: Form T2091 (IND) requires information about the property, the period of time it was designated as the principal residence, and other relevant details.

Q: Are there any deadlines for submitting Form T2091 (IND)?

A: Yes, Form T2091 (IND) must be filed by the individual's tax filing deadline for the year in which the designation is being made.

Q: Can I designate more than one property as my principal residence using Form T2091 (IND)?

A: No, Form T2091 (IND) can only be used to designate one property as your principal residence.

Q: What happens if I fail to file Form T2091 (IND) on time?

A: Failing to file Form T2091 (IND) on time may result in penalties or loss of certain tax benefits.

Q: Is there a fee for filing Form T2091 (IND)?

A: No, there is no fee for filing Form T2091 (IND).

Q: Can I amend a previously filed Form T2091 (IND)?

A: Yes, you can file an amended Form T2091 (IND) to correct any errors or changes in your designation of a property as your principal residence.