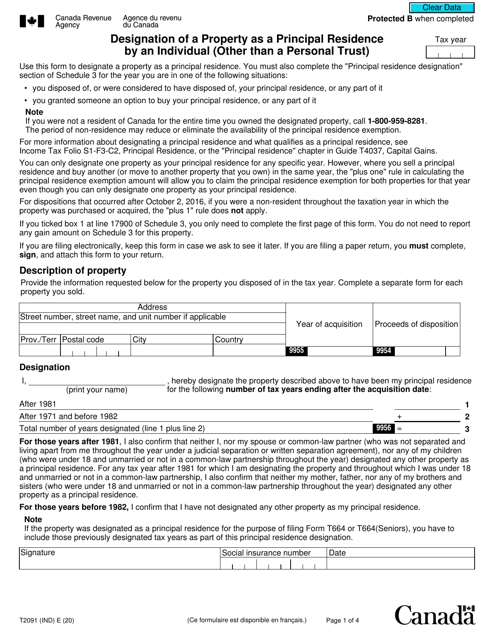

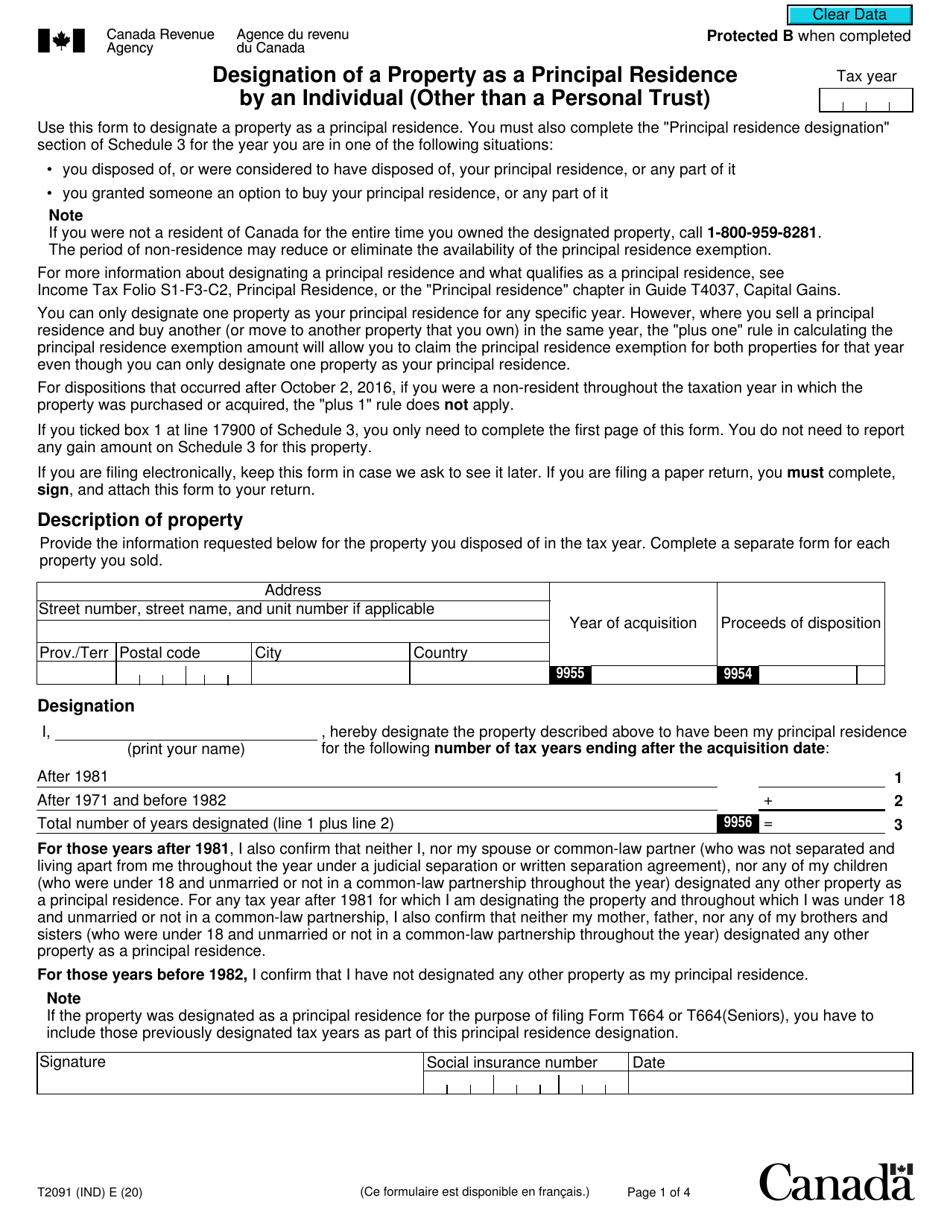

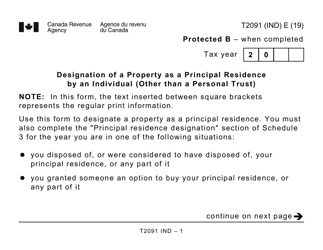

Form T2091 (IND) Designation of a Property as a Principal Residence by an Individual (Other Than a Personal Trust) - Canada

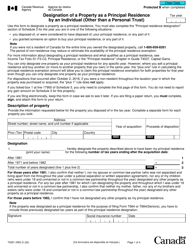

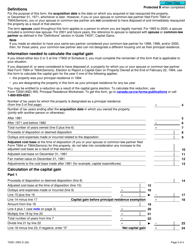

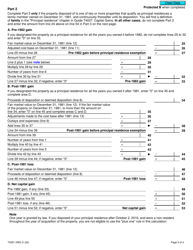

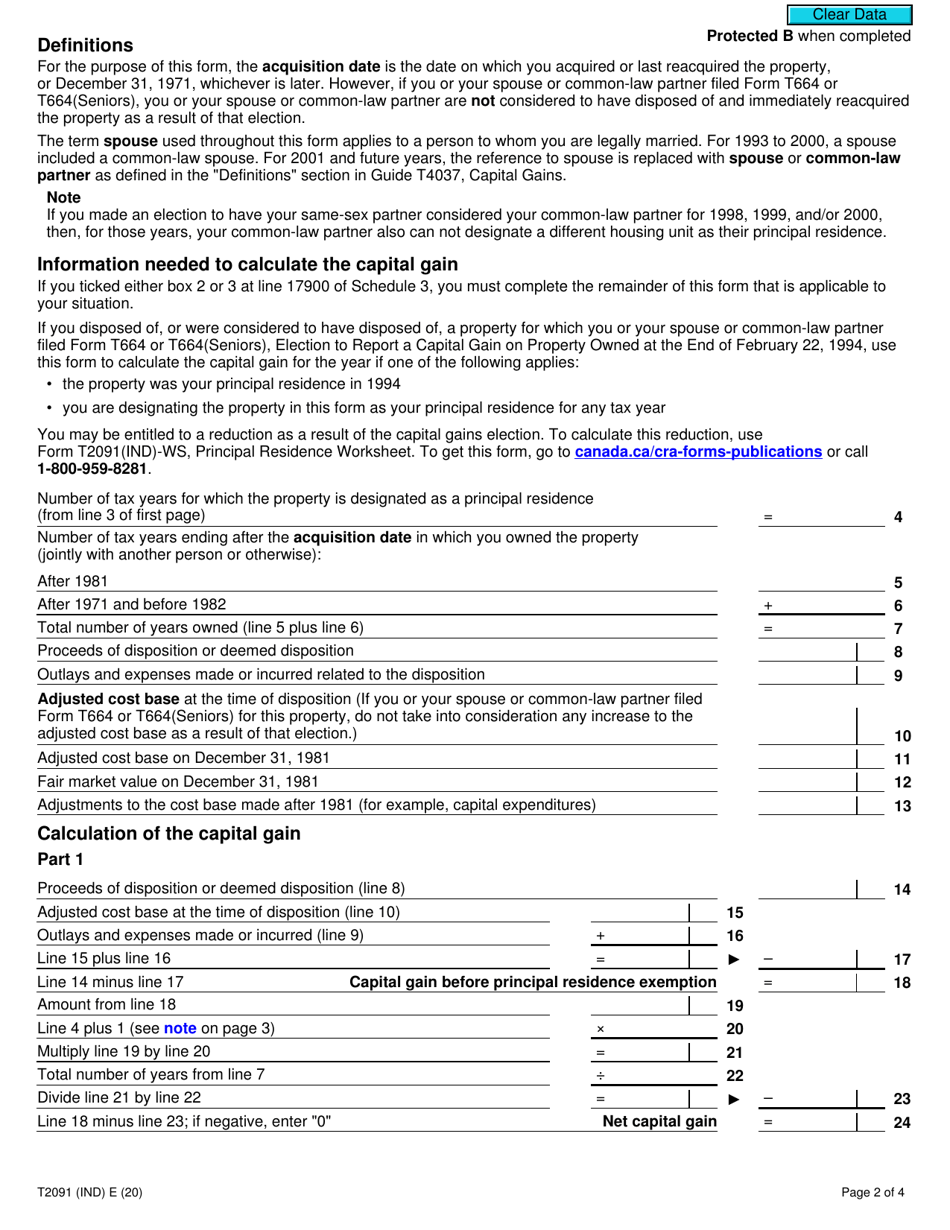

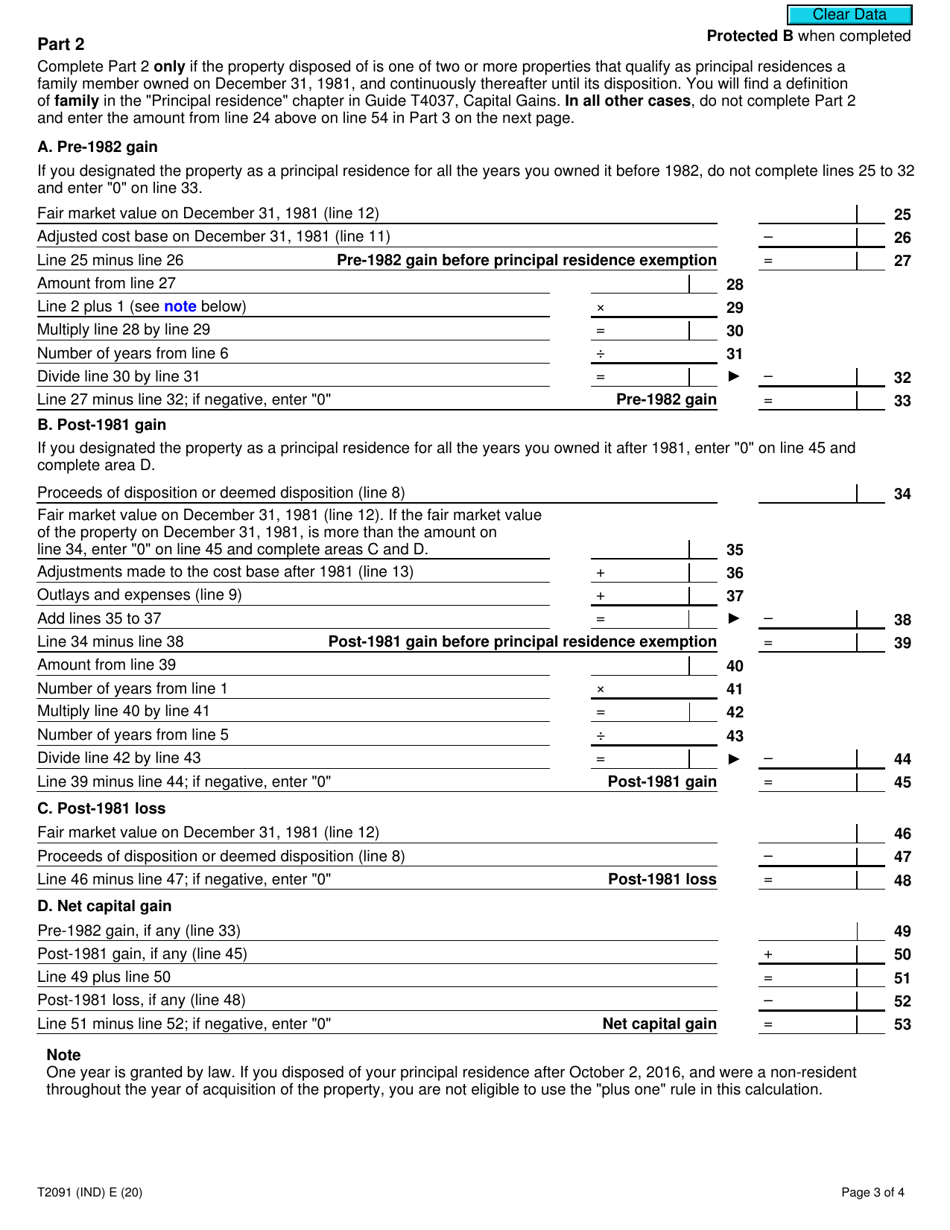

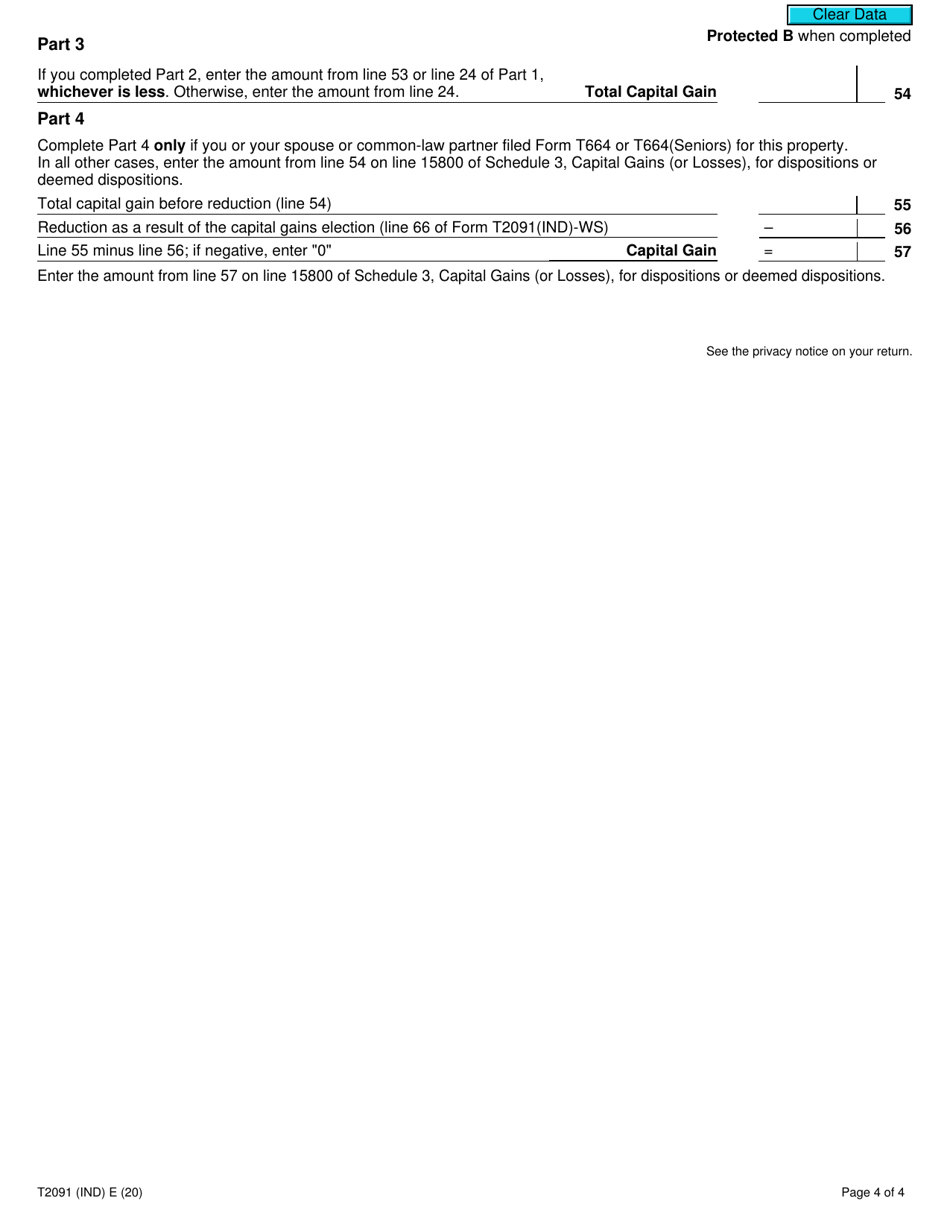

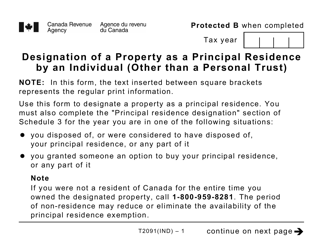

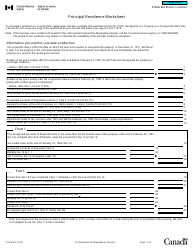

Form T2091 (IND) is used in Canada to designate a property as a principal residence by an individual (other than a personal trust). This form is required when an individual wants to claim the principal residence exemption for tax purposes. It helps individuals report the sale of a property and determine the amount of the gain on the sale that is eligible for the principal residence exemption.

In Canada, the individual who owns the property files the Form T2091 (IND) to designate it as their principal residence.

Form T2091 (IND) Designation of a Property as a Principal Residence by an Individual (Other Than a Personal Trust) - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T2091 (IND)?

A: Form T2091 (IND) is a document used in Canada to designate a property as a principal residence by an individual.

Q: Who can use Form T2091 (IND)?

A: Form T2091 (IND) is used by individuals (other than a personal trust) to designate a property as their principal residence.

Q: Why would someone use Form T2091 (IND)?

A: This form is used to designate a property as a principal residence for tax purposes, which can provide certain tax benefits.

Q: What is a principal residence?

A: A principal residence is the main home where an individual resides.

Q: Are there any tax benefits to designating a property as a principal residence?

A: Yes, designating a property as a principal residence can provide tax benefits, including the ability to claim the principal residence exemption on any capital gains when the property is sold.

Q: Is Form T2091 (IND) only used in Canada?

A: Yes, Form T2091 (IND) is specific to Canada and is used for Canadian tax purposes.

Q: Can a personal trust use Form T2091 (IND)?

A: No, Form T2091 (IND) can only be used by individuals (other than a personal trust).