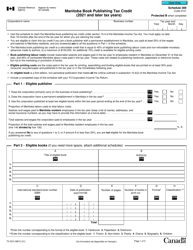

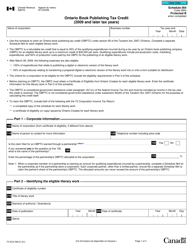

This version of the form is not currently in use and is provided for reference only. Download this version of

Form T1299

for the current year.

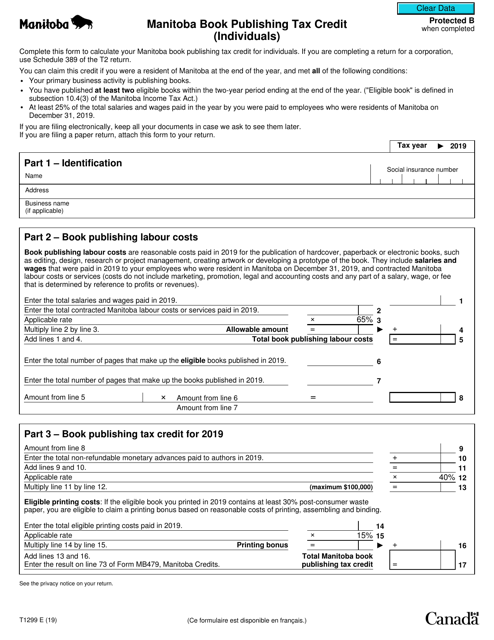

Form T1299 Manitoba Book Publishing Tax Credit (Individuals) - Canada

Form T1299 Manitoba Book Publishing Tax Credit (Individuals) is used in Canada to claim a tax credit for individuals engaged in the business of book publishing in Manitoba. This credit helps to offset the cost of eligible activities related to the publishing of books in Manitoba.

The Form T1299 Manitoba Book Publishing Tax Credit (Individuals) in Canada is filed by individuals who are claiming the tax credit for book publishing activities in the province of Manitoba.

FAQ

Q: What is Form T1299 Manitoba Book Publishing Tax Credit?

A: Form T1299 is a tax form used by individuals in Manitoba, Canada to claim the Manitoba Book Publishing Tax Credit.

Q: What is the Manitoba Book Publishing Tax Credit?

A: The Manitoba Book Publishing Tax Credit is a tax credit available to individuals in Manitoba who are involved in the publishing industry.

Q: Who is eligible to claim the Manitoba Book Publishing Tax Credit?

A: Individuals who are residents of Manitoba and involved in the book publishing industry may be eligible to claim this tax credit.

Q: What expenses are eligible for the Manitoba Book Publishing Tax Credit?

A: Expenses such as the cost of publishing, promoting, and distributing qualifying books are eligible for this tax credit.

Q: How do I claim the Manitoba Book Publishing Tax Credit?

A: To claim this tax credit, you need to complete Form T1299 and include it with your personal income tax return for the relevant tax year.

Q: Are there any limitations to the Manitoba Book Publishing Tax Credit?

A: Yes, there are limitations on the amount of credit that can be claimed, based on certain criteria. Consult the official guidelines or a tax professional for specific details.

Q: When is the deadline to submit Form T1299 Manitoba Book Publishing Tax Credit?

A: The deadline to submit Form T1299 and claim the Manitoba Book Publishing Tax Credit is typically the same as the deadline for filing your personal income tax return, which is April 30th of the following year.

Q: Can I claim the Manitoba Book Publishing Tax Credit if I am not involved in the book publishing industry?

A: No, this tax credit is specifically for individuals involved in the book publishing industry in Manitoba.

Q: Is the Manitoba Book Publishing Tax Credit refundable?

A: Yes, this tax credit is refundable, which means it can reduce the amount of tax you owe or result in a refund if you have already paid your taxes.