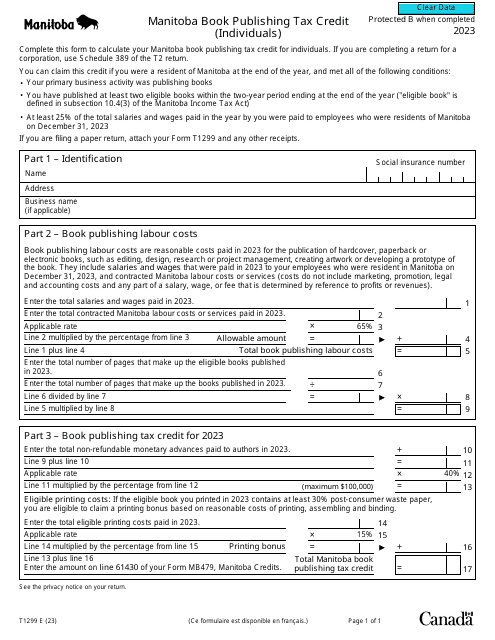

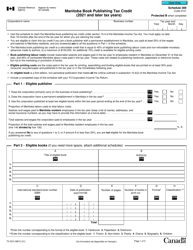

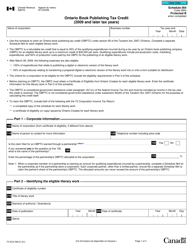

Form T1299 Manitoba Book Publishing Tax Credit (Individuals) - Canada

Form T1299 Manitoba Book Publishing Tax Credit (Individuals) - Canada is used to claim the tax credit for individuals involved in the book publishing industry in Manitoba.

Form T1299 Manitoba Book Publishing Tax Credit (Individuals) - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T1299?

A: Form T1299 is a tax form specific to the Manitoba Book Publishing Tax Credit for individuals.

Q: What is the Manitoba Book Publishing Tax Credit?

A: The Manitoba Book Publishing Tax Credit is a tax credit program designed to support the book publishing industry in Manitoba.

Q: Who can claim the Manitoba Book Publishing Tax Credit?

A: Individuals who have incurred eligible book publishing expenses in Manitoba can claim this tax credit.

Q: What are eligible book publishing expenses?

A: Eligible book publishing expenses include costs related to the acquisition, production, or promotion of a book by a publisher.

Q: How much is the tax credit?

A: The tax credit is equal to 30% of eligible book publishing expenses.

Q: Are there any limitations on claiming the tax credit?

A: Yes, there are limitations on the amount of tax credit that can be claimed in a given year.

Q: Is the Manitoba Book Publishing Tax Credit refundable?

A: Yes, the tax credit is refundable if the credit exceeds your total tax liability.

Q: Are there any deadlines for claiming the tax credit?

A: Yes, the tax credit must be claimed within four years from the end of the tax year in which the expenses were incurred.