This version of the form is not currently in use and is provided for reference only. Download this version of

Form T1255

for the current year.

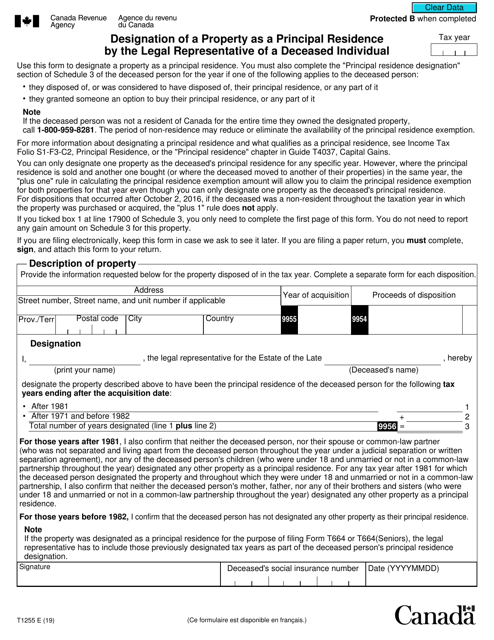

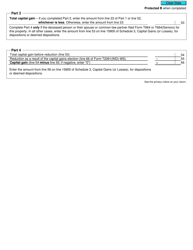

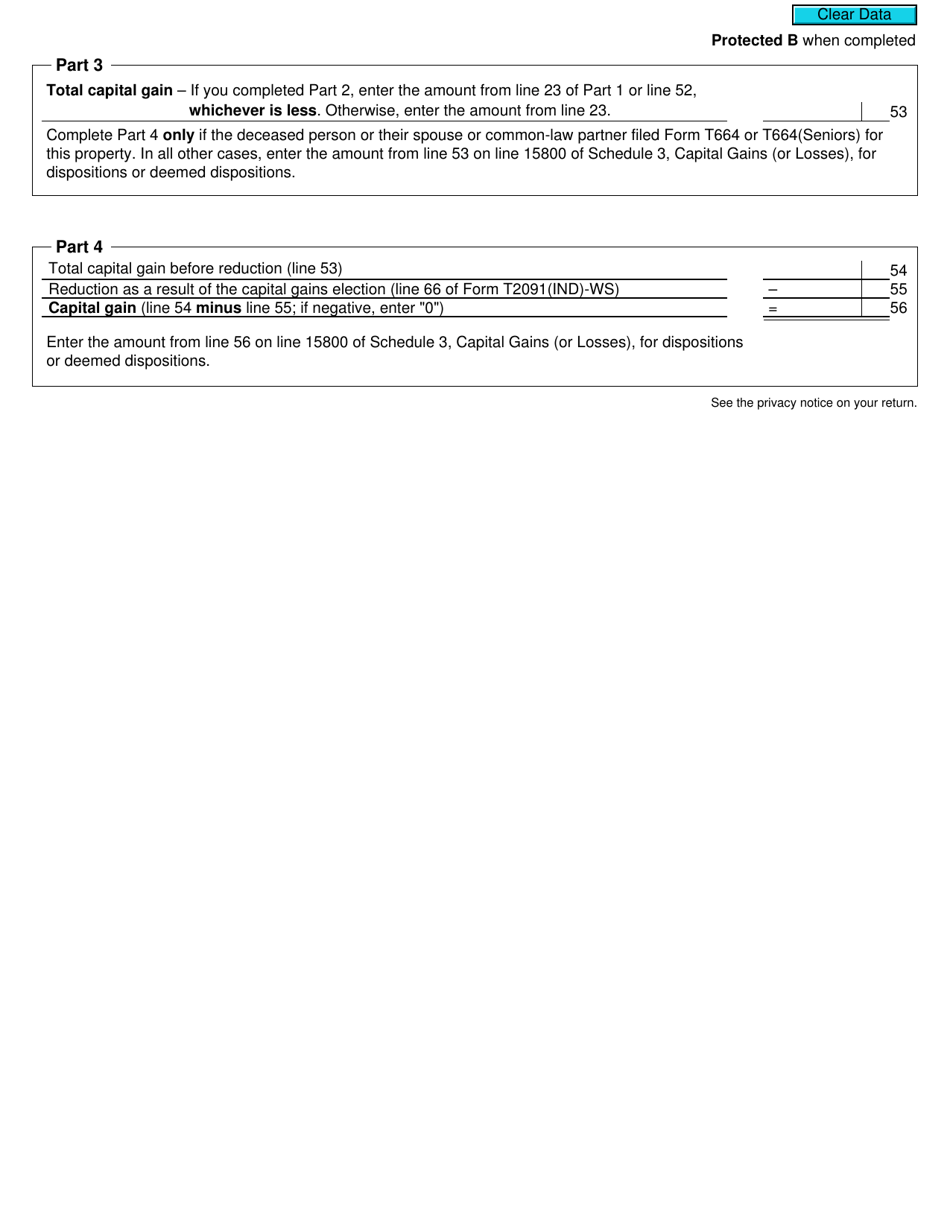

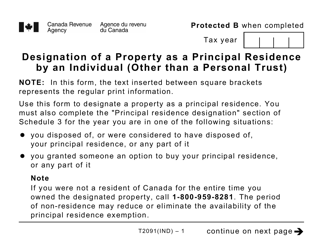

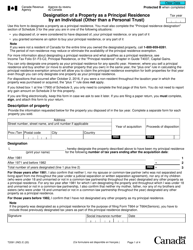

Form T1255 Designation of a Property as a Principal Residence by the Legal Representative of a Deceased Individual - Canada

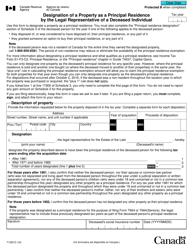

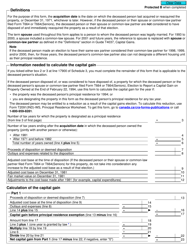

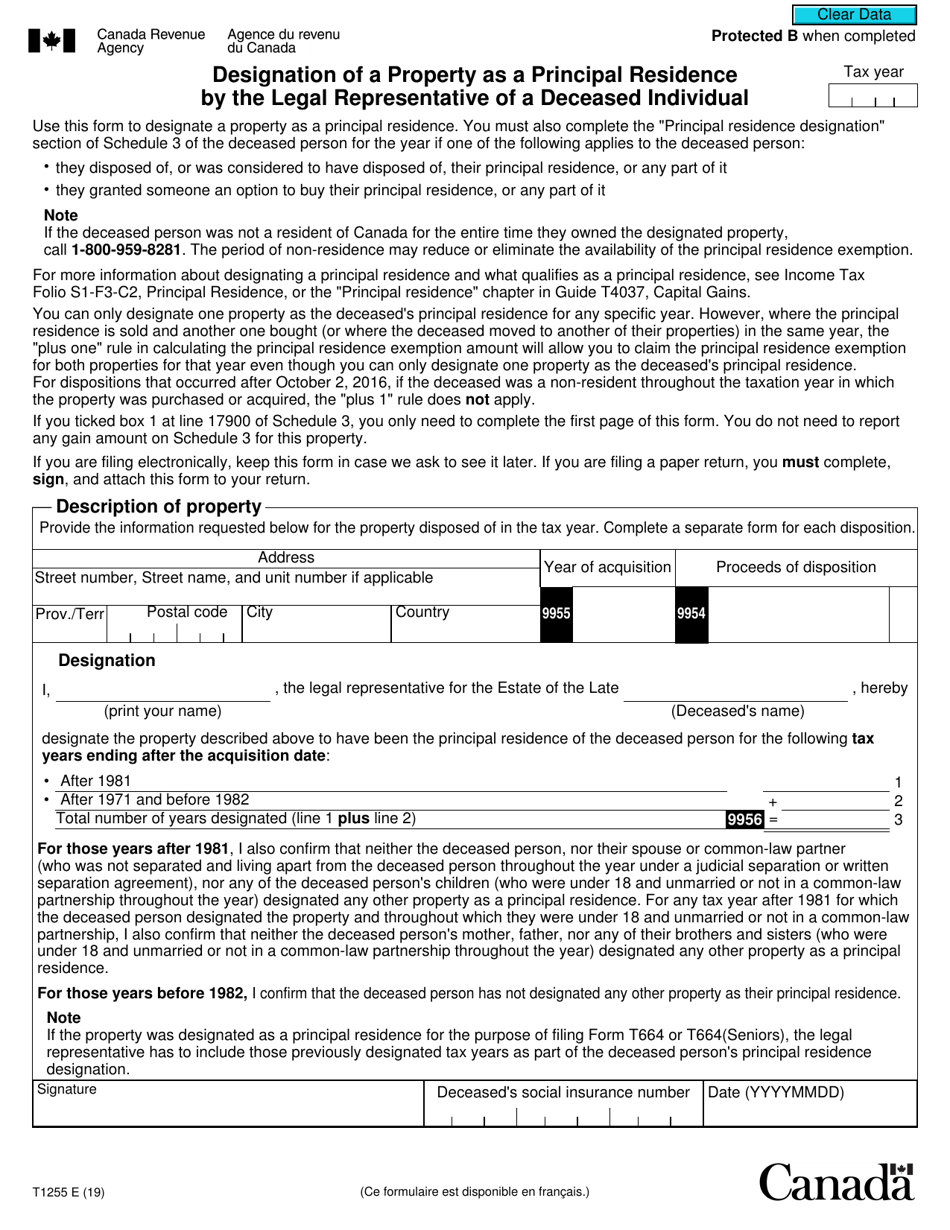

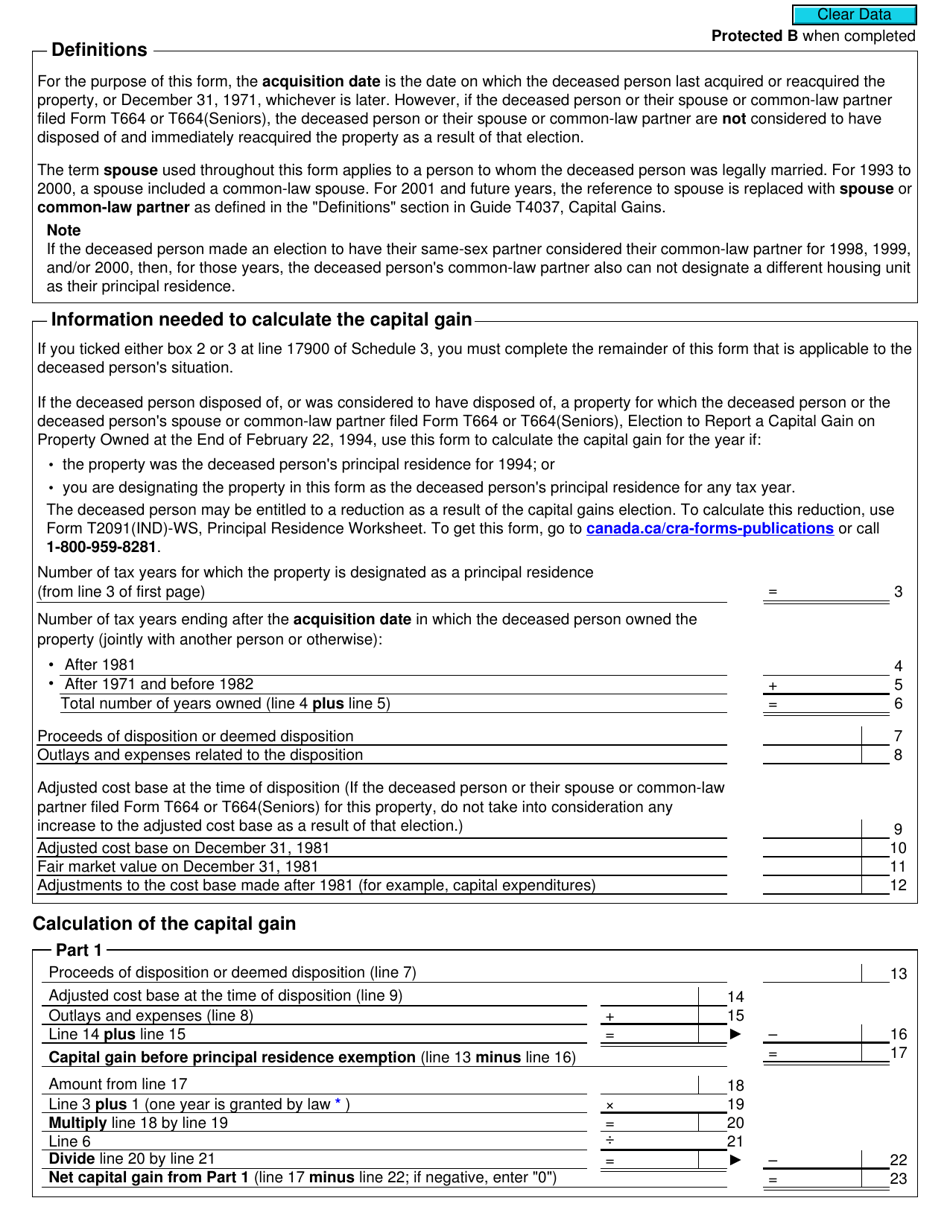

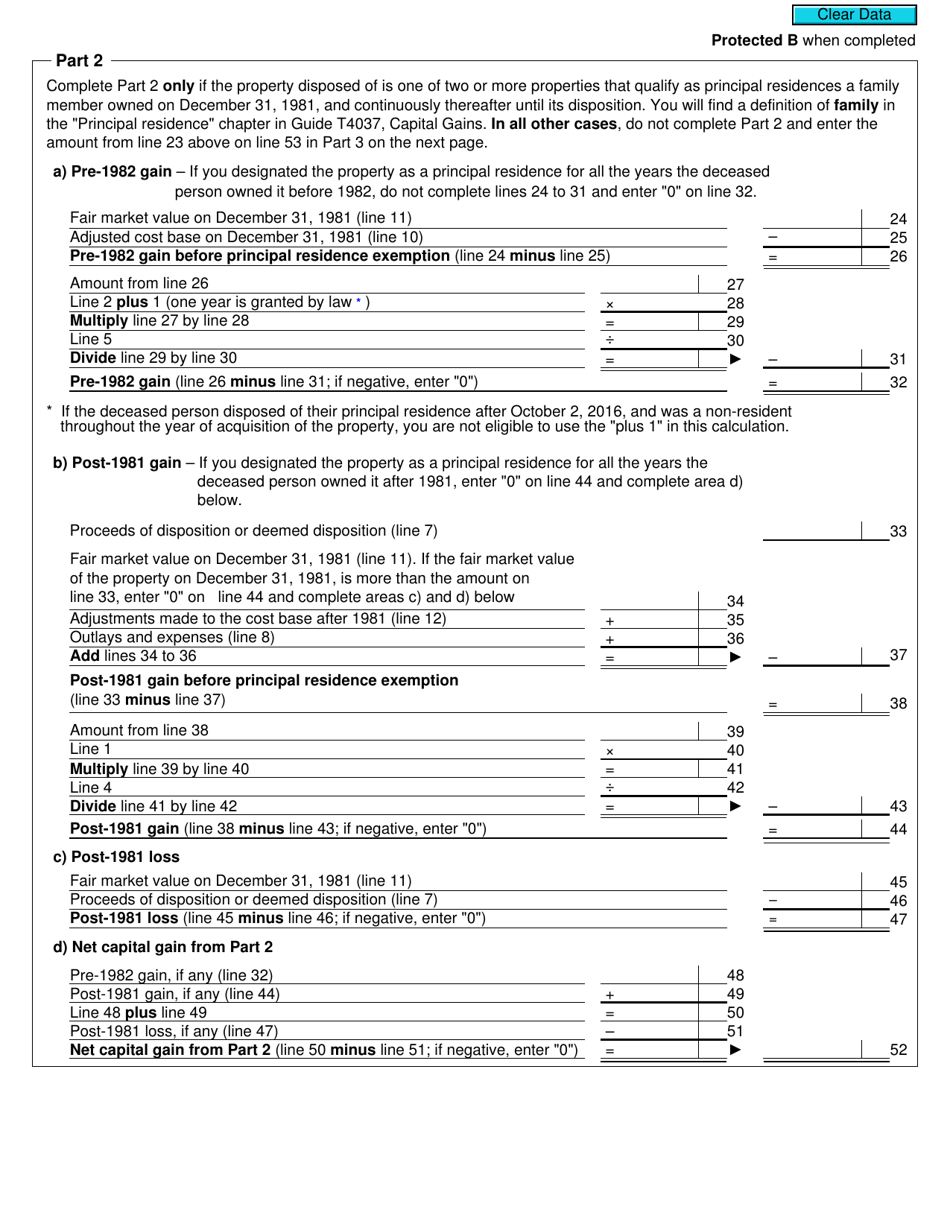

Form T1255 is used in Canada to designate a property as the principal residence of a deceased individual. This form is completed by the legal representative (executor or administrator) of the deceased person's estate in order to claim the principal residence exemption on the deceased individual's final tax return. This exemption can help reduce or eliminate the capital gains tax that may be owed on the sale of the property.

The legal representative of a deceased individual files the Form T1255 Designation of a Property as a Principal Residence in Canada.

FAQ

Q: What is Form T1255?

A: Form T1255 is a document used in Canada to designate a property as a principal residence by the legal representative of a deceased individual.

Q: Who can use Form T1255?

A: The legal representative of a deceased individual can use Form T1255.

Q: What is the purpose of Form T1255?

A: The purpose of Form T1255 is to designate a property as a principal residence for tax purposes.

Q: Why is it important to designate a property as a principal residence?

A: Designating a property as a principal residence can have tax implications, such as the principal residence exemption.