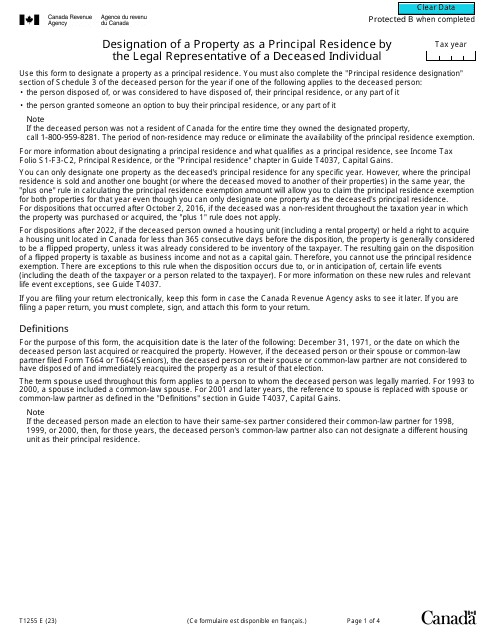

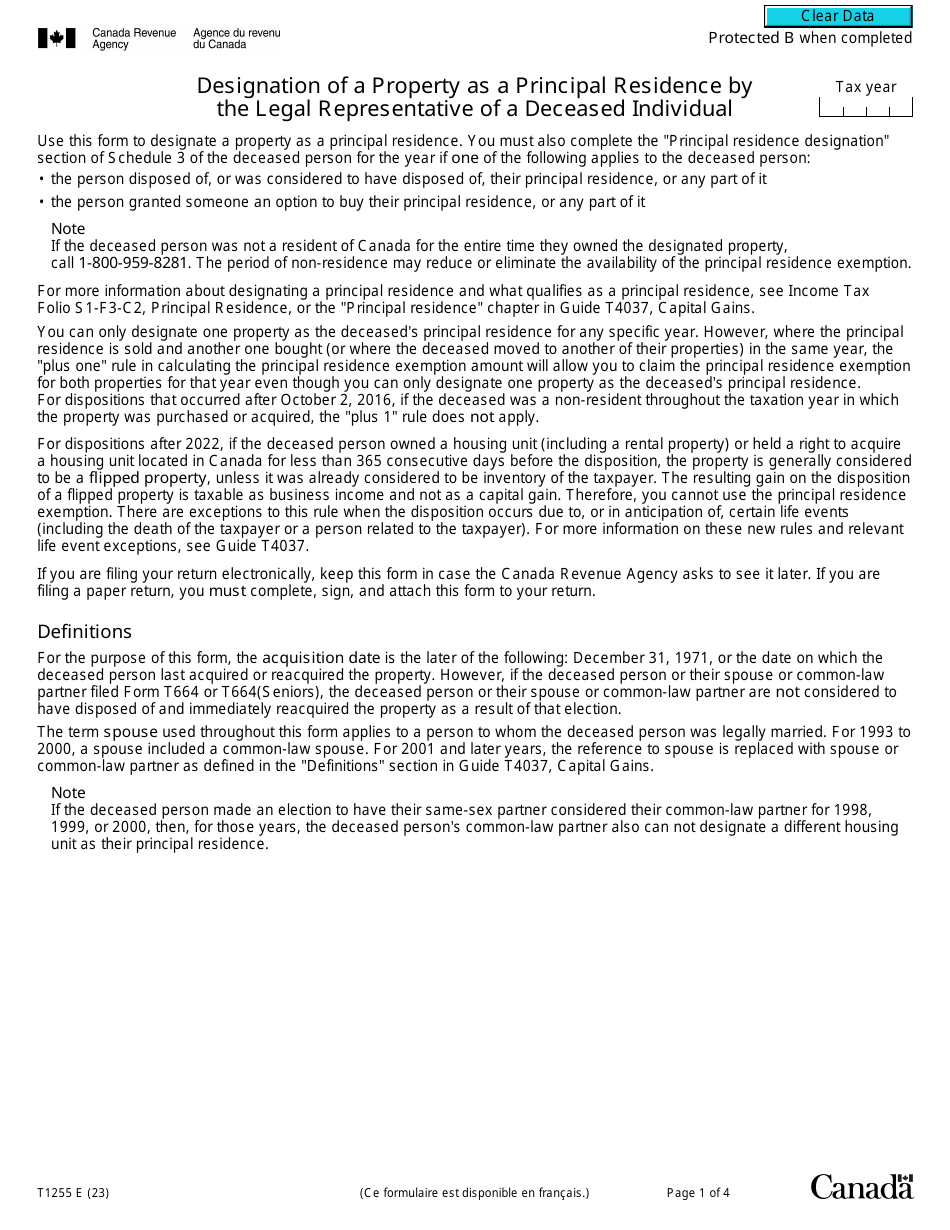

Form T1255 Designation of a Property as a Principal Residence by the Legal Representative of a Deceased Individual - Canada

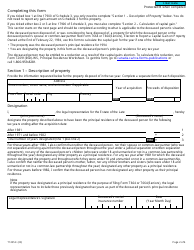

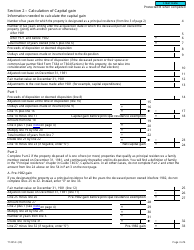

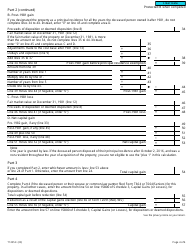

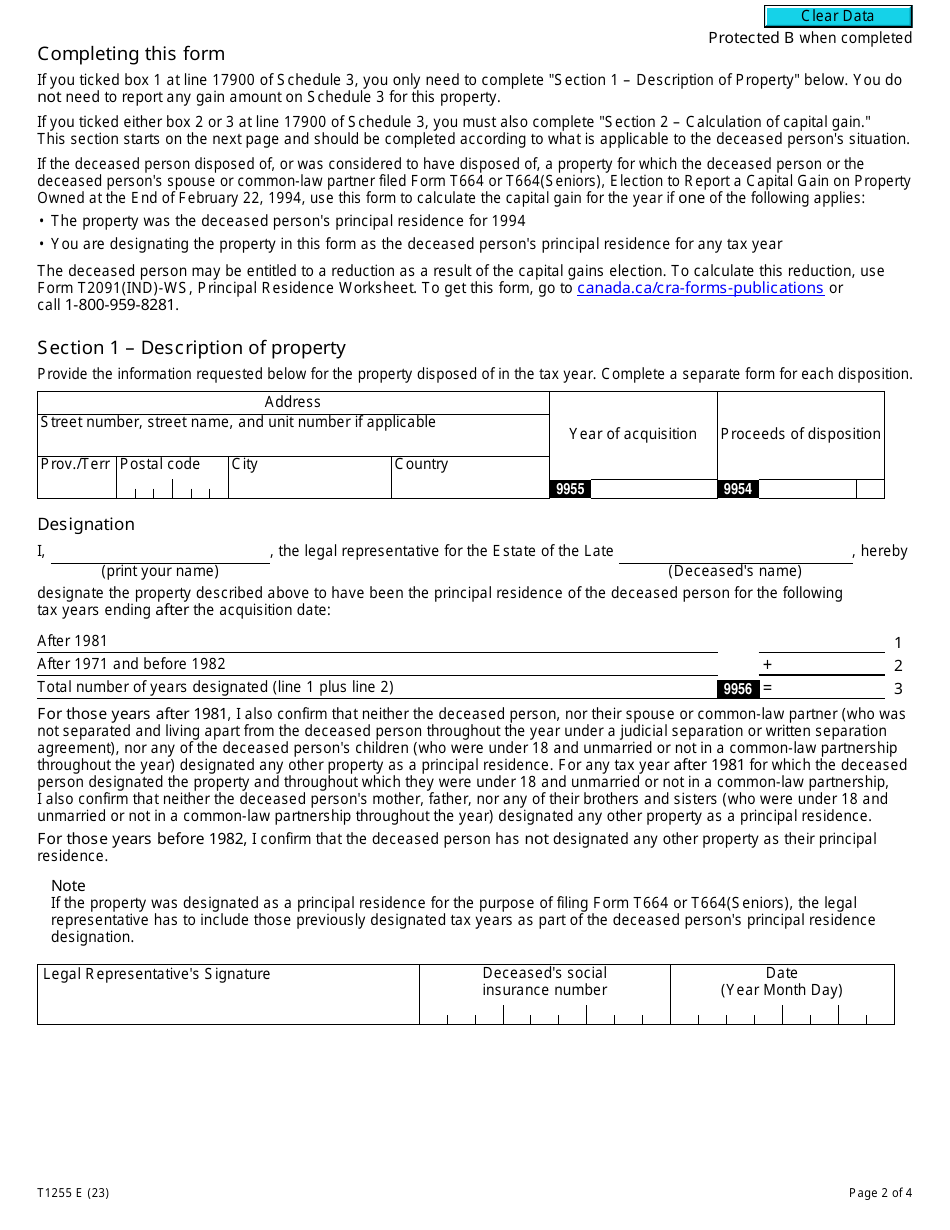

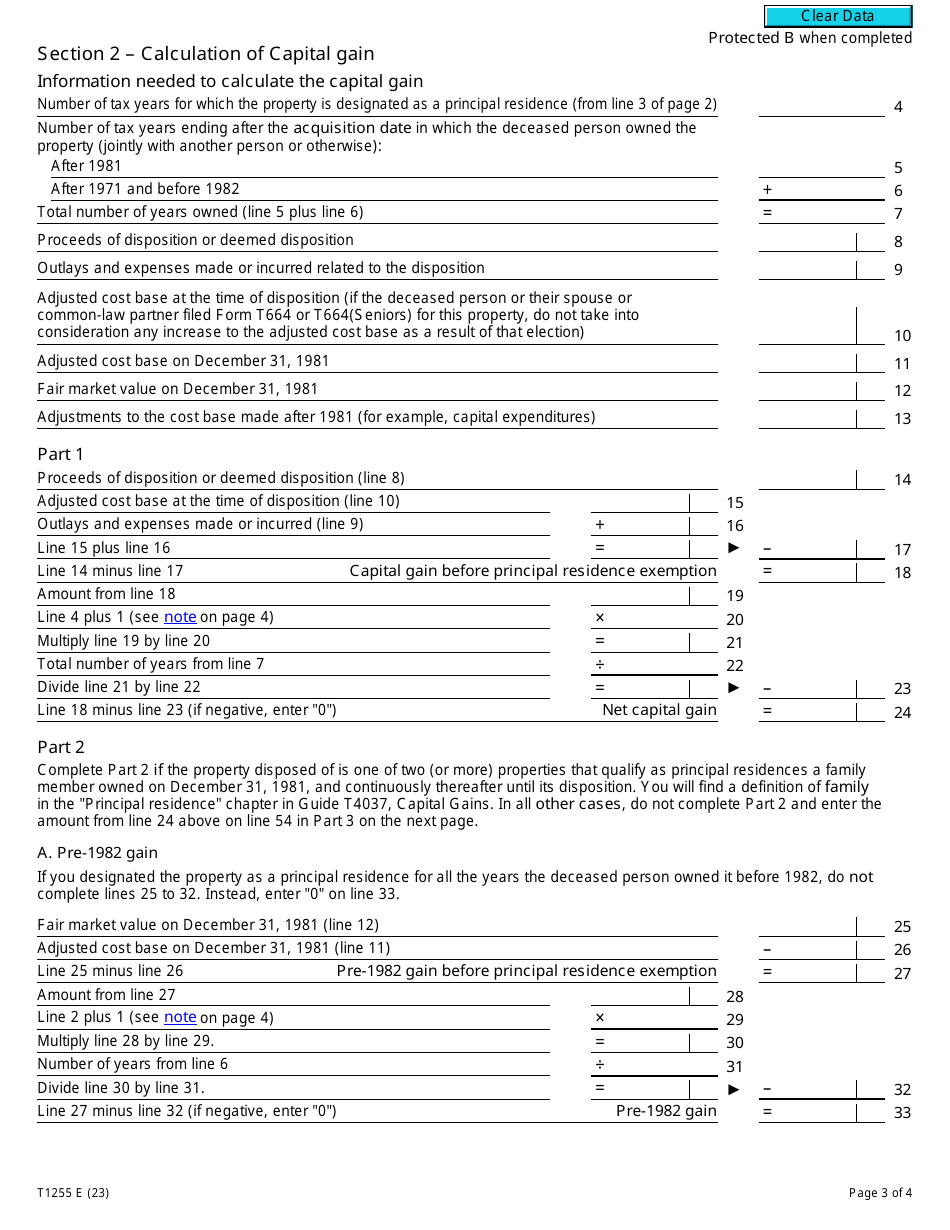

Form T1255, Designation of a Property as a Principal Residence by the Legal Representative of a Deceased Individual, is used in Canada to designate a property as the principal residence for tax purposes after the death of an individual. It allows the legal representative of a deceased individual to claim the principal residence exemption on behalf of the deceased for the year of death and subsequent years.

The legal representative of a deceased individual in Canada files the Form T1255 for the designation of a property as a principal residence.

Form T1255 Designation of a Property as a Principal Residence by the Legal Representative of a Deceased Individual - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T1255?

A: Form T1255 is used to designate a property as a principal residence by the legal representative of a deceased individual in Canada.

Q: Who can use Form T1255?

A: Form T1255 is used by the legal representative of a deceased individual in Canada.

Q: What is the purpose of Form T1255?

A: The purpose of Form T1255 is to designate a property as a principal residence for a deceased individual in Canada.

Q: When should Form T1255 be used?

A: Form T1255 should be used when the legal representative of a deceased individual wants to designate a property as a principal residence in Canada.

Q: How is Form T1255 submitted?

A: Form T1255 can be submitted electronically or by mail to the Canada Revenue Agency (CRA).

Q: Are there any deadlines for submitting Form T1255?

A: Yes, Form T1255 must be filed with the CRA within 36 months after the end of the year in which the individual died.

Q: Are there any penalties for not filing Form T1255?

A: Yes, there can be penalties or interest charges for not filing Form T1255 within the specified deadline.