This version of the form is not currently in use and is provided for reference only. Download this version of

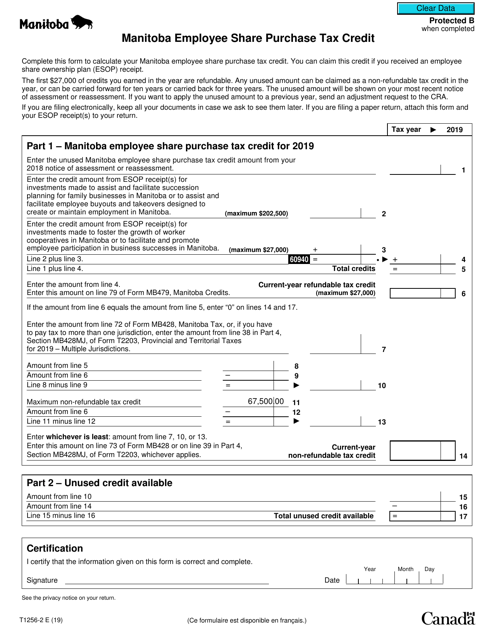

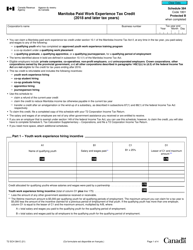

Form T1256-2

for the current year.

Form T1256-2 Manitoba Employee Share Purchase Tax Credit - Canada

The Form T1256-2 is used in Manitoba, Canada for claiming the Employee Share Purchase Tax Credit. This credit is available to eligible employees who have purchased shares of their employer's corporation. It helps reduce the amount of tax owed by the employee.

The Form T1256-2 Manitoba Employee Share Purchase Tax Credit in Canada is typically filed by the individual employee who is claiming the tax credit.

FAQ

Q: What is Form T1256-2?

A: Form T1256-2 is a tax form in Canada.

Q: What is the Manitoba Employee Share Purchase Tax Credit?

A: The Manitoba Employee Share Purchase Tax Credit is a tax credit available to residents of Manitoba who purchase shares as part of an employee share purchase plan.

Q: Who is eligible for the Manitoba Employee Share Purchase Tax Credit?

A: Residents of Manitoba who purchase shares through an employee share purchase plan are eligible for the tax credit.

Q: How much is the tax credit?

A: The tax credit is equal to 10% of the cost of the shares purchased, up to a maximum of $2,000 per year.

Q: How do I claim the tax credit?

A: To claim the tax credit, you must complete Form T1256-2 and include it with your tax return.

Q: Are there any restrictions or limitations on the tax credit?

A: Yes, there are certain restrictions and limitations on the tax credit. It is recommended to consult the official guidelines or seek professional tax advice for specific details.

Q: Is the tax credit refundable?

A: No, the tax credit is not refundable. It can only be used to reduce your tax liability.

Q: When is the deadline to claim the tax credit?

A: The deadline to claim the tax credit is the same as the deadline for filing your annual tax return, which is typically April 30th of the following year.