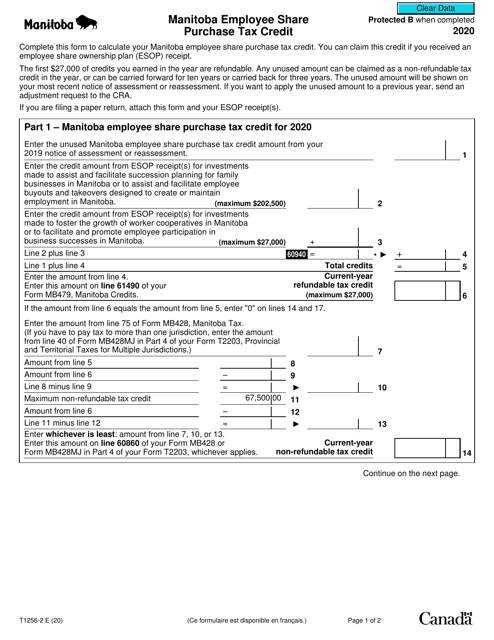

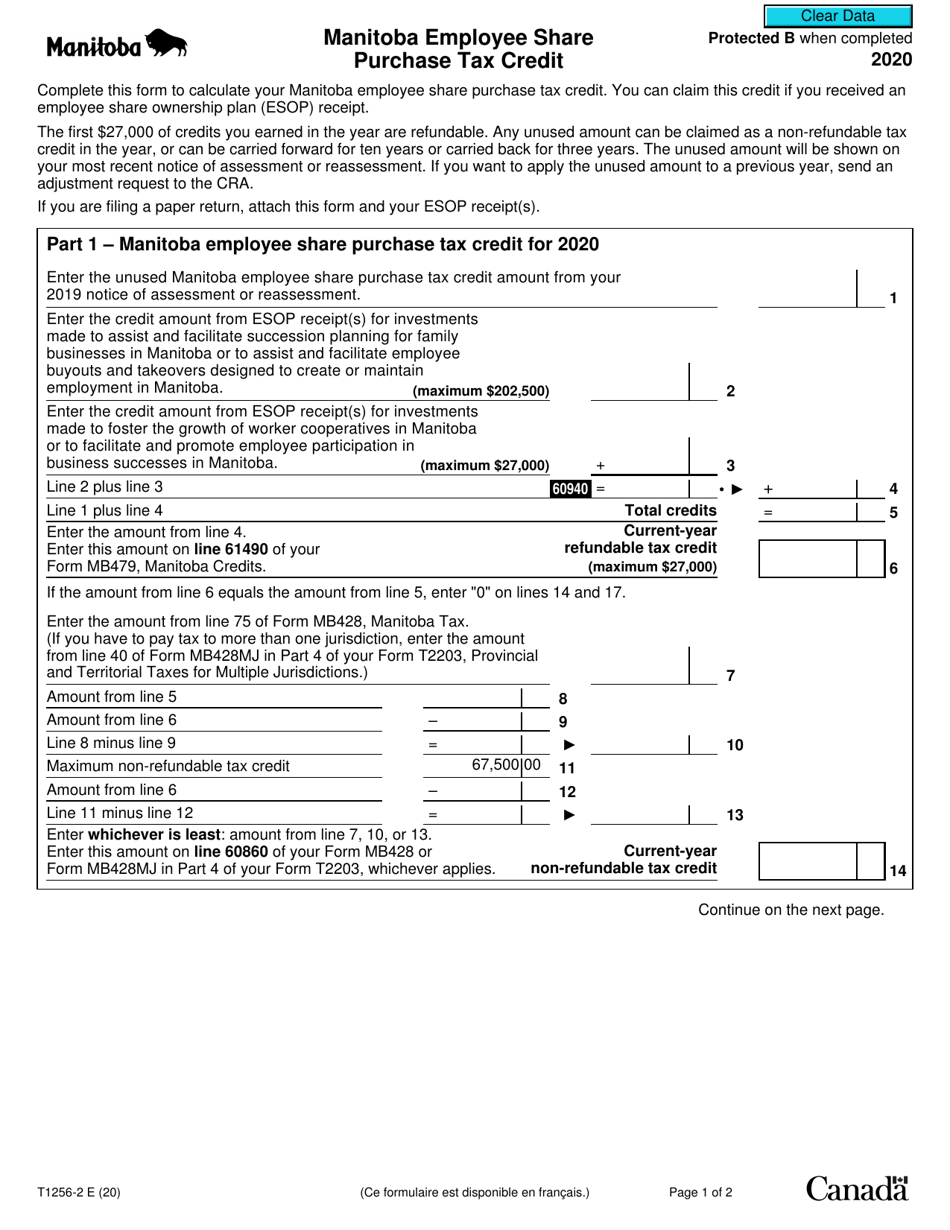

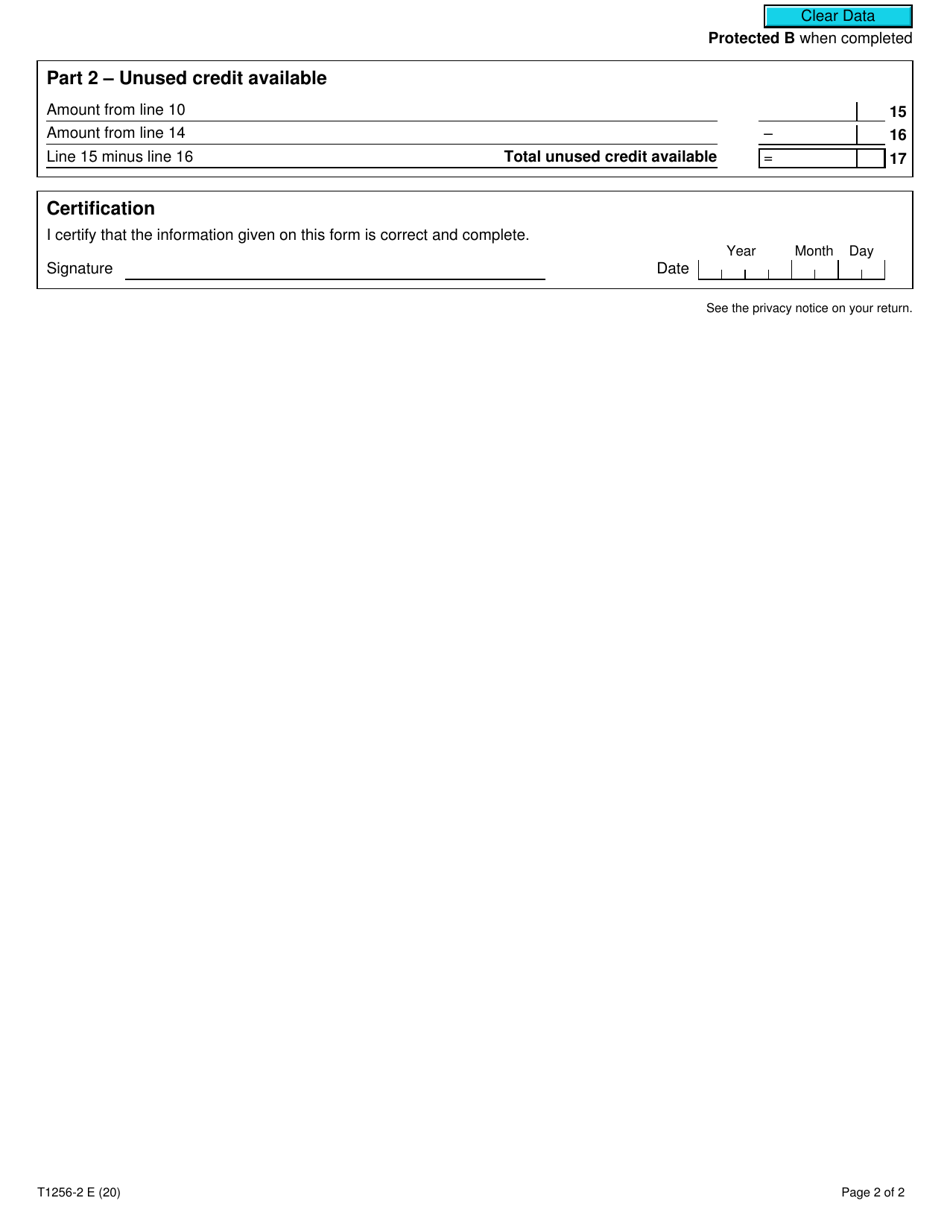

Form T1256-2 Manitoba Employee Share Purchase Tax Credit - Canada

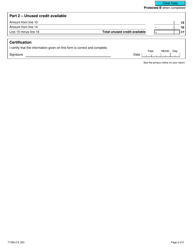

Form T1256-2, the Manitoba Employee Share Purchase Tax Credit, is used in Canada for individuals who have acquired eligible shares through an employee share purchase plan in Manitoba. The form helps taxpayers calculate and claim the tax credit they are eligible for based on the shares they have purchased.

The Form T1256-2 Manitoba Employee Share Purchase Tax Credit is filed by individuals who are eligible for the Manitoba Employee Share Purchase Tax Credit in Canada.

Form T1256-2 Manitoba Employee Share Purchase Tax Credit - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T1256-2?

A: Form T1256-2 is a tax form used in Manitoba, Canada.

Q: What is the Manitoba Employee Share Purchase Tax Credit?

A: The Manitoba Employee Share Purchase Tax Credit is a tax credit that allows eligible individuals to claim a credit for shares purchased through an employee share purchase plan.

Q: Who is eligible for the Manitoba Employee Share Purchase Tax Credit?

A: Eligible individuals include Manitoba residents who have acquired eligible shares through an employee share purchase plan.

Q: What are eligible shares?

A: Eligible shares include shares of a corporation that meet certain criteria, such as being listed on a designated stock exchange.

Q: How much is the tax credit?

A: The tax credit is equal to 15% of the cost of eligible shares acquired during the tax year, up to a maximum amount.

Q: How is the tax credit claimed?

A: The tax credit is claimed by completing Form T1256-2 and including it with your income tax return.

Q: Are there any limitations or restrictions on the tax credit?

A: Yes, there are certain limitations and restrictions that apply to the Manitoba Employee Share Purchase Tax Credit. It is recommended to consult the official guidelines or seek professional advice for more information.