This version of the form is not currently in use and is provided for reference only. Download this version of

Form T1243

for the current year.

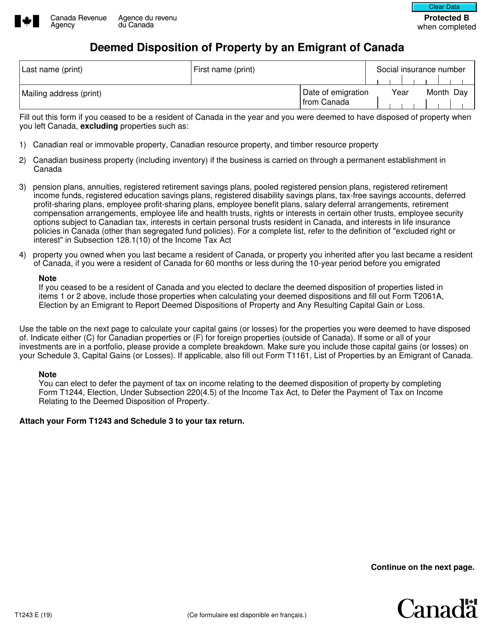

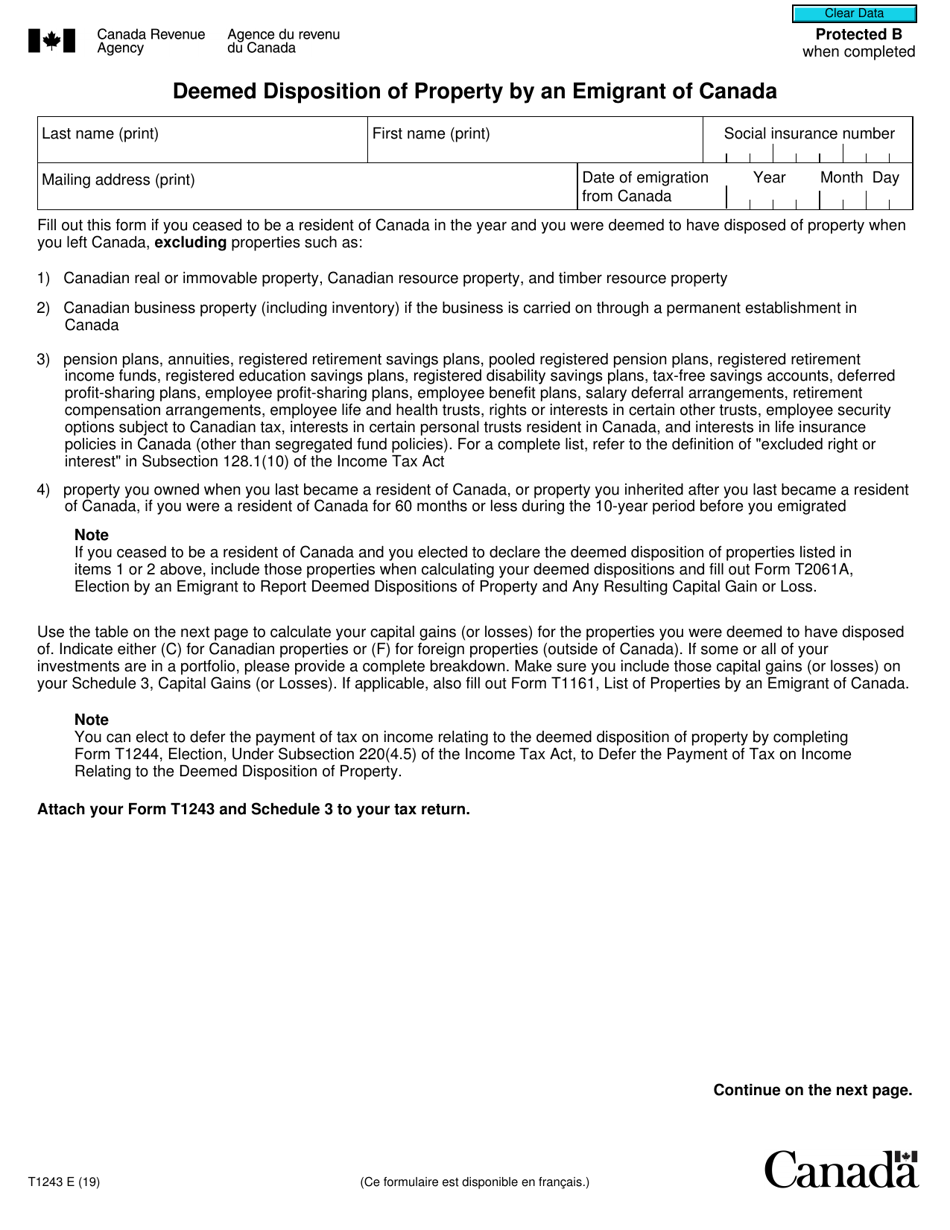

Form T1243 Deemed Disposition of Property by an Emigrant of Canada - Canada

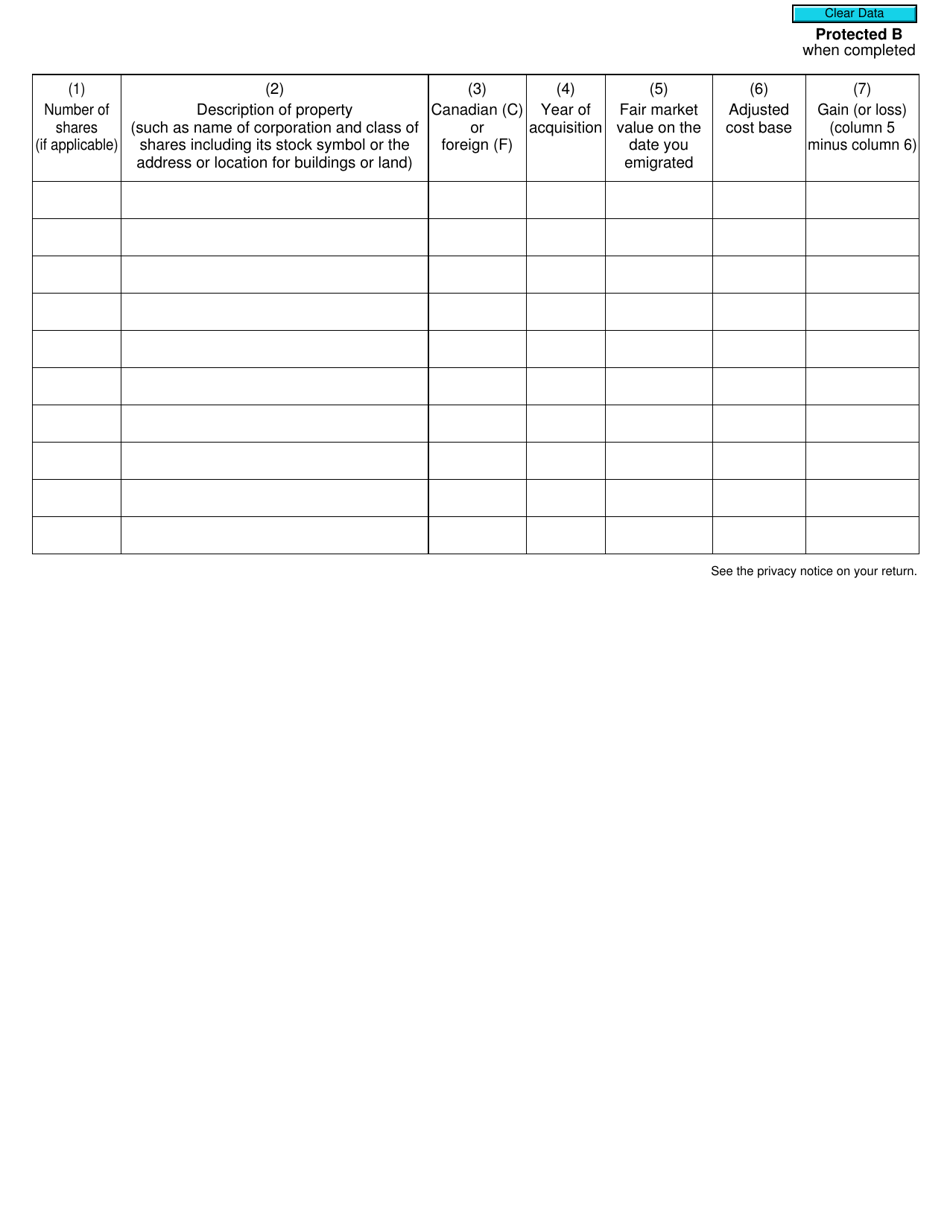

Form T1243 is used by individuals who are emigrating from Canada to report a deemed disposition of property for tax purposes. When a person leaves Canada, they are considered to have disposed of certain property at fair market value, which may result in capital gains or losses. This form allows individuals to calculate and report any potential tax implications of this deemed disposition.

The emigrant, or the person leaving Canada, files the Form T1243 for deemed disposition of property.

FAQ

Q: What is Form T1243?

A: Form T1243 is a tax form used in Canada to report the deemed disposition of property by an emigrant of Canada.

Q: What is a deemed disposition?

A: A deemed disposition refers to the tax treatment of a property as if it has been sold at fair market value, even though no actual sale has taken place.

Q: Who needs to file Form T1243?

A: Individuals who are emigrating from Canada and have deemed disposition of property need to file Form T1243.

Q: What is the purpose of filing Form T1243?

A: The purpose of filing Form T1243 is to report the deemed disposition of property and calculate any applicable taxes.

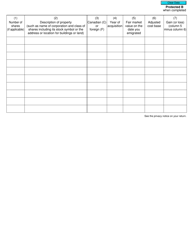

Q: What information is required in Form T1243?

A: Form T1243 requires information about the property being deemed disposed of, including its description, fair market value, and any expenses related to the disposition.

Q: When should Form T1243 be filed?

A: Form T1243 should be filed within 10 days after the emigrant's departure from Canada.

Q: Are there any penalties for not filing Form T1243?

A: Yes, there can be penalties for not filing Form T1243, including fines and interest on the amount owed.

Q: Can I e-file Form T1243?

A: No, Form T1243 cannot be e-filed and must be filed in paper format.

Q: Is Form T1243 specific to emigrants of Canada?

A: Yes, Form T1243 is specifically for individuals who are emigrating from Canada and have deemed disposition of property.