This version of the form is not currently in use and is provided for reference only. Download this version of

Form T1244

for the current year.

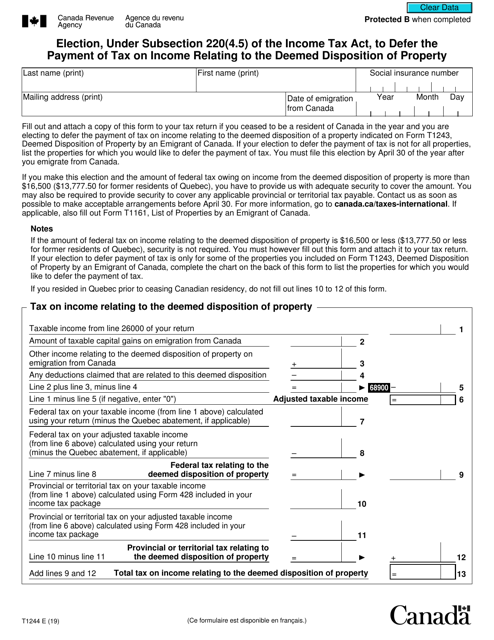

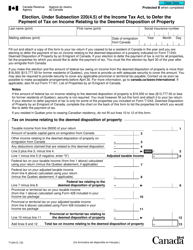

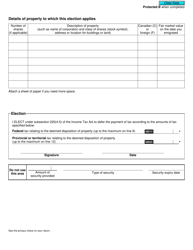

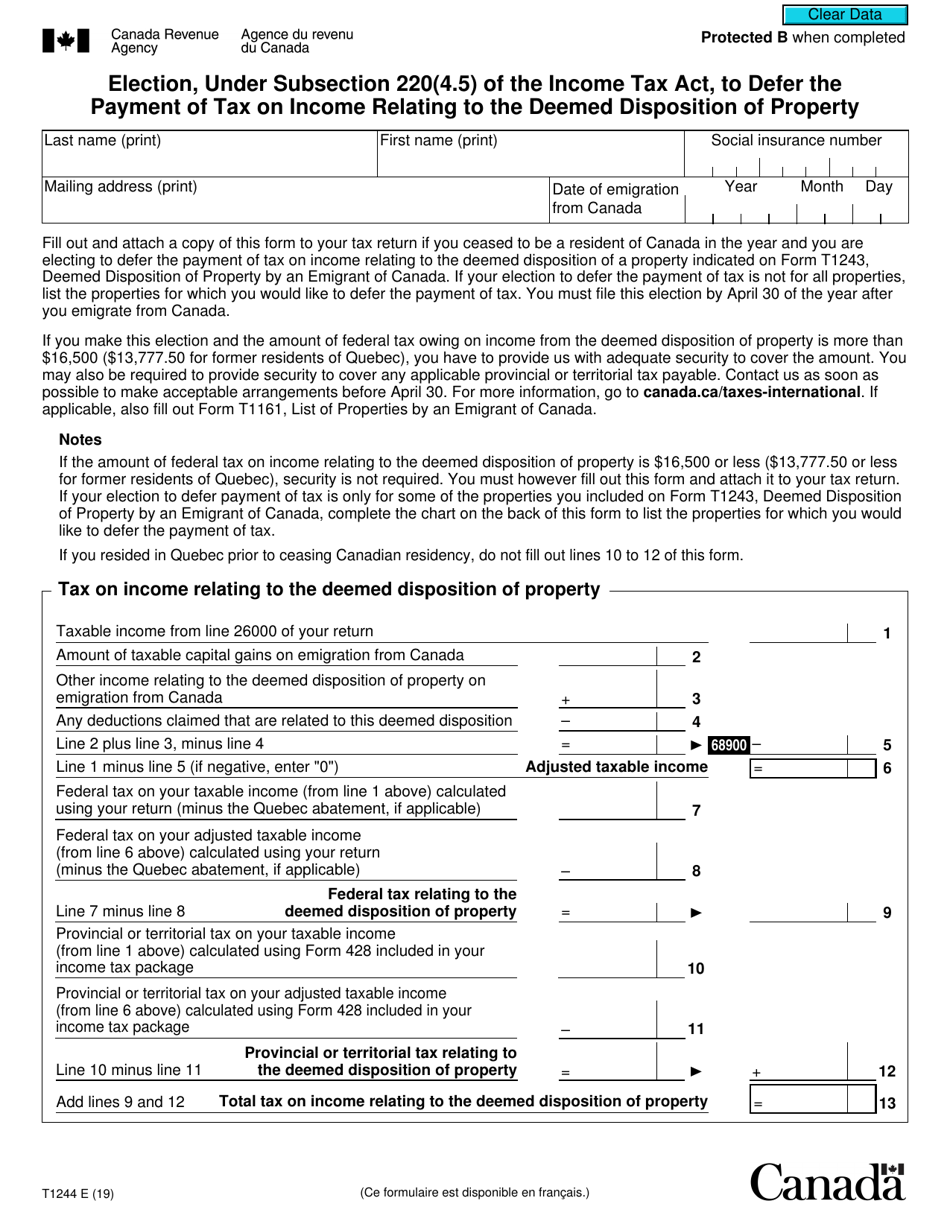

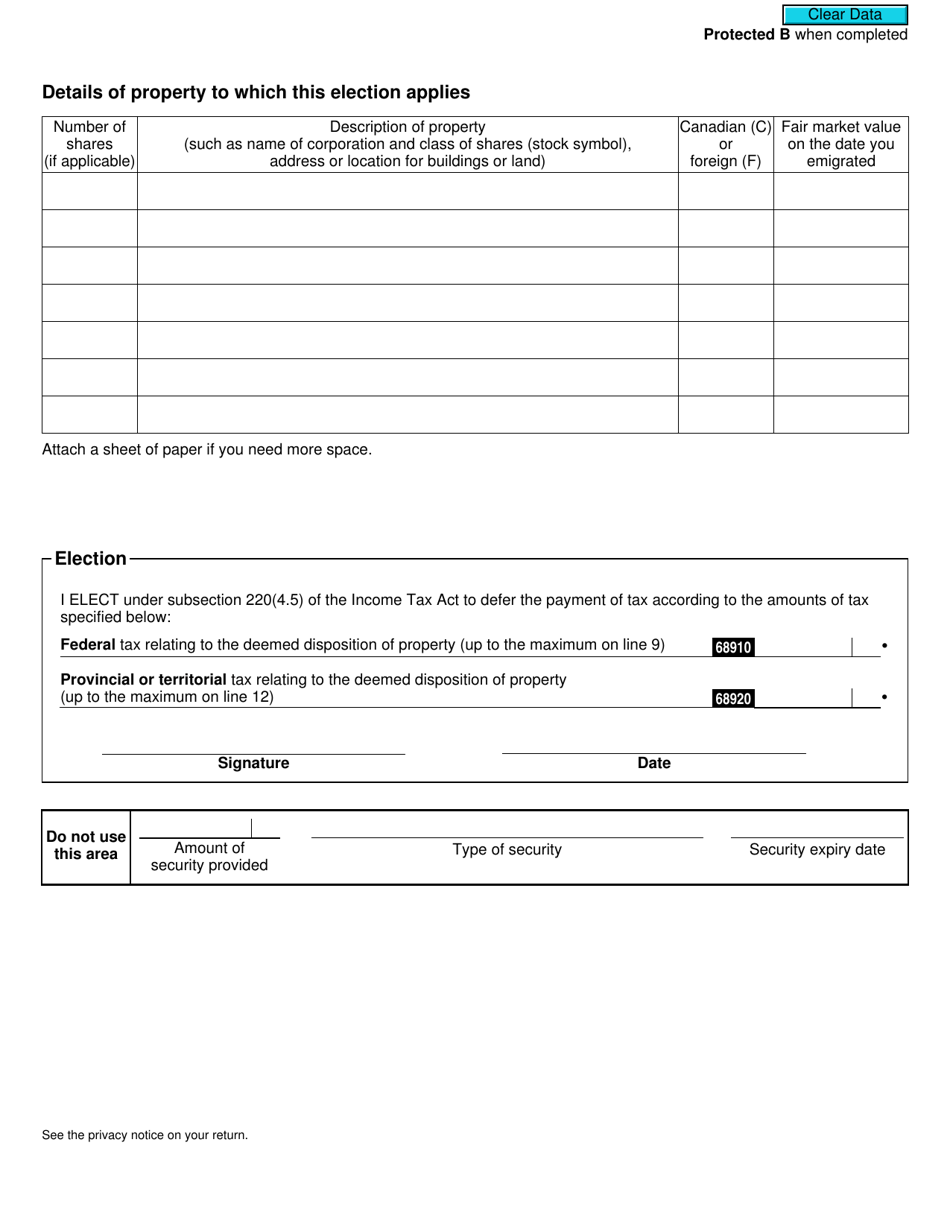

Form T1244 Election, Under Subsection 220(4.5) of the Income Tax Act, to Defer the Payment of Tax on Income Relating to the Deemed Disposition of Property - Canada

Form T1244 Election, Under Subsection 220(4.5) of the Income Tax Act, is used in Canada to defer the payment of tax on income relating to the deemed disposition of property. By filing this form, taxpayers can elect to defer the tax liability, which would otherwise be payable when certain property is transferred or deemed to be disposed of.

The taxpayer files the Form T1244 election in Canada to defer the payment of tax on income relating to the deemed disposition of property, under subsection 220(4.5) of the Income Tax Act.

FAQ

Q: What is Form T1244?

A: Form T1244 is an election form under subsection 220(4.5) of the Income Tax Act in Canada.

Q: What does Form T1244 allow you to do?

A: Form T1244 allows you to defer the payment of tax on income relating to the deemed disposition of property.

Q: What is the purpose of Form T1244?

A: The purpose of Form T1244 is to provide taxpayers with the option to defer tax payment on certain income.

Q: Which section of the Income Tax Act does Form T1244 fall under?

A: Form T1244 falls under subsection 220(4.5) of the Income Tax Act.

Q: Who is eligible to use Form T1244?

A: Any taxpayer who has income relating to the deemed disposition of property may be eligible to use Form T1244.

Q: Can Form T1244 be used to defer any type of income?

A: No, Form T1244 can only be used to defer the payment of tax on income relating to the deemed disposition of property.

Q: How does Form T1244 work?

A: By filing Form T1244, taxpayers can elect to defer the payment of tax on certain income and have it taxed in a later year.

Q: Are there any restrictions on using Form T1244?

A: Yes, there are certain restrictions and conditions outlined in the Income Tax Act that must be met to use Form T1244.