This version of the form is not currently in use and is provided for reference only. Download this version of

Form T1175

for the current year.

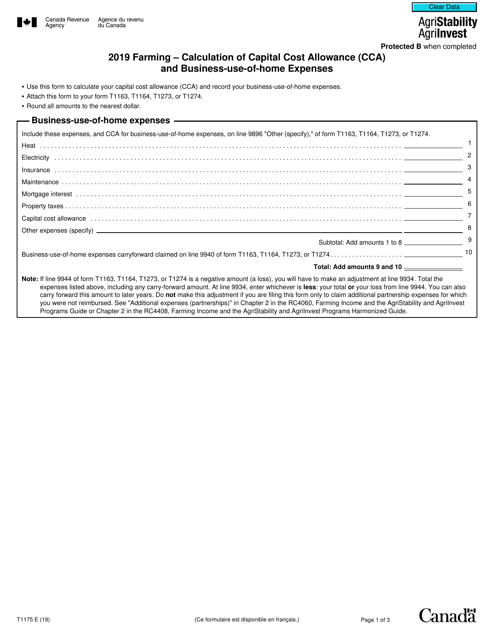

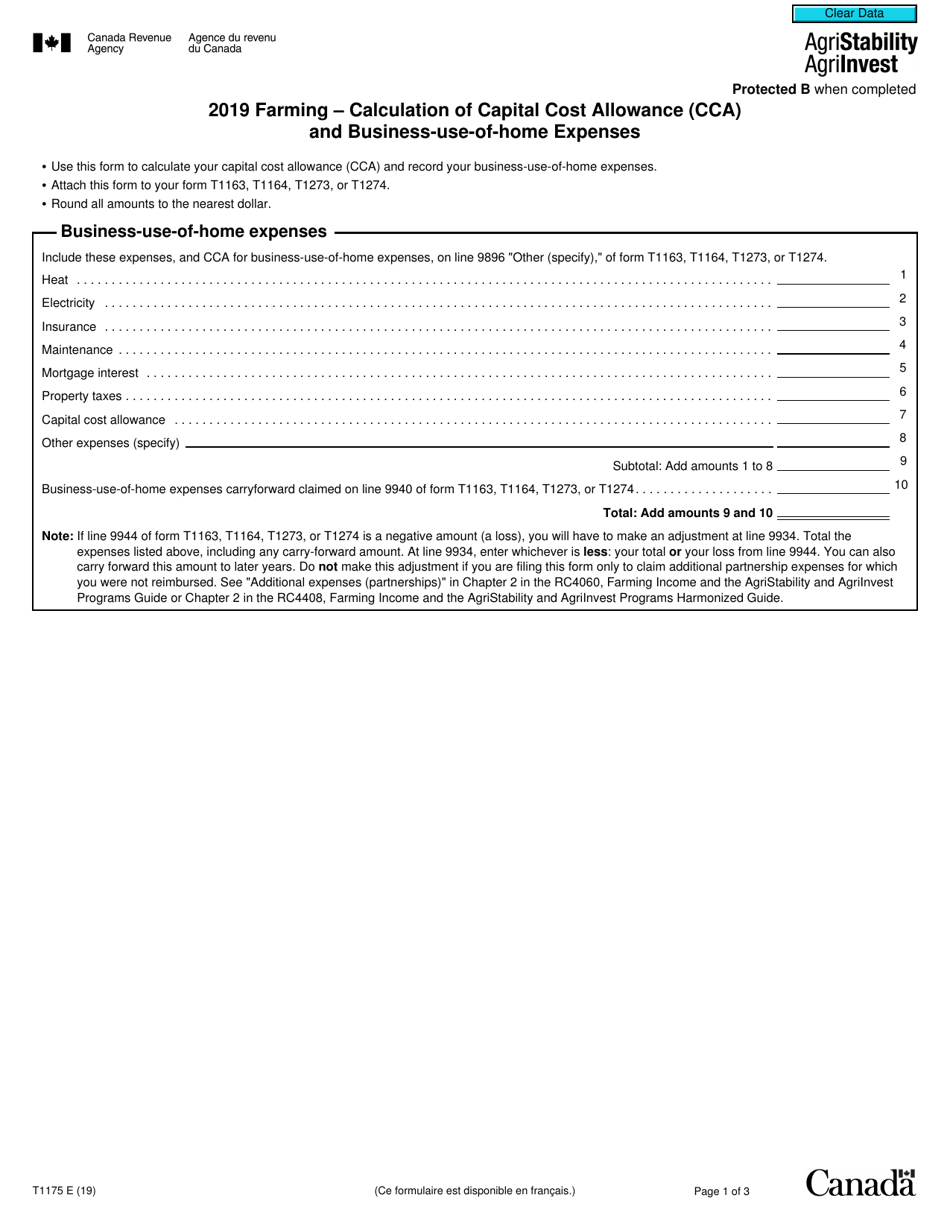

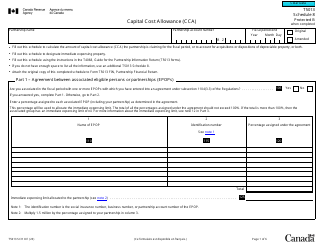

Form T1175 Farming - Calculation of Capital Cost Allowance (Cca) and Business-Use-Of-Home Expenses - Canada

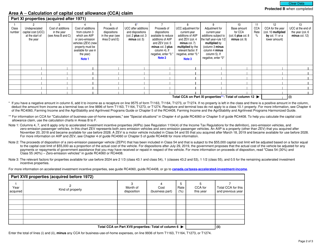

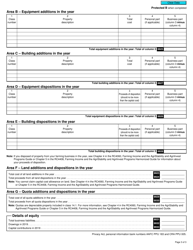

Form T1175 Farming - Calculation of Capital Cost Allowance (CCA) and Business-Use-Of-Home Expenses is used by individuals in Canada who are farming to calculate the depreciation expenses (CCA) for their farming assets and claim expenses related to using a portion of their home for business purposes.

The Form T1175 Farming - Calculation of Capital Cost Allowance (CCA) and Business-Use-Of-Home Expenses in Canada is typically filed by Canadian farmers who want to calculate their capital cost allowance and claim business-use-of-home expenses.

FAQ

Q: What is Form T1175?

A: Form T1175 is a form used in Canada for calculating Capital Cost Allowance (CCA) and Business-Use-of-Home Expenses for farming.

Q: What is Capital Cost Allowance (CCA)?

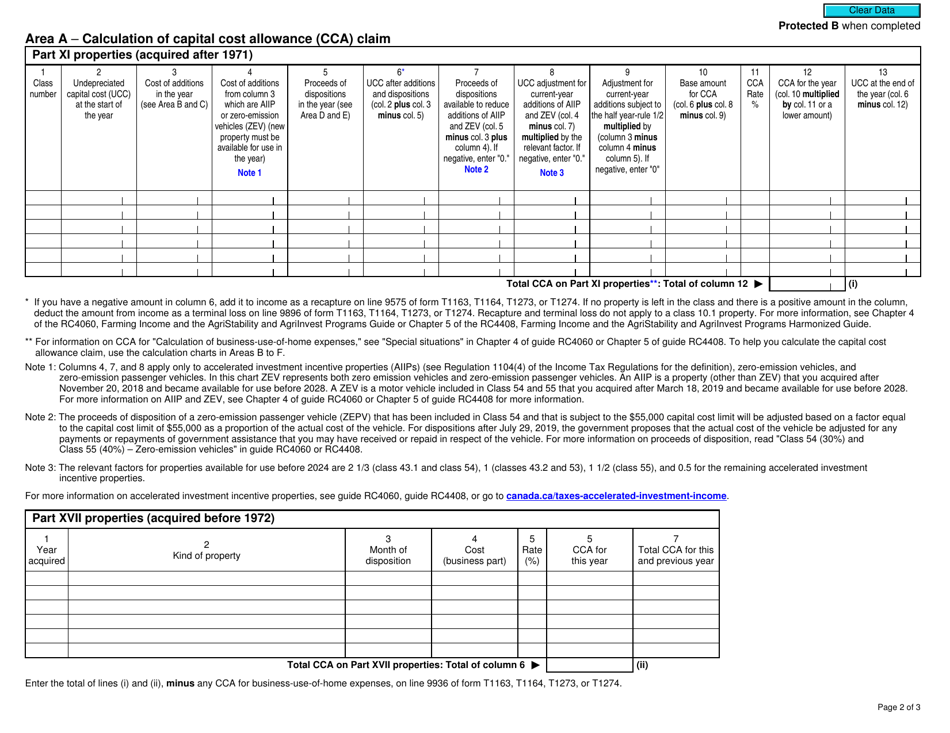

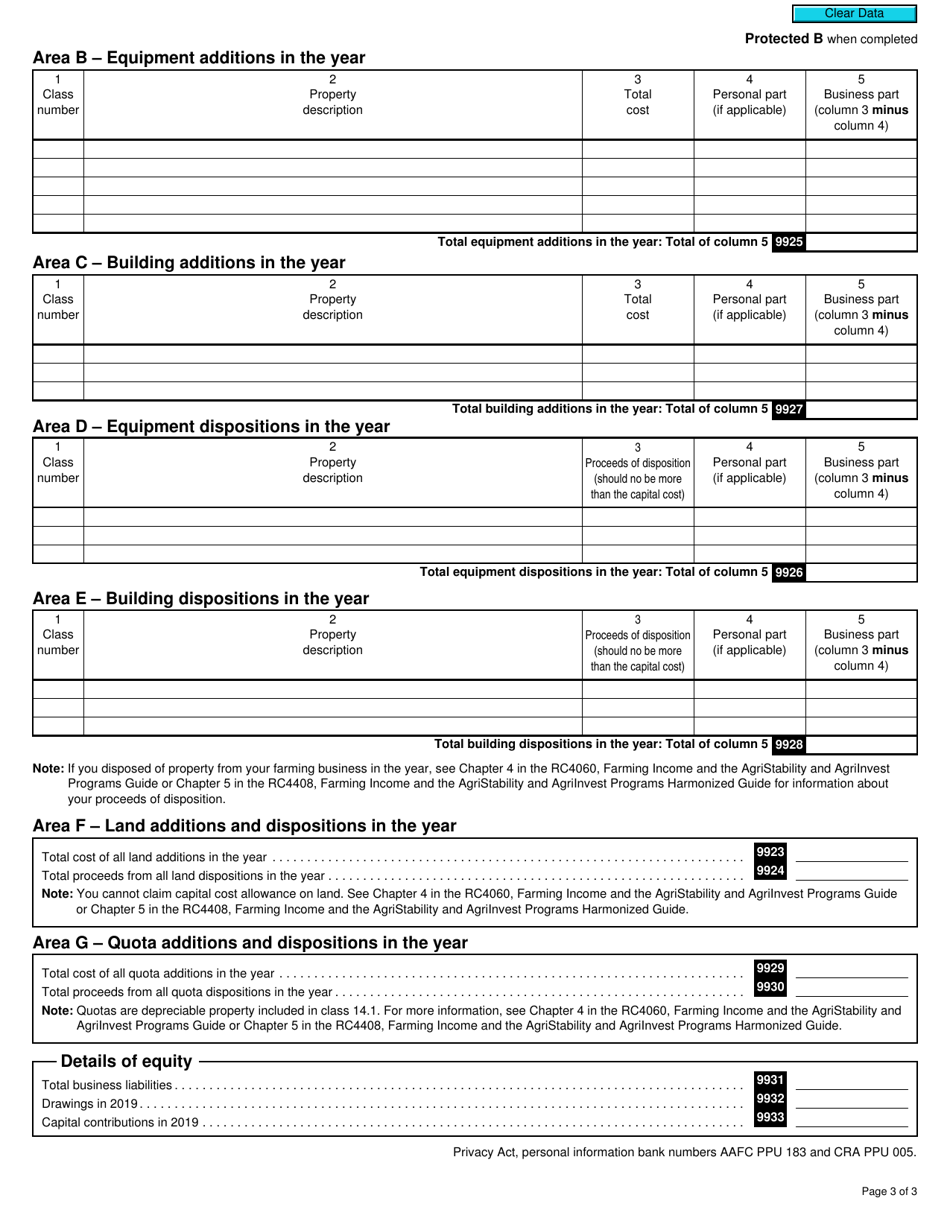

A: Capital Cost Allowance (CCA) is a tax deduction that allows farmers in Canada to recover the cost of depreciable assets used in their farming business over a period of time.

Q: What are Business-Use-of-Home Expenses?

A: Business-Use-of-Home Expenses are expenses incurred by farmers in Canada for using a part of their home as a place of business for their farming operations.

Q: Why is Form T1175 important for farmers in Canada?

A: Form T1175 is important for farmers in Canada as it helps them calculate the Capital Cost Allowance (CCA) for their depreciable assets and determine the deductible expenses for using their home for business purposes.