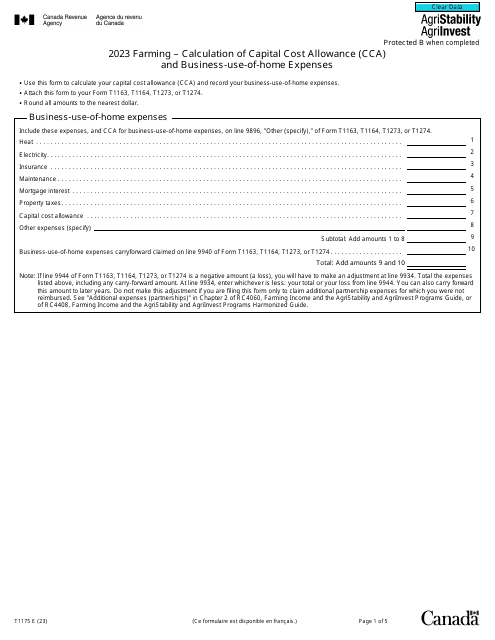

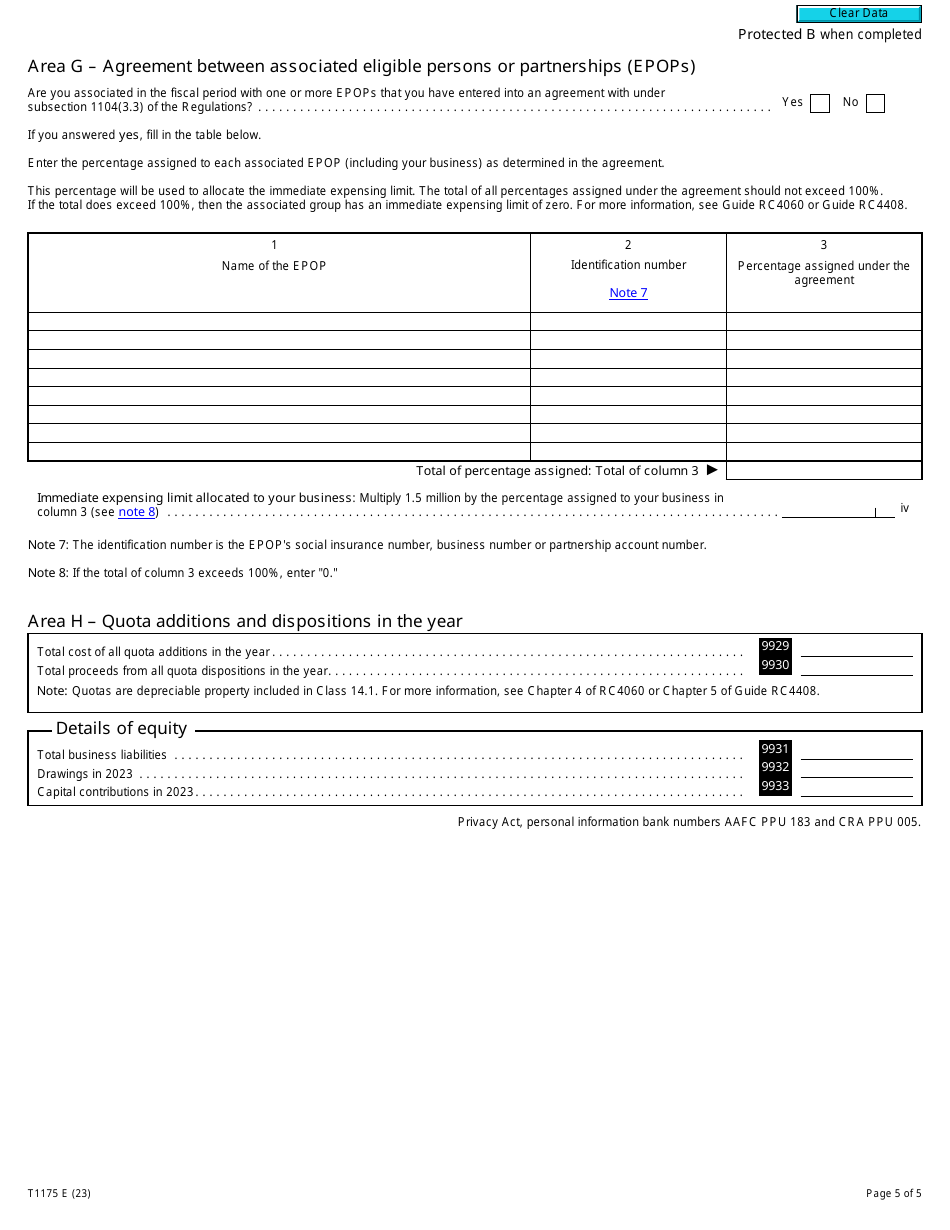

Form T1175 Farming - Calculation of Capital Cost Allowance (Cca) and Business-Use-Of-Home Expenses - Canada

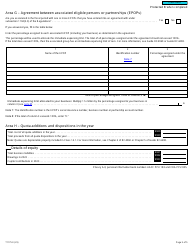

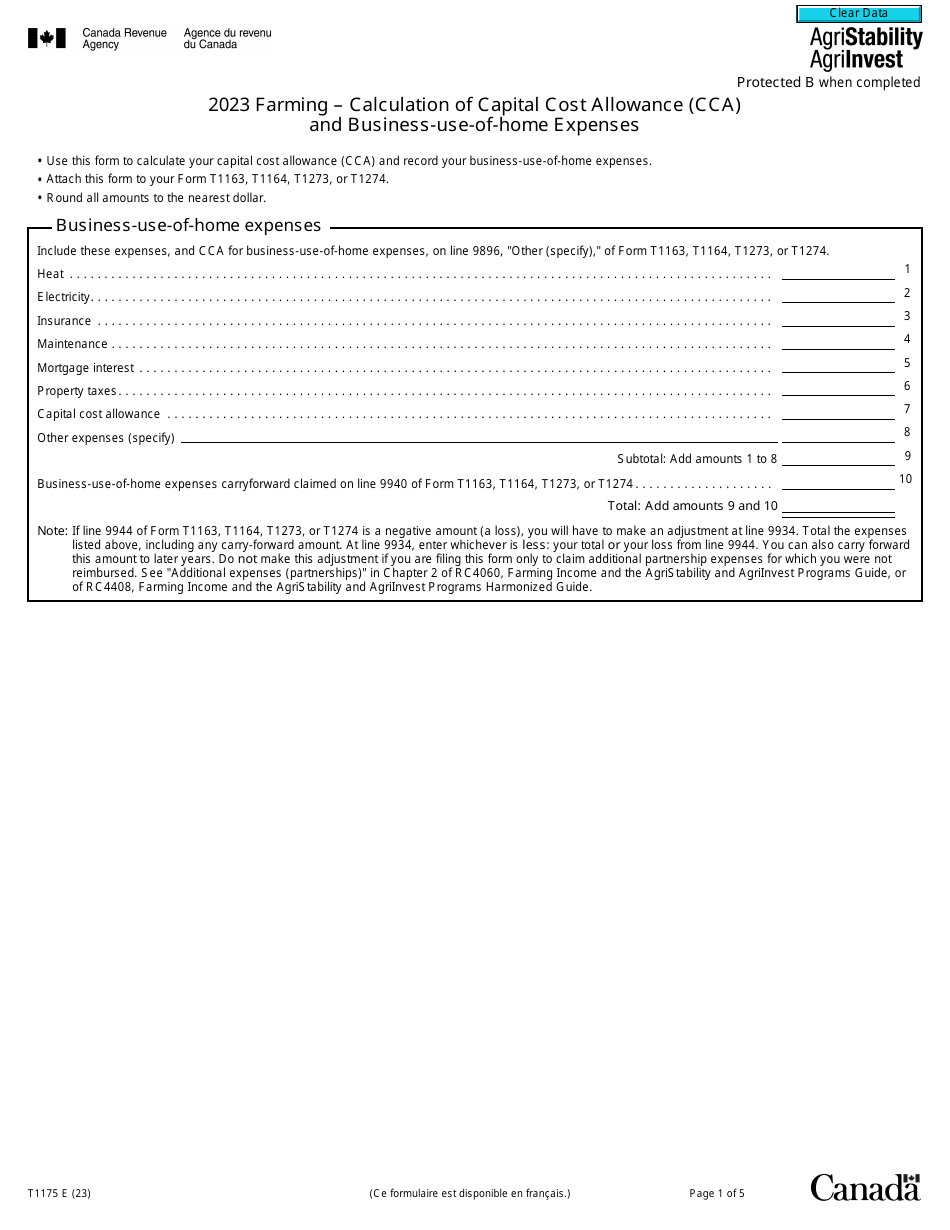

Form T1175 - Farming - Calculation of Capital Cost Allowance (CCA) and Business-Use-Of-Home Expenses - Canada is used by farmers to calculate the capital cost allowance and business-use-of-home expenses for tax purposes. It helps farmers determine the depreciation of their farming assets and calculate the expenses related to using a part of their home for business purposes.

The Form T1175 Farming - Calculation of Capital Cost Allowance (CCA) and Business-Use-of-Home Expenses is filed by individuals or businesses in Canada who are engaged in farming activities.

Form T1175 Farming - Calculation of Capital Cost Allowance (Cca) and Business-Use-Of-Home Expenses - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T1175?

A: Form T1175 is a tax form used by Canadian farmers to calculate their Capital Cost Allowance (CCA) and Business-Use-of-Home Expenses.

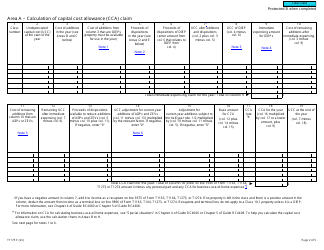

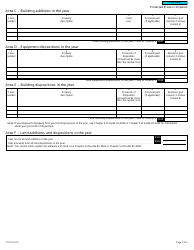

Q: What is Capital Cost Allowance (CCA)?

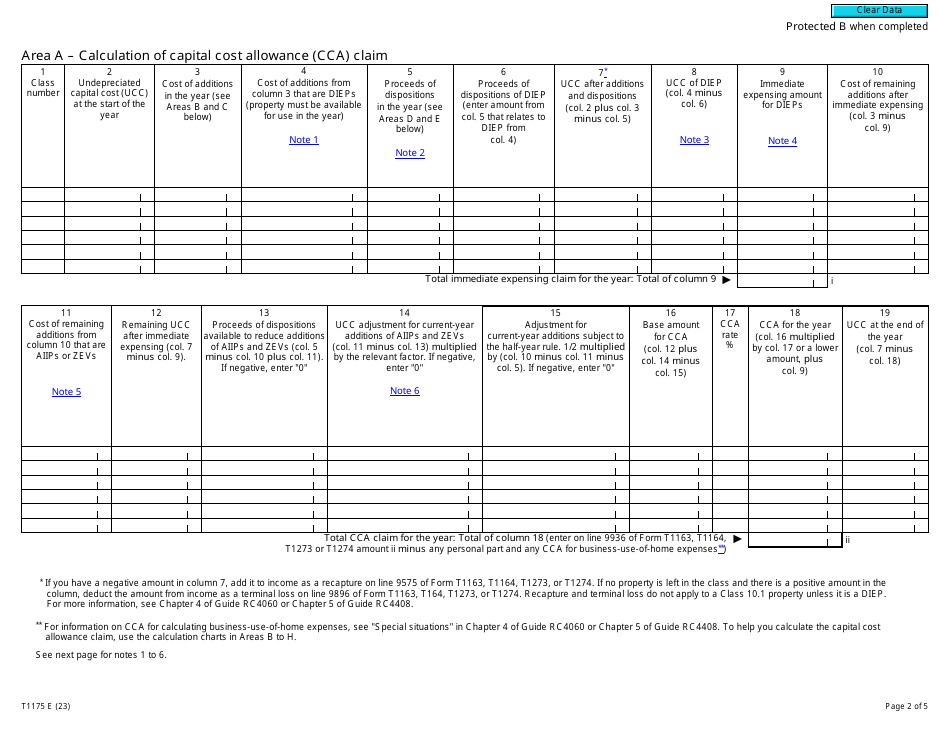

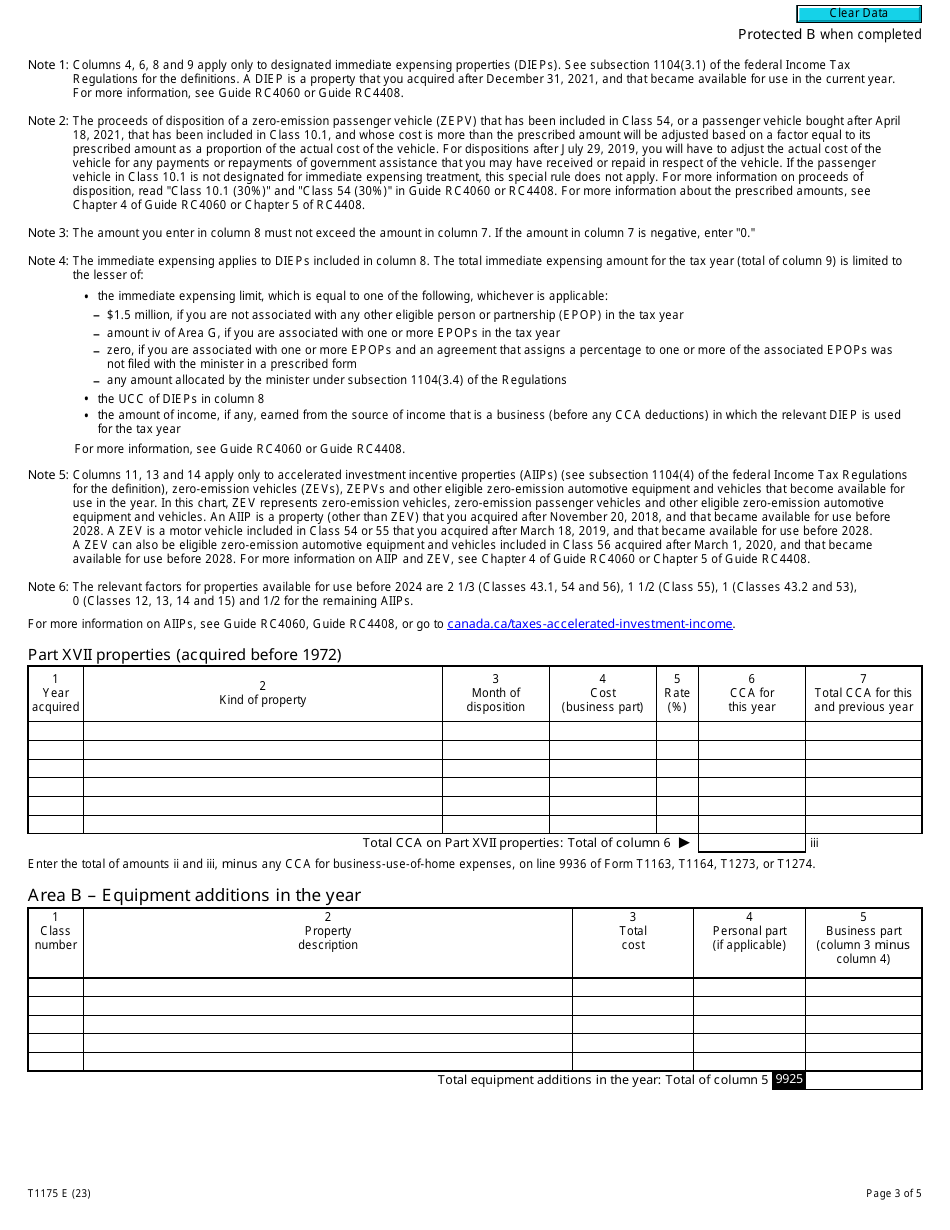

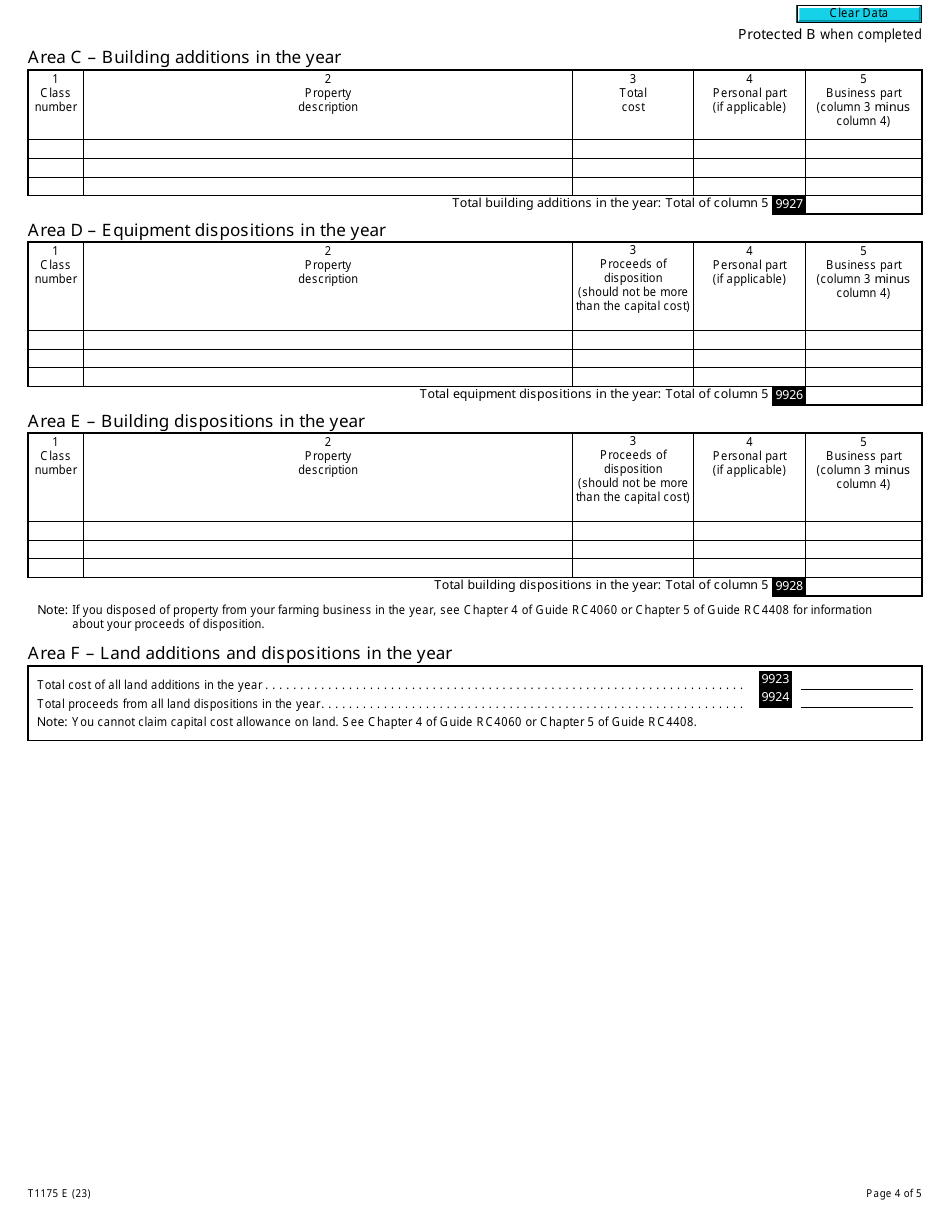

A: Capital Cost Allowance (CCA) is a tax deduction that allows farmers to recover the cost of depreciable assets used in their farming business over a period of time.

Q: How can farmers calculate CCA?

A: Farmers can calculate CCA by using Form T1175 and following the instructions provided. They will need to determine the classes and rates of depreciation for their specific assets.

Q: What are Business-Use-of-Home Expenses?

A: Business-Use-of-Home Expenses are expenses incurred by farmers for using a portion of their home for business purposes. These expenses may include a portion of the home's utilities, maintenance, and property taxes.

Q: Can farmers claim Business-Use-of-Home Expenses?

A: Yes, farmers can claim Business-Use-of-Home Expenses if they meet certain criteria, including using the specific area of their home exclusively for their farming business and regularly meeting clients or customers there.

Q: How do farmers claim Business-Use-of-Home Expenses?

A: Farmers can claim Business-Use-of-Home Expenses by completing Form T1175 and including the relevant information about their home and business use.

Q: Are there any restrictions on claiming CCA and Business-Use-of-Home Expenses?

A: Yes, there are certain restrictions and limitations on claiming CCA and Business-Use-of-Home Expenses. It is important for farmers to consult the Canada Revenue Agency (CRA) or a tax professional for guidance.

Q: What other tax forms do Canadian farmers need to file?

A: In addition to Form T1175, Canadian farmers may need to file other tax forms such as T1 Income Tax and Benefit Return, Schedule T2125 Statement of Farming Activities, and T777 Statement of Employment Expenses.

Q: Is it recommended for farmers to seek professional tax advice?

A: Yes, it is recommended for farmers to seek professional tax advice, especially when dealing with complex tax forms and calculations like Form T1175.