This version of the form is not currently in use and is provided for reference only. Download this version of

Form T1206

for the current year.

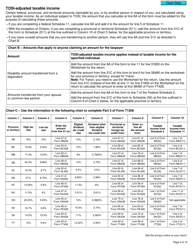

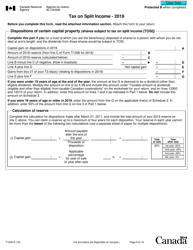

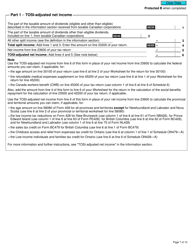

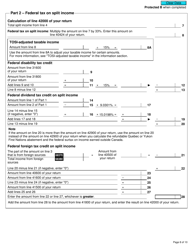

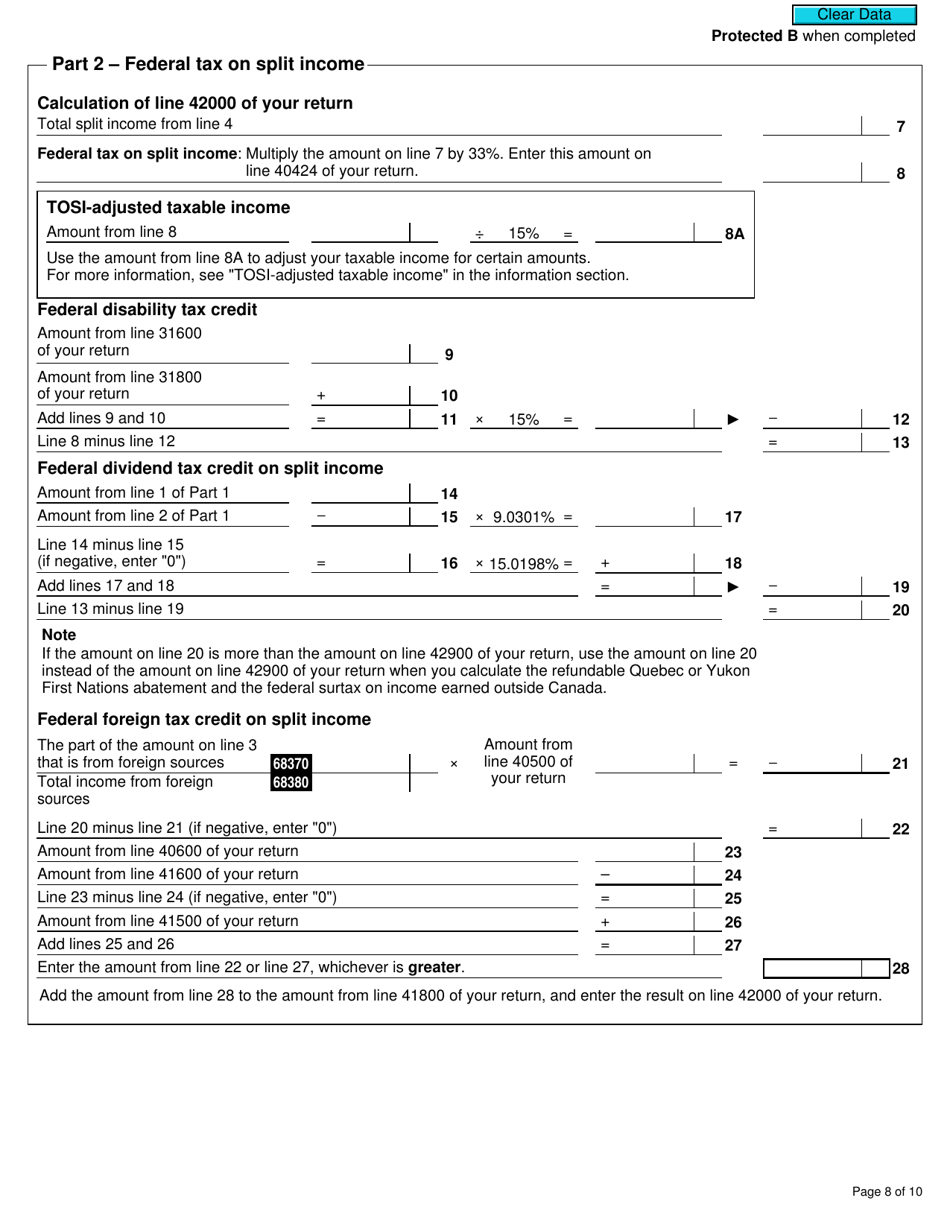

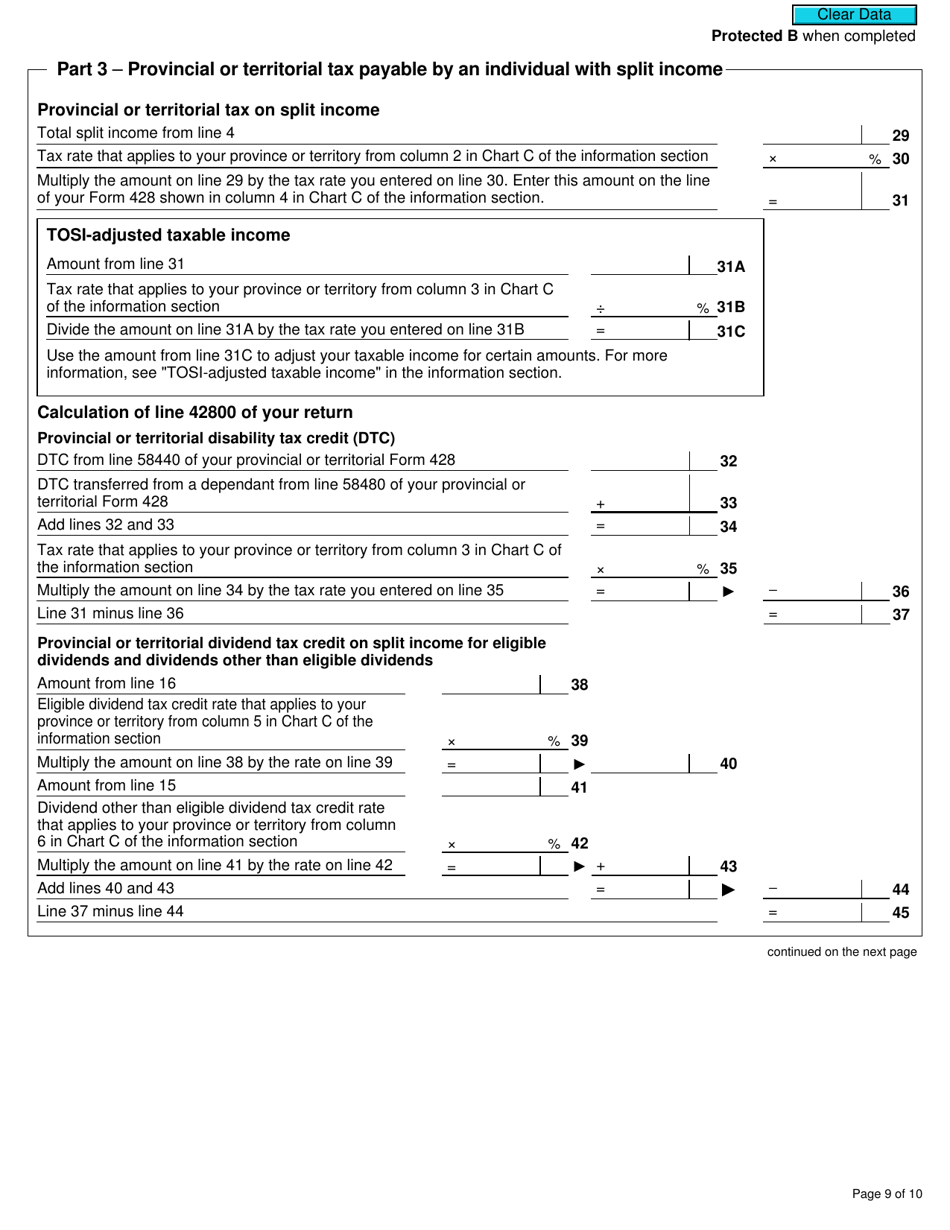

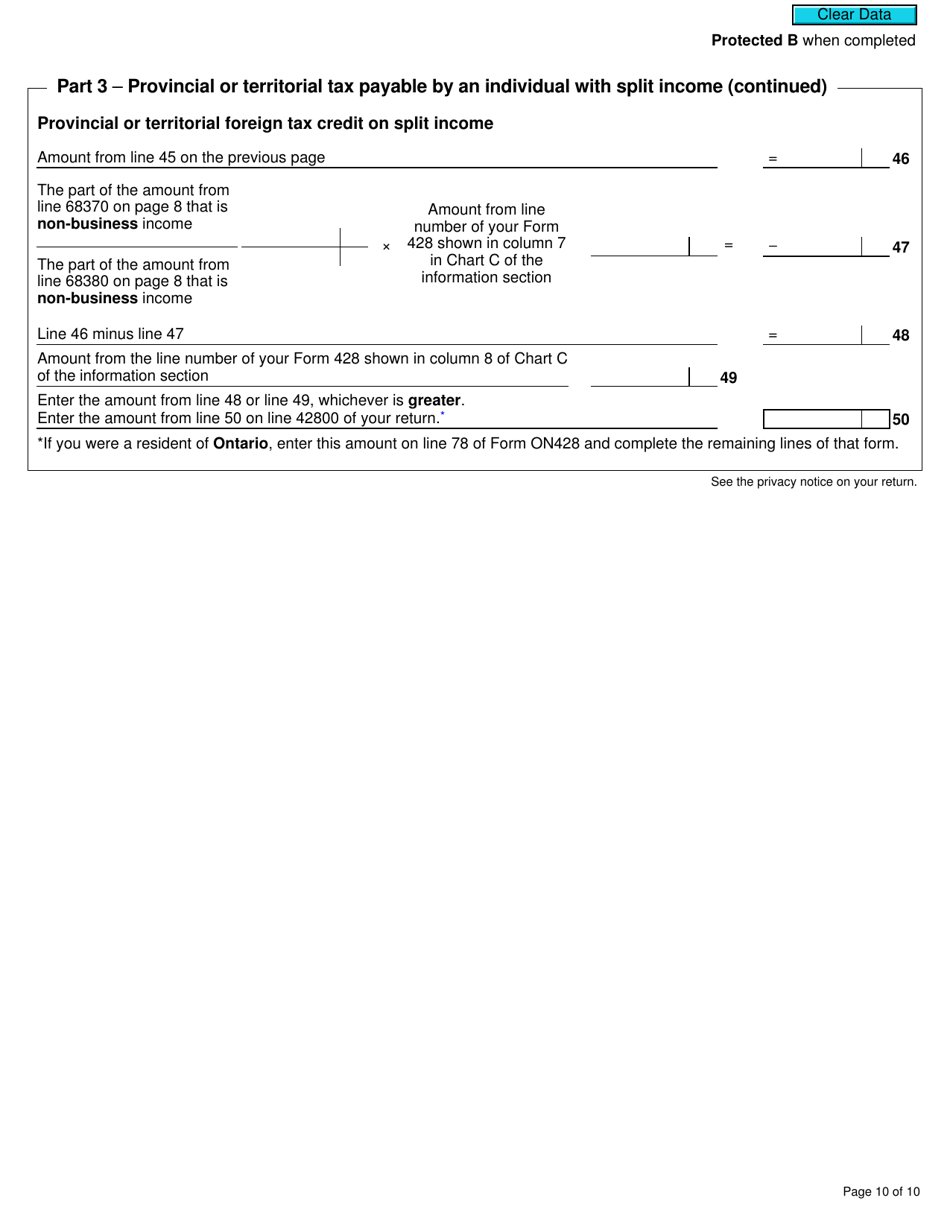

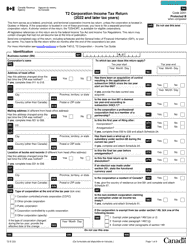

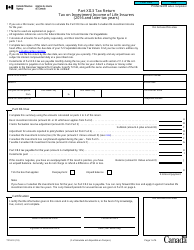

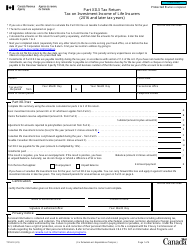

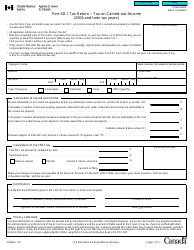

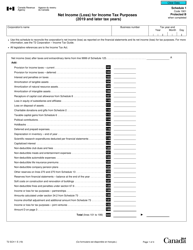

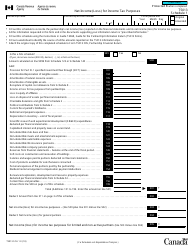

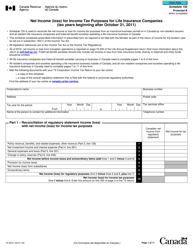

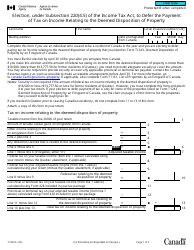

Form T1206 Tax on Split Income - Canada

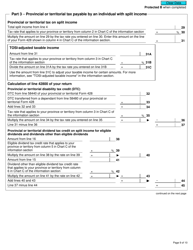

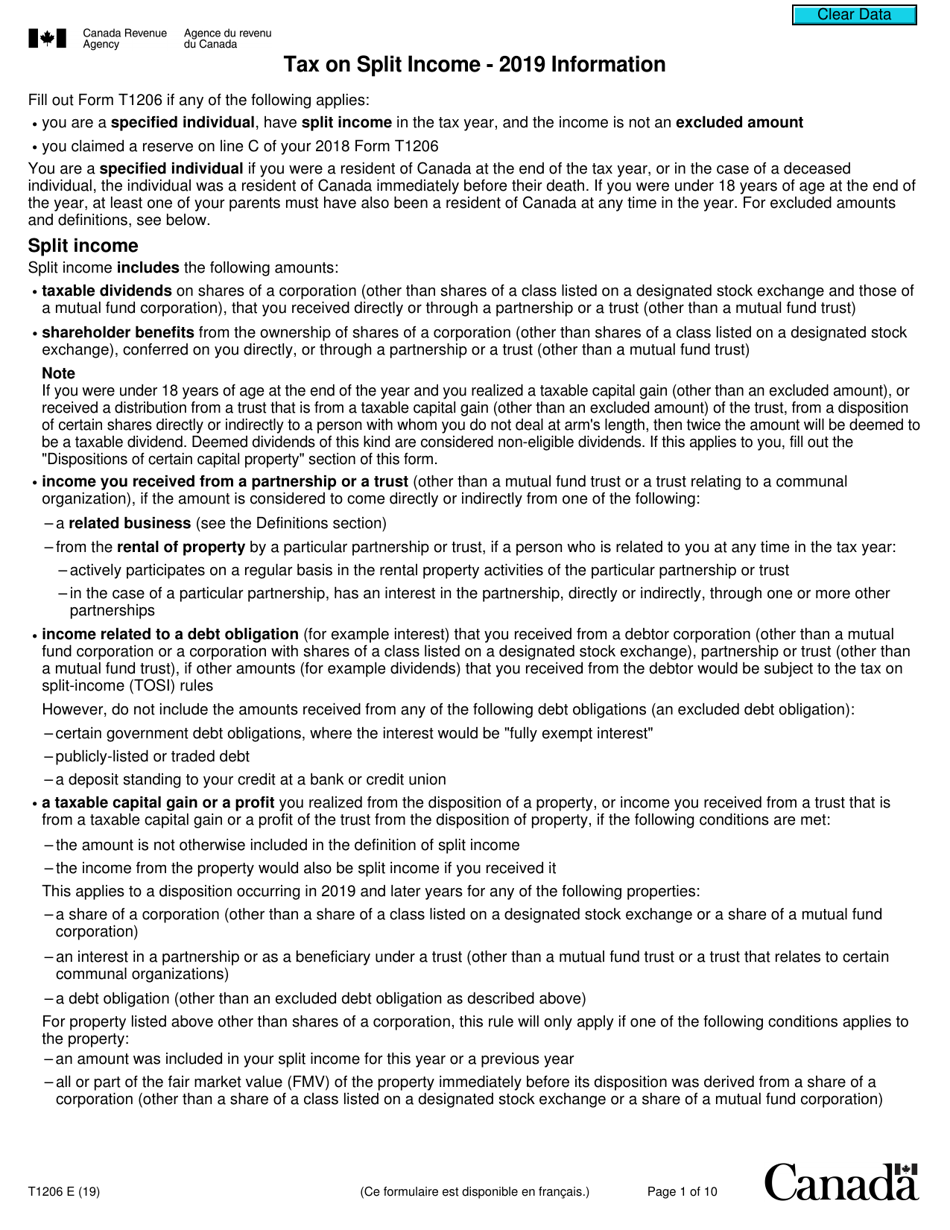

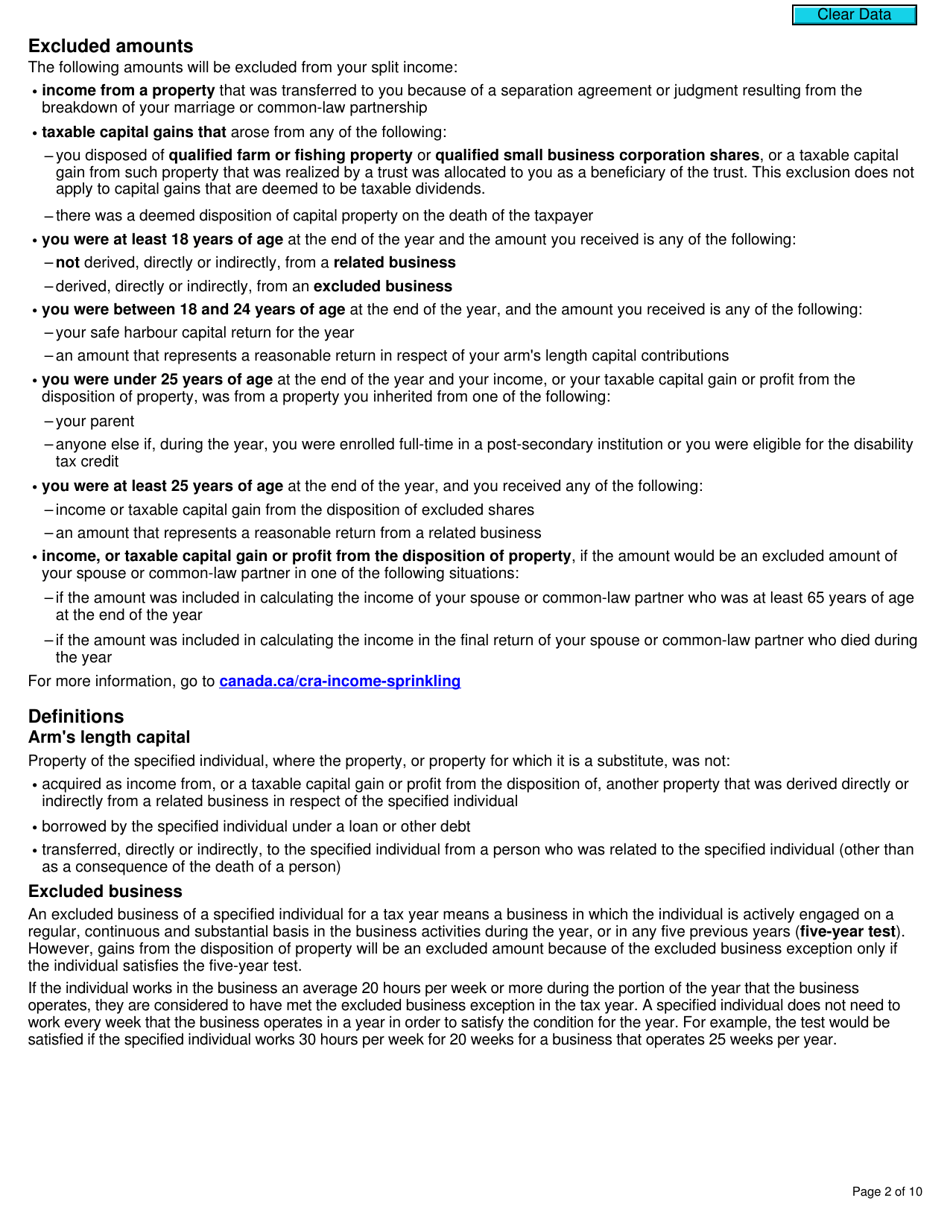

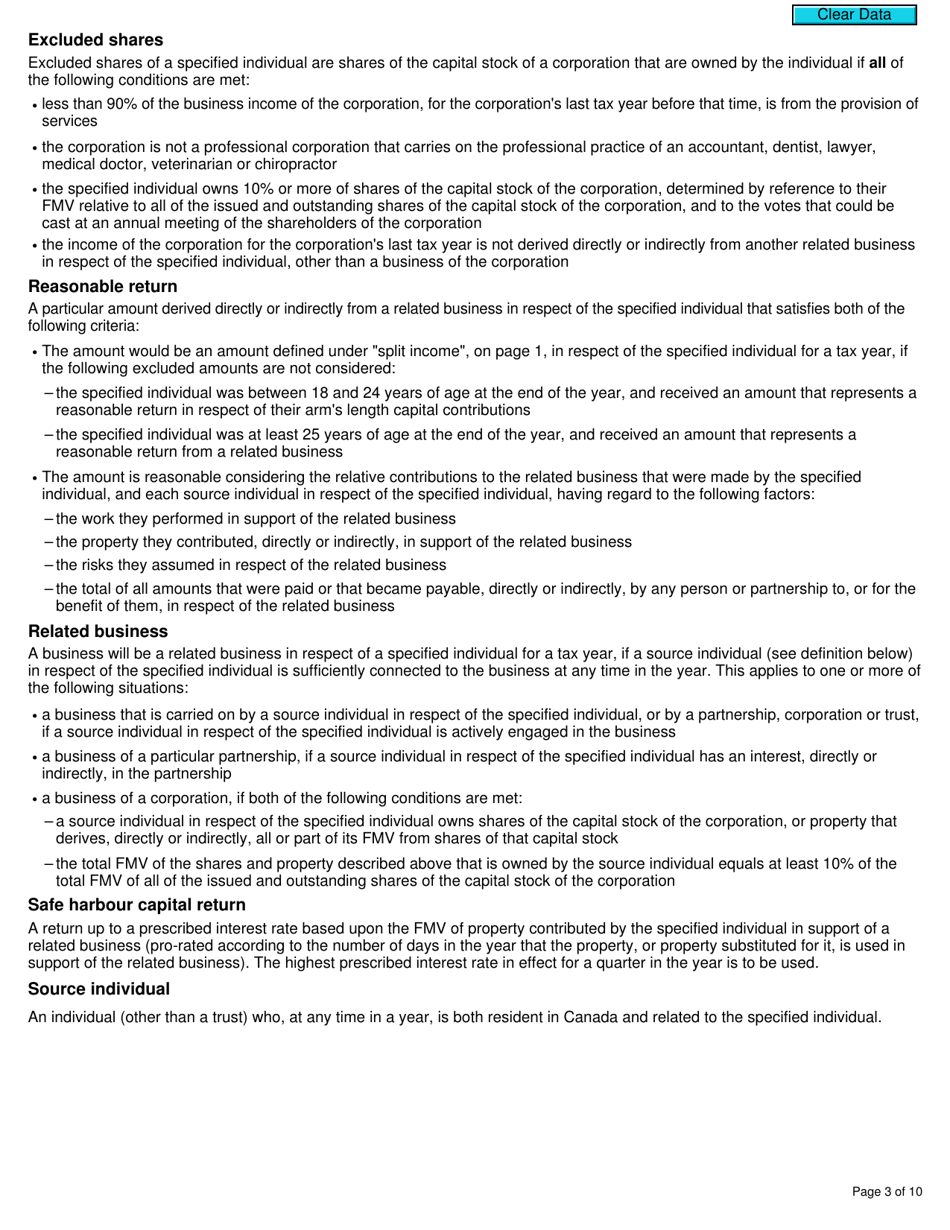

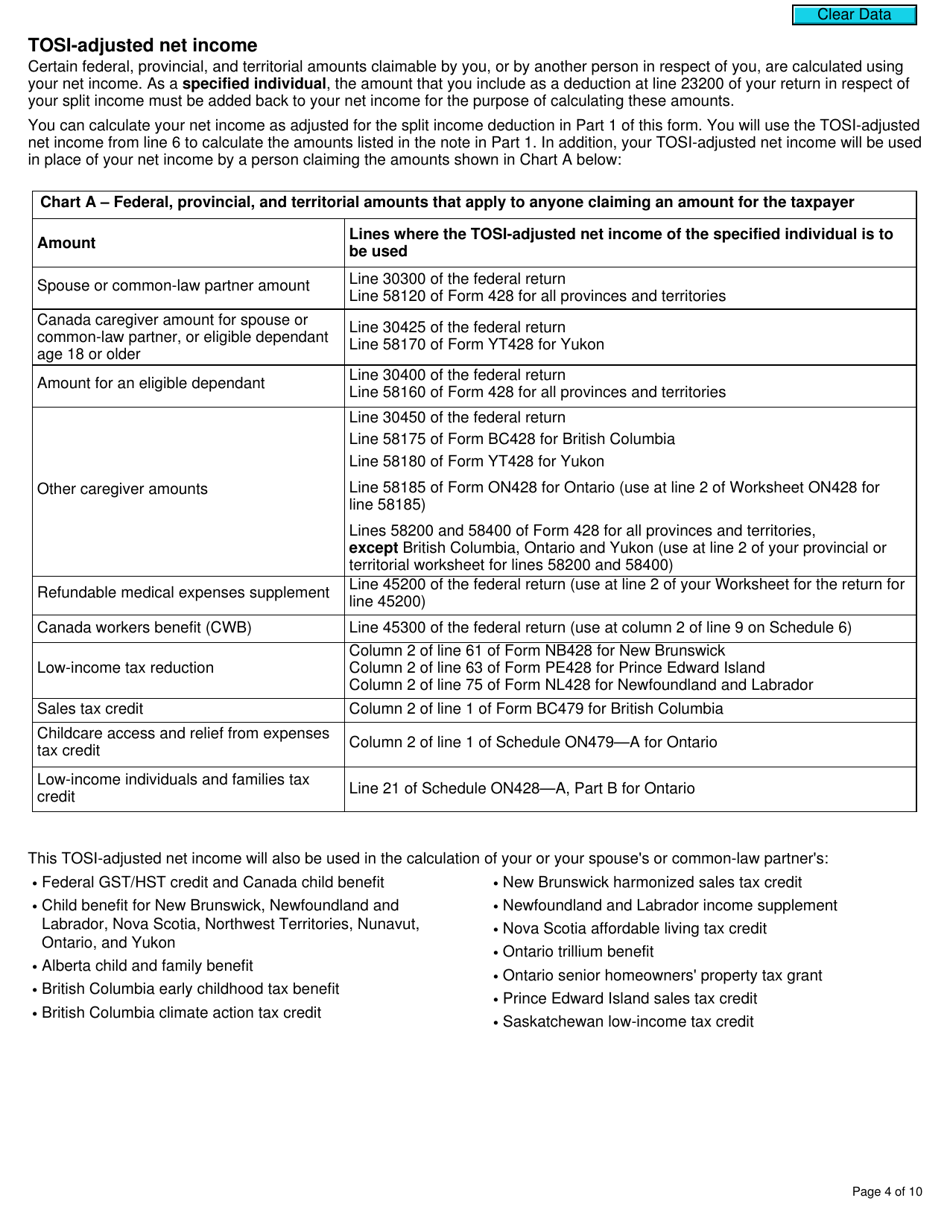

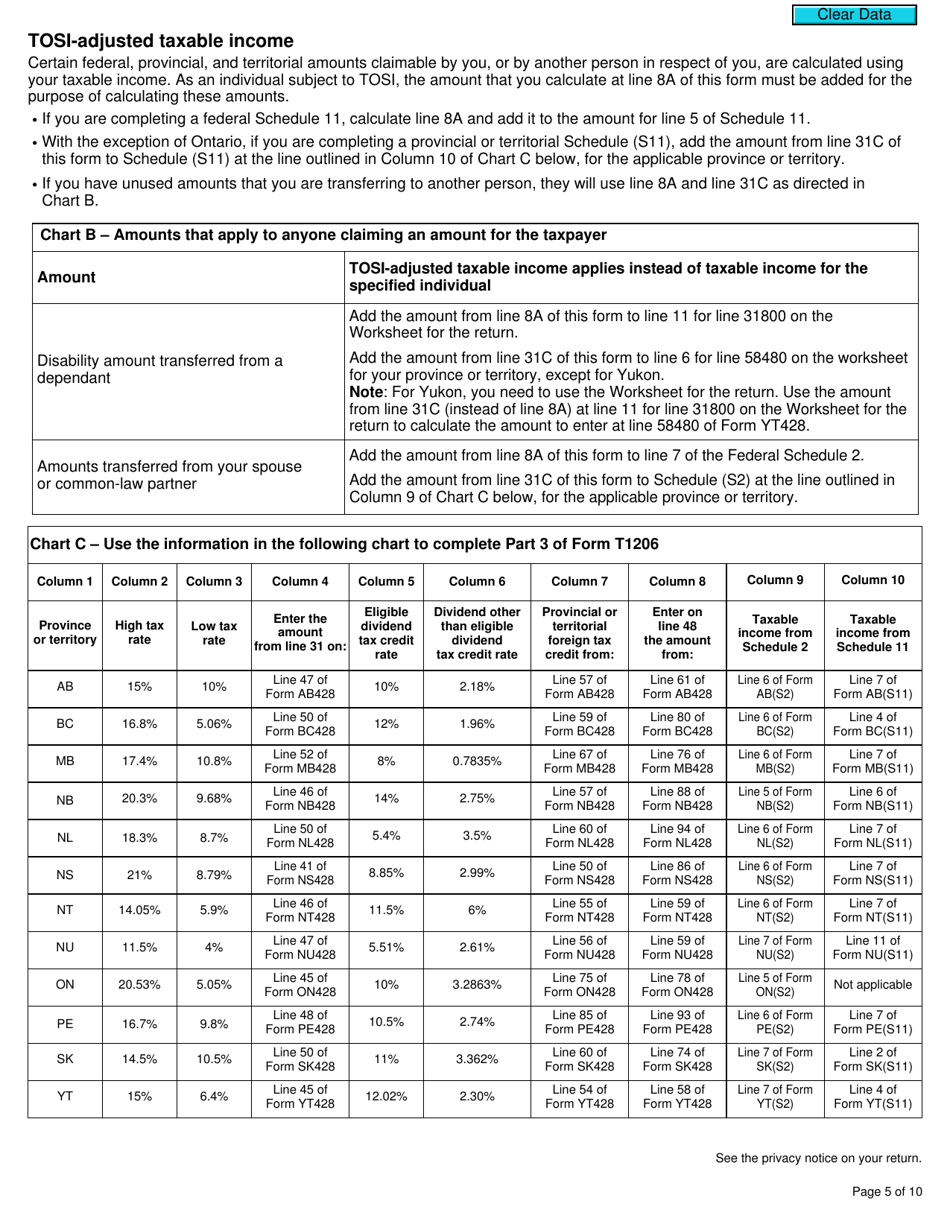

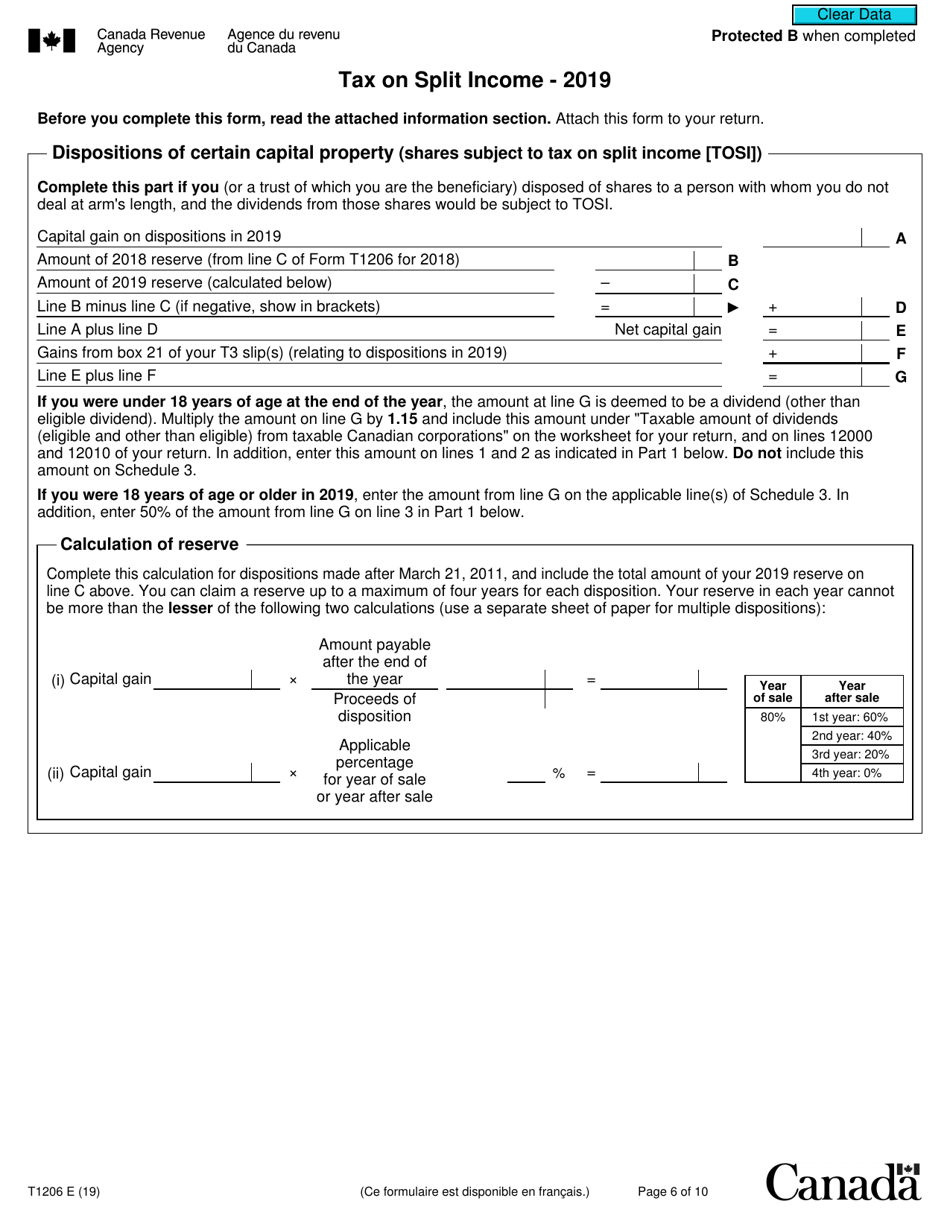

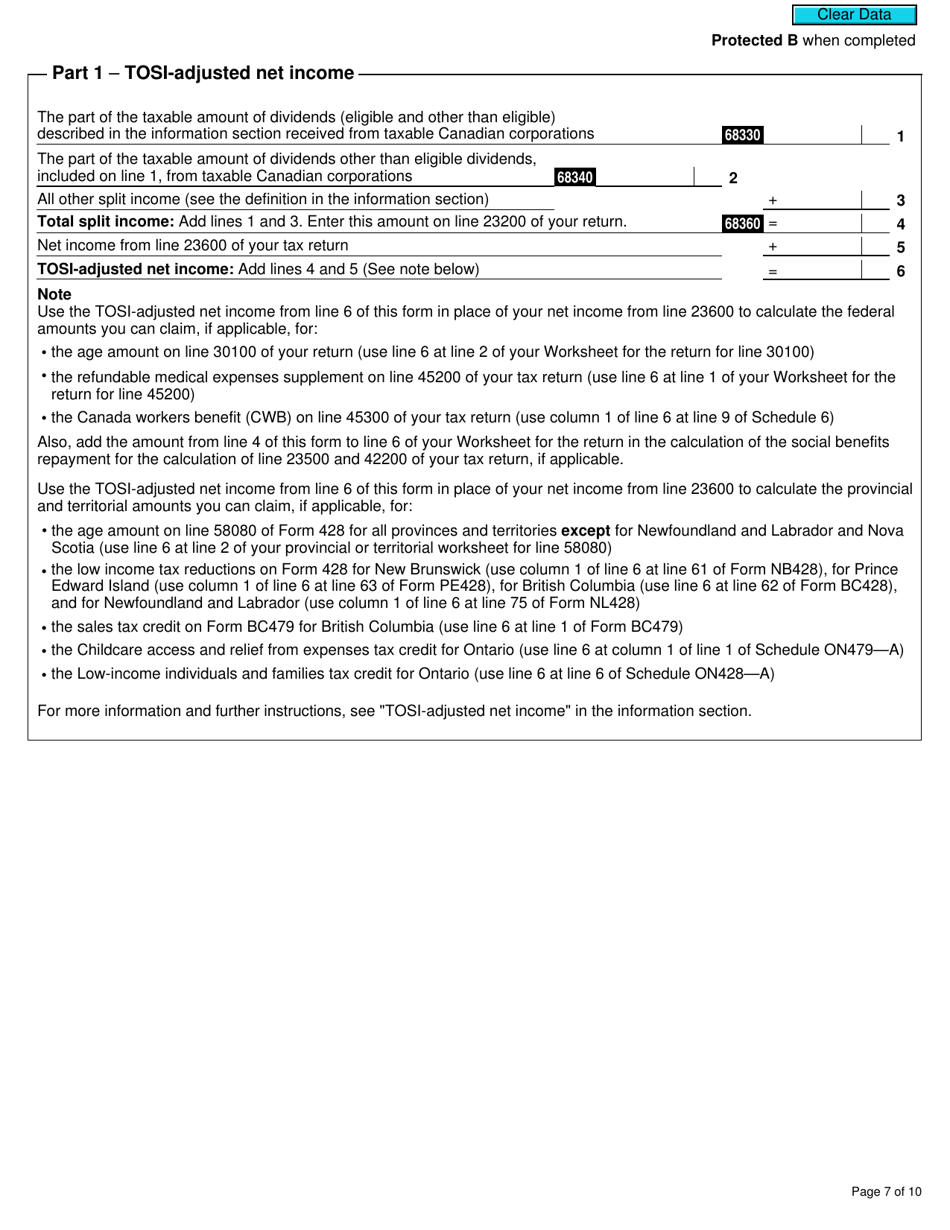

Form T1206, Tax on Split Income, is used by individuals in Canada to calculate and report income that may be subject to the Tax on Split Income (TOSI) rules. These rules are designed to prevent income splitting, which is the practice of transferring income from a higher-income individual to a lower-income individual to reduce overall tax liability. The form helps determine if any additional tax is owed due to TOSI rules.

The individual who earns split income in Canada is required to file Form T1206 for tax purposes.

FAQ

Q: What is Form T1206?

A: Form T1206 is a tax form used in Canada to report and calculate the tax on split income.

Q: What is split income?

A: Split income refers to the income, typically dividends, that is received by a person who is under the age of 18 and is related to a specified individual, such as a parent.

Q: Why do I need to fill out Form T1206?

A: You need to fill out Form T1206 if you have received split income and need to calculate the tax payable on that income.

Q: How do I calculate the tax on split income?

A: To calculate the tax on split income, you will need to use the tax rates specified by the Canada Revenue Agency (CRA) for the current tax year.

Q: When is the deadline to file Form T1206?

A: The deadline for filing Form T1206 is the same as the deadline for filing your personal income tax return, which is usually April 30th of each year (or June 15th for self-employed individuals).

Q: Is there a penalty for not filing Form T1206?

A: Yes, there may be penalties for not filing Form T1206 or for filing it incorrectly. It is important to accurately report and calculate the tax on split income to avoid any penalties or interest charges.