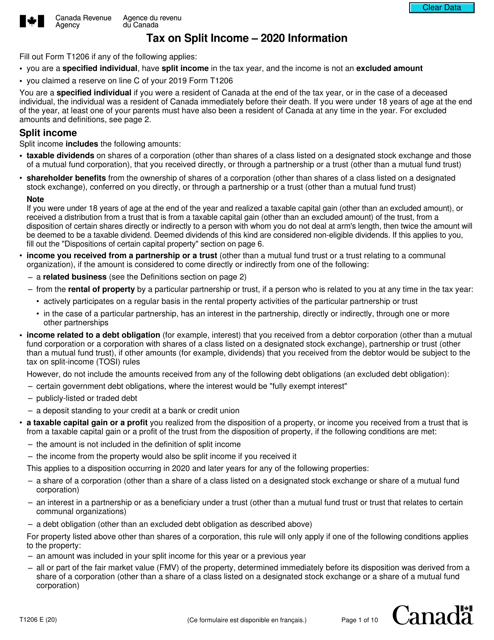

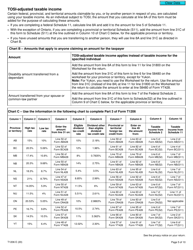

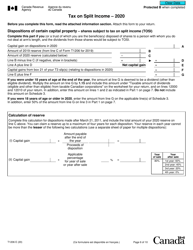

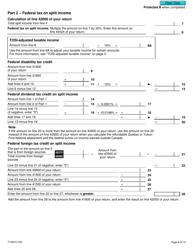

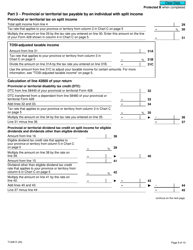

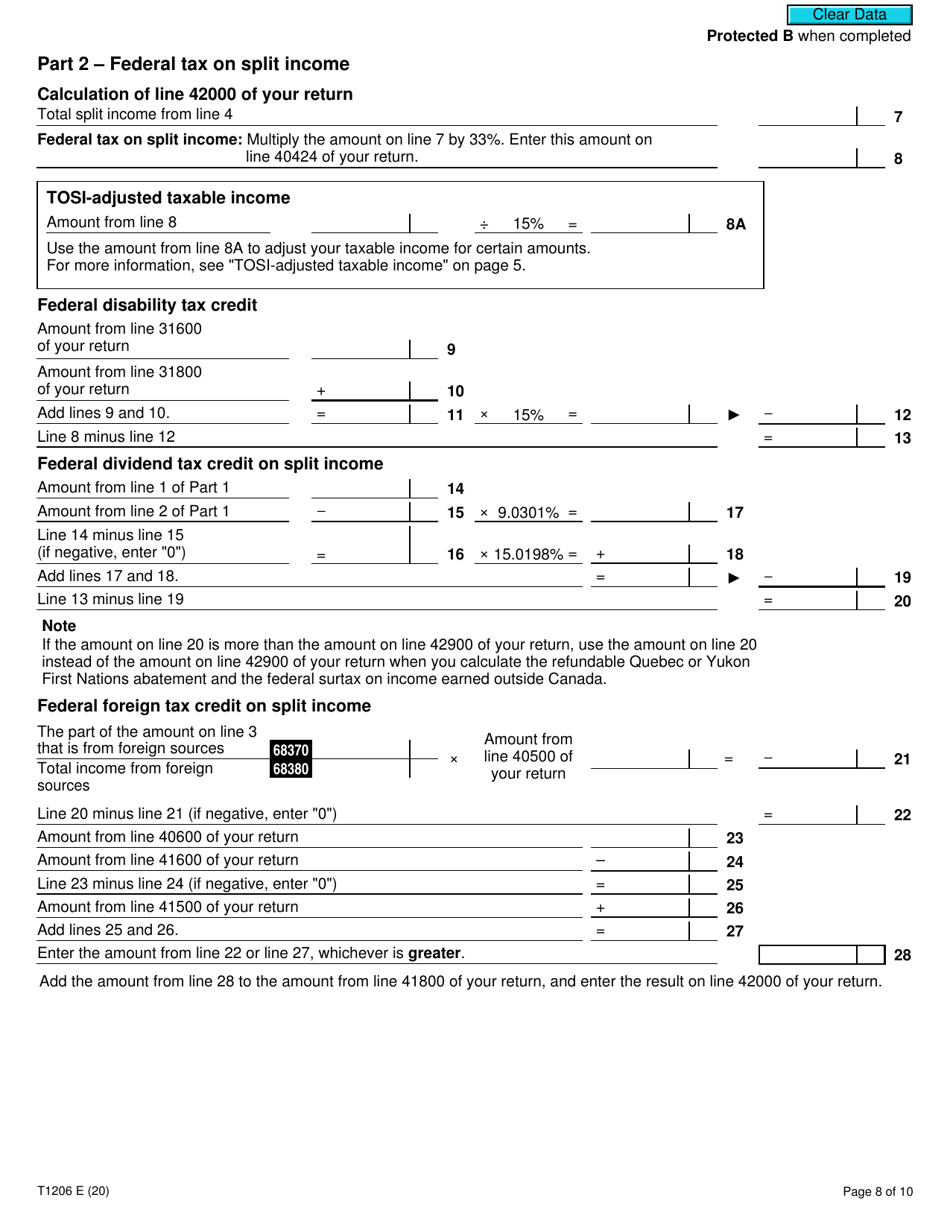

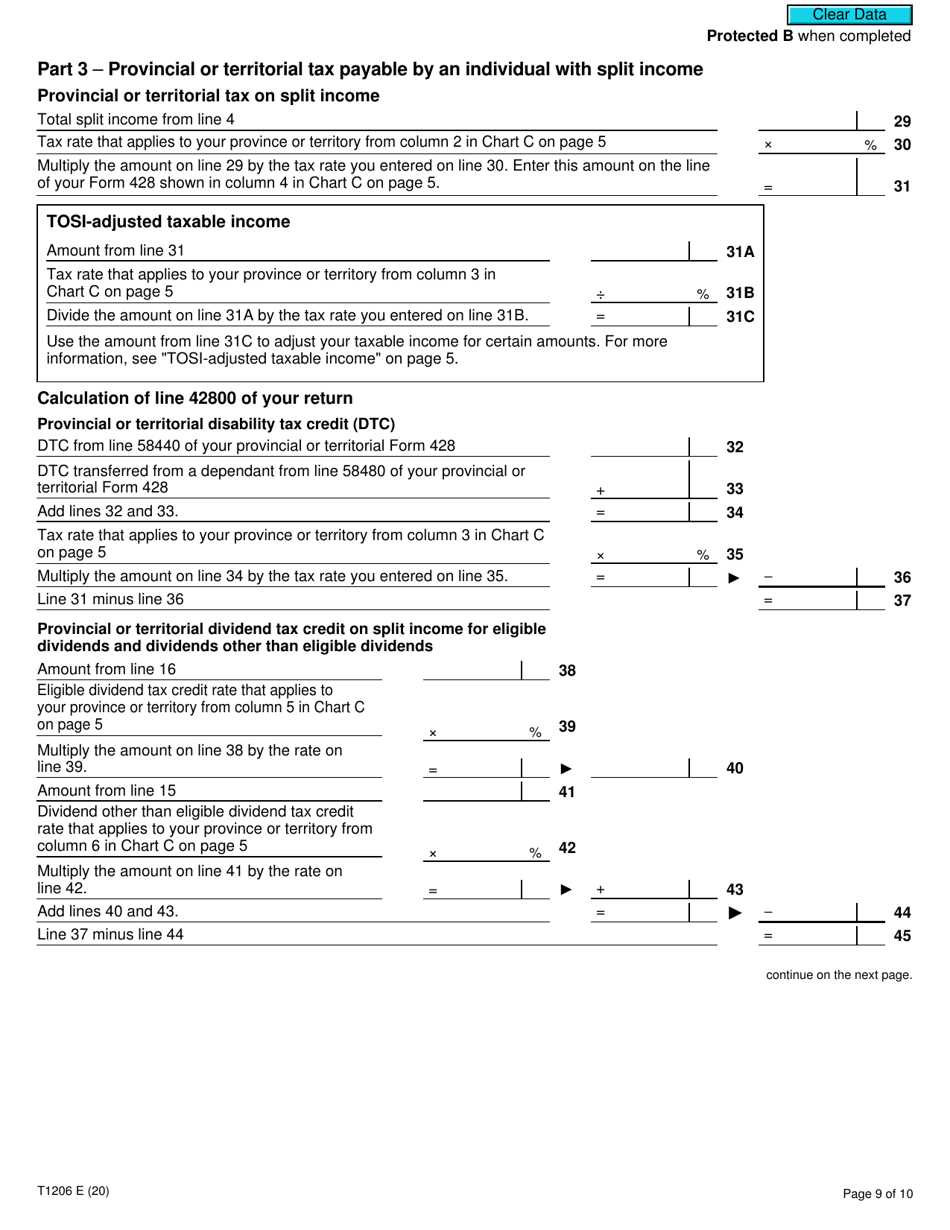

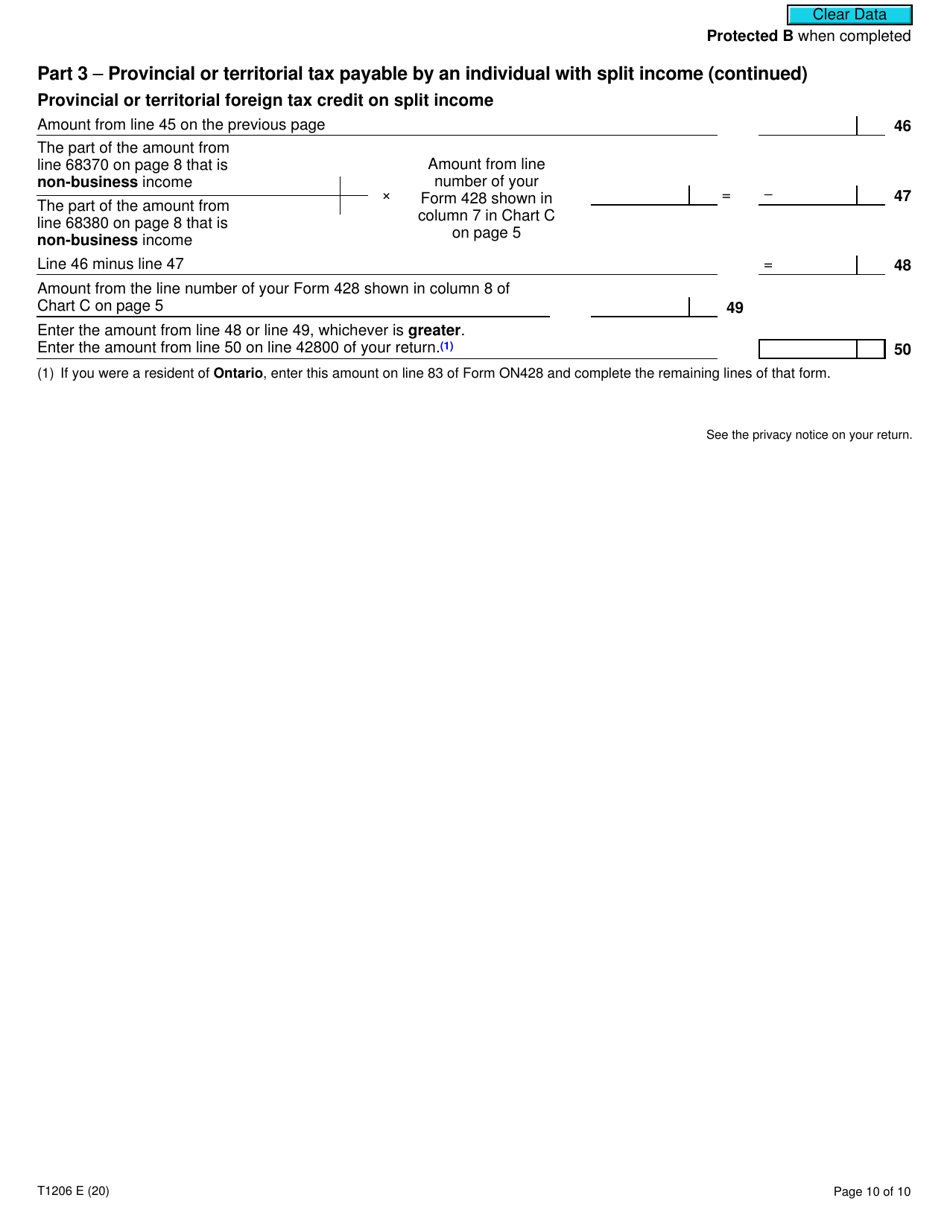

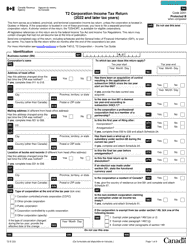

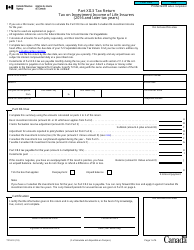

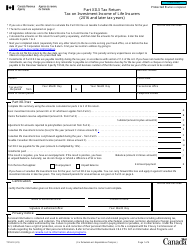

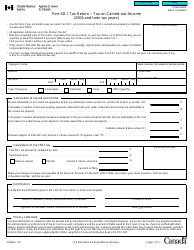

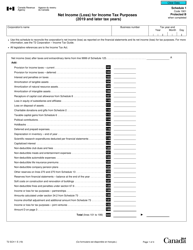

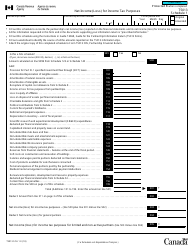

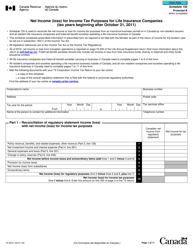

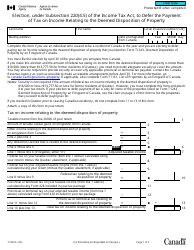

Form T1206 Tax on Split Income - Canada

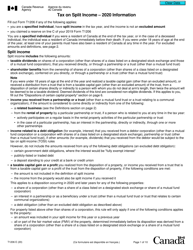

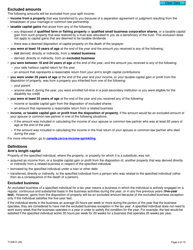

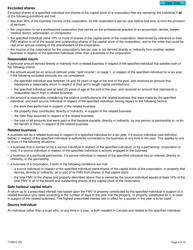

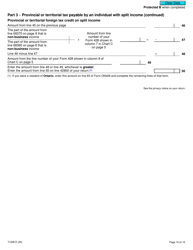

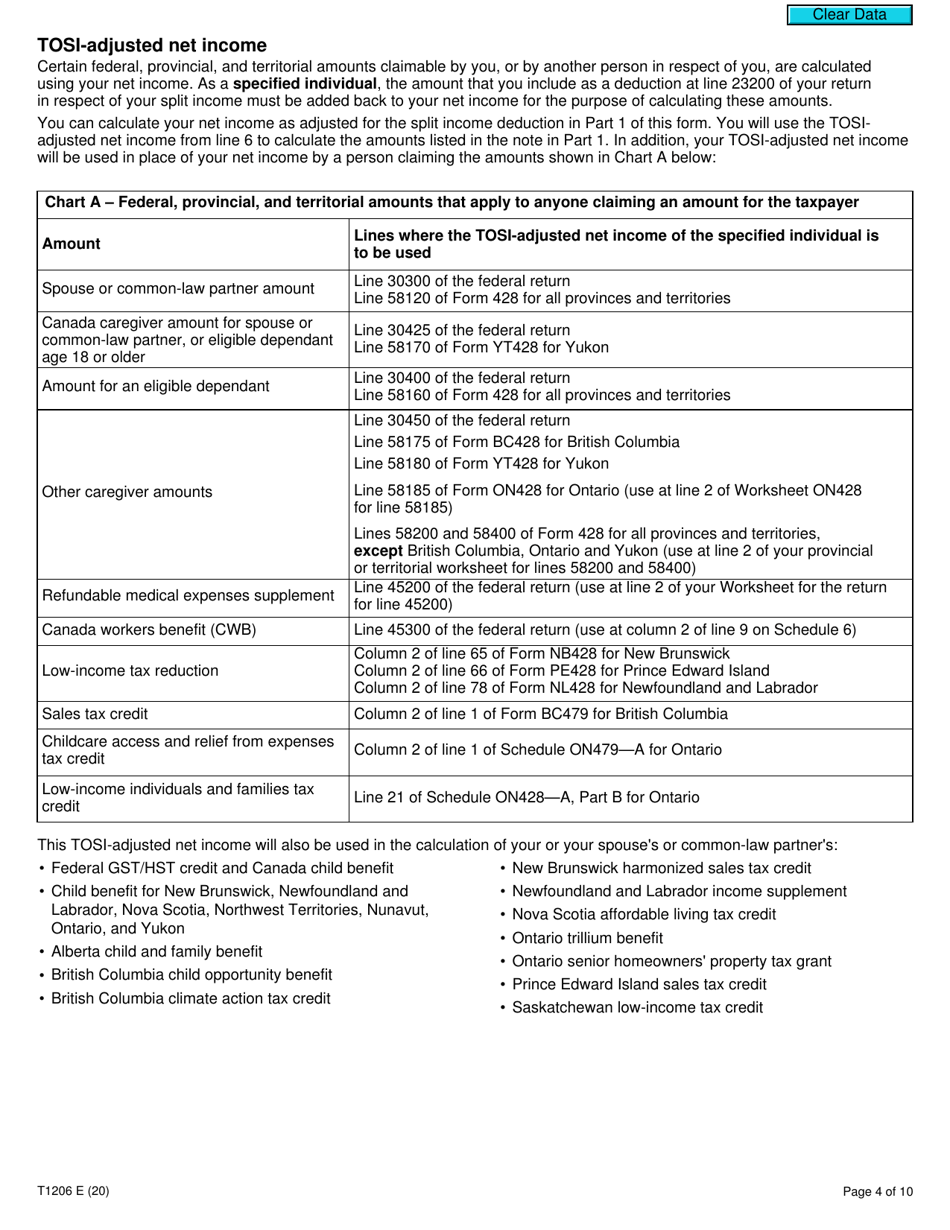

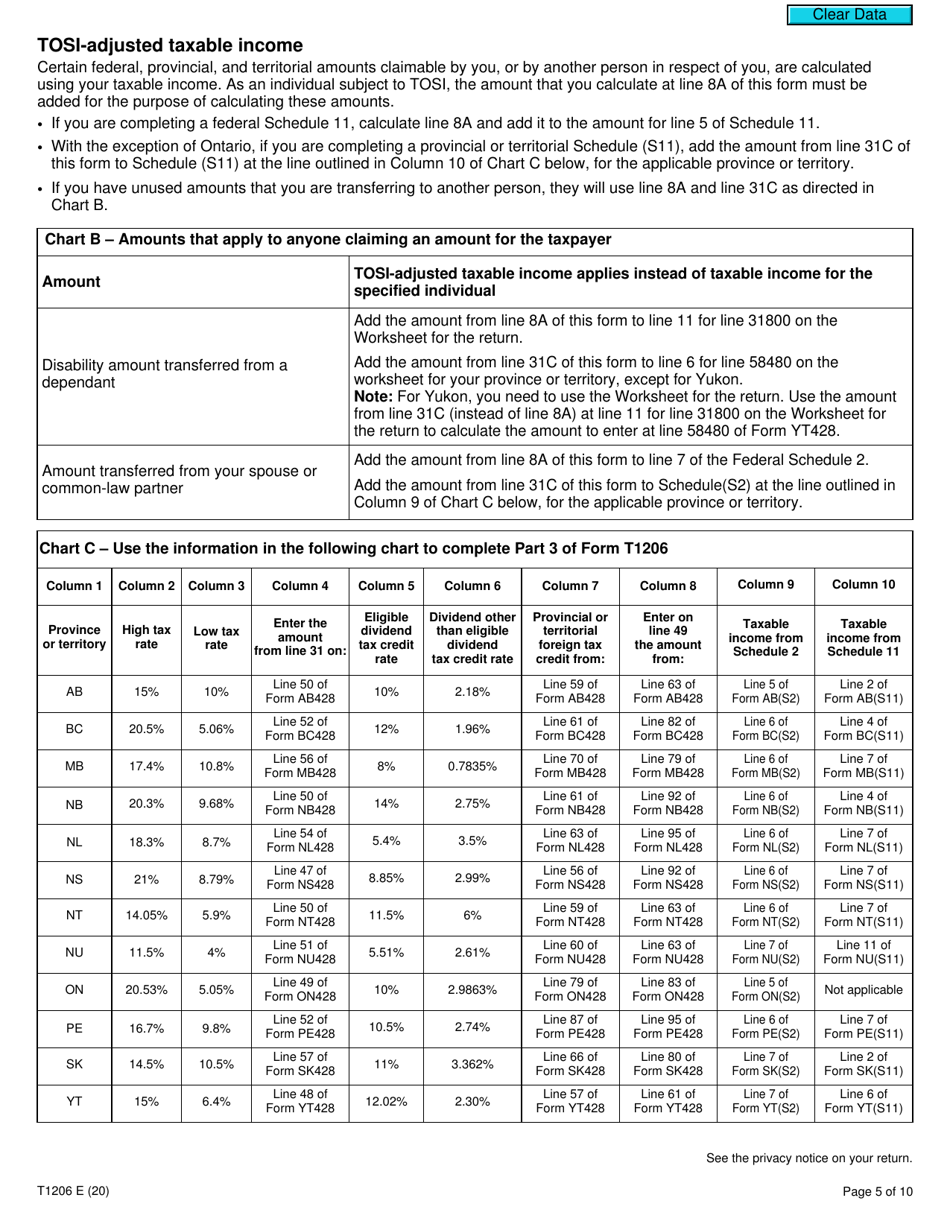

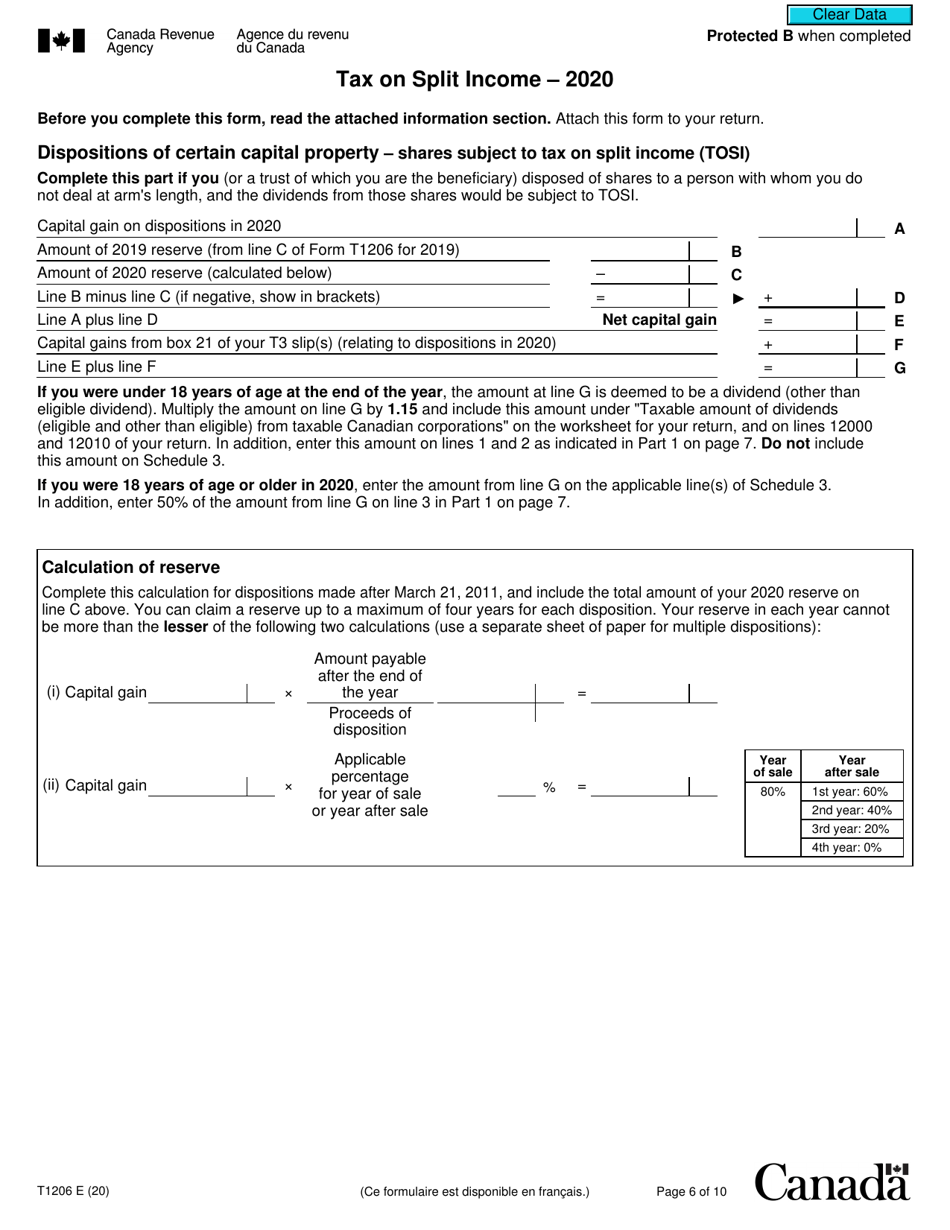

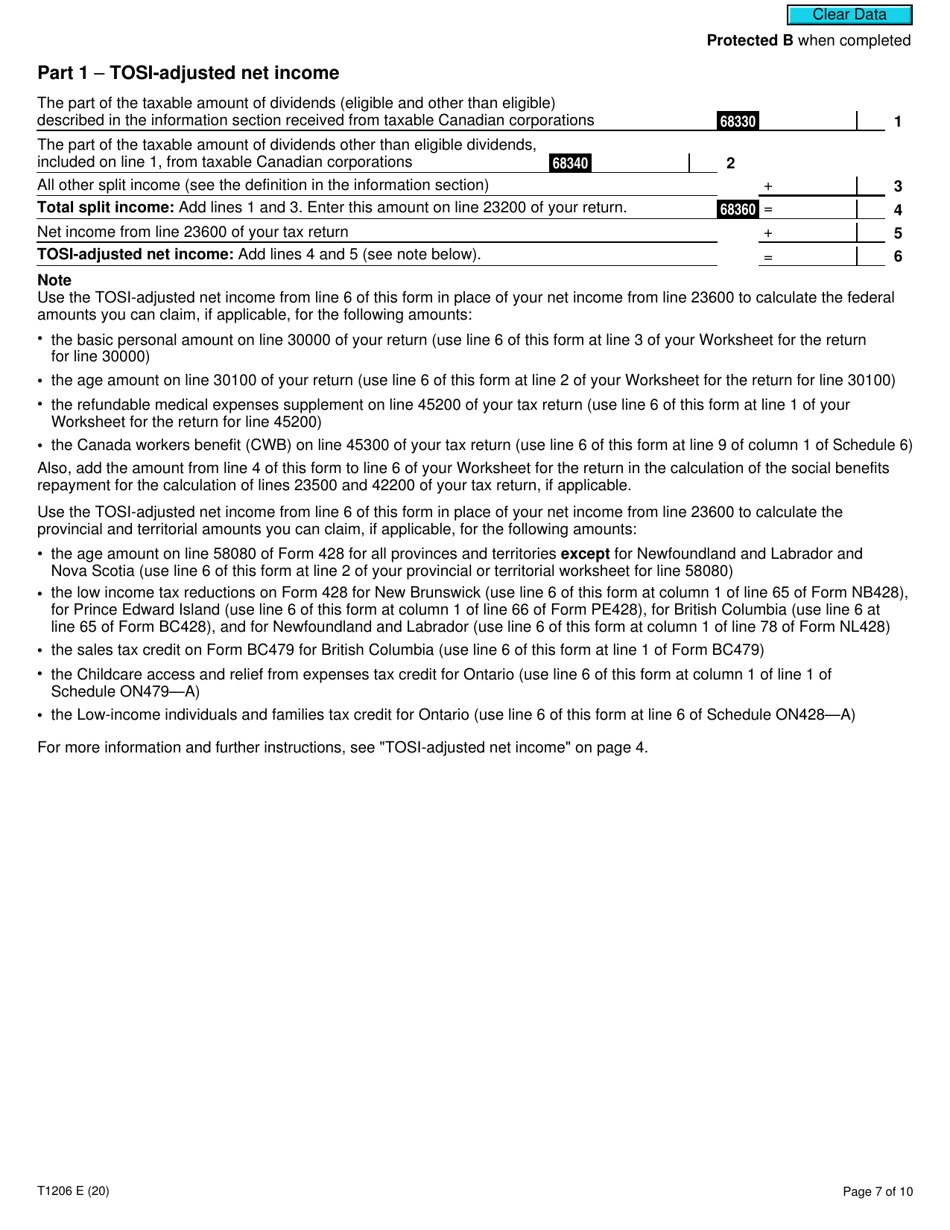

Form T1206 Tax on Split Income in Canada is used to calculate the tax payable on split income, which is the income earned by minor children through certain businesses or investments. This form helps determine if the tax on split income rules apply to you, and if so, it calculates the amount of tax owed.

The Form T1206 Tax on Split Income in Canada is filed by individuals who have received split income, which is income earned through certain types of businesses or partnerships with family members.

Form T1206 Tax on Split Income - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T1206?

A: Form T1206 is a tax form used in Canada to report split income.

Q: What is split income?

A: Split income refers to income received by a minor child from certain sources, such as a corporation in which a parent or other related person is involved.

Q: Who needs to file Form T1206?

A: Form T1206 must be filed by Canadian residents who receive split income.

Q: When is Form T1206 due?

A: Form T1206 is usually due along with your tax return, which is generally due on April 30th in Canada.

Q: What are the penalties for not filing Form T1206?

A: Failure to file Form T1206 or reporting incorrect information may result in penalties and interest charges.

Q: What other forms may be required along with Form T1206?

A: Depending on your situation, you may also need to complete other tax forms like the T1, T3, or T5 forms.

Q: Is there a minimum age for needing to file Form T1206?

A: No, there is no minimum age requirement for needing to file Form T1206 if you receive split income.

Q: Do I need to report split income if it is below a certain amount?

A: Yes, all split income must be reported on Form T1206, regardless of the amount.