This version of the form is not currently in use and is provided for reference only. Download this version of

Form T1231

for the current year.

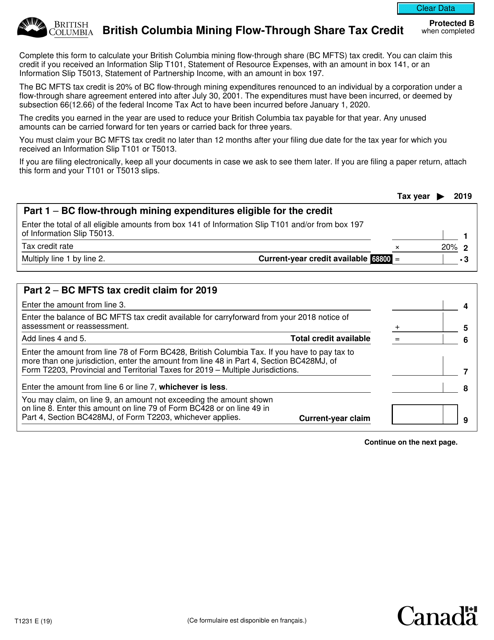

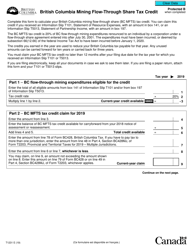

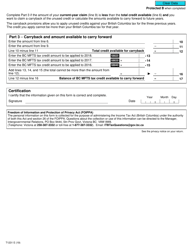

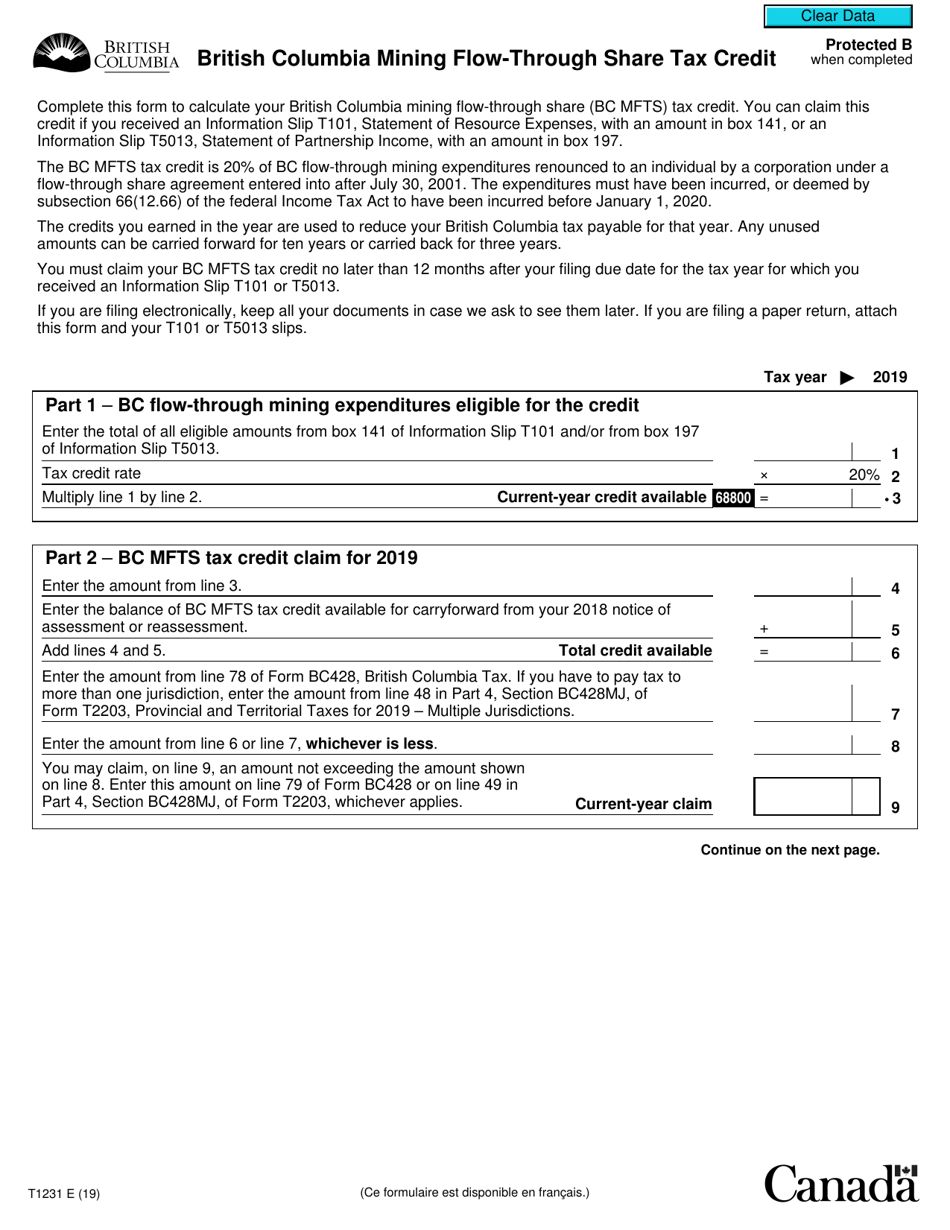

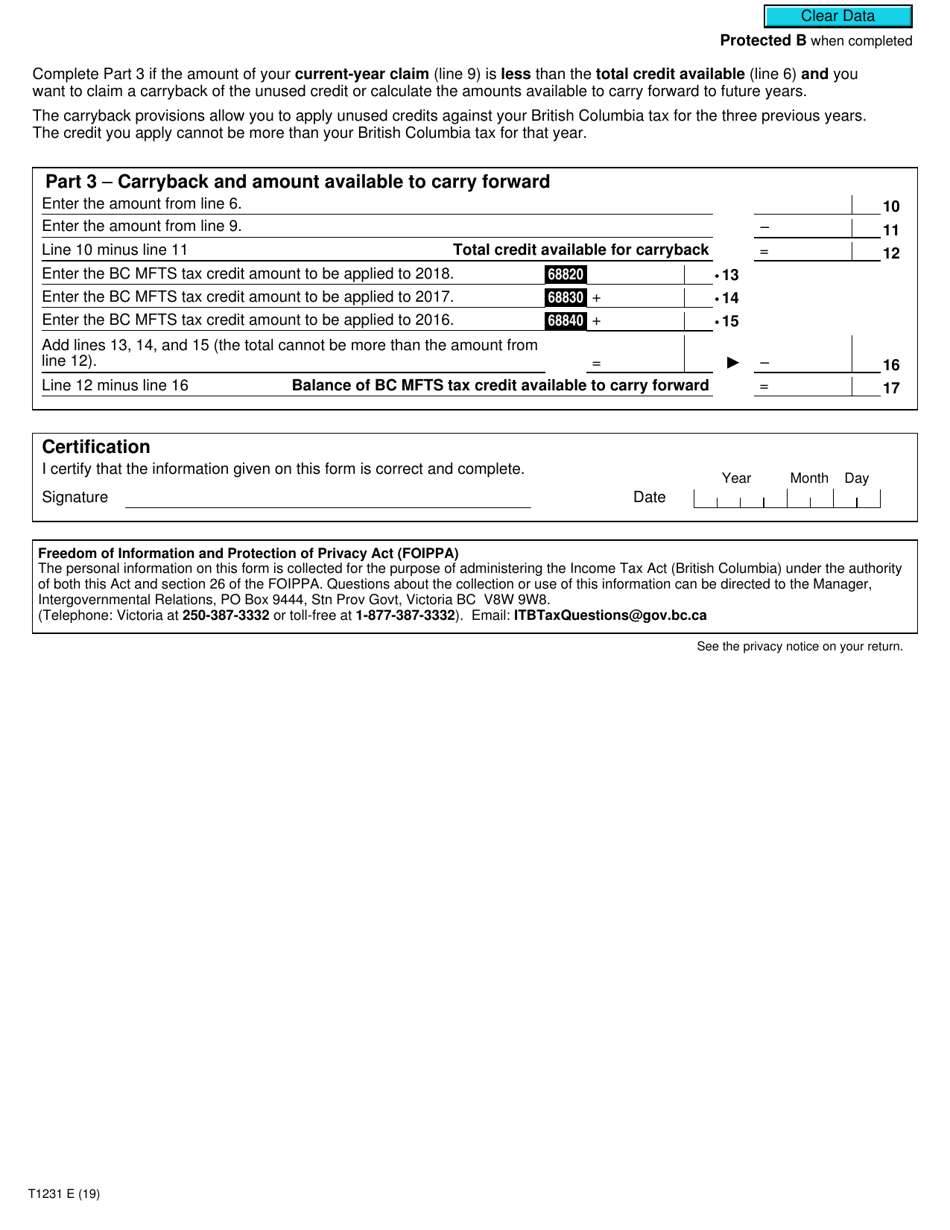

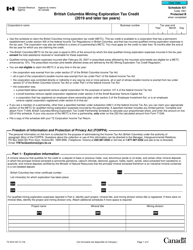

Form T1231 British Columbia Mining Flow-Through Share Tax Credit - Canada

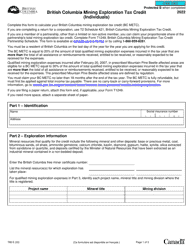

Form T1231 is used in Canada for claiming the British Columbia Mining Flow-Through Share Tax Credit. This tax credit is specifically available for individuals who invested in flow-through mining shares in British Columbia. It allows taxpayers to claim a non-refundable tax credit on their federal tax return.

The investor who wishes to claim the British Columbia Mining Flow-Through Share Tax Credit files the Form T1231 in Canada.

FAQ

Q: What is Form T1231?

A: Form T1231 is a tax form in Canada.

Q: What is the British Columbia Mining Flow-Through Share Tax Credit?

A: The British Columbia Mining Flow-Through Share Tax Credit is a tax credit in Canada.

Q: Who is eligible for the British Columbia Mining Flow-Through Share Tax Credit?

A: Individuals who invest in flow-through shares of British Columbia mining companies are eligible for this tax credit.

Q: What is a flow-through share?

A: A flow-through share is a special type of investment in the mining industry that allows investors to deduct certain expenses and receive tax benefits.

Q: How does the British Columbia Mining Flow-Through Share Tax Credit work?

A: Investors who purchase flow-through shares of British Columbia mining companies can claim a tax credit for a percentage of their investment.

Q: What expenses can be deducted with the British Columbia Mining Flow-Through Share Tax Credit?

A: Expenses related to mineral exploration and development can be deducted with this tax credit.

Q: Is the British Columbia Mining Flow-Through Share Tax Credit available only for residents of British Columbia?

A: No, this tax credit is available for residents of all provinces and territories in Canada.

Q: How do I claim the British Columbia Mining Flow-Through Share Tax Credit?

A: To claim this tax credit, you need to complete and file Form T1231 with your income tax return.

Q: Are there any limitations or restrictions on the British Columbia Mining Flow-Through Share Tax Credit?

A: Yes, there are certain limitations and restrictions on this tax credit, such as the maximum amount that can be claimed and the type of mining companies that qualify.