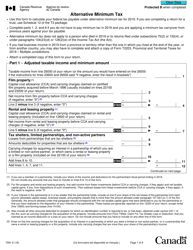

This version of the form is not currently in use and is provided for reference only. Download this version of

Form T1132

for the current year.

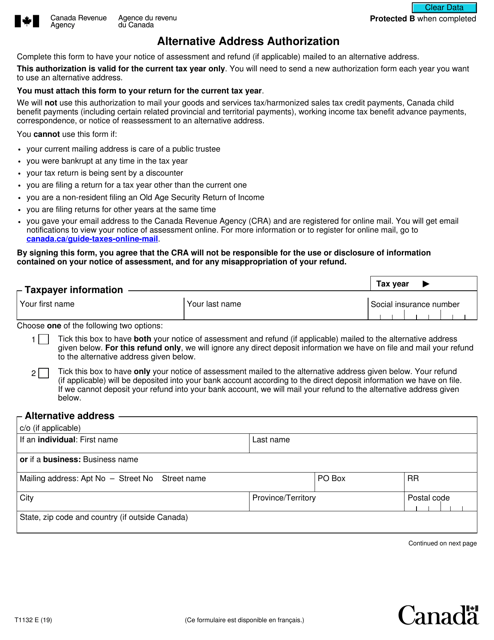

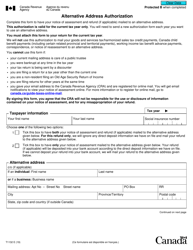

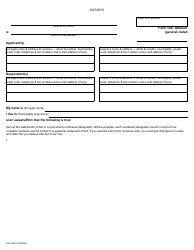

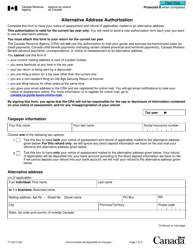

Form T1132 Alternative Address Authorization - Canada

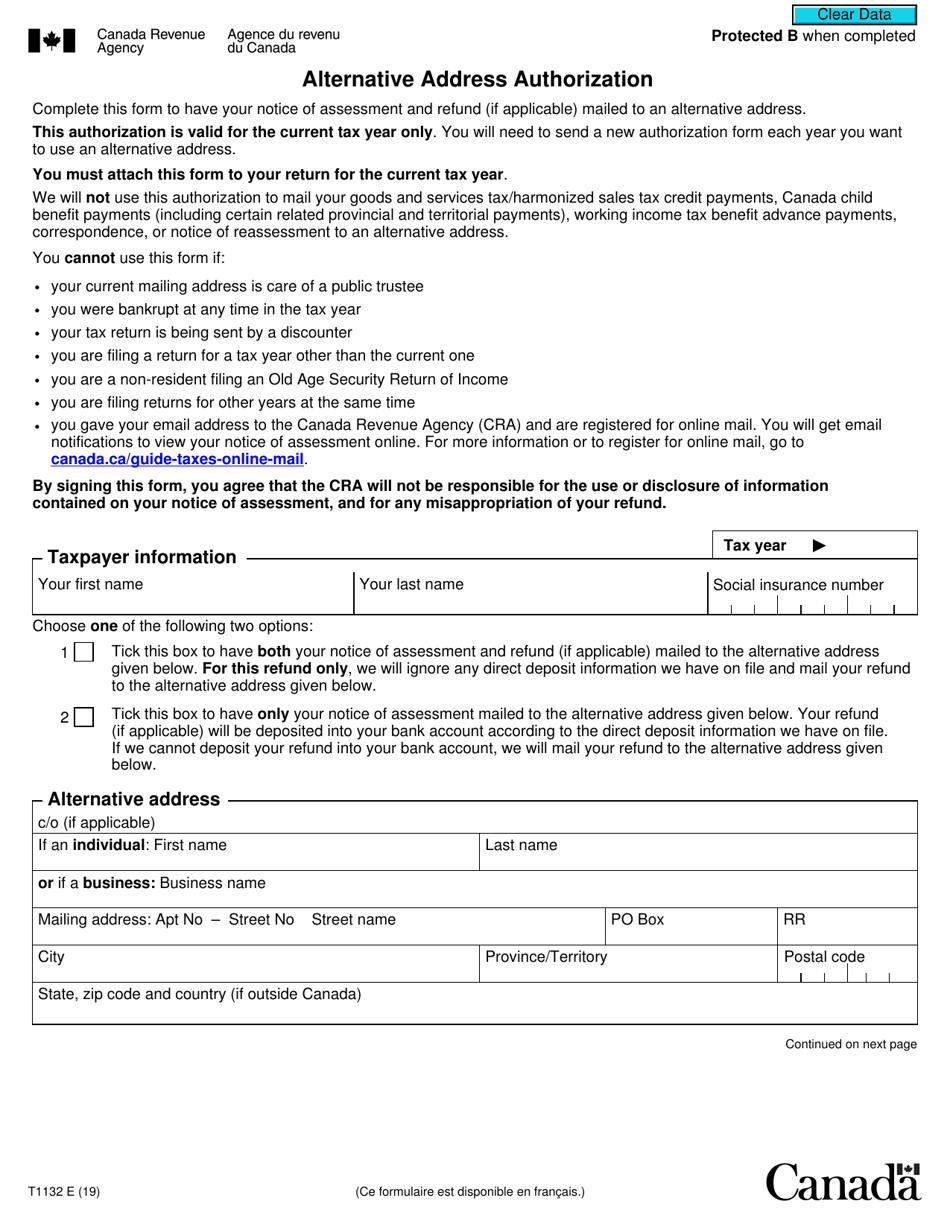

Form T1132 Alternative Address Authorization is used in Canada to authorize the Canada Revenue Agency (CRA) to send important tax-related correspondence to an alternate address instead of the taxpayer's regular address. This form is typically used when the taxpayer wants their tax information to be sent to a different address, such as a tax professional's office or a family member's address.

The Form T1132 Alternative Address Authorization in Canada is filed by individuals who want to authorize a representative to use an alternative address for the purpose of receiving their correspondence from the Canada Revenue Agency (CRA).

FAQ

Q: What is Form T1132?

A: Form T1132 is the Alternative Address Authorization form in Canada.

Q: What is the purpose of Form T1132?

A: The purpose of Form T1132 is to authorize the Canada Revenue Agency (CRA) to use an alternative address for an individual or entity.

Q: Who needs to fill out Form T1132?

A: Any individual or entity who wants to authorize the CRA to use an alternative address needs to fill out Form T1132.

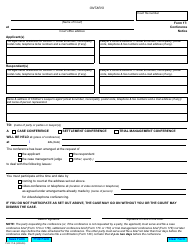

Q: What information is required on Form T1132?

A: Form T1132 requires the individual or entity's name, address, tax account number, and details of the authorized representative, if applicable.

Q: Is there a fee to submit Form T1132?

A: No, there is no fee to submit Form T1132.

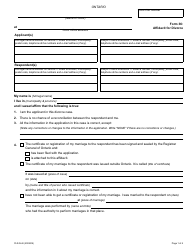

Q: How can I submit Form T1132?

A: Form T1132 can be submitted by mail or fax to the Canada Revenue Agency.

Q: What should I do if there are changes to my authorized representative or address?

A: If there are any changes to your authorized representative or address, you need to notify the Canada Revenue Agency in writing as soon as possible.