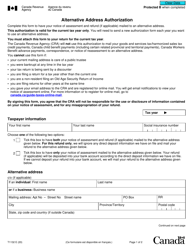

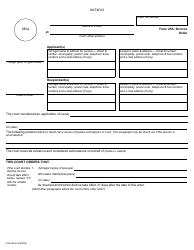

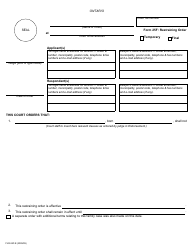

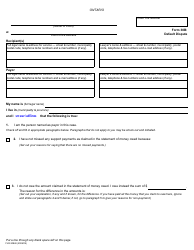

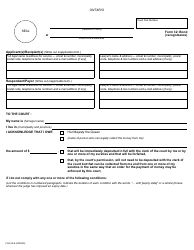

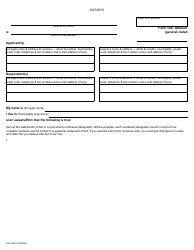

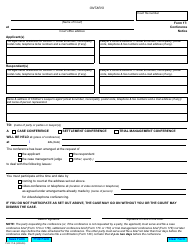

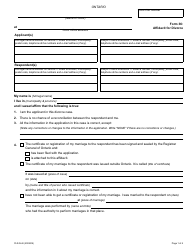

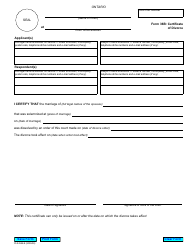

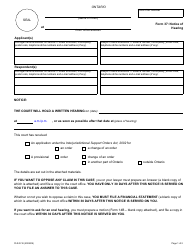

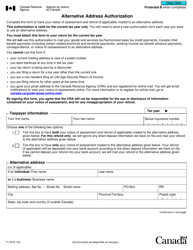

Form T1132 Alternative Address Authorization - Canada

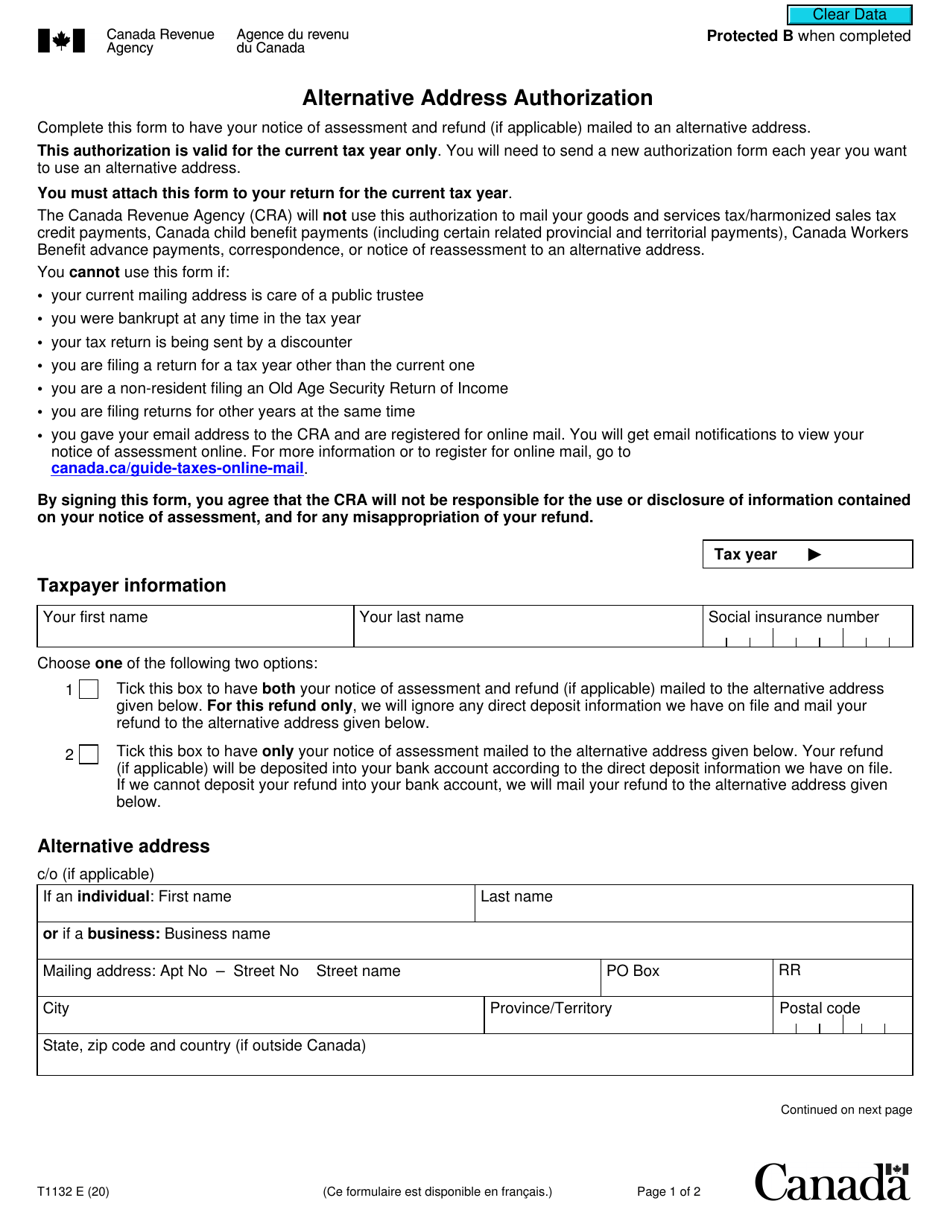

Form T1132 Alternative Address Authorization in Canada is used to authorize the Canada Revenue Agency (CRA) to send your tax-related correspondence to a different address, other than your home address. This form is typically used when you want the CRA to send your tax documents to a trusted representative or a different mailing address.

Individual taxpayers or authorized representatives may file the Form T1132 Alternative Address Authorization in Canada.

Form T1132 Alternative Address Authorization - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T1132?

A: Form T1132 is used in Canada to authorize an alternative address for the taxpayer.

Q: Why would someone need to use Form T1132?

A: Someone may need to use Form T1132 if they want to authorize an alternative address to receive tax-related correspondence or notices.

Q: Who can use Form T1132?

A: Any taxpayer in Canada can use Form T1132 to authorize an alternative address.

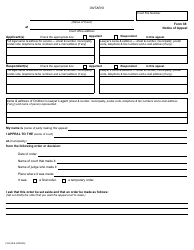

Q: How do I fill out Form T1132?

A: You need to provide your personal information, tax identification number, the reason for the alternative address, and the address you want to authorize.

Q: Is there a fee to submit Form T1132?

A: No, there is no fee to submit Form T1132.

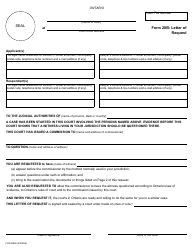

Q: What happens after I submit Form T1132?

A: The Canada Revenue Agency will update their records with the alternative address provided and send future correspondence to that address.

Q: How long does it take for the alternative address to be effective?

A: It typically takes 4-8 weeks for the alternative address to be updated and become effective.

Q: Can I revoke or change the alternative address later?

A: Yes, you can revoke or change the alternative address by submitting another Form T1132 with the updated information.

Q: Are there any restrictions on using an alternative address?

A: There are some restrictions on using an alternative address, such as not being able to use a post office box or a foreign address. It's best to review the form instructions for specific details.