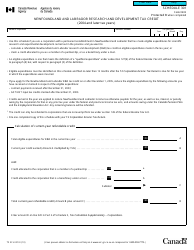

This version of the form is not currently in use and is provided for reference only. Download this version of

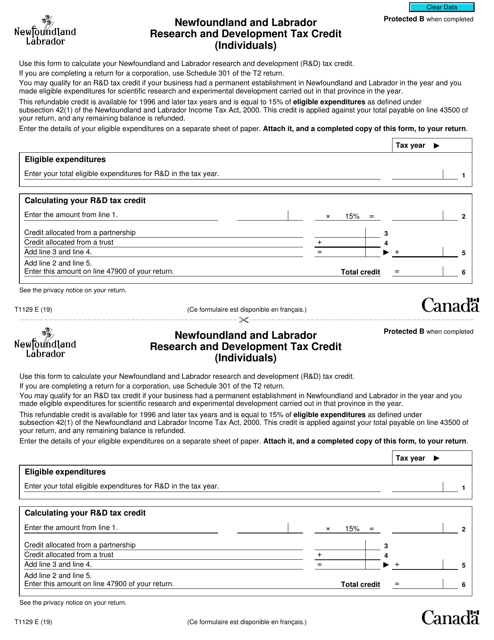

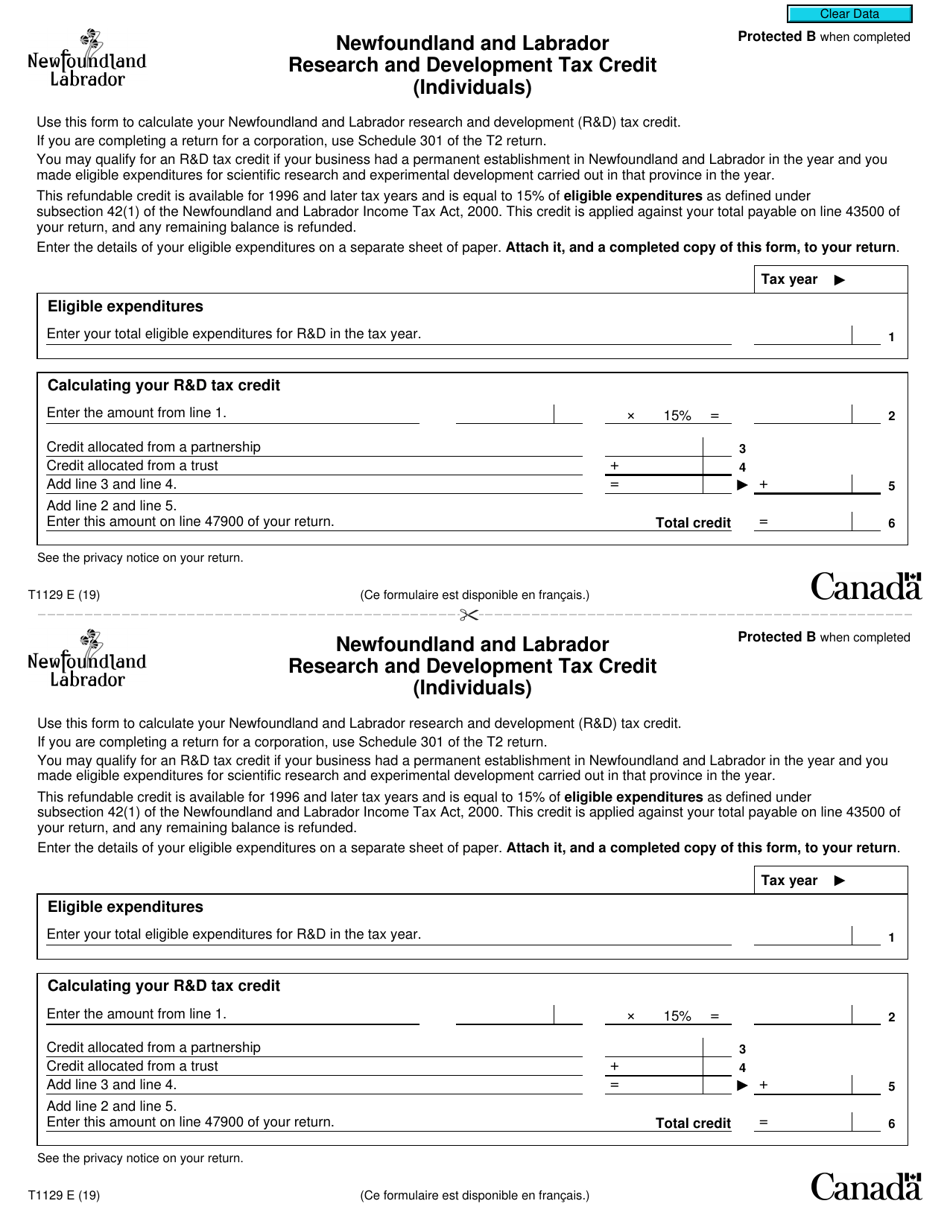

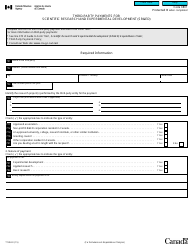

Form T1129

for the current year.

Form T1129 Newfoundland and Labrador Research and Development Tax Credit (Individuals) - Canada

Form T1129 Newfoundland and Labrador Research and Development Tax Credit (Individuals) - Canada is used by individuals in Newfoundland and Labrador to claim tax credits for research and development activities. This form allows individuals to report and claim eligible expenses related to scientific research and experimental development conducted in the province.

The Form T1129 Newfoundland and Labrador Research and Development Tax Credit (Individuals) in Canada is filed by individuals who have incurred eligible research and development expenses in Newfoundland and Labrador.

FAQ

Q: What is Form T1129?

A: Form T1129 is a tax form used by individuals in Newfoundland and Labrador, Canada to claim the Research and Development Tax Credit.

Q: Who can use Form T1129?

A: Residents of Newfoundland and Labrador, Canada who have incurred qualifying research and development expenses can use Form T1129.

Q: What is the purpose of the Research and Development Tax Credit?

A: The Research and Development Tax Credit is designed to incentivize individuals in Newfoundland and Labrador to invest in research and development activities.

Q: What expenses are eligible for the Research and Development Tax Credit?

A: Eligible expenses include expenditures related to scientific research and experimental development conducted in Newfoundland and Labrador.

Q: How much is the credit?

A: The credit amount is 15% of qualifying research and development expenses.

Q: Is there a limit to the credit amount?

A: Yes, there is a limit of $5,000 for qualifying research and development expenses.

Q: Can the credit be carried forward or back?

A: No, the credit cannot be carried forward or back.

Q: Is Form T1129 specific to Newfoundland and Labrador?

A: Yes, Form T1129 is specific to residents of Newfoundland and Labrador, Canada.

Q: Is there a similar tax credit available in other provinces?

A: Yes, other provinces in Canada may have similar research and development tax credits available, but the specific forms and requirements may vary.