This version of the form is not currently in use and is provided for reference only. Download this version of

Form T1032

for the current year.

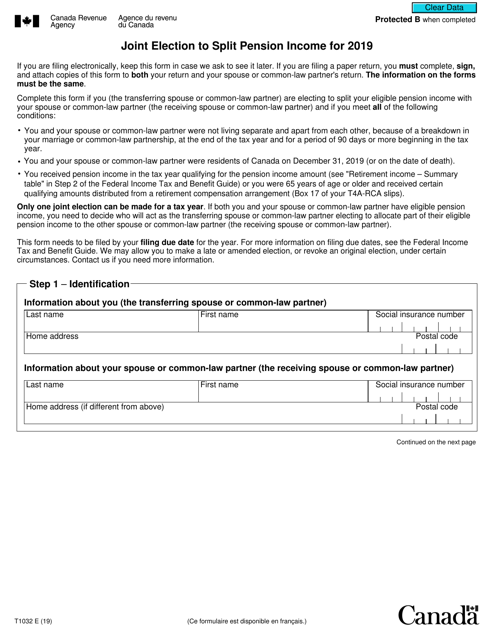

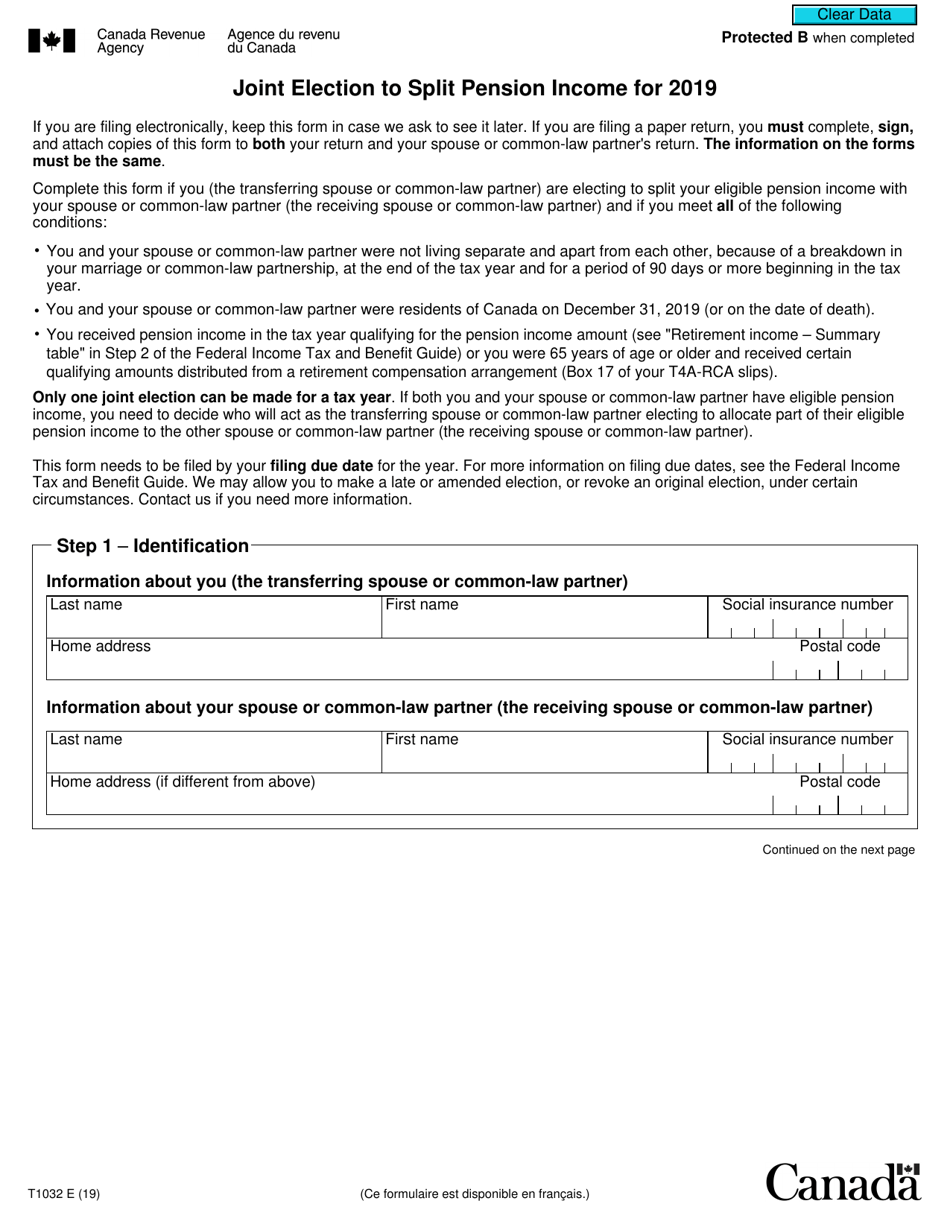

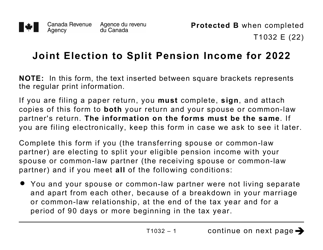

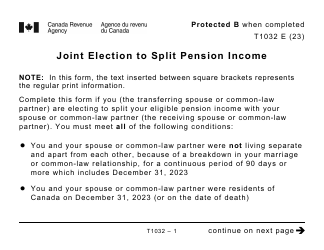

Form T1032 Joint Election to Split Pension Income - Canada

The Form T1032 Joint Election to Split Pension Income in Canada is used for couples who want to split their pension income. By completing this form, couples can elect to divide their eligible pension income equally or in a way that is beneficial for their tax situation. This can help reduce their overall tax liability and potentially provide tax savings.

In Canada, both spouses or common-law partners who are eligible to split pension income can file the Form T1032 Joint Election to Split Pension Income. This form allows them to allocate a portion of their pension income, such as from a registered retirement savings plan (RRSP) or a registered pension plan (RPP), to their spouse or partner for tax purposes. By splitting the pension income, couples can potentially reduce their overall tax liability.

FAQ

Q: What is Form T1032?

A: Form T1032 is a document used in Canada to make a joint election to split pension income between two spouses or common-law partners.

Q: Who can use Form T1032?

A: Form T1032 can be used by Canadian residents who are receiving eligible pension income and want to split it with their spouse or common-law partner.

Q: Why would someone use Form T1032?

A: Using Form T1032 allows couples to split their pension income, which can help reduce their overall tax liability. It may be beneficial if one spouse or common-law partner has a higher income and the other has little or no income.

Q: What is pension income?

A: Pension income includes payments received from a registered pension plan, a registered retirement income fund (RRIF), or an annuity, as well as certain foreign pensions.

Q: Is there any age requirement to use Form T1032?

A: There is no age requirement to use Form T1032. As long as both individuals meet the eligibility criteria and want to split their pension income, they can use this form.

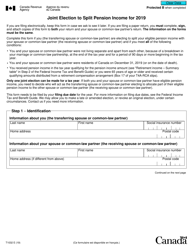

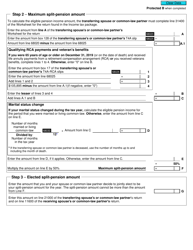

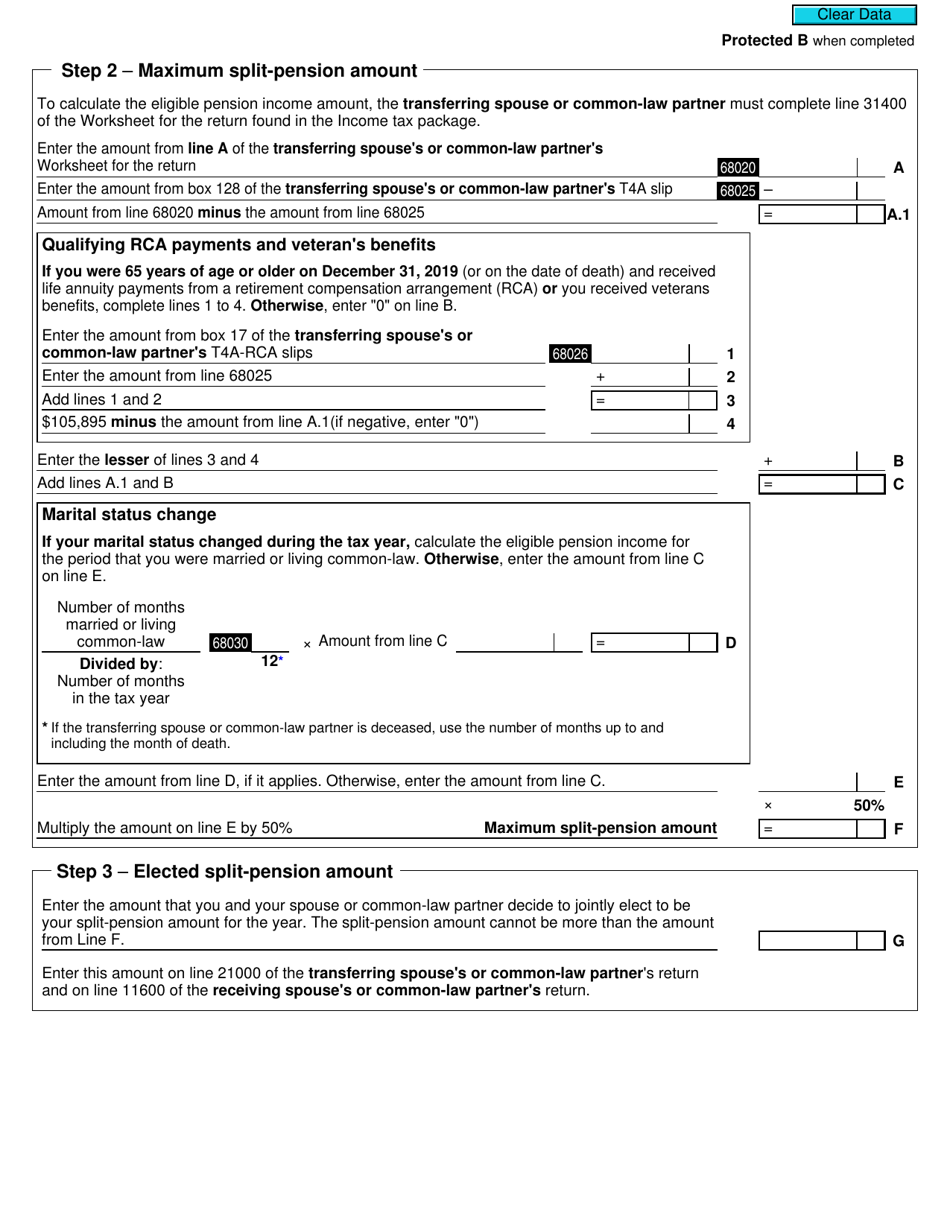

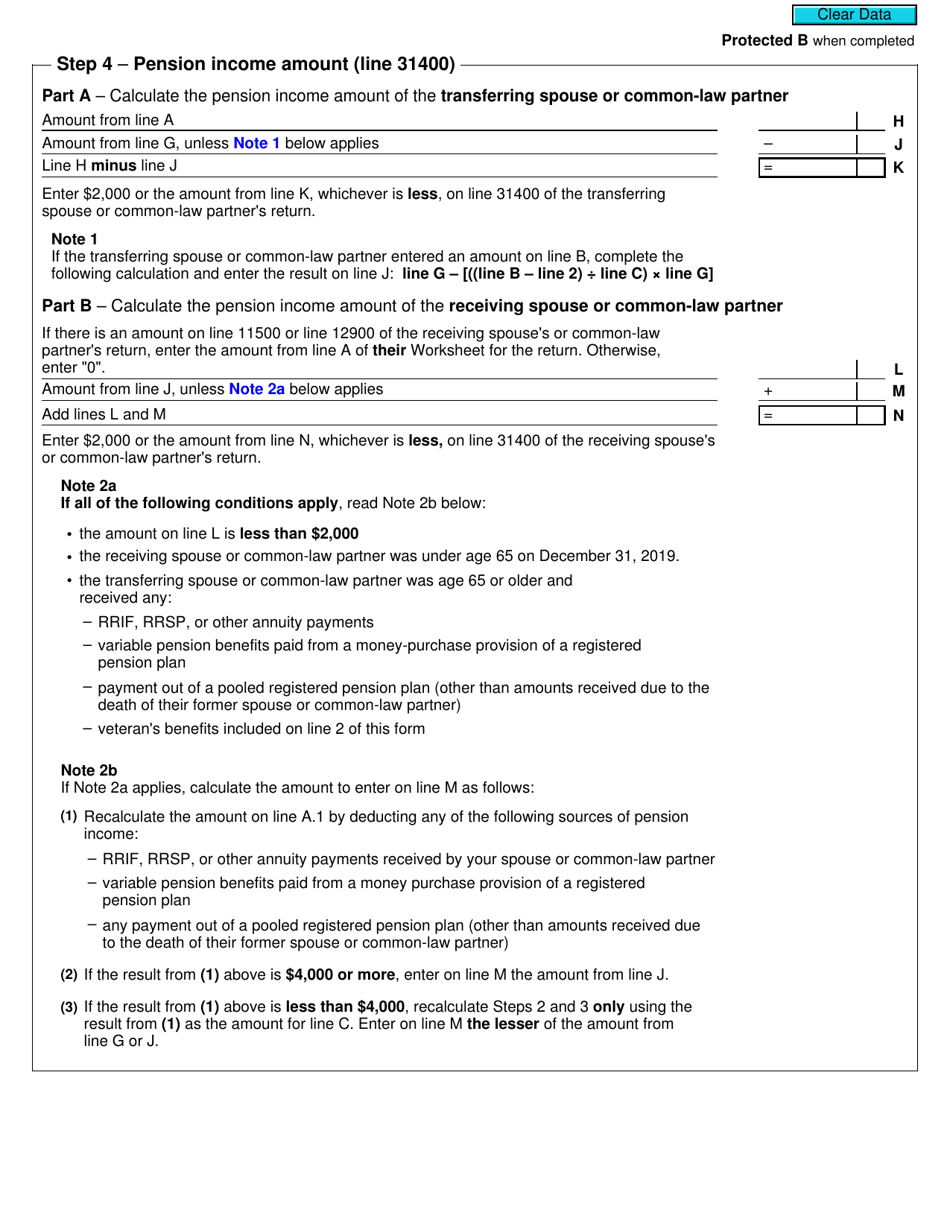

Q: How does pension income splitting work?

A: When pension income is split, up to 50% of the pension income can be allocated to the lower-income spouse or common-law partner. This means that the higher-income spouse or common-law partner will pay taxes on a reduced amount of pension income, while the lower-income spouse or common-law partner will include the allocated amount in their own income.

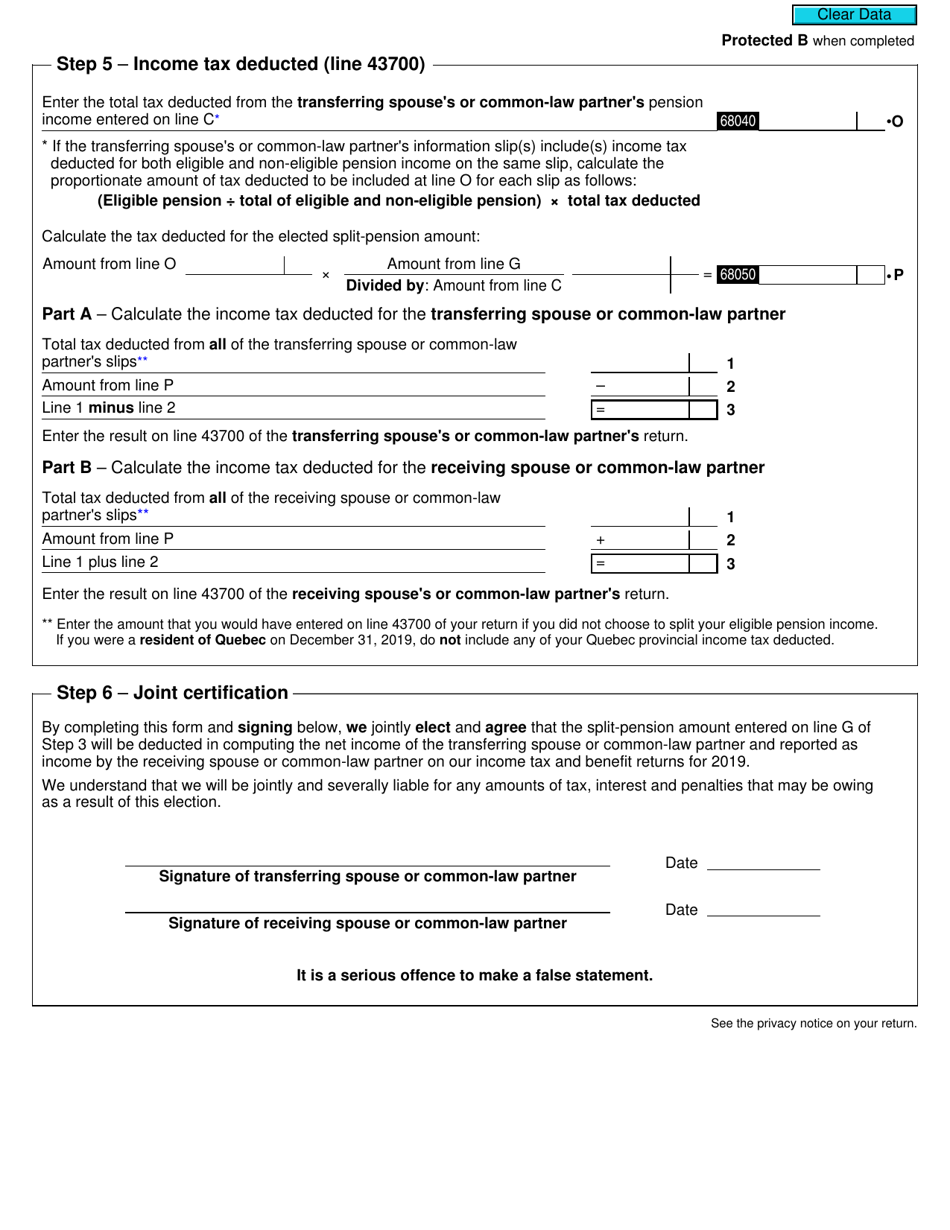

Q: When should Form T1032 be filed?

A: Form T1032 should be filed with your personal income tax return for the year in which you want to start splitting pension income.

Q: Is there a deadline to submit Form T1032?

A: Yes, Form T1032 must be filed by the tax deadline for the year in which you want to split pension income. This deadline is usually April 30, but it may vary depending on your individual circumstances.