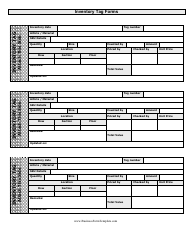

This version of the form is not currently in use and is provided for reference only. Download this version of

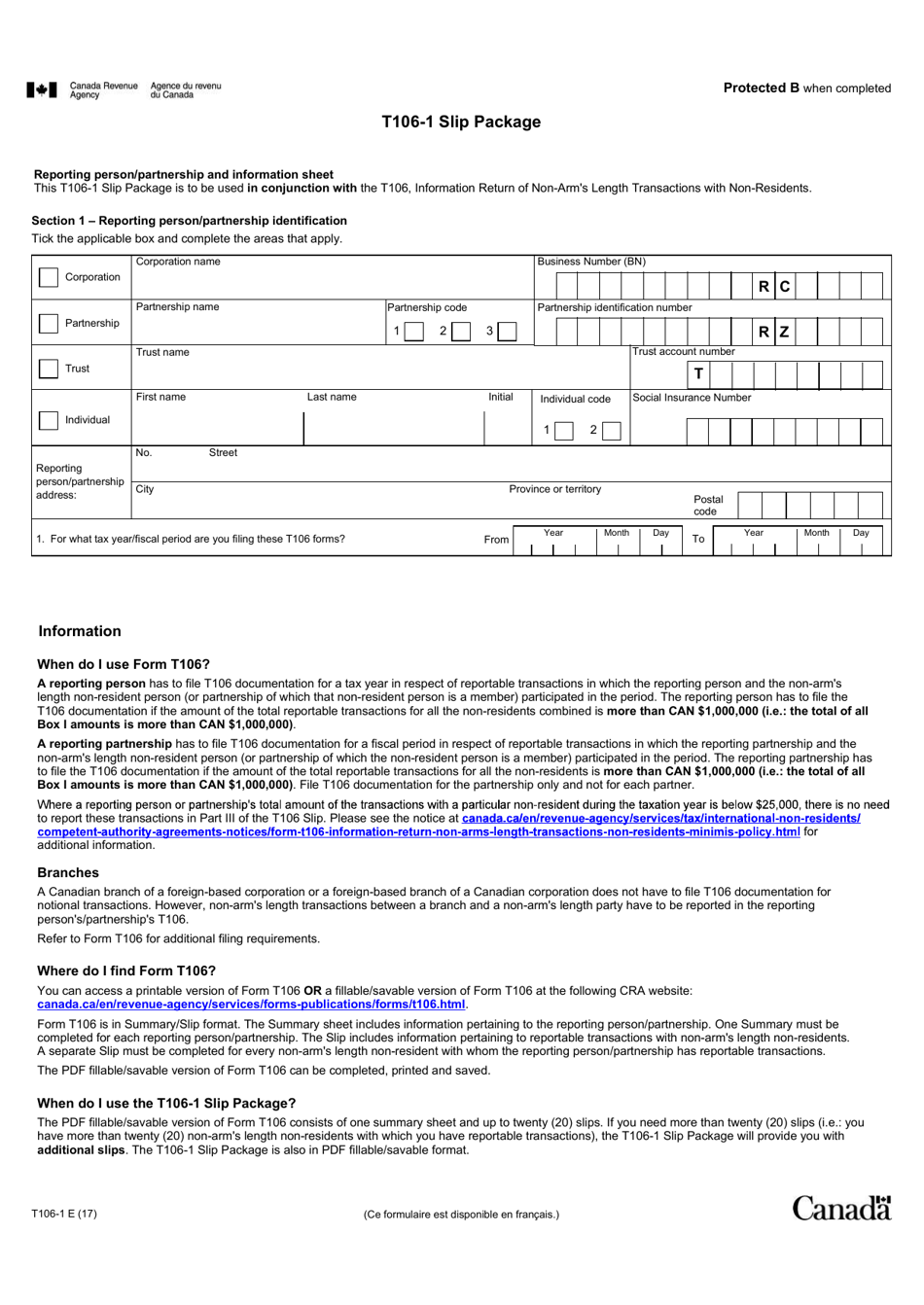

Form T106-1

for the current year.

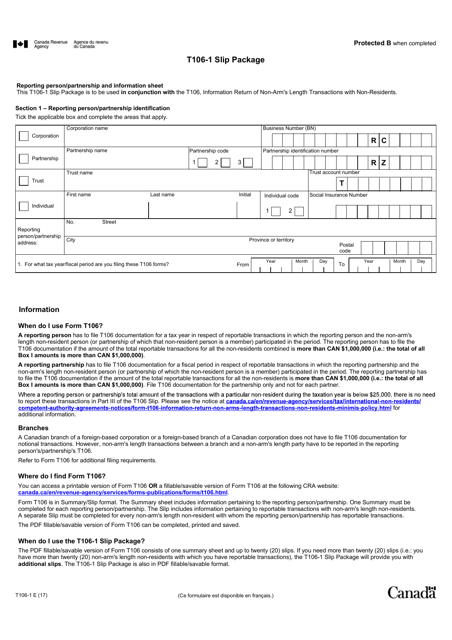

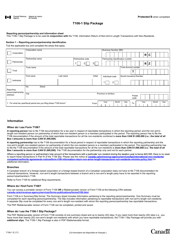

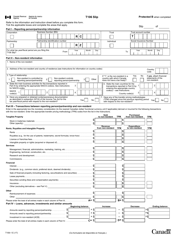

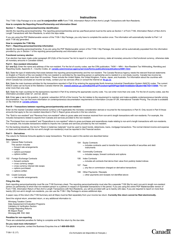

Form T106-1 Slip Package - Canada

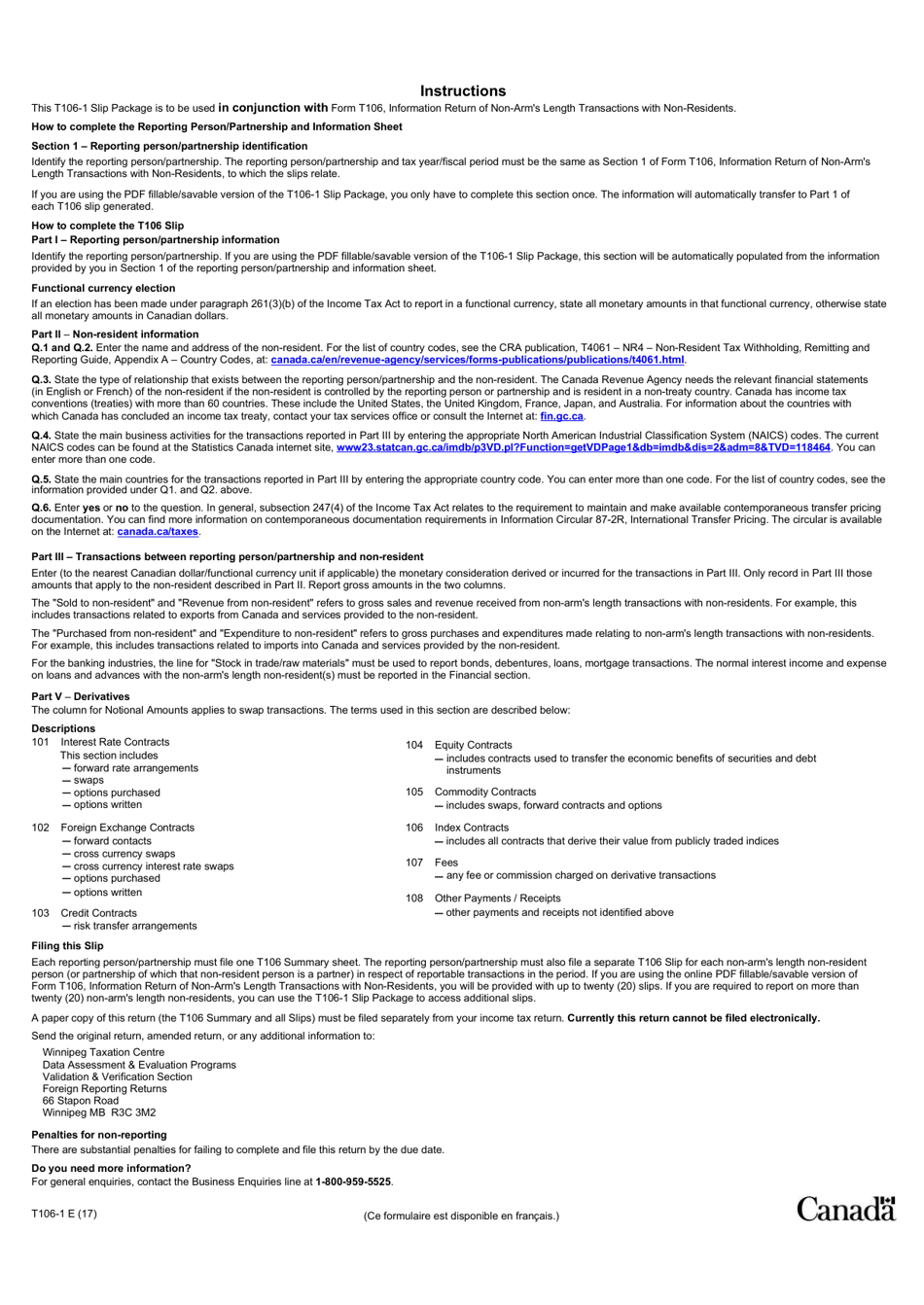

Form T106-1 Slip Package in Canada is used to report foreign non-business income and foreign non-business taxes paid by Canadian residents. It includes multiple slips that provide detailed information on various types of foreign income and taxes.

The Form T106-1 slip package in Canada is filed by the taxpayer who has received a T106-1 slip.

FAQ

Q: What is a T106-1 slip?

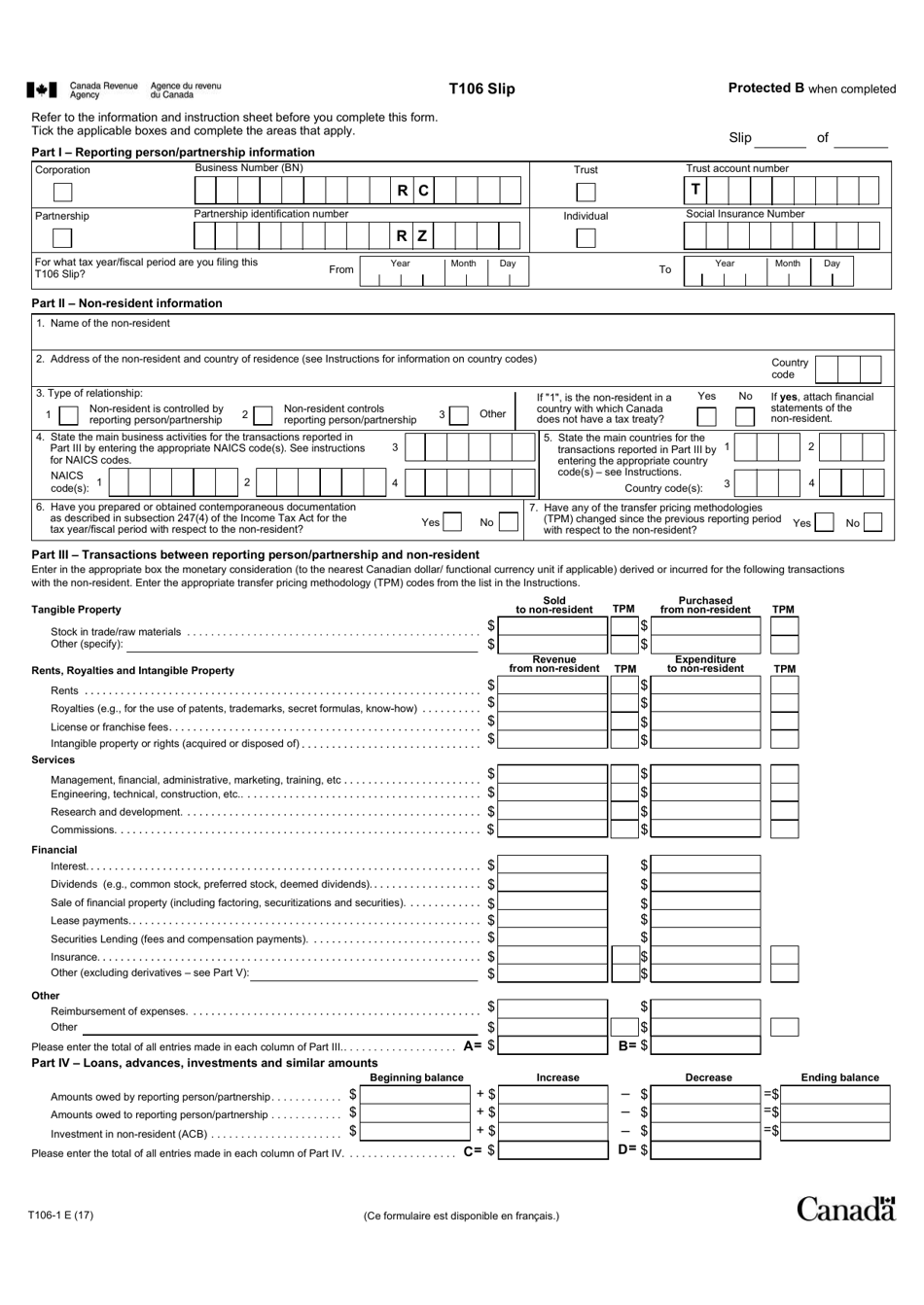

A: A T106-1 slip is a form used in Canada to report certain types of income.

Q: Who needs to file a T106-1 slip?

A: The T106-1 slip is most commonly used by partnerships and trusts.

Q: What information is reported on a T106-1 slip?

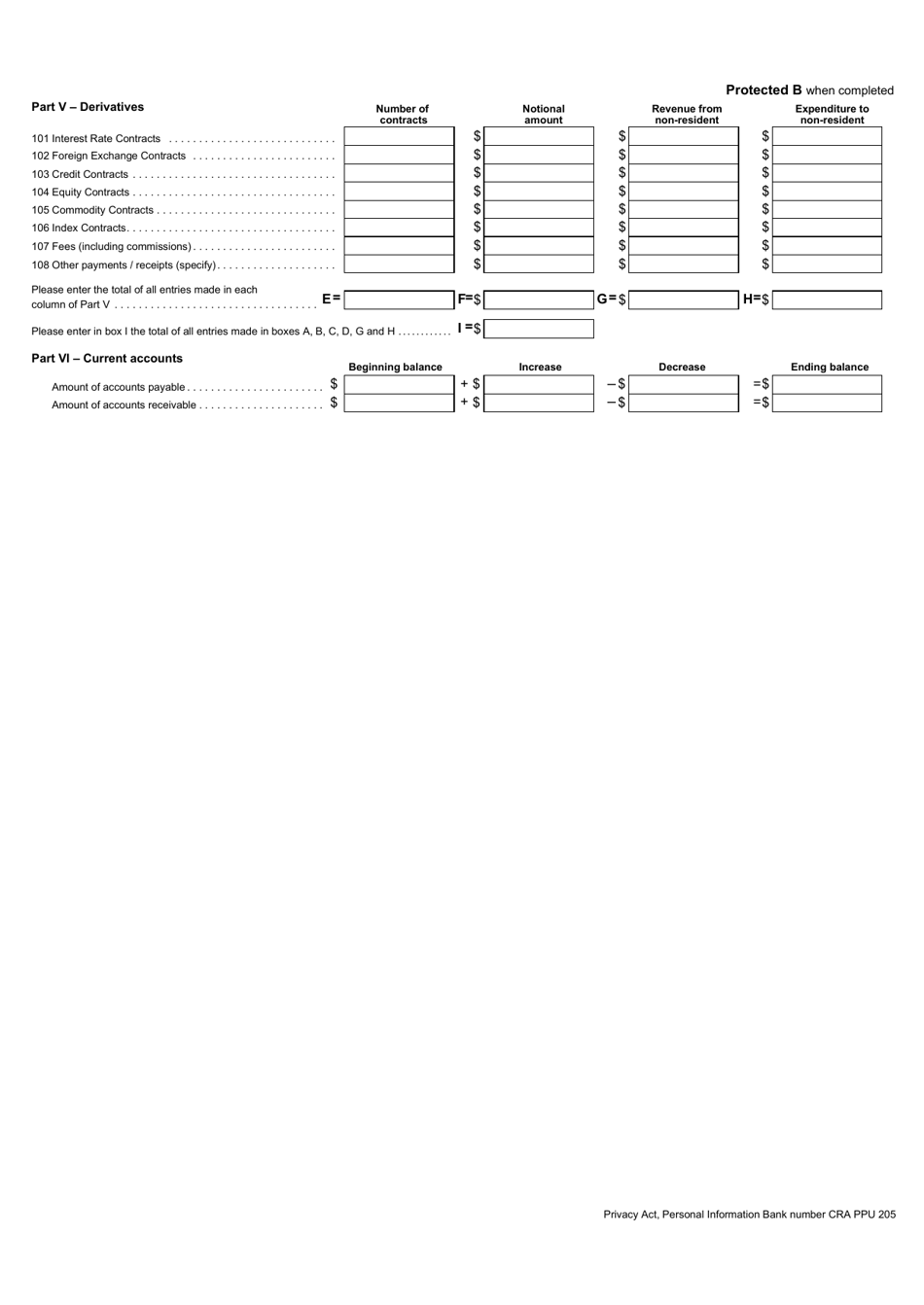

A: The T106-1 slip reports various types of income, such as rental income, royalties, and partnership income.

Q: When is the deadline to file a T106-1 slip?

A: The deadline to file a T106-1 slip is the same as the deadline for filing your income tax return, which is generally April 30th for individuals and June 15th for self-employed individuals.

Q: Is there a penalty for late filing of a T106-1 slip?

A: Yes, there may be penalties for late filing of a T106-1 slip. It is important to file on time to avoid penalties and interest charges.