This version of the form is not currently in use and is provided for reference only. Download this version of

Form T1014-1

for the current year.

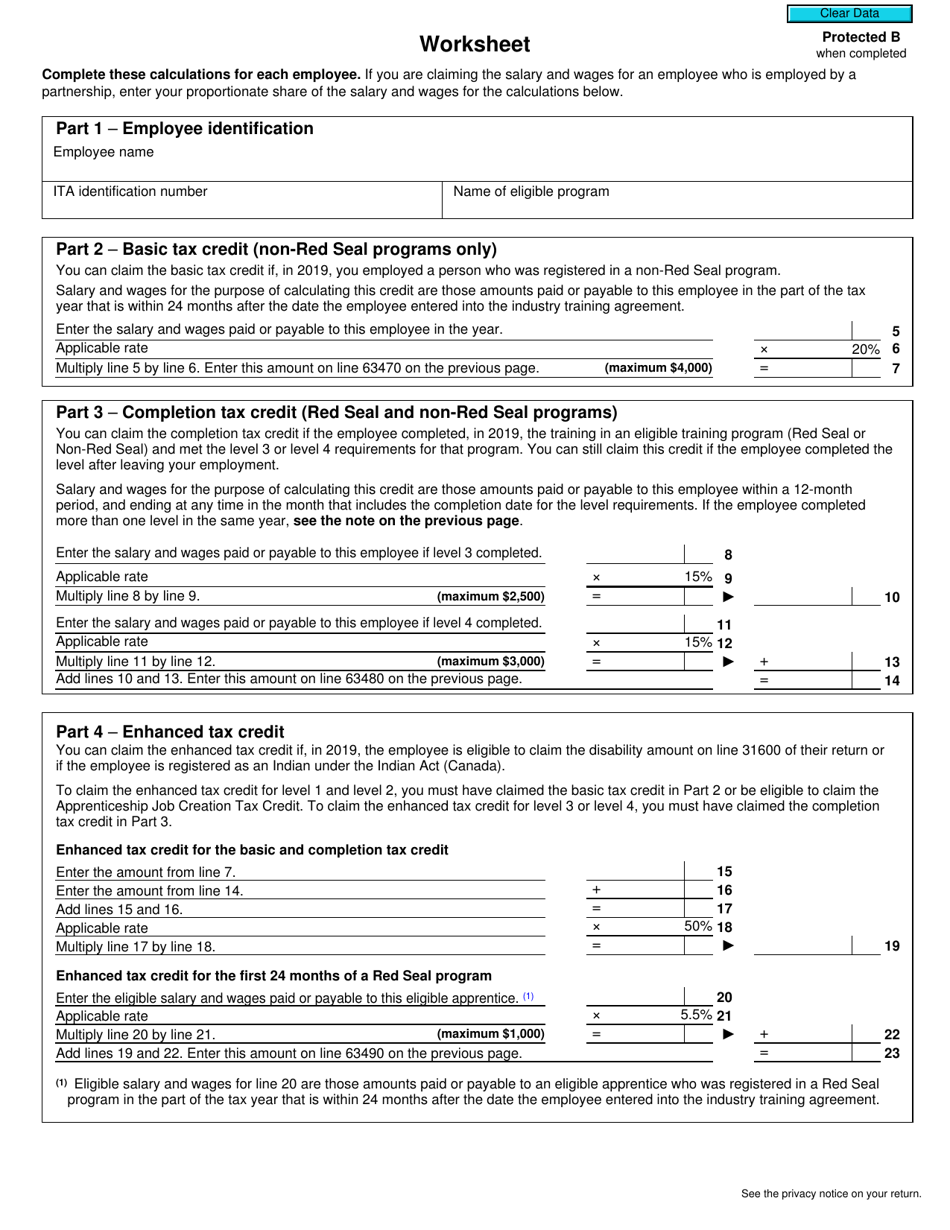

Form T1014-1 British Columbia Training Tax Credit (Employers) - Canada

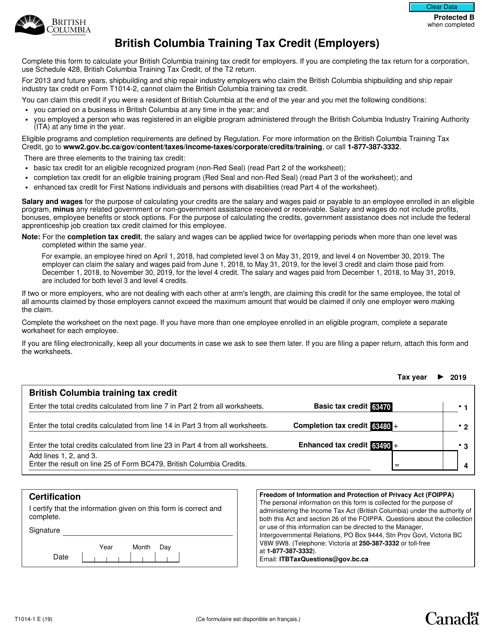

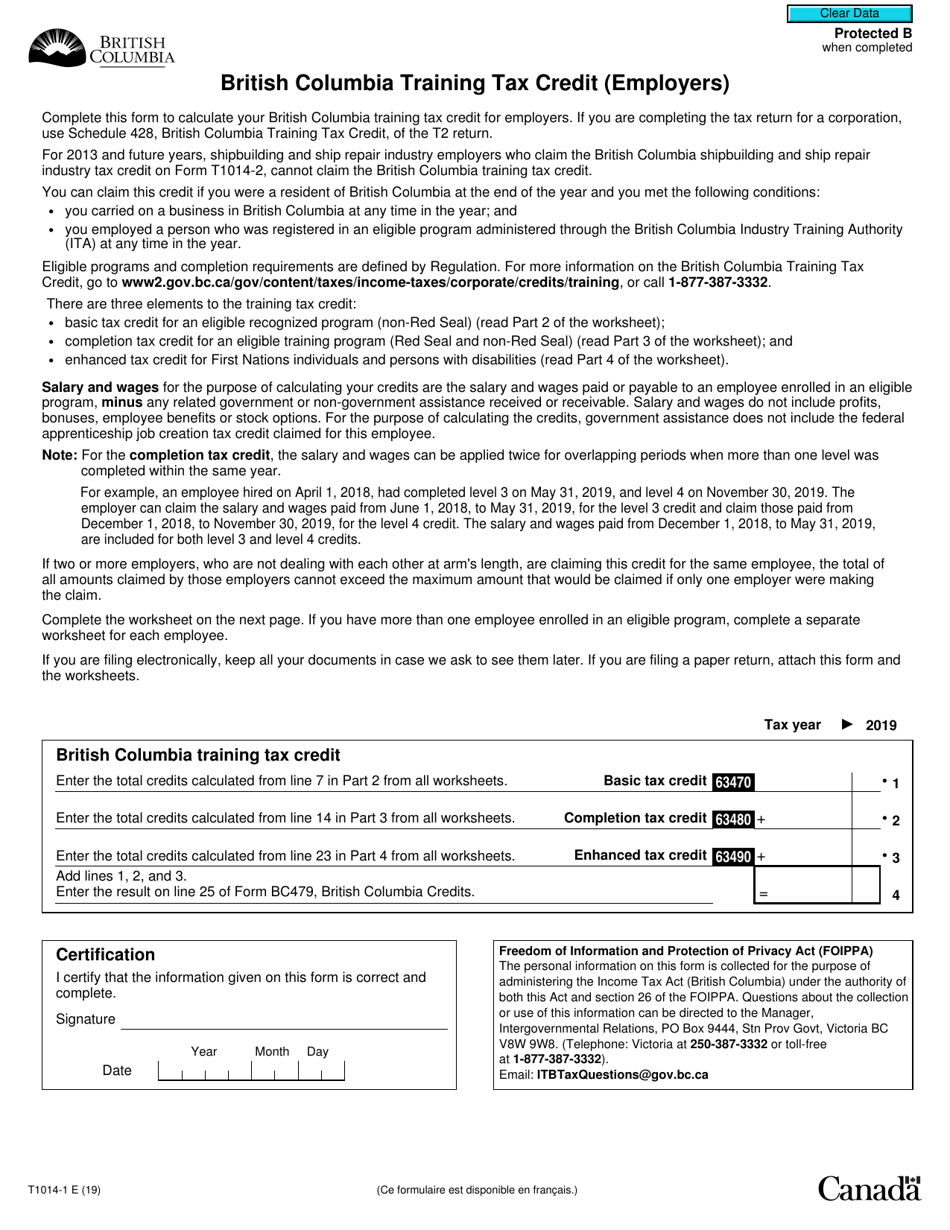

The Form T1014-1 British Columbia Training Tax Credit (Employers) is specific to the province of British Columbia in Canada. It is designed to provide a tax credit to employers who invest in eligible training programs for their employees. This tax credit encourages employers to enhance the skills and knowledge of their workforce, ultimately leading to increased productivity and competitiveness in the province. The specific details and eligibility criteria for this tax credit can be found on the official website of the Canada Revenue Agency or by consulting with a professional tax advisor.

The Form T1014-1 British Columbia Training Tax Credit (Employers) in Canada is filed by eligible employers in the province of British Columbia who are claiming a tax credit for eligible training expenditures incurred during the tax year.

FAQ

Q: What is Form T1014-1?

A: Form T1014-1 is a tax form used by employers in British Columbia, Canada to claim the Training Tax Credit.

Q: What is the Training Tax Credit?

A: The Training Tax Credit is a tax incentive provided by the government of British Columbia to encourage employers to invest in employee training and skills development.

Q: Who is eligible to claim the Training Tax Credit?

A: Employers in British Columbia who have incurred eligible training expenses for their employees may be eligible to claim the Training Tax Credit.

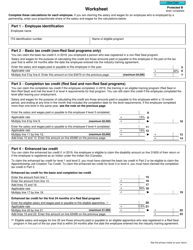

Q: What expenses can be claimed for the Training Tax Credit?

A: Eligible training expenses that can be claimed for the Training Tax Credit include registration fees, tuition fees, and related course materials.

Q: How much is the Training Tax Credit?

A: The amount of the Training Tax Credit is calculated based on the eligible training expenses incurred by the employer and can vary depending on the nature and duration of the training.

Q: How do I claim the Training Tax Credit?

A: To claim the Training Tax Credit, employers must complete and submit Form T1014-1 along with their annual corporate tax return. It is important to keep all supporting documentation and receipts for the training expenses.

Q: Is there a deadline for claiming the Training Tax Credit?

A: Yes, the Training Tax Credit must be claimed within 18 months after the end of the calendar year in which the eligible training expenses were incurred.

Q: Are there other training-related tax incentives in British Columbia?

A: Yes, in addition to the Training Tax Credit, British Columbia also offers a number of other tax incentives and grants to support workforce training and skills development programs. Employers are encouraged to explore all available options to maximize their benefits.

Q: Can I claim the Training Tax Credit if I am self-employed?

A: No, the Training Tax Credit is specifically for employers in British Columbia. Self-employed individuals may be eligible for other tax deductions or credits related to training and professional development.