This version of the form is not currently in use and is provided for reference only. Download this version of

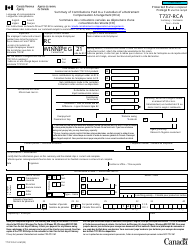

Form RC267

for the current year.

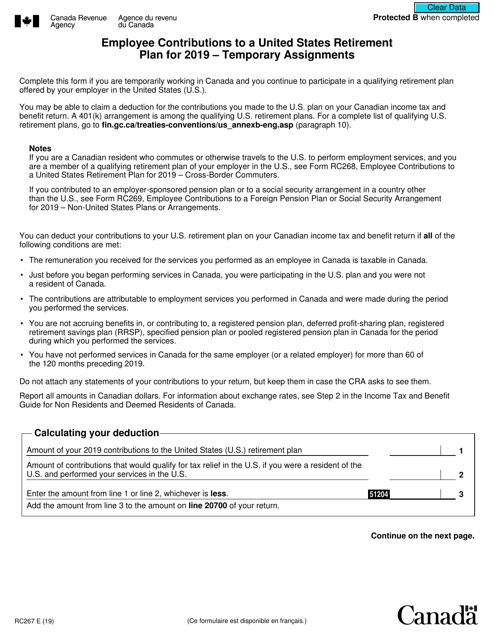

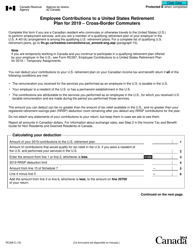

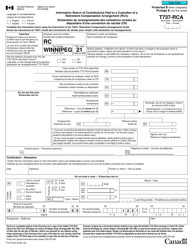

Form RC267 Employee Contributions to a United States Retirement Plan - Temporary Assignments - Canada

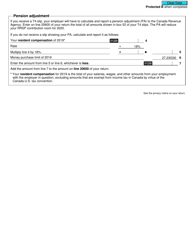

Form RC267, Employee Contributions to a United States Retirement Plan - Temporary Assignments - Canada, is used by Canadian residents who are temporarily working in the United States and are contributing to a U.S. retirement plan. This form is used to report those contributions to the Canadian tax authorities.

The Form RC267 is filed by individuals who are temporary residents of Canada and are contributing to a United States retirement plan while on a temporary assignment.

FAQ

Q: What is Form RC267?

A: Form RC267 is a document used by employees in Canada who are on temporary assignments in the United States and have made contributions to a United States retirement plan.

Q: Who needs to fill out Form RC267?

A: Employees in Canada who are on temporary assignments in the United States and have made contributions to a United States retirement plan need to fill out Form RC267.

Q: What is the purpose of Form RC267?

A: The purpose of Form RC267 is to provide information about the employee's contributions to a United States retirement plan, which may affect their Canadian tax obligations.

Q: What information is required on Form RC267?

A: Form RC267 requires the employee to provide details about their temporary assignment in the United States, the contributions made to the retirement plan, and any distributions received from the plan during the tax year.

Q: When is Form RC267 due?

A: Form RC267 is due on or before the employee's Canadian income tax filing deadline, which is usually April 30th of the following year.

Q: What should I do if I have questions about filling out Form RC267?

A: If you have questions about filling out Form RC267, you can contact the Canada Revenue Agency (CRA) for assistance.