This version of the form is not currently in use and is provided for reference only. Download this version of

Form RC201

for the current year.

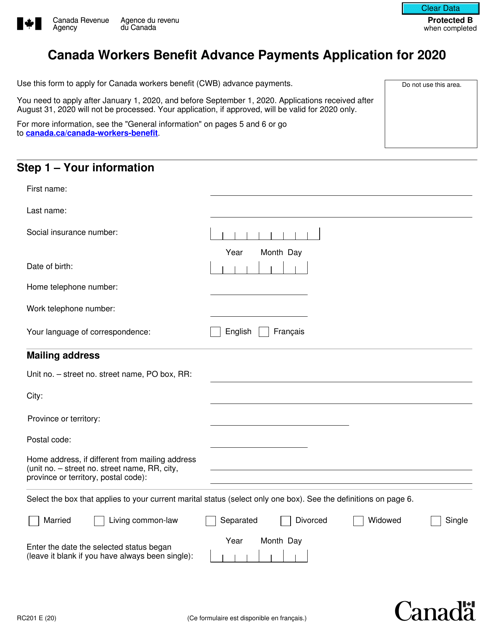

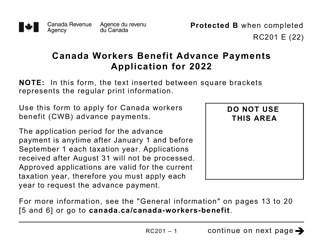

Form RC201 Canada Workers Benefit Advance Payments Application - Canada

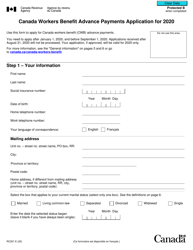

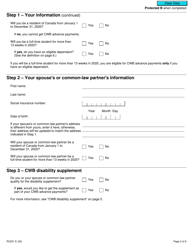

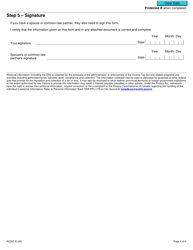

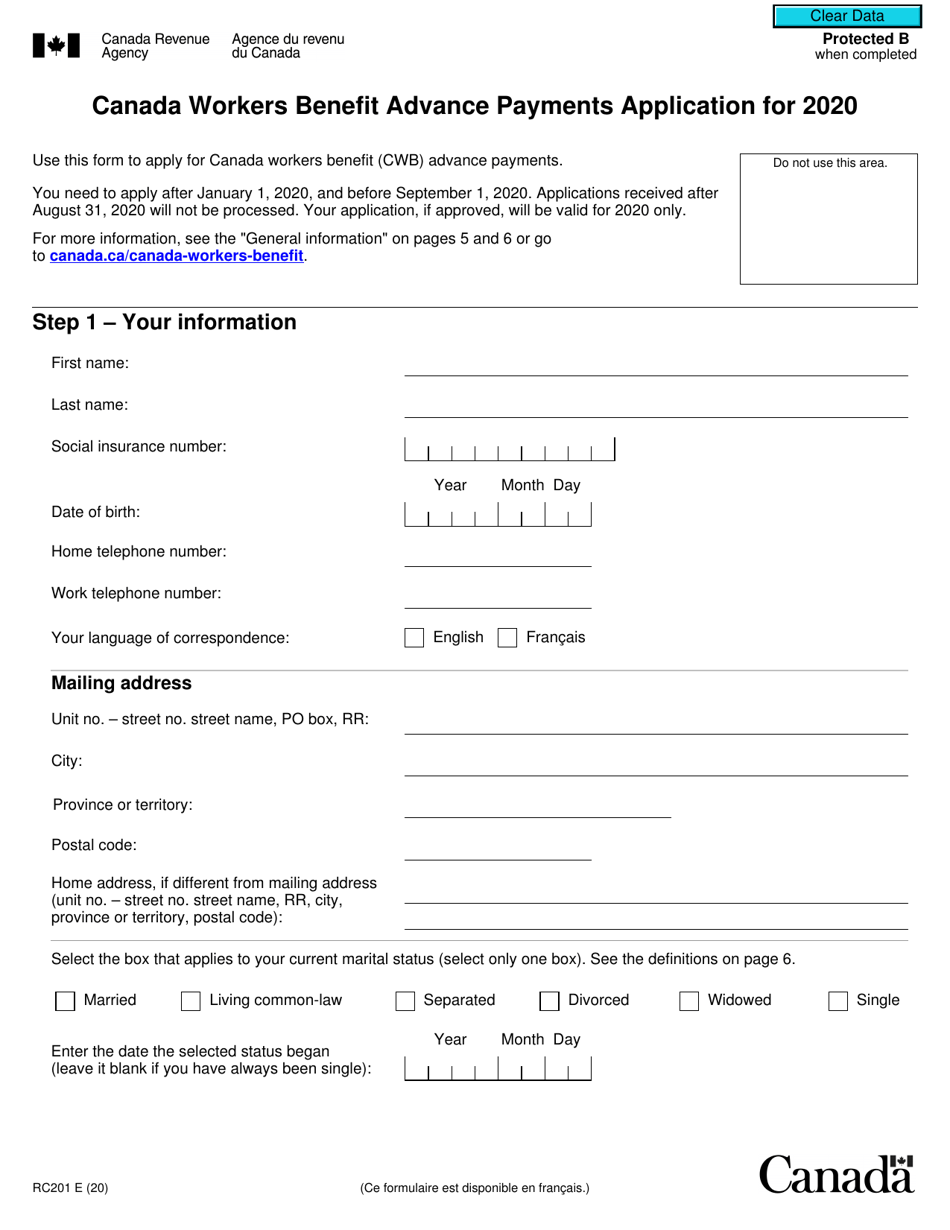

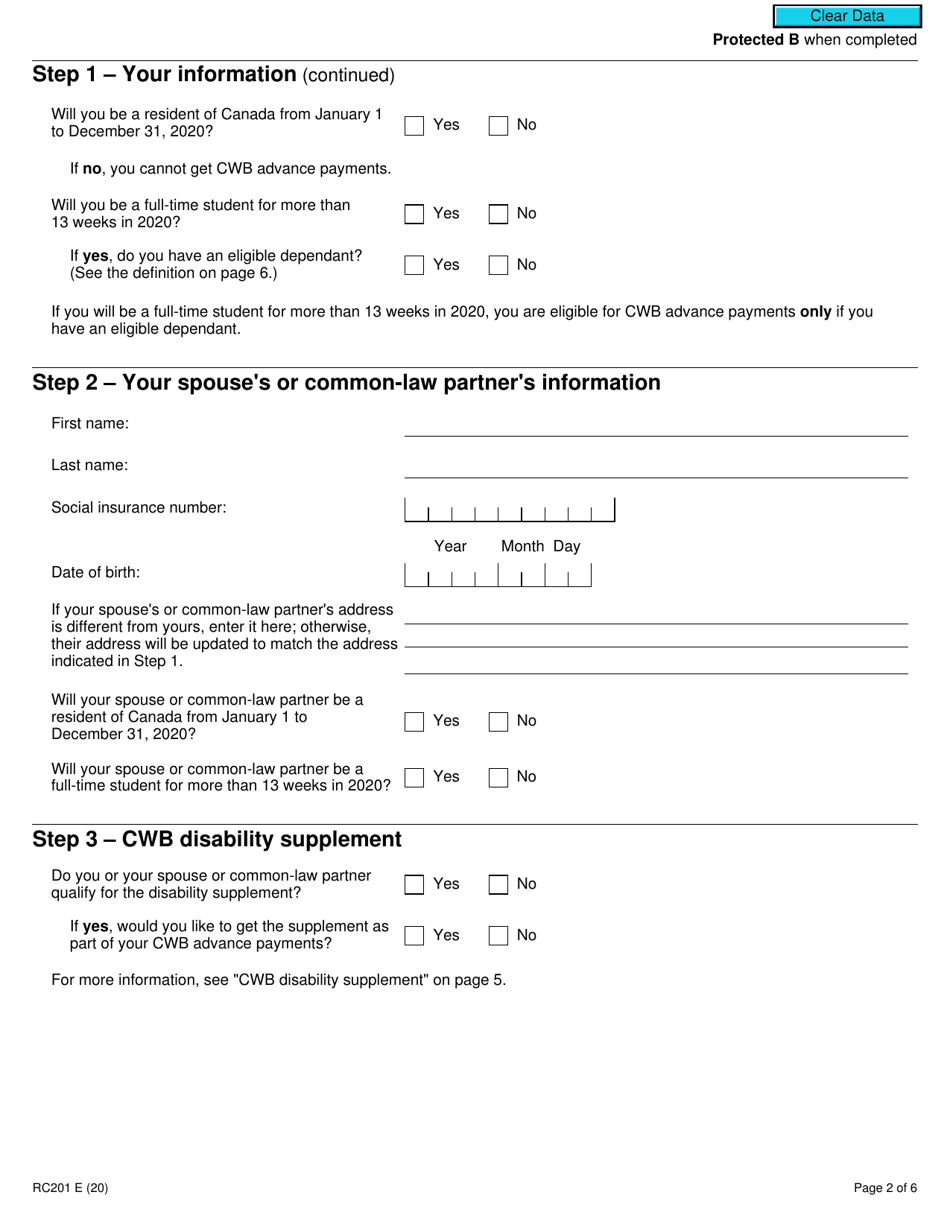

Form RC201 Canada Workers Benefit Advance Payments Application is used to apply for the Canada Workers Benefit (CWB) advance payments. The CWB is a refundable tax credit that provides financial assistance to low-income individuals and families who are working. This form is used to determine if you are eligible for the advance payments and to provide your personal and income information.

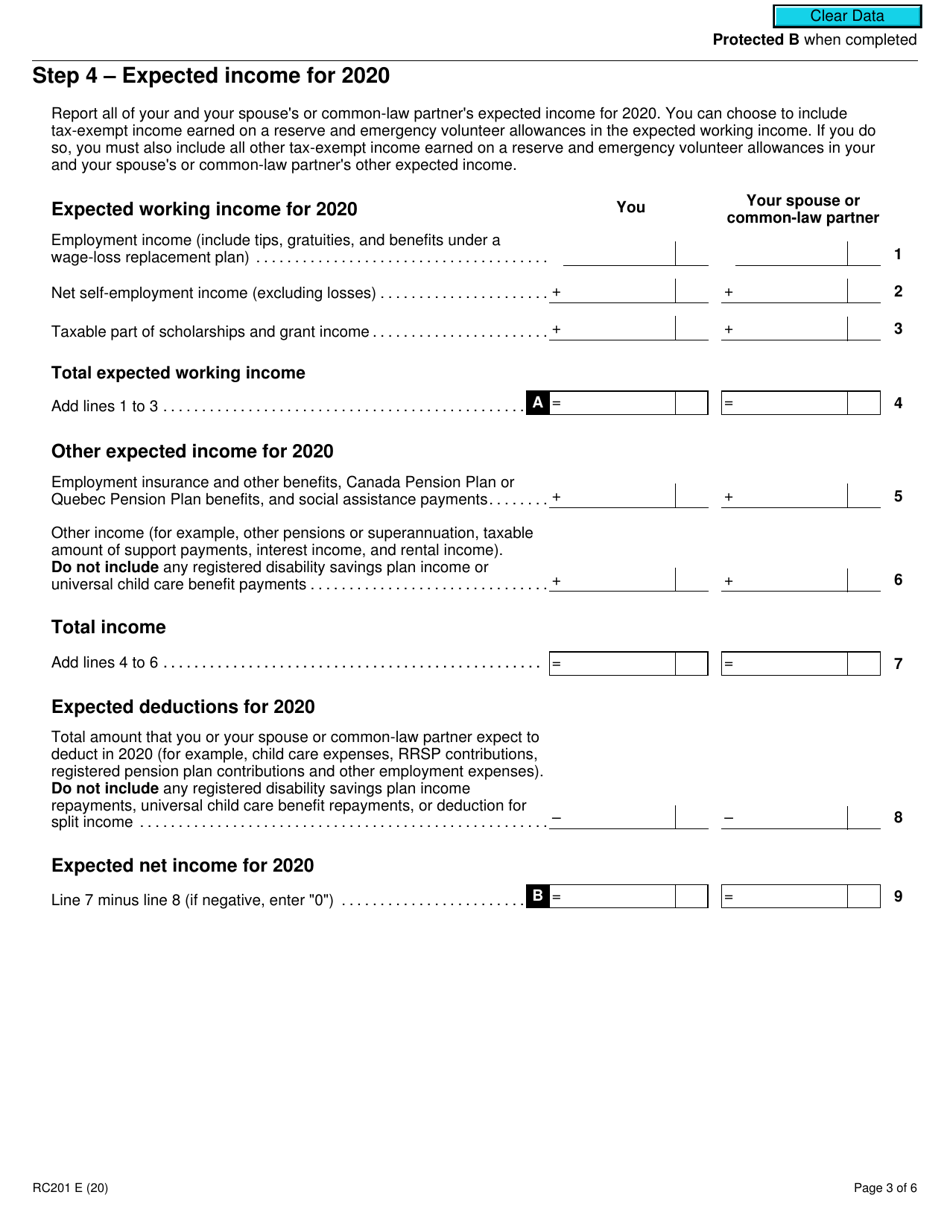

The individual who is claiming the Canada Workers Benefit advance payments files the Form RC201 Canada Workers Benefit Advance Payments Application.

FAQ

Q: What is Form RC201?

A: Form RC201 is the Canada Workers Benefit Advance Payments Application.

Q: What is the Canada Workers Benefit?

A: The Canada Workers Benefit is a refundable tax credit that provides financial support to low-income workers.

Q: What are advance payments?

A: Advance payments are periodic payments made in advance based on estimated eligibility for the Canada Workers Benefit.

Q: Who can apply for advance payments?

A: Low-income workers who meet the eligibility criteria can apply for advance payments.

Q: How can I apply for advance payments?

A: You can apply for advance payments by completing and submitting Form RC201.

Q: What information is required on Form RC201?

A: Form RC201 requires personal information, income details, and other supporting documents.

Q: When should I submit Form RC201?

A: Form RC201 should be submitted as soon as possible to receive the advance payments throughout the year.

Q: How will I receive the advance payments?

A: The advance payments will be directly deposited into your bank account or mailed to you as a cheque.

Q: Are the advance payments taxable?

A: No, the advance payments are not taxable.