This version of the form is not currently in use and is provided for reference only. Download this version of

Form GST23

for the current year.

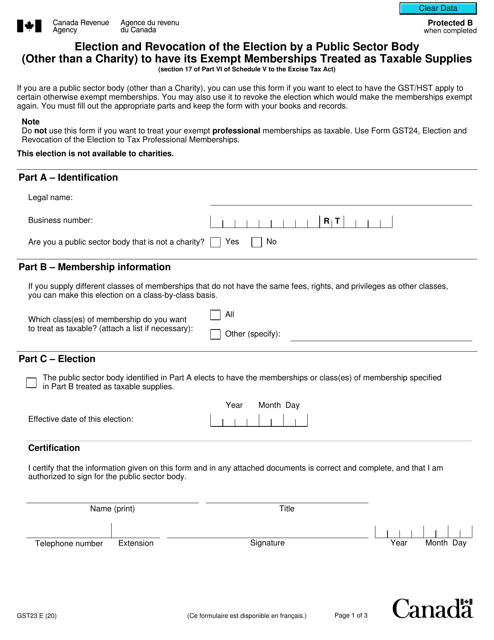

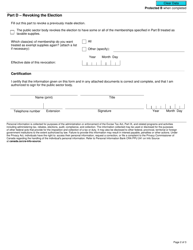

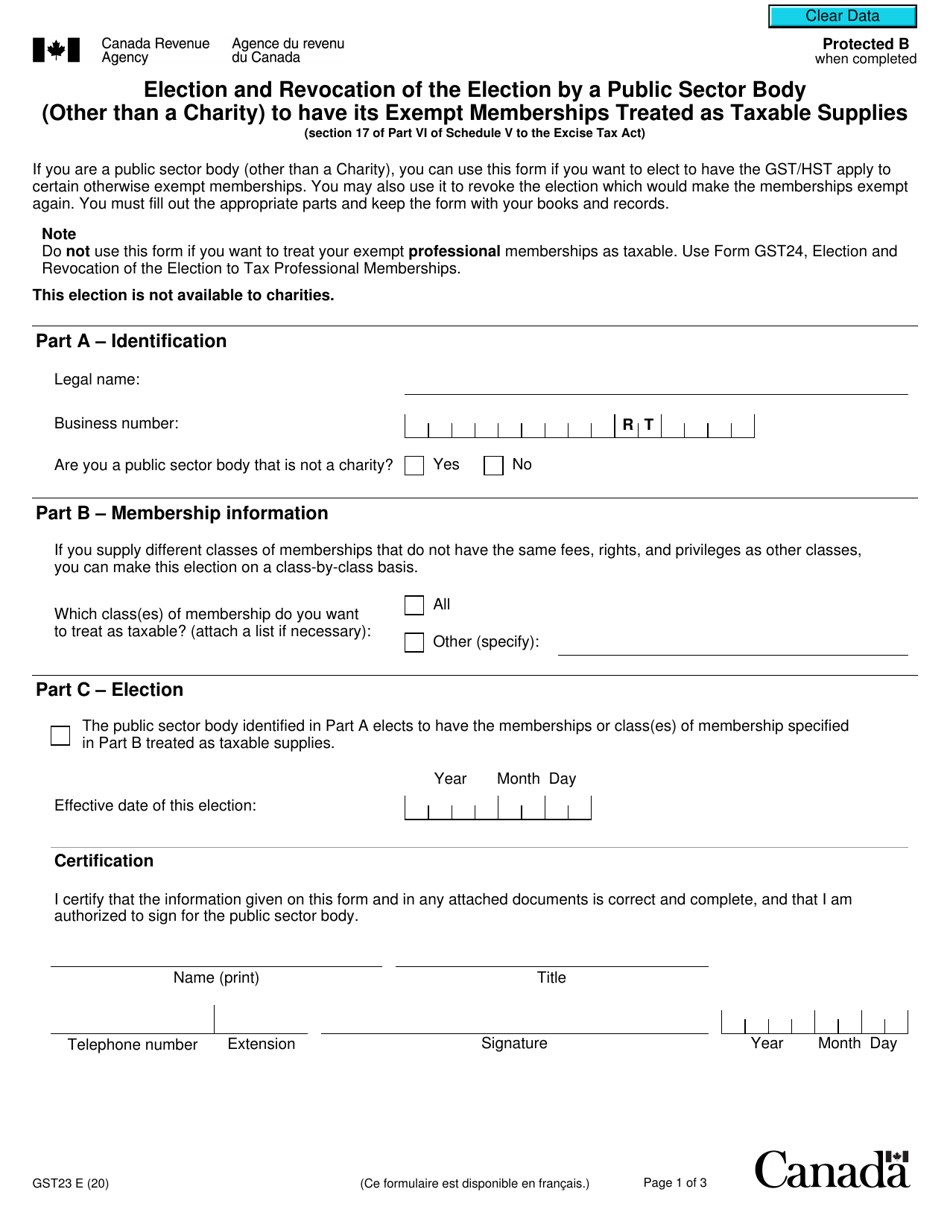

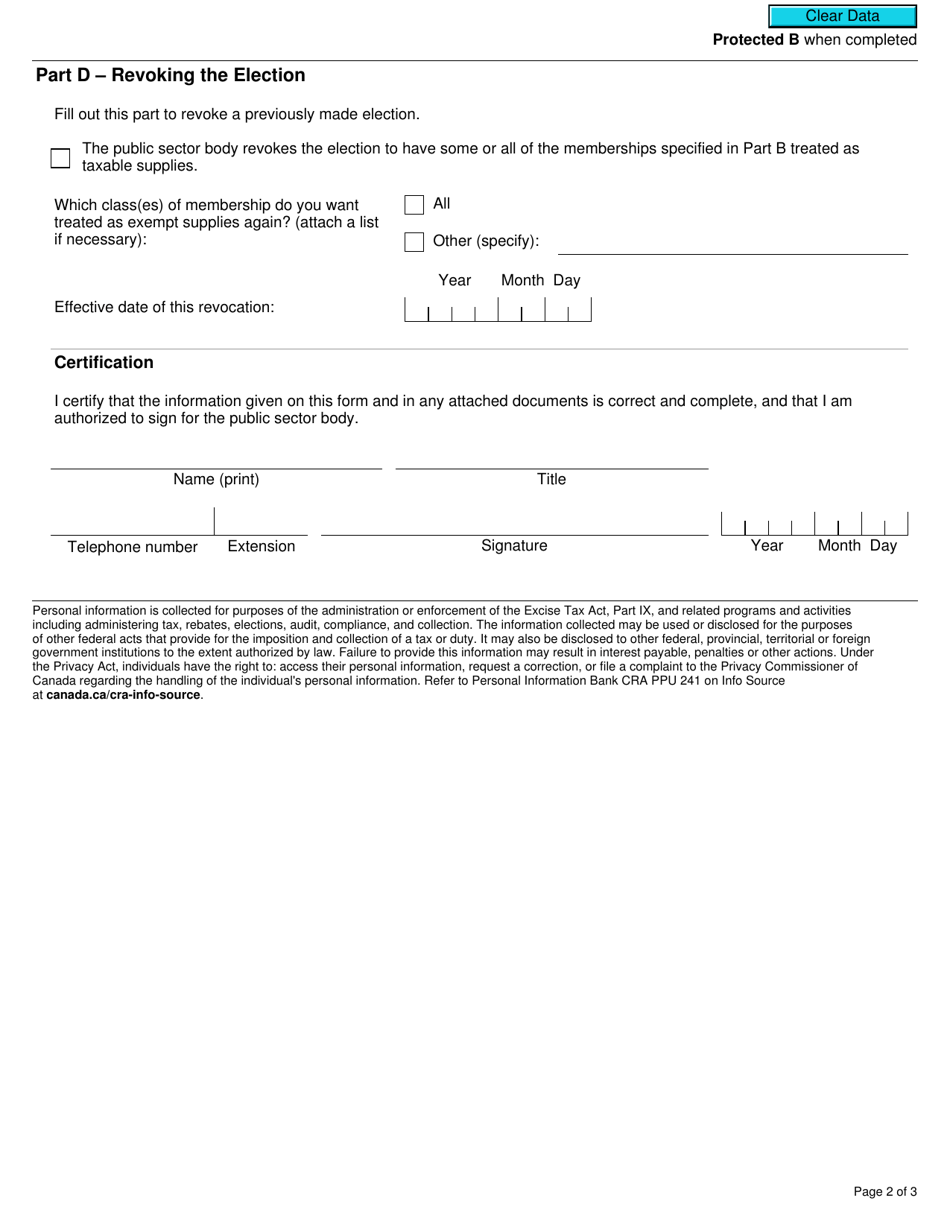

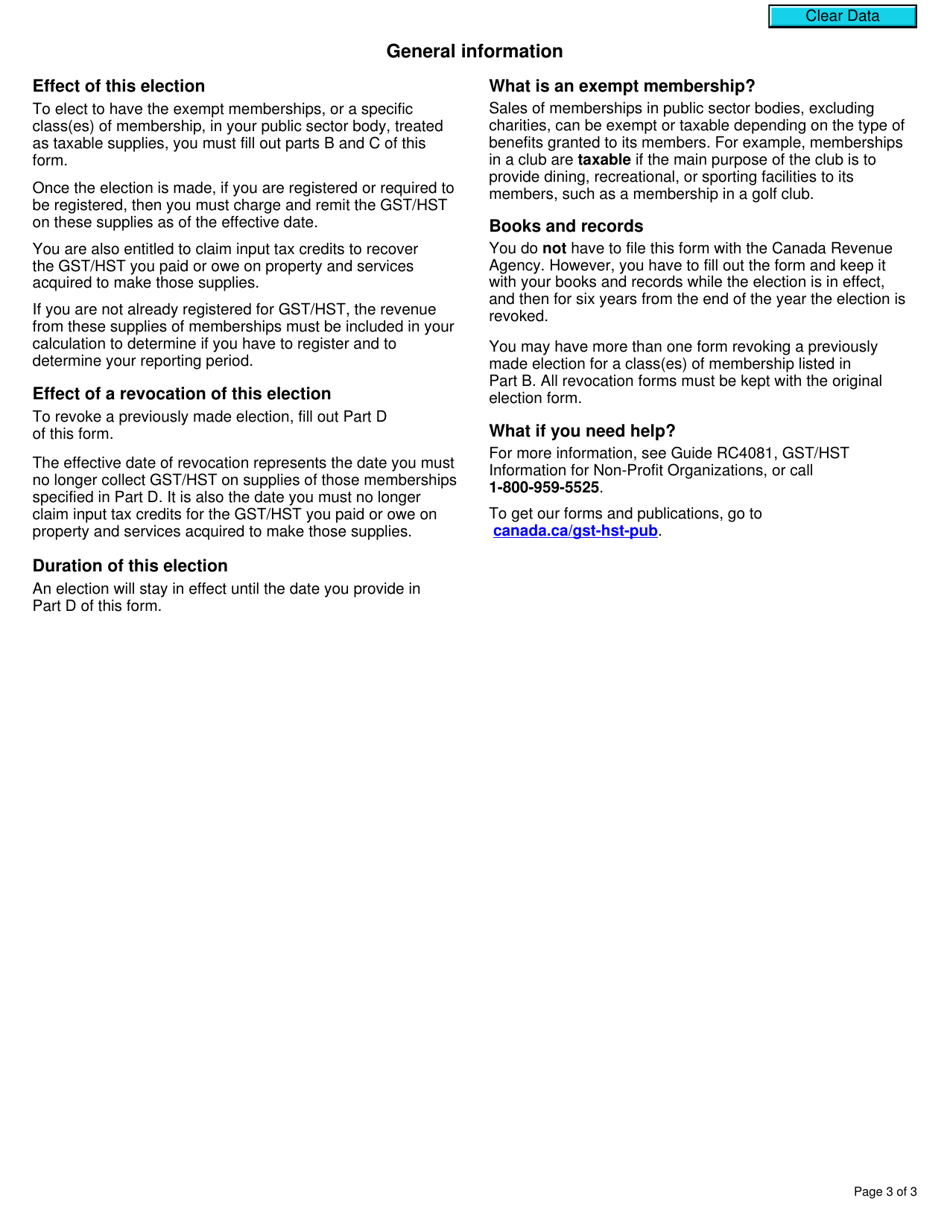

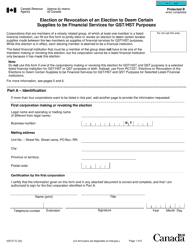

Form GST23 Election and Revocation of the Election by a Public Sector Body (Other Than a Charity) to Have Its Exempt Memberships Treated as Taxable Supplies - Canada

Form GST23 is used in Canada for a public sector body (other than a charity) to elect or revoke the election to have its exempt memberships treated as taxable supplies for Goods and Services Tax (GST) purposes. This form helps in determining whether the public sector body should charge and remit GST on its membership fees.

The Form GST23 "Election and Revocation of the Election by a Public Sector Body (Other Than a Charity) to Have Its Exempt Memberships Treated as Taxable Supplies" is filed by a Public Sector Body (Other Than a Charity) in Canada.

FAQ

Q: What is Form GST23?

A: Form GST23 is a form used in Canada to elect or revoke the election for a public sector body (other than a charity) to have its exempt memberships treated as taxable supplies.

Q: Who can use Form GST23?

A: Public sector bodies in Canada (other than charities) can use Form GST23 to elect or revoke the election for their exempt memberships to be treated as taxable supplies.

Q: What does it mean for memberships to be treated as taxable supplies?

A: When memberships are treated as taxable supplies, GST/HST must be charged on the membership fees and the public sector body can claim input tax credits on the related expenses.

Q: What is the purpose of the election?

A: The purpose of the election is to allow public sector bodies to recover GST/HST paid on expenses related to providing exempt memberships.