This version of the form is not currently in use and is provided for reference only. Download this version of

Form XE8

for the current year.

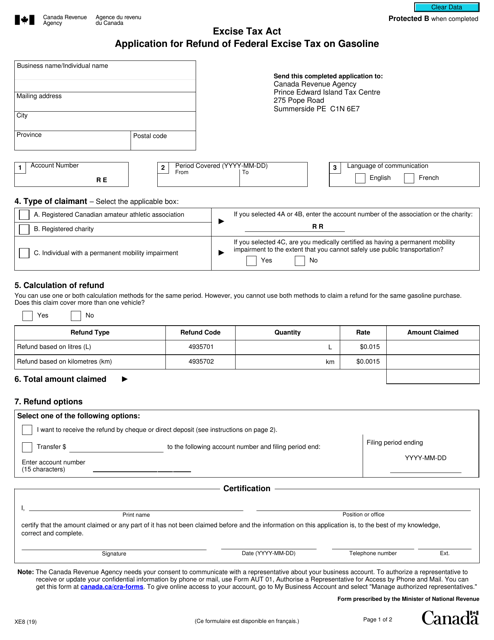

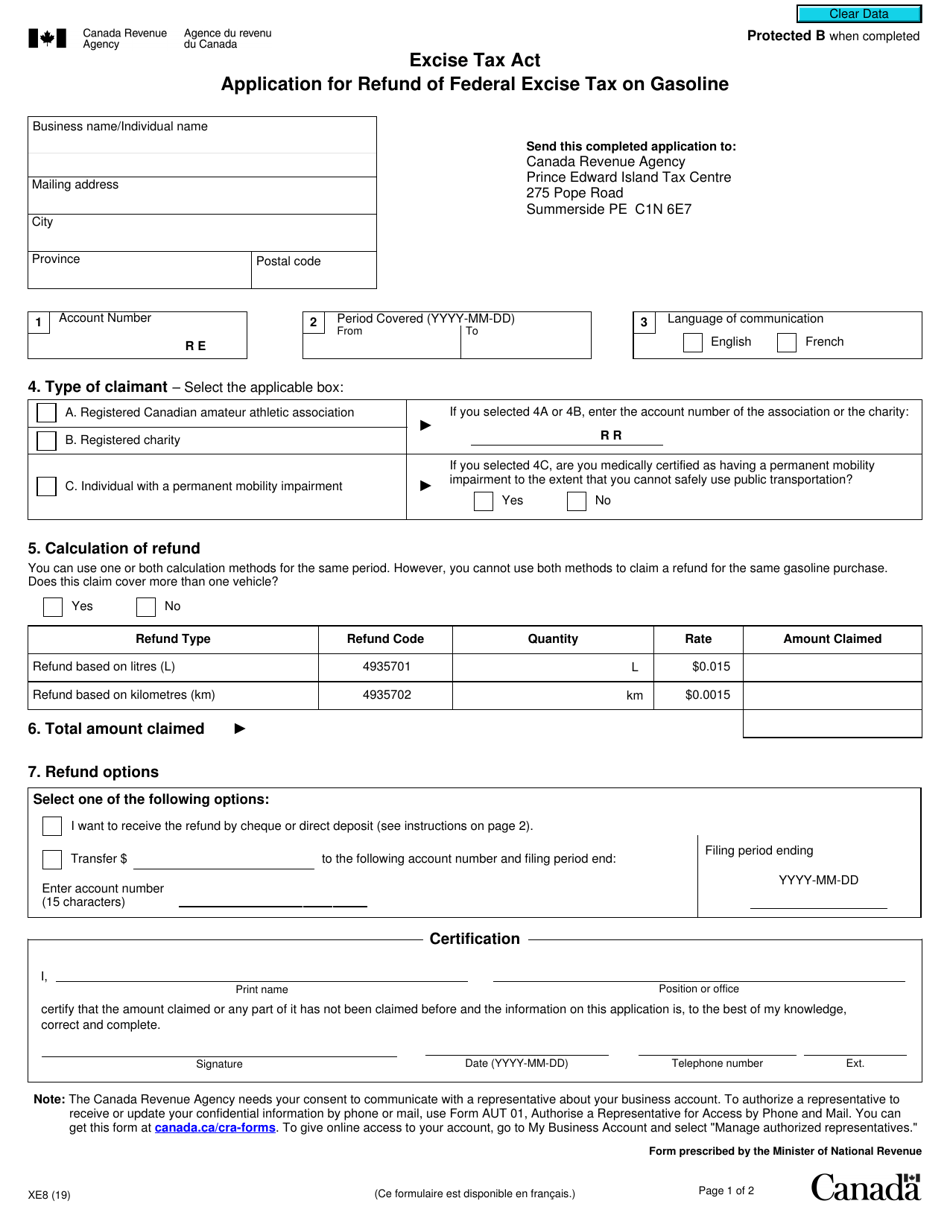

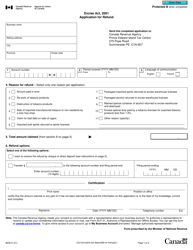

Form XE8 Excise Tax Act - Application for Refund of Federal Excise Tax on Gasoline - Canada

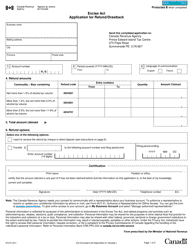

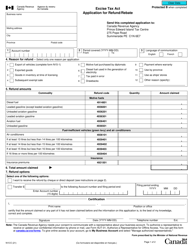

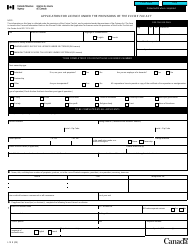

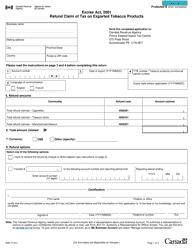

Form XE8 Excise Tax Act - Application for Refund of Federal Excise Tax on Gasoline in Canada is used to apply for a refund of the federal excise tax paid on gasoline. It allows individuals or businesses to claim a refund for taxes paid on gasoline that was used for specific purposes, such as farming, fishing, or interjurisdictional use.

The Form XE8 Excise Tax Act - Application for Refund of Federal Excise Tax on Gasoline in Canada is typically filed by individuals or businesses that are eligible for a refund of the federal excise tax on gasoline.

FAQ

Q: What is Form XE8?

A: Form XE8 is the Application for Refund of Federal Excise Tax on Gasoline.

Q: Who can use Form XE8?

A: This form can be used by individuals or businesses who are eligible for a refund of the federal excise tax on gasoline.

Q: What is the purpose of Form XE8?

A: The purpose of Form XE8 is to request a refund of the federal excise tax paid on gasoline in Canada.

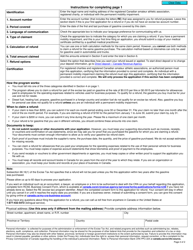

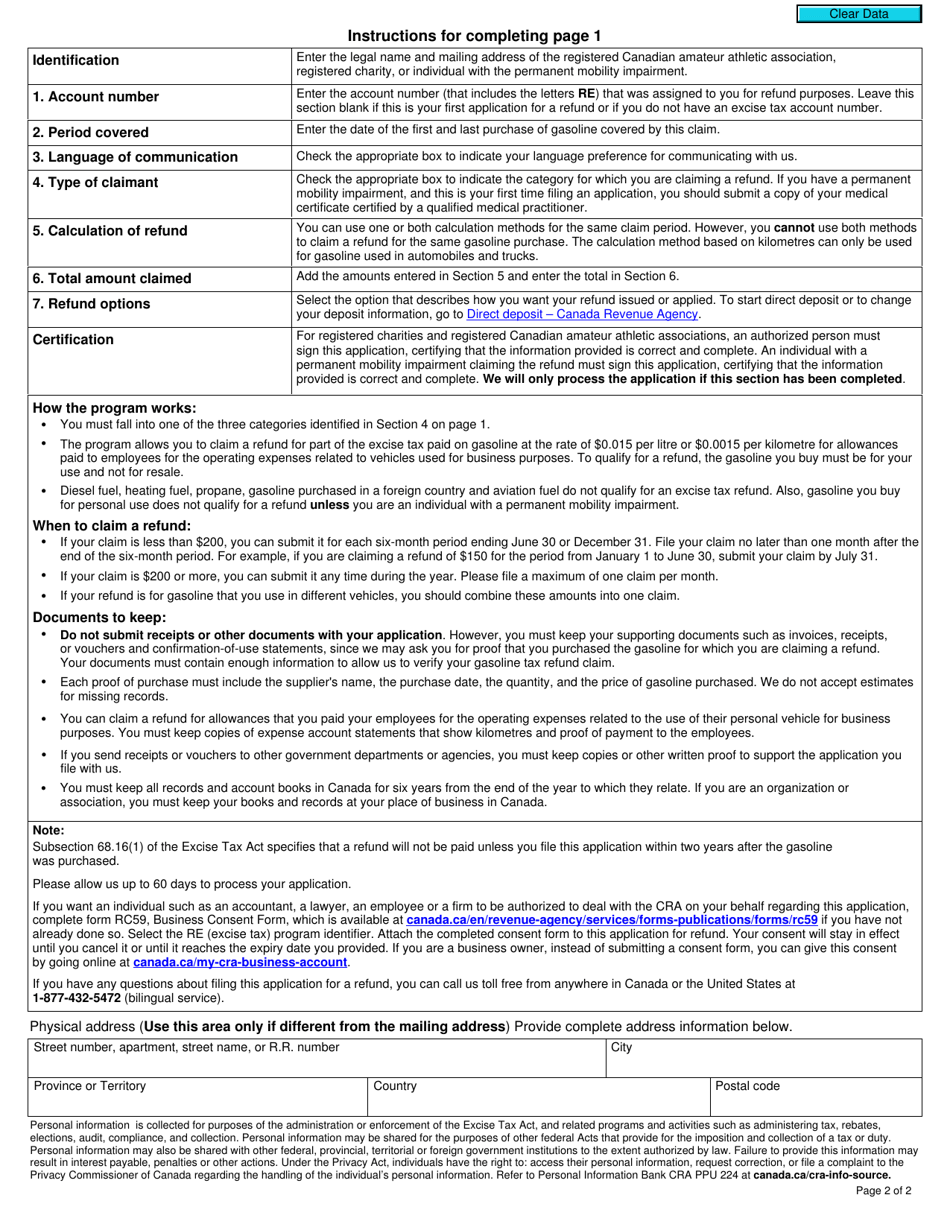

Q: How do I fill out Form XE8?

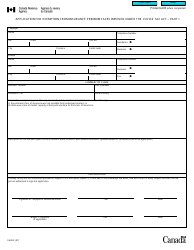

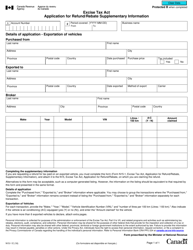

A: You will need to provide your personal or business information, details of the gasoline purchases, and supporting documentation to fill out Form XE8.

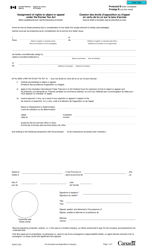

Q: What is the deadline to submit Form XE8?

A: The deadline for submitting Form XE8 depends on the specific refund period. It is important to check the instructions provided with the form or consult the CRA for the deadline.

Q: How long does it take to receive a refund?

A: The processing time for a refund may vary. It is advisable to contact the CRA for information on the expected processing time.

Q: Is there a fee for filing Form XE8?

A: No, there is no fee for filing Form XE8.

Q: What supporting documents do I need to submit with Form XE8?

A: You may need to provide copies of receipts and invoices as supporting documents to prove the gasoline purchases.