This version of the form is not currently in use and is provided for reference only. Download this version of

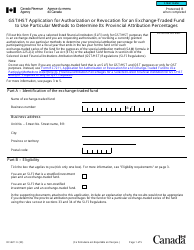

Form GST10

for the current year.

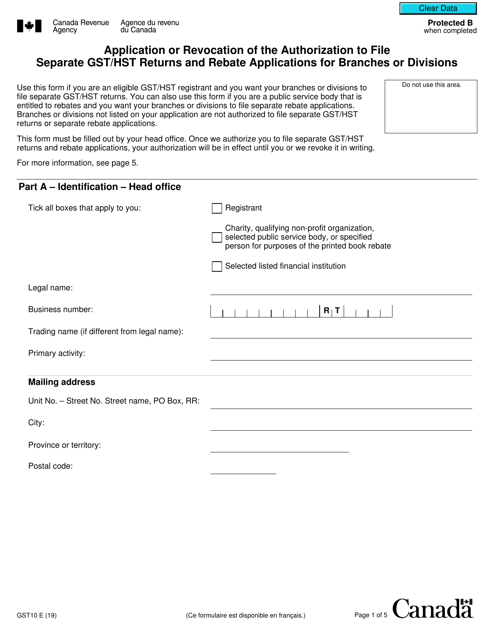

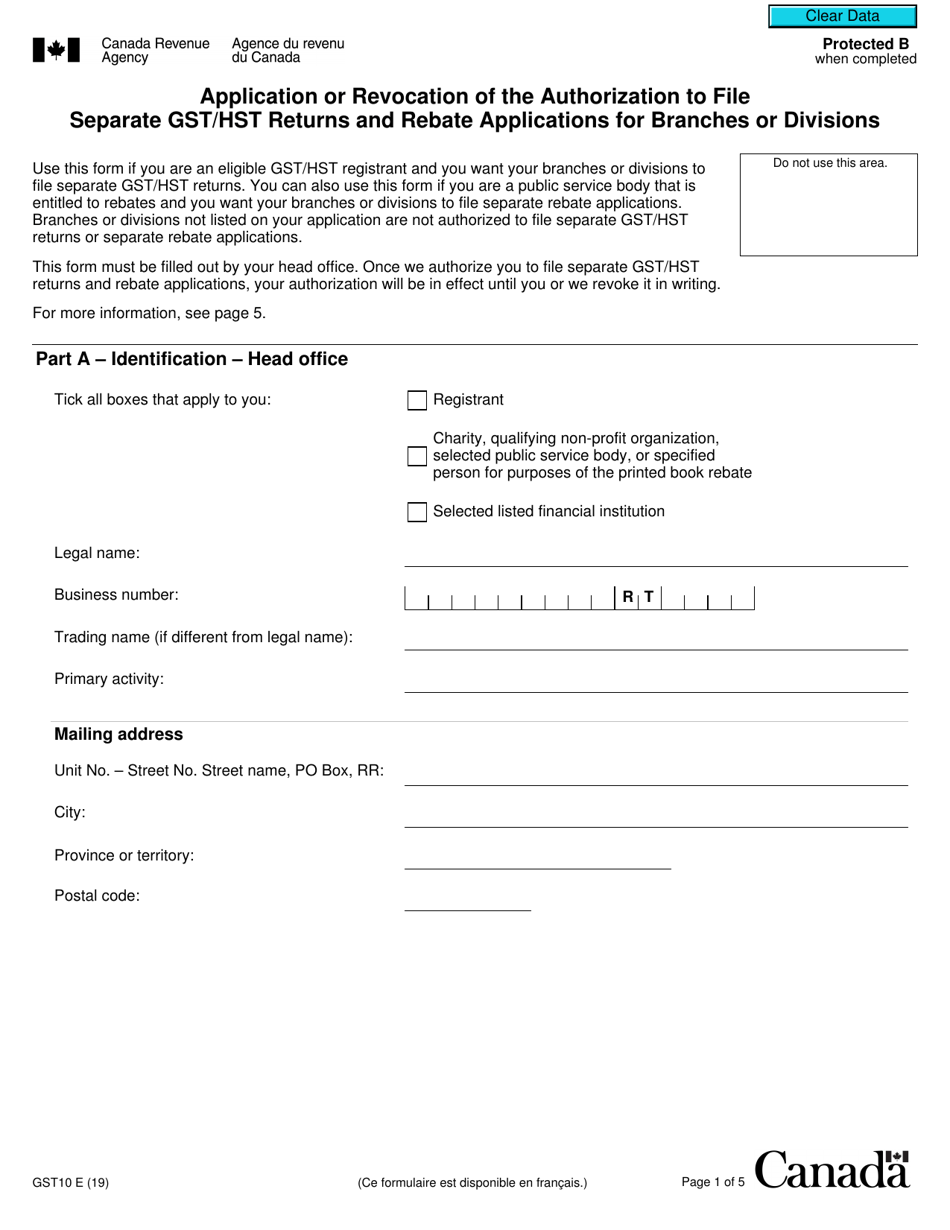

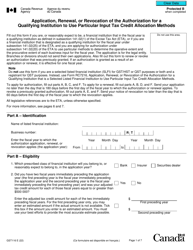

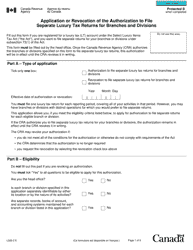

Form GST10 Application or Revocation of the Authorization to File Separate Gst / Hst Returns and Rebate Applications for Branches or Divisions - Canada

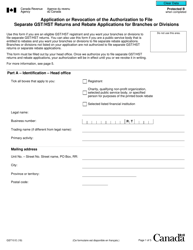

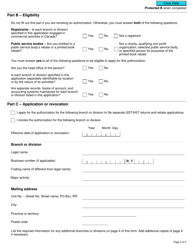

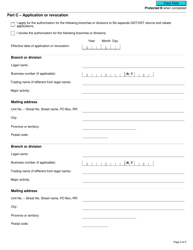

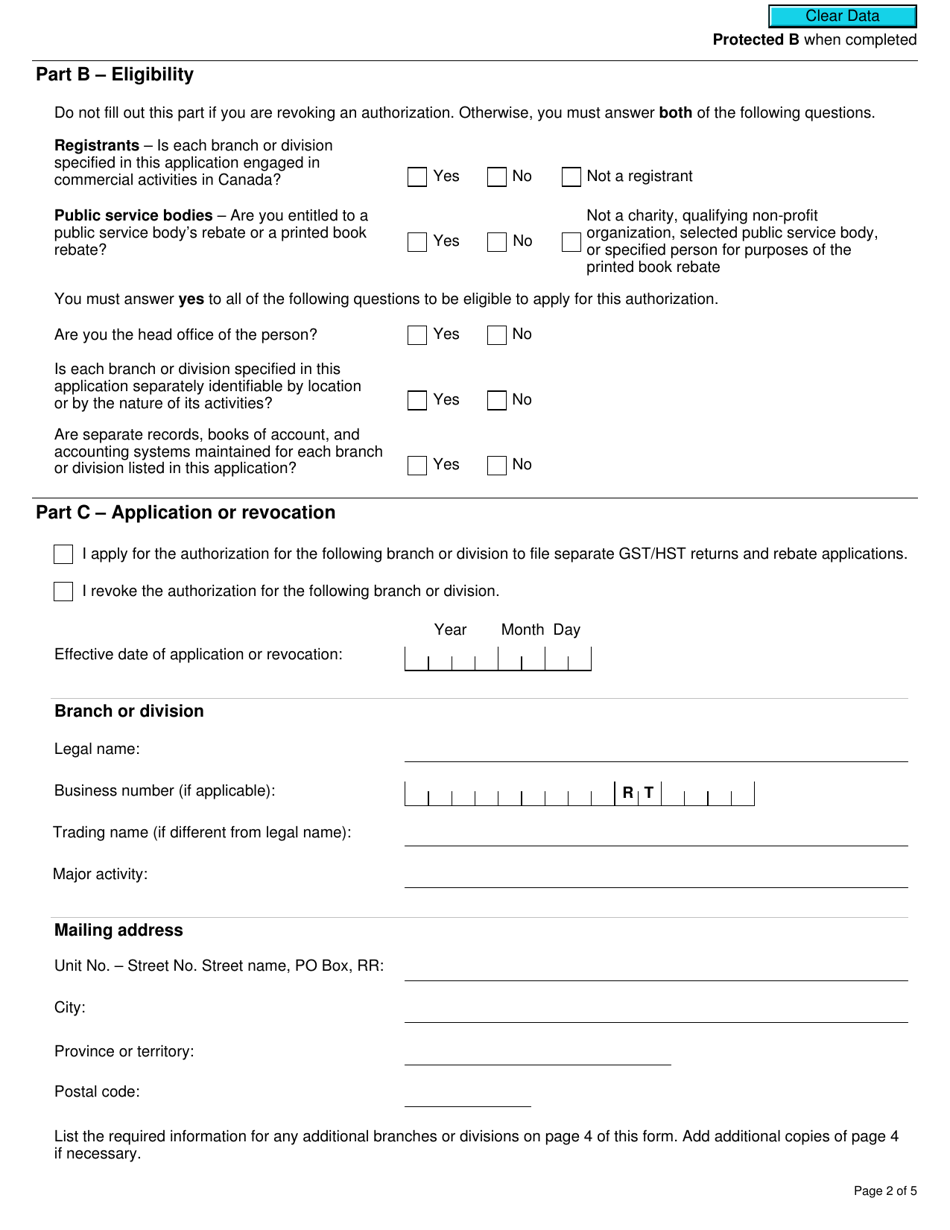

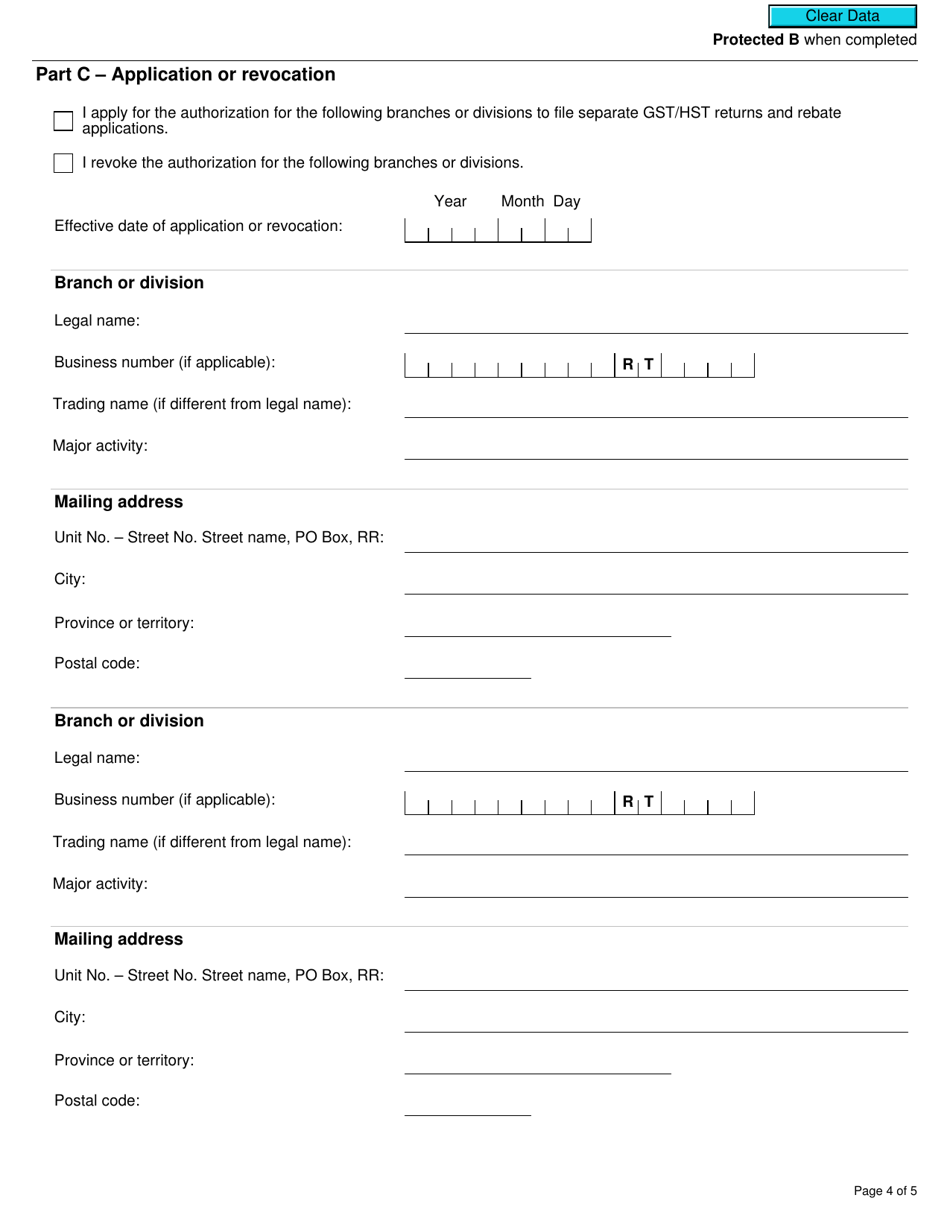

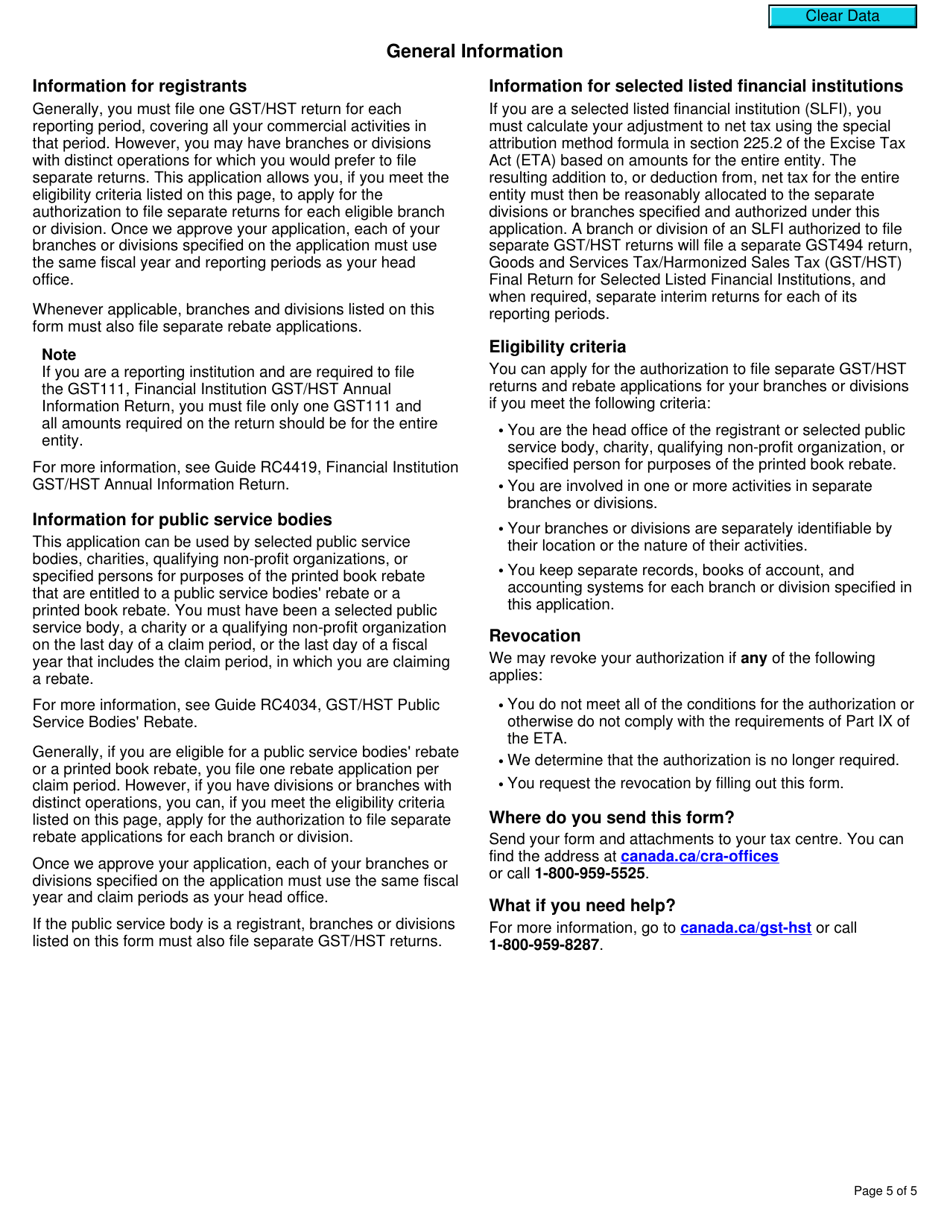

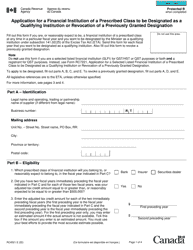

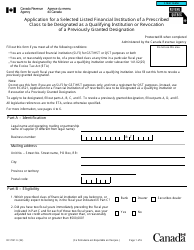

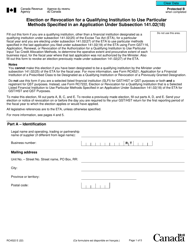

Form GST10 Application or Revocation of the Authorization to File Separate GST/HST Returns and Rebate Applications for Branches or Divisions in Canada is used to request or cancel the authorization to file separate GST/HST returns and rebate applications for branches or divisions of a business. This form allows businesses to manage their tax reporting separately for different branches or divisions.

The Form GST10 is filed by the authorized representative of the business applying for or revoking authorization to file separate GST/HST returns and rebate applications for its branches or divisions in Canada.

FAQ

Q: What is Form GST10 used for?

A: Form GST10 is used for the application or revocation of the authorization to file separate GST/HST returns and rebate applications for branches or divisions in Canada.

Q: Who can use Form GST10?

A: Any business in Canada that has branches or divisions and wishes to file separate GST/HST returns and rebate applications for them can use Form GST10.

Q: How do I fill out Form GST10?

A: You need to provide your business information, details of the branches or divisions, and indicate whether you are applying for or revoking the authorization.

Q: Is there a fee to submit Form GST10?

A: No, there is no fee to submit Form GST10.

Q: How long does it take for the CRA to process Form GST10?

A: Processing times may vary, but the CRA aims to process Form GST10 within 45 calendar days.

Q: Can I submit Form GST10 electronically?

A: Yes, you can submit Form GST10 electronically through the CRA's My Business Account or Represent a Client portals.

Q: Can I make changes to my authorization after submitting Form GST10?

A: Yes, you can make changes to your authorization by submitting a new Form GST10.