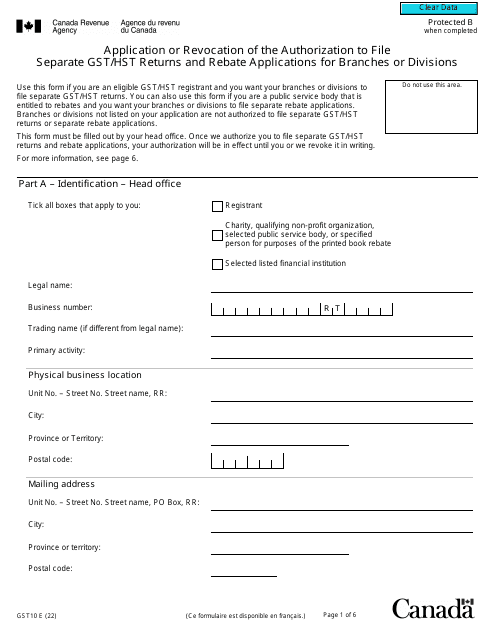

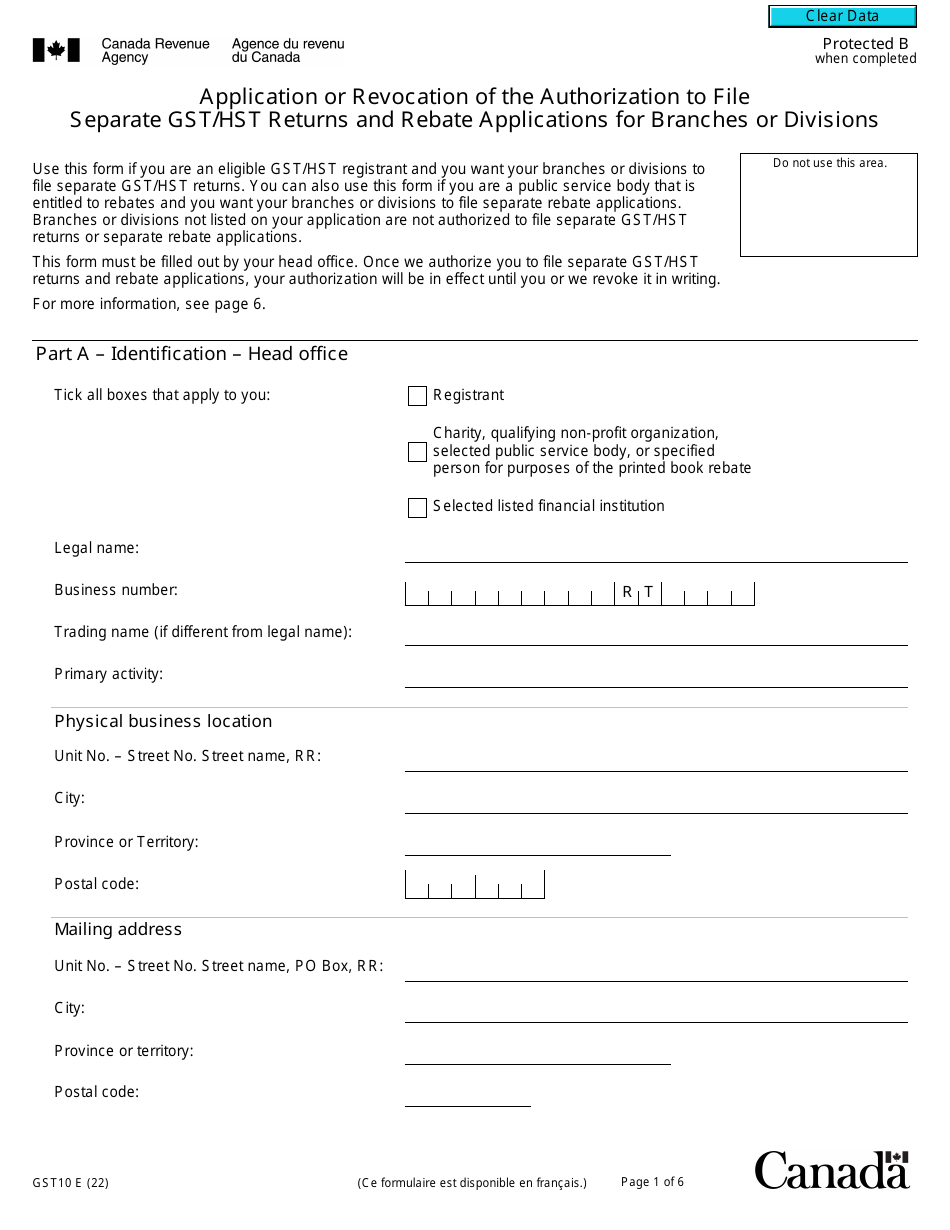

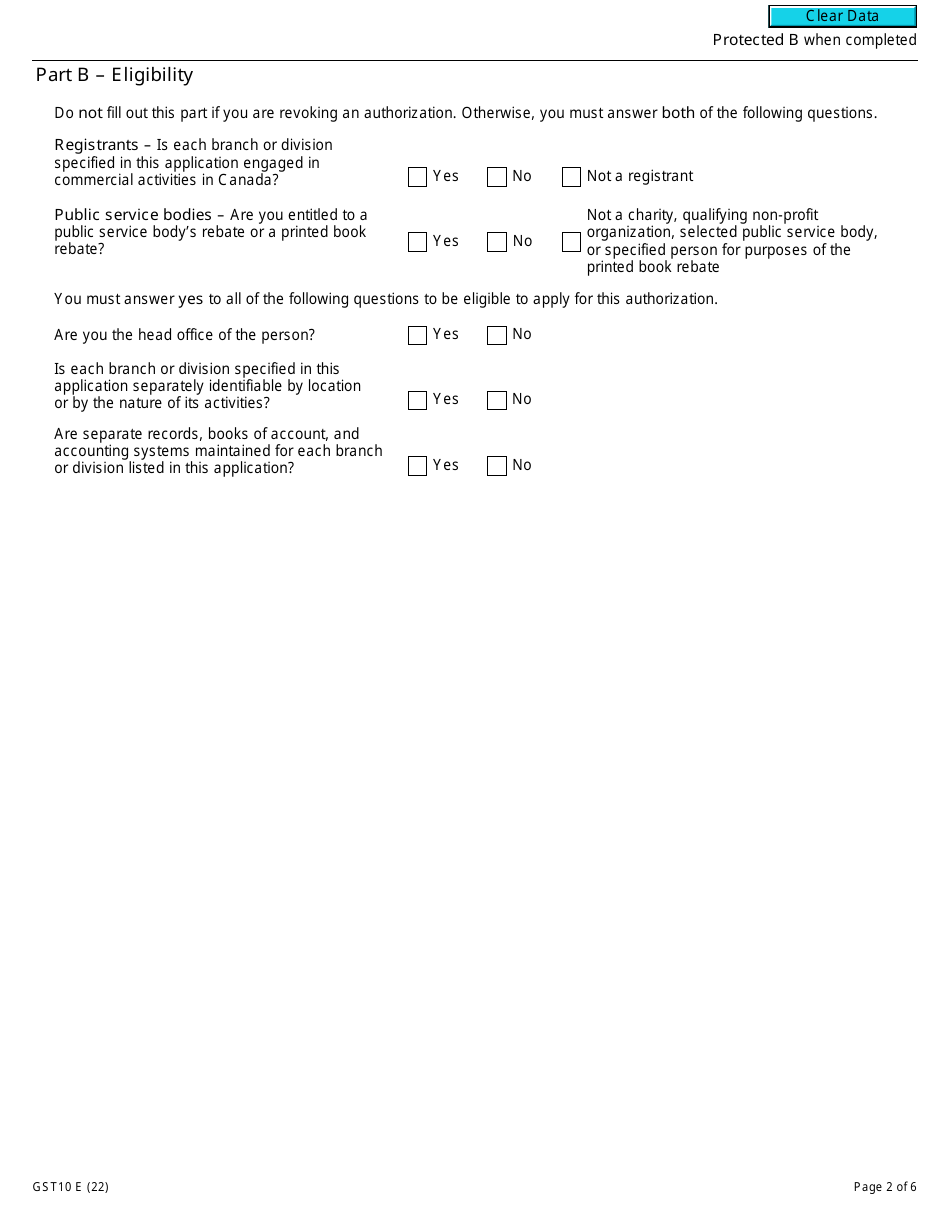

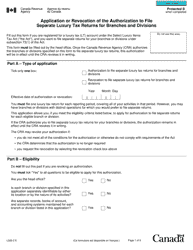

Form GST10 Application or Revocation of the Authorization to File Separate Gst / Hst Returns and Rebate Applications for Branches or Divisions - Canada

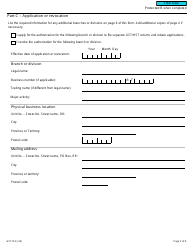

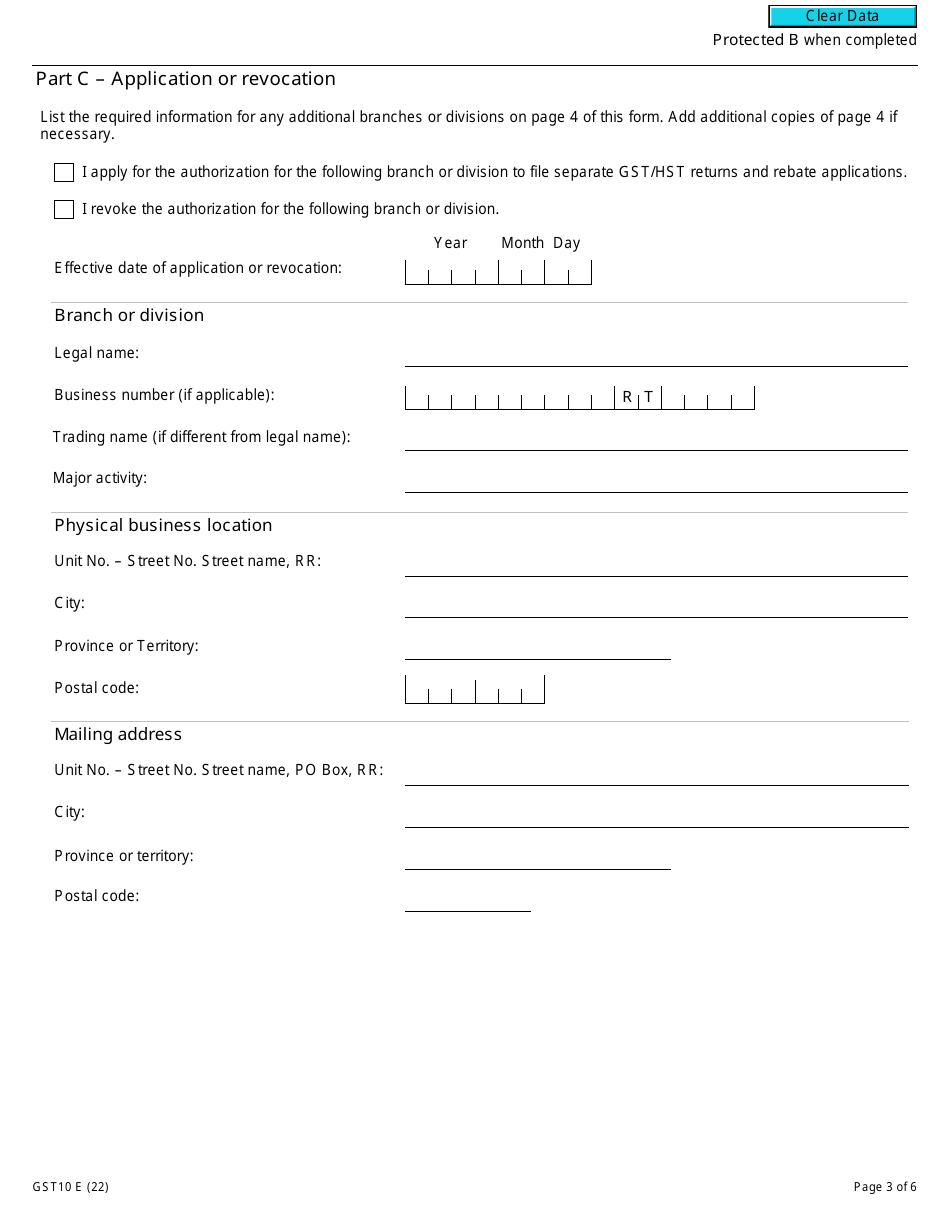

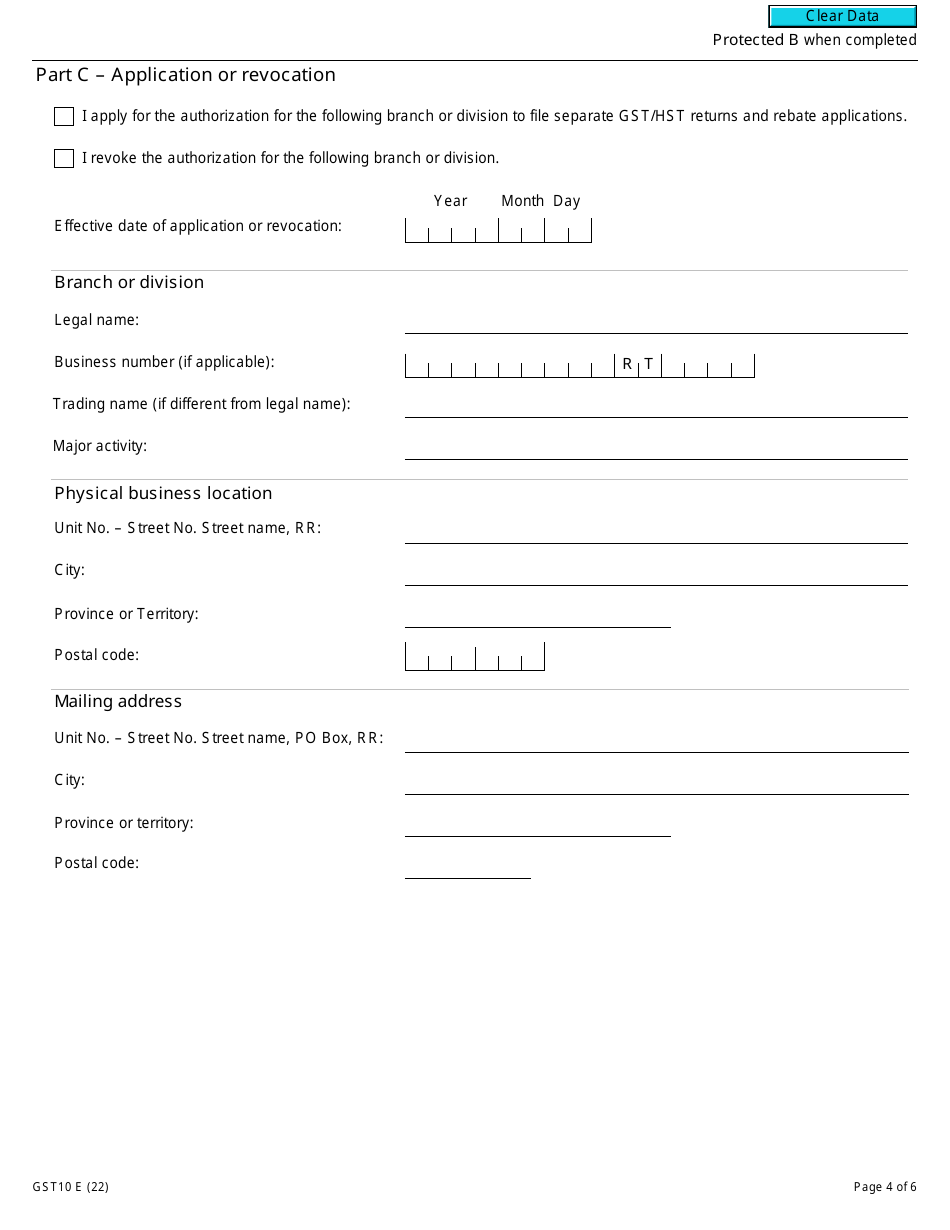

Form GST10 in Canada is used to either apply for or revoke the authorization to file separate GST/HST returns and rebate applications for branches or divisions of a business. This form allows businesses to separate their taxes and rebates according to different branches or divisions within their organization.

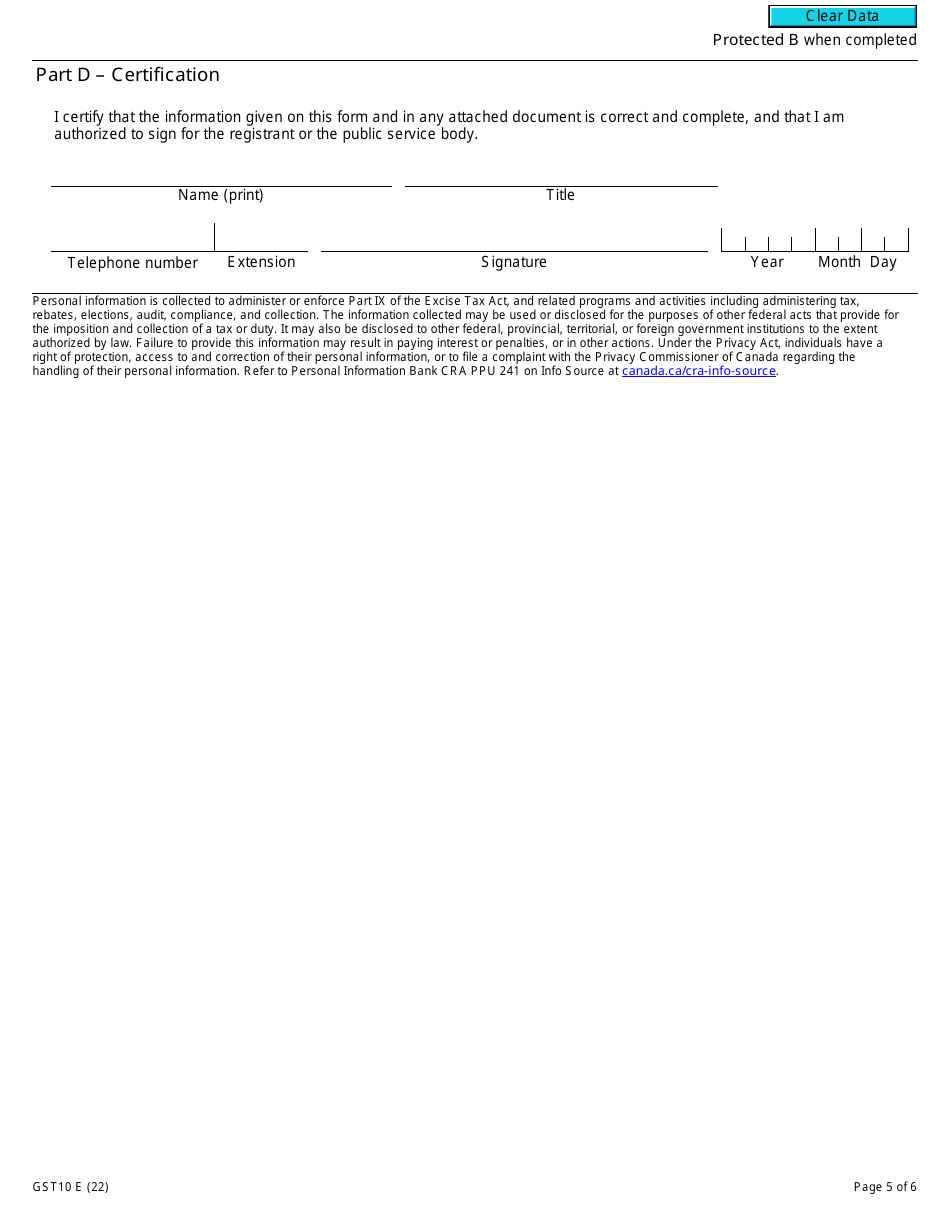

The authorized representative of the company or organization files the Form GST10 Application or Revocation of the Authorization to File Separate GST/HST Returns and Rebate Applications for Branches or Divisions in Canada.

Form GST10 Application or Revocation of the Authorization to File Separate Gst/Hst Returns and Rebate Applications for Branches or Divisions - Canada - Frequently Asked Questions (FAQ)

Q: What is Form GST10?

A: Form GST10 is the application or revocation of the authorization to file separate GST/HST returns and rebate applications for branches or divisions in Canada.

Q: Who needs to file Form GST10?

A: Any business in Canada that wants to file separate GST/HST returns and rebate applications for its branches or divisions needs to file Form GST10.

Q: What is the purpose of Form GST10?

A: The purpose of Form GST10 is to allow businesses in Canada to authorize or revoke the authorization to file separate GST/HST returns and rebate applications for their branches or divisions.

Q: Are there any fees associated with filing Form GST10?

A: No, there are no fees associated with filing Form GST10.

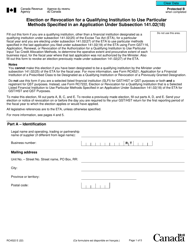

Q: What information do I need to provide on Form GST10?

A: You will need to provide information about your business, including its name, address, and business number. You will also need to provide details about your branches or divisions.

Q: Is Form GST10 mandatory?

A: No, filing Form GST10 is not mandatory. It is optional for businesses that want to file separate GST/HST returns and rebate applications for their branches or divisions.