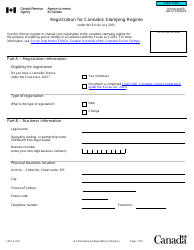

This version of the form is not currently in use and is provided for reference only. Download this version of

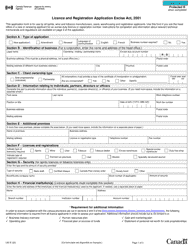

Form B256

for the current year.

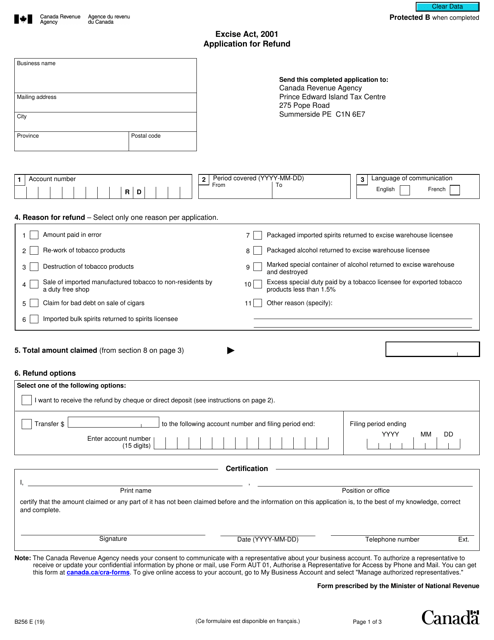

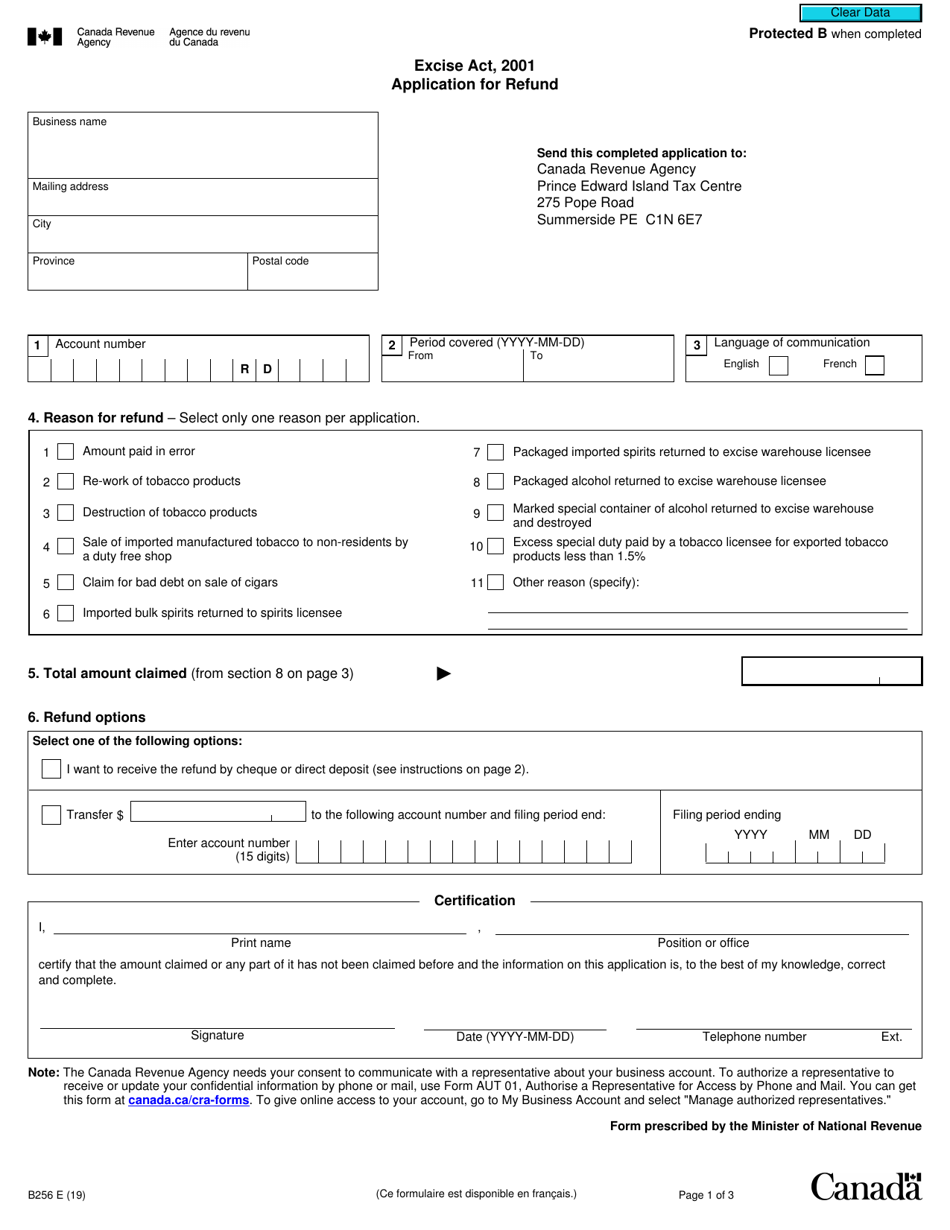

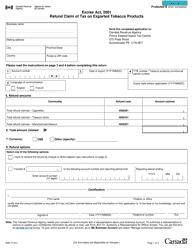

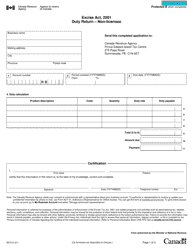

Form B256 Excise Act, 2001 - Application for Refund - Canada

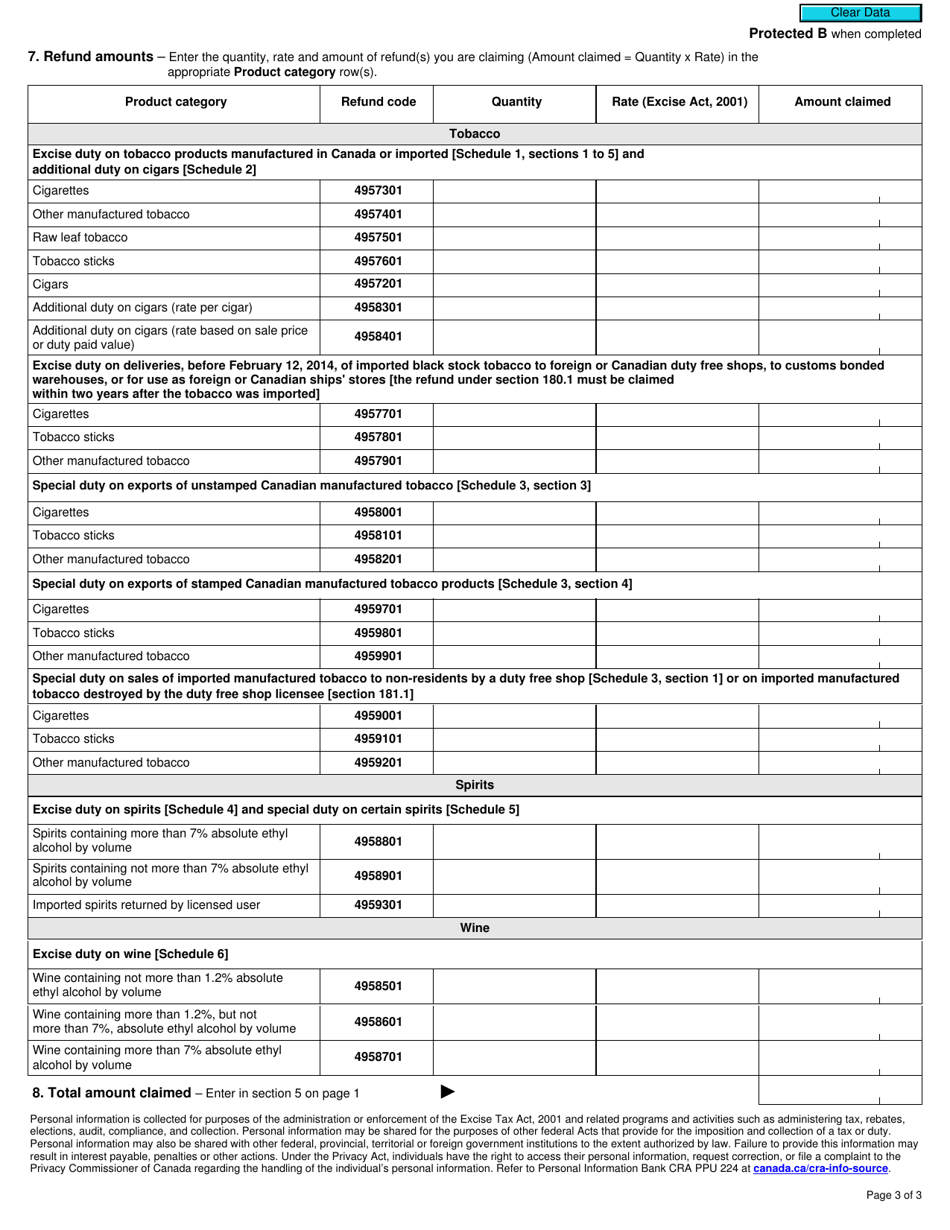

Form B256 Excise Act, 2001 - Application for Refund is used in Canada to claim a refund for certain excise taxes that have been overpaid or wrongly collected. It allows individuals or businesses to request a refund for excise taxes related to specific products or activities.

The Form B256 Excise Act, 2001 - Application for Refund in Canada is filed by individuals or businesses who are seeking a refund for excise taxes paid.

FAQ

Q: What is Form B256?

A: Form B256 is an Application for Refund under the Excise Act, 2001 in Canada.

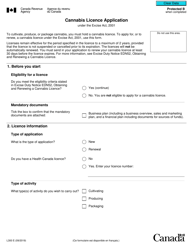

Q: What is the Excise Act, 2001?

A: The Excise Act, 2001 is a Canadian law that governs various excise taxes and duties.

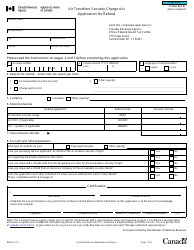

Q: What can I use Form B256 for?

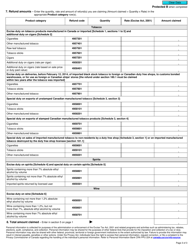

A: Form B256 can be used to apply for a refund of excise taxes or duties paid under the Excise Act, 2001.

Q: Who can use Form B256?

A: Any individual or corporation that has paid excise taxes or duties under the Excise Act, 2001 in Canada can use Form B256.

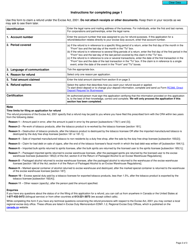

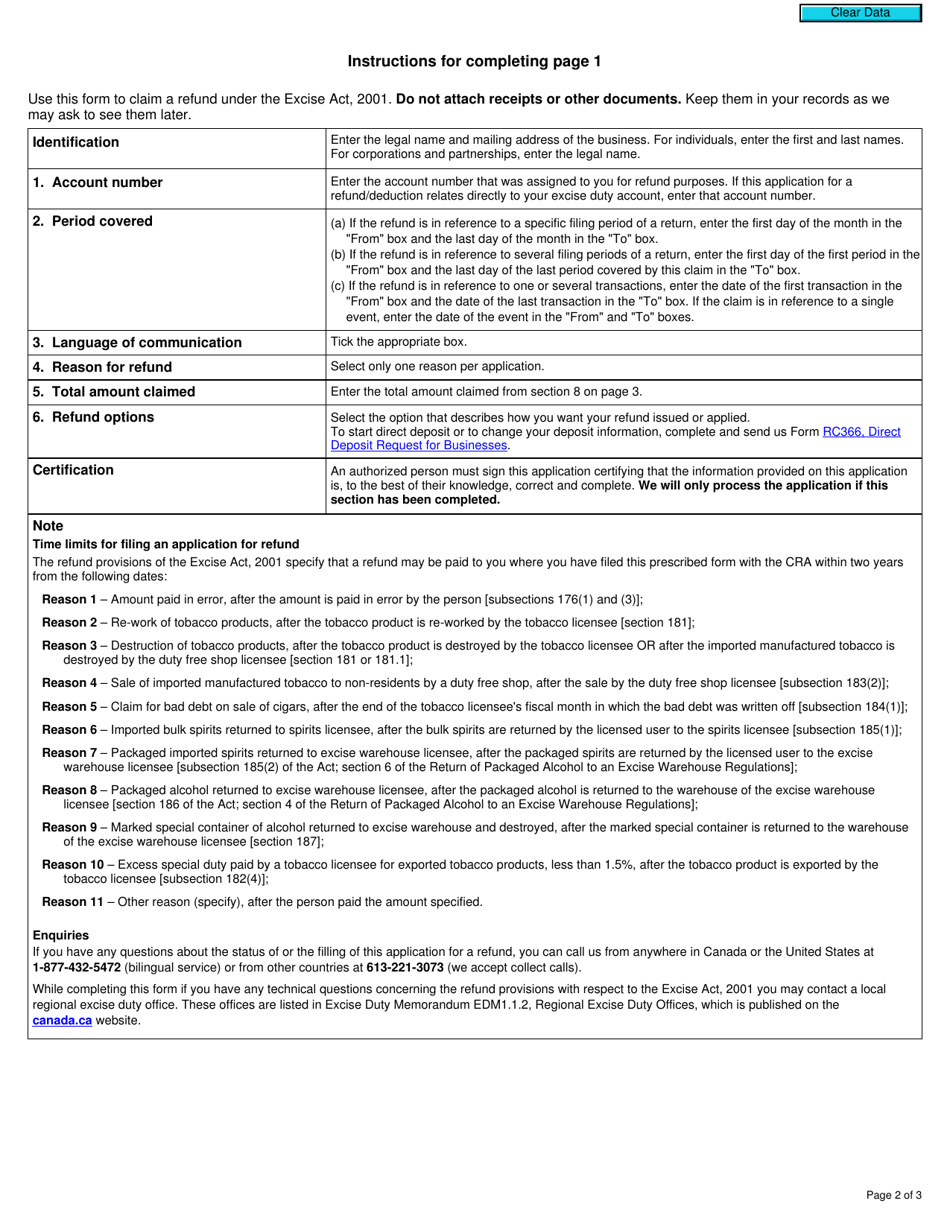

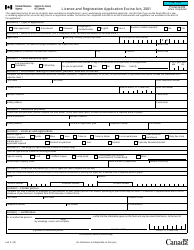

Q: What information is required on Form B256?

A: Form B256 requires information such as the type and amount of excise taxes or duties paid, the reason for the refund, and supporting documentation.

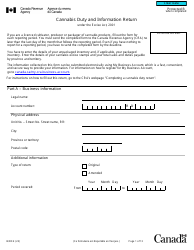

Q: Is there a deadline for submitting Form B256?

A: Yes, there is a deadline for submitting Form B256. It must be filed within four years from the date the excise taxes or duties were paid.

Q: How long does it take to process a refund application using Form B256?

A: The processing time for a refund application using Form B256 can vary, but it typically takes several weeks to several months.