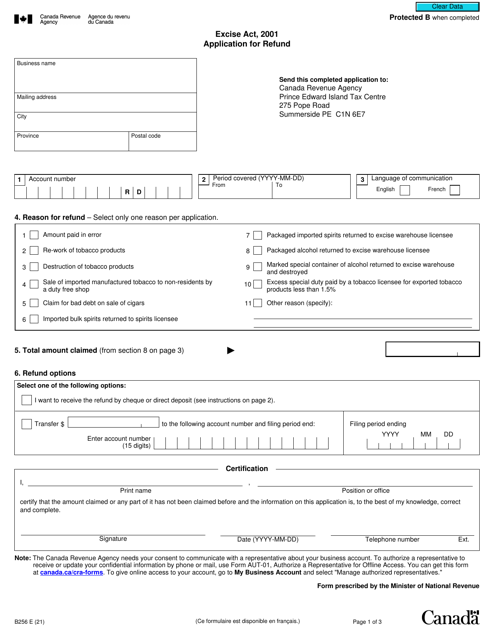

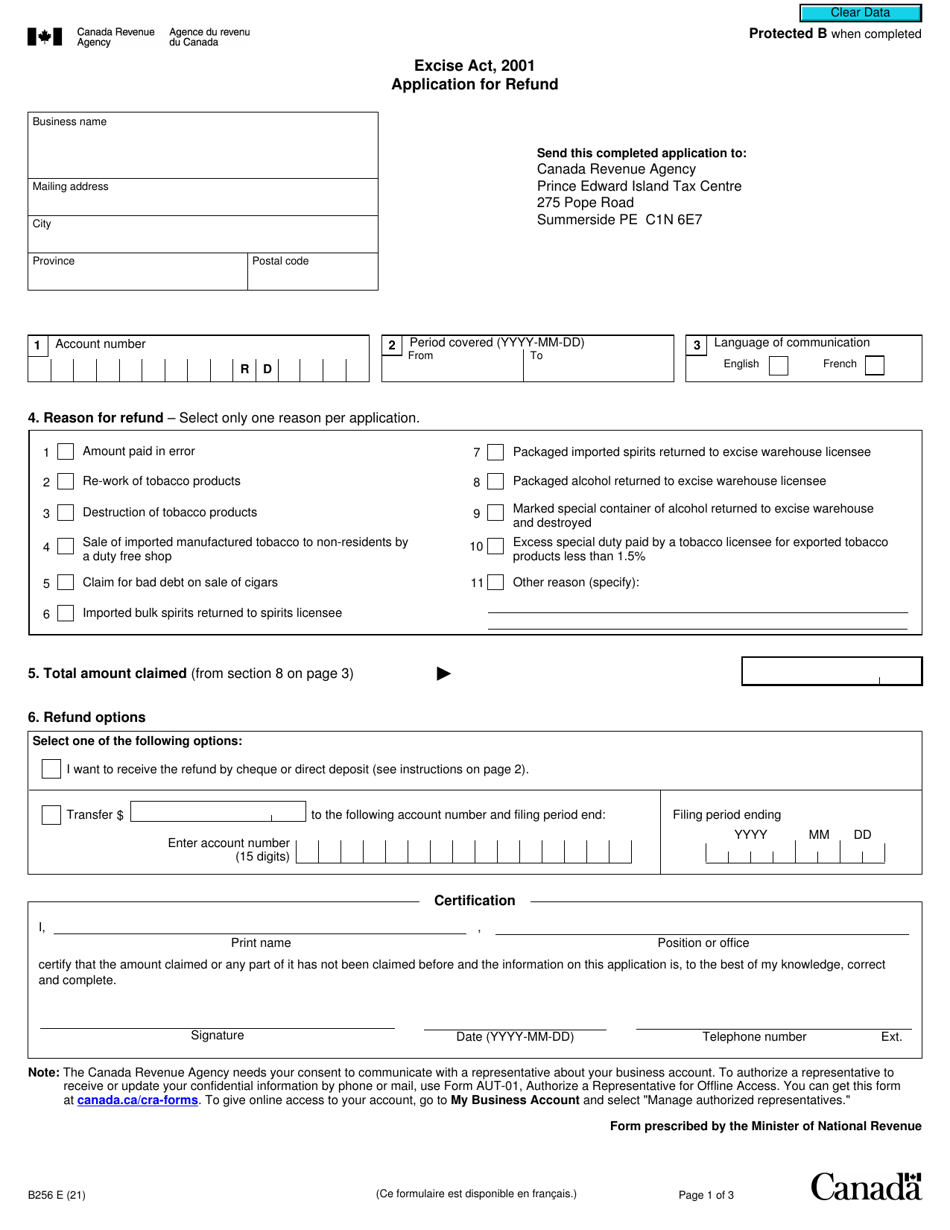

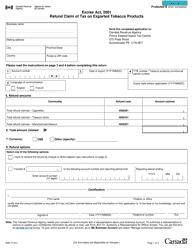

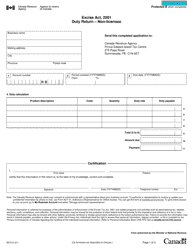

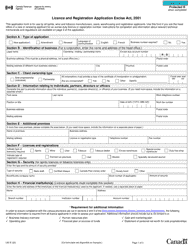

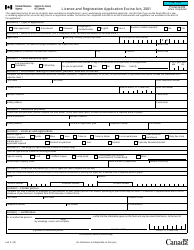

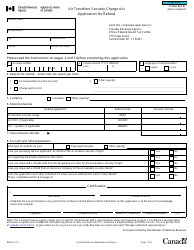

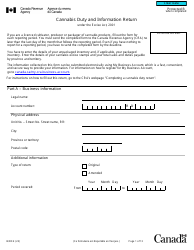

Form B256 Excise Act, 2001 - Application for Refund - Canada

Form B256 Excise Act, 2001 - Application for Refund is used in Canada to request a refund of excise tax paid on specific goods or services.

The Form B256 Excise Act, 2001 - Application for Refund in Canada is filed by individuals or businesses who are seeking a refund for excise taxes paid.

Form B256 Excise Act, 2001 - Application for Refund - Canada - Frequently Asked Questions (FAQ)

Q: What is Form B256? A: Form B256 is an application for refund under the Excise Act, 2001 in Canada.

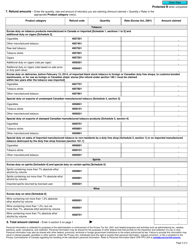

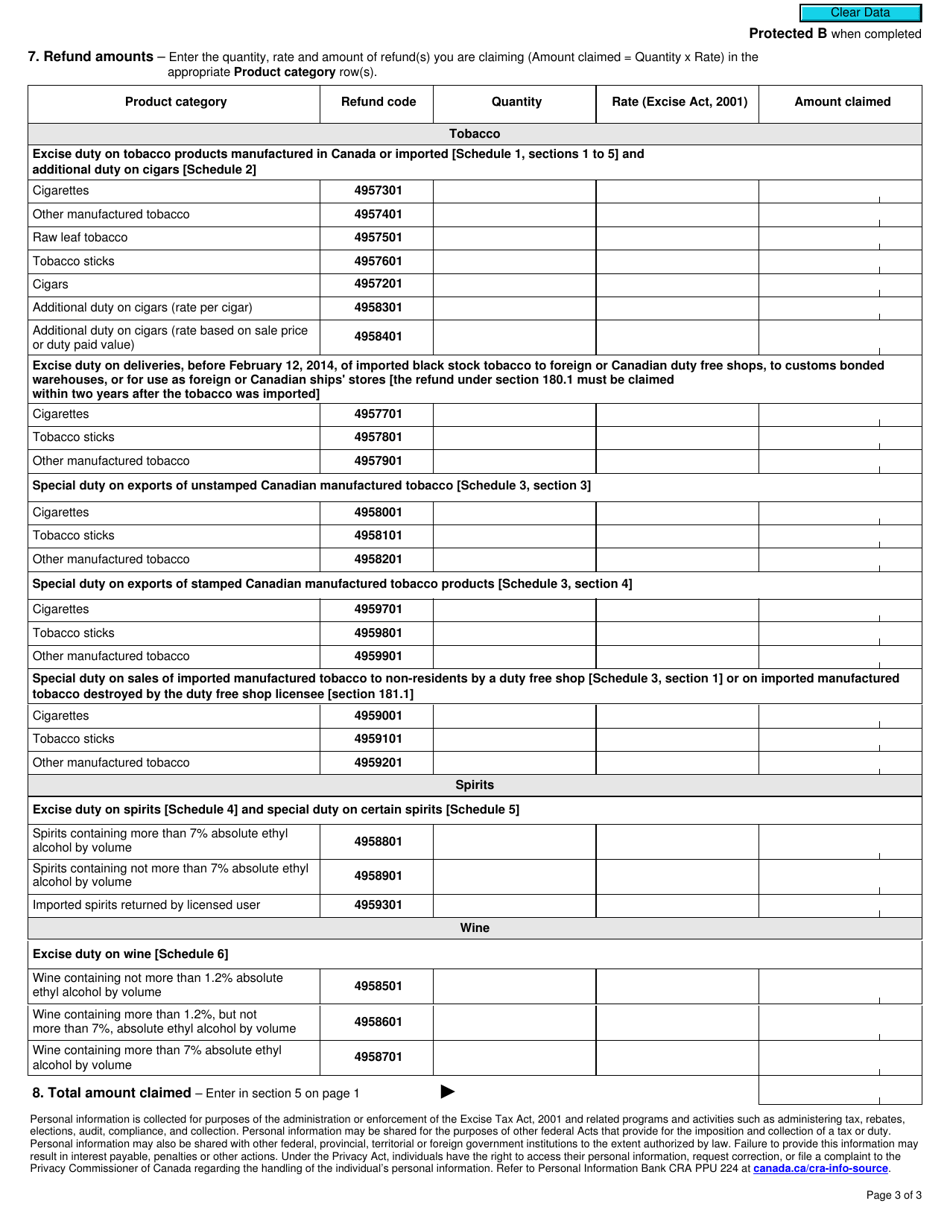

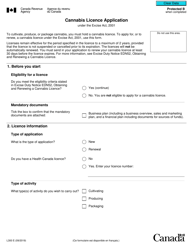

Q: What is the Excise Act, 2001? A: The Excise Act, 2001 is a Canadian law that governs the collection of excise taxes on specific goods, such as alcohol and tobacco.

Q: Who can use Form B256? A: Form B256 can be used by individuals or businesses that are eligible for a refund under the Excise Act, 2001.

Q: What types of refunds can be claimed using Form B256? A: Form B256 is used to claim refunds for excise taxes paid on specific goods, such as alcohol and tobacco.

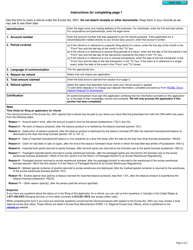

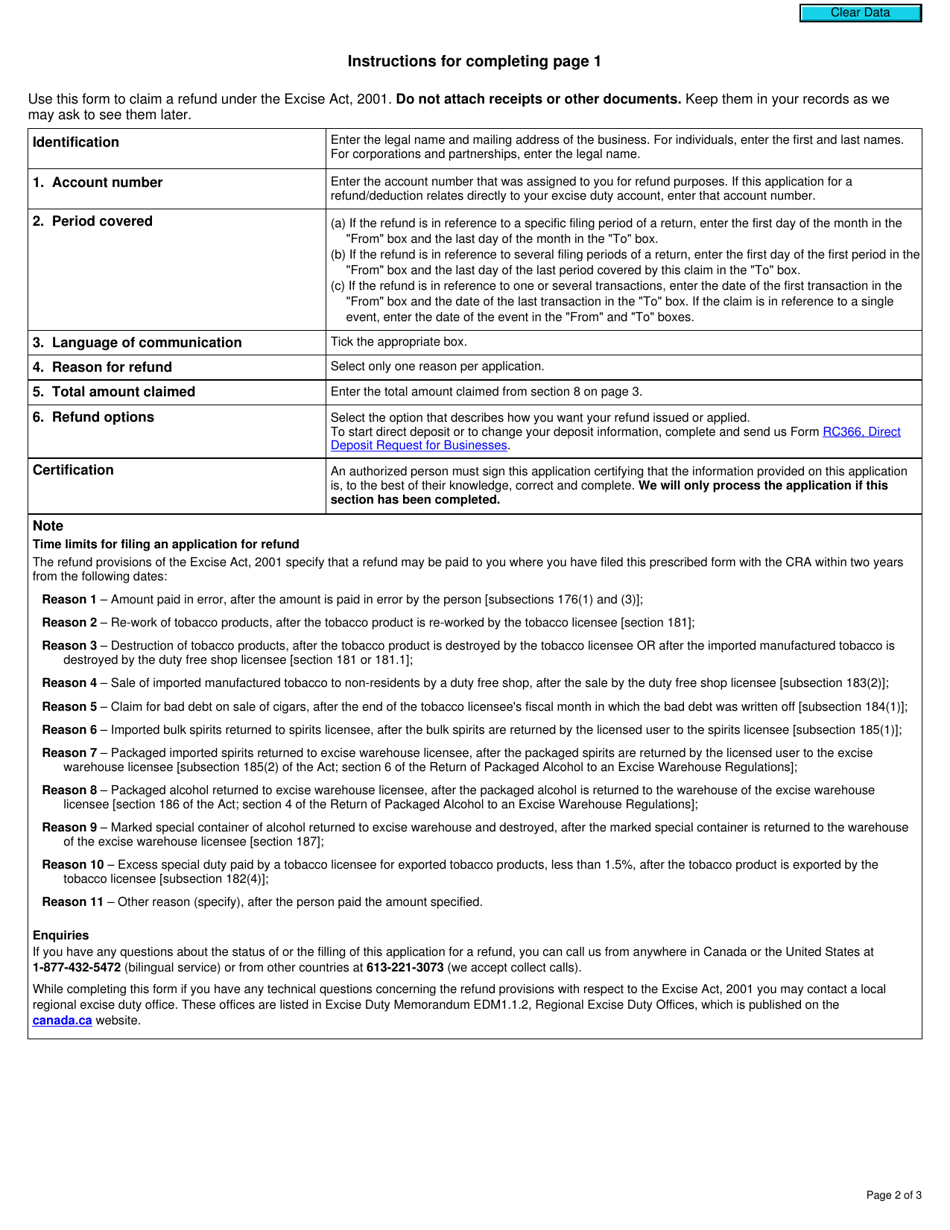

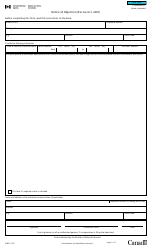

Q: What information is required on Form B256? A: Form B256 requires information such as the taxpayer's name, contact information, the amount of refund being claimed, and supporting documentation.

Q: How long does it take to process a refund claim with Form B256? A: The processing time for a refund claim using Form B256 can vary, but the CRA aims to process most claims within 90 days.

Q: Can I get assistance with filling out Form B256? A: Yes, you can contact the CRA for assistance with filling out Form B256 or seek help from a tax professional.

Q: Are there any deadlines for filing Form B256? A: It is important to file Form B256 within the specified timeframe outlined by the CRA to ensure eligibility for a refund.