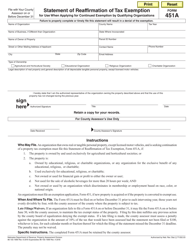

This version of the form is not currently in use and is provided for reference only. Download this version of

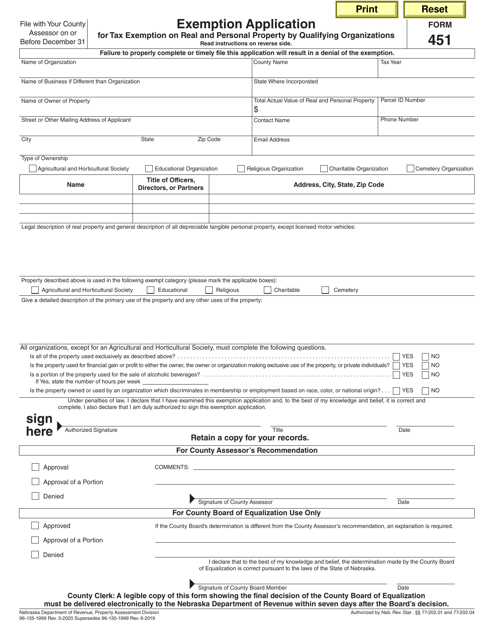

Form 451

for the current year.

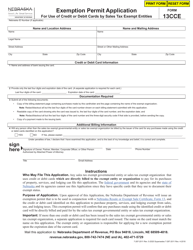

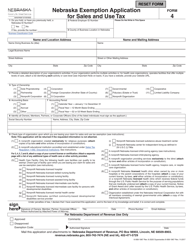

Form 451 Exemption Application for Tax Exemption on Real and Personal Property by Qualifying Organizations - Nebraska

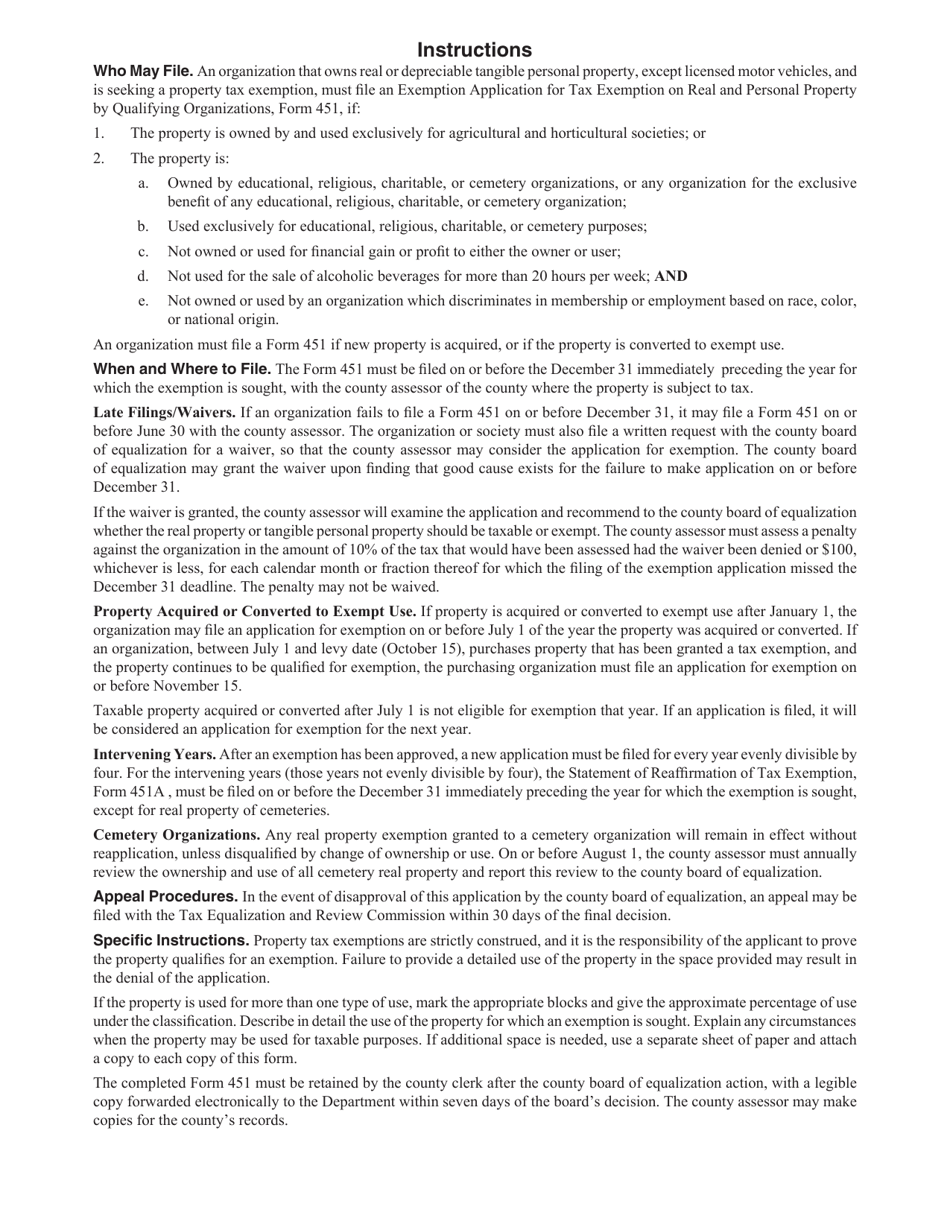

What Is Form 451?

This is a legal form that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 451?

A: Form 451 is an application for tax exemption on real and personal property.

Q: Who can use Form 451?

A: Qualifying organizations in Nebraska can use Form 451 to apply for tax exemption on real and personal property.

Q: What does tax exemption on real and personal property mean?

A: Tax exemption means that qualifying organizations are not required to pay property taxes on their real and personal property.

Q: What are qualifying organizations?

A: Qualifying organizations include non-profit or charitable organizations that meet the criteria set by the state of Nebraska.

Q: How do I complete Form 451?

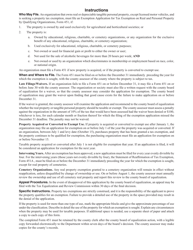

A: You need to provide information about your organization, its purpose, assets, and use of the property. Detailed instructions are provided with the form.

Q: Is there a deadline for filing Form 451?

A: Yes, Form 451 should be filed by December 31st of each year to receive tax exemption for the following year.

Q: Are there any fees associated with filing Form 451?

A: There is no fee for filing Form 451.

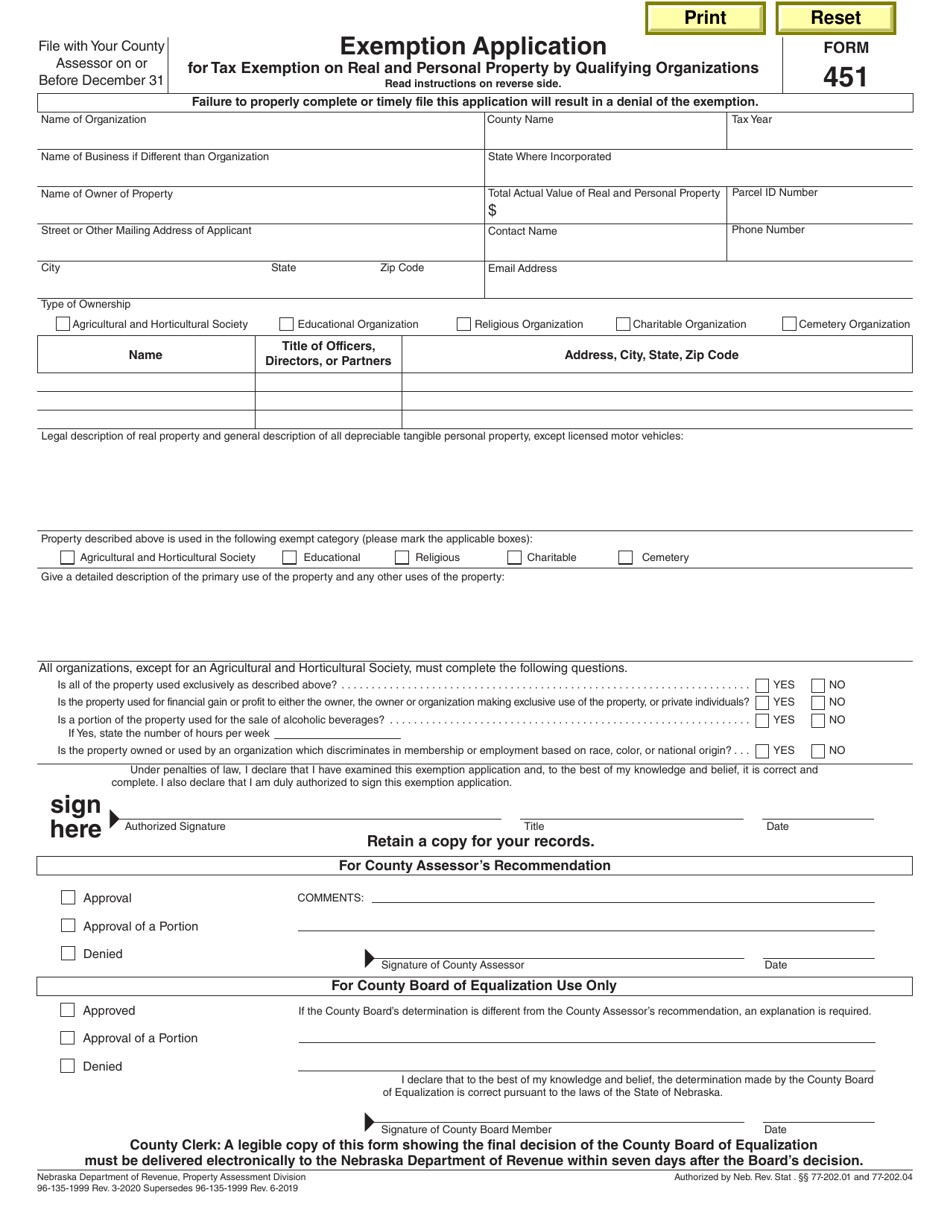

Q: What happens after I submit Form 451?

A: The Nebraska Department of Revenue will review your application and notify you of their decision.

Q: Can I appeal if my application is denied?

A: Yes, you can appeal the decision within 30 days of receiving the denial notice.

Form Details:

- Released on March 1, 2020;

- The latest edition provided by the Nebraska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 451 by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.