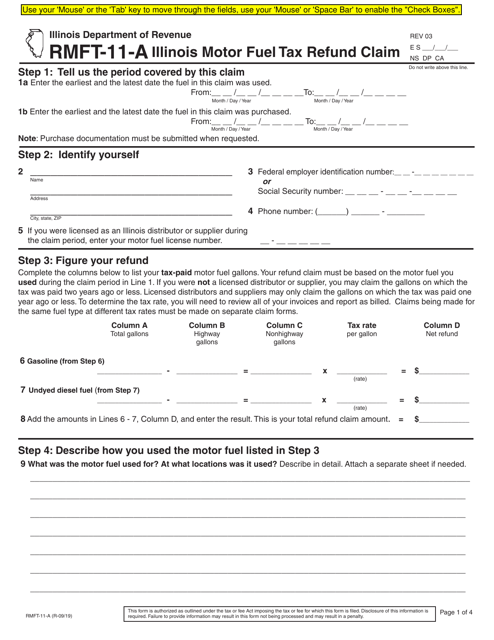

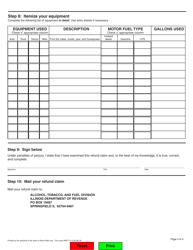

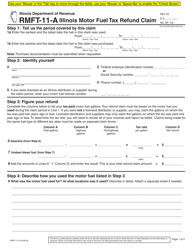

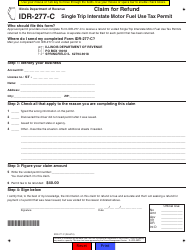

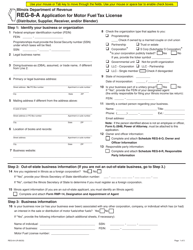

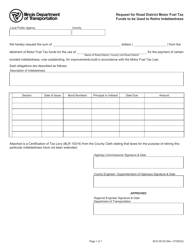

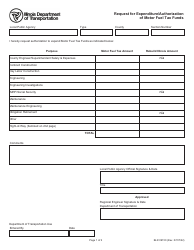

Form RMFT-11-A (REV03) Illinois Motor Fuel Tax Refund Claim - Illinois

What Is Form RMFT-11-A (REV03)?

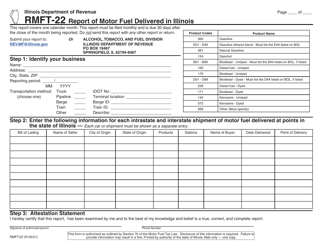

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RMFT-11-A?

A: Form RMFT-11-A is a tax refund claim form for Illinois Motor Fuel Tax.

Q: Who can use Form RMFT-11-A?

A: This form can be used by individuals or businesses that are eligible for a refund of Illinois Motor Fuel Tax.

Q: What is the purpose of Form RMFT-11-A?

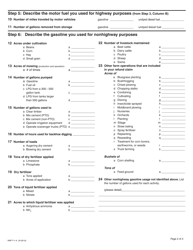

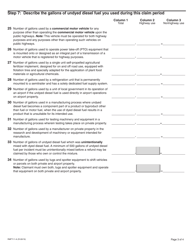

A: The purpose of this form is to claim a refund for Illinois Motor Fuel Tax paid on fuels used for certain purposes as outlined in the form.

Q: Which version of Form RMFT-11-A should I use?

A: Use the most recent version of Form RMFT-11-A, which is currently REV03.

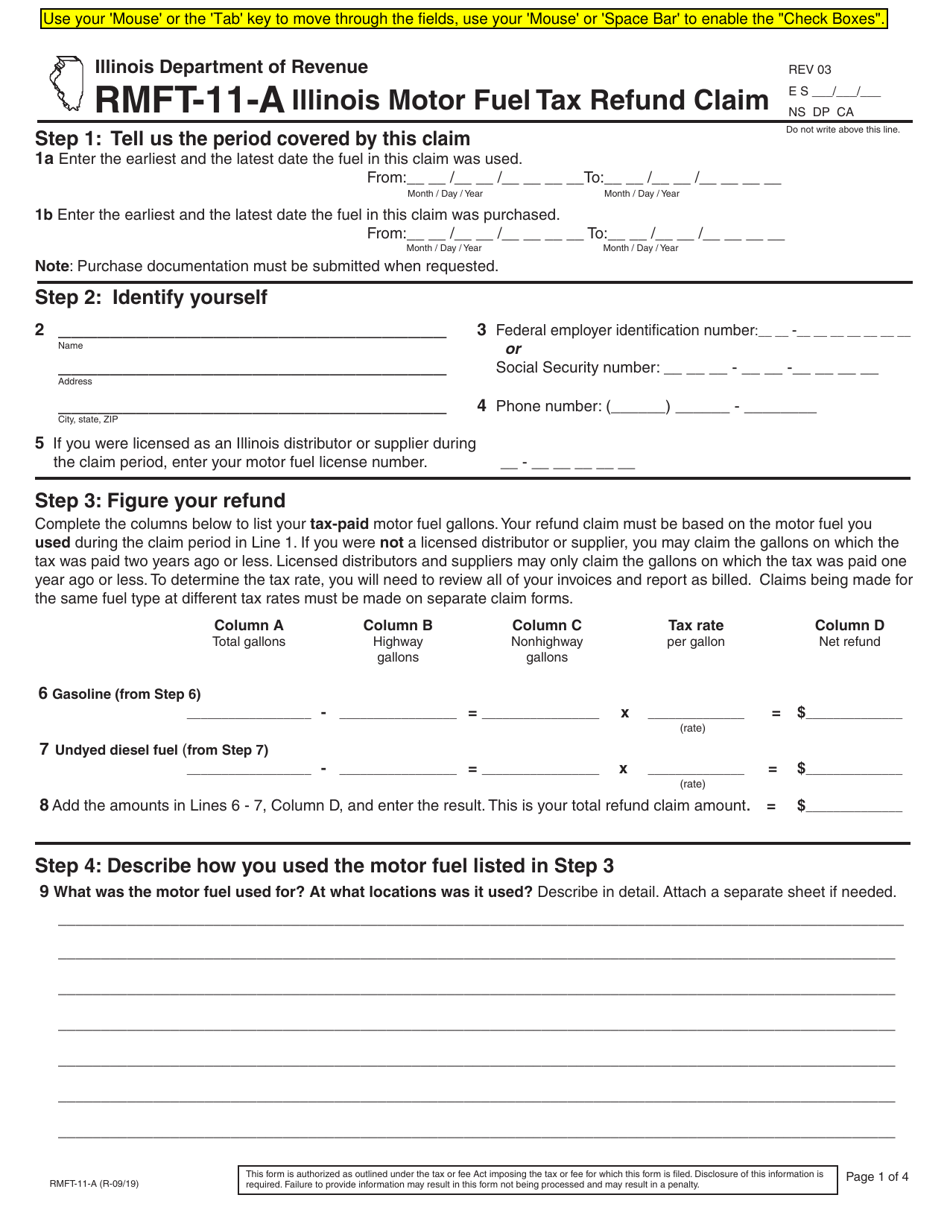

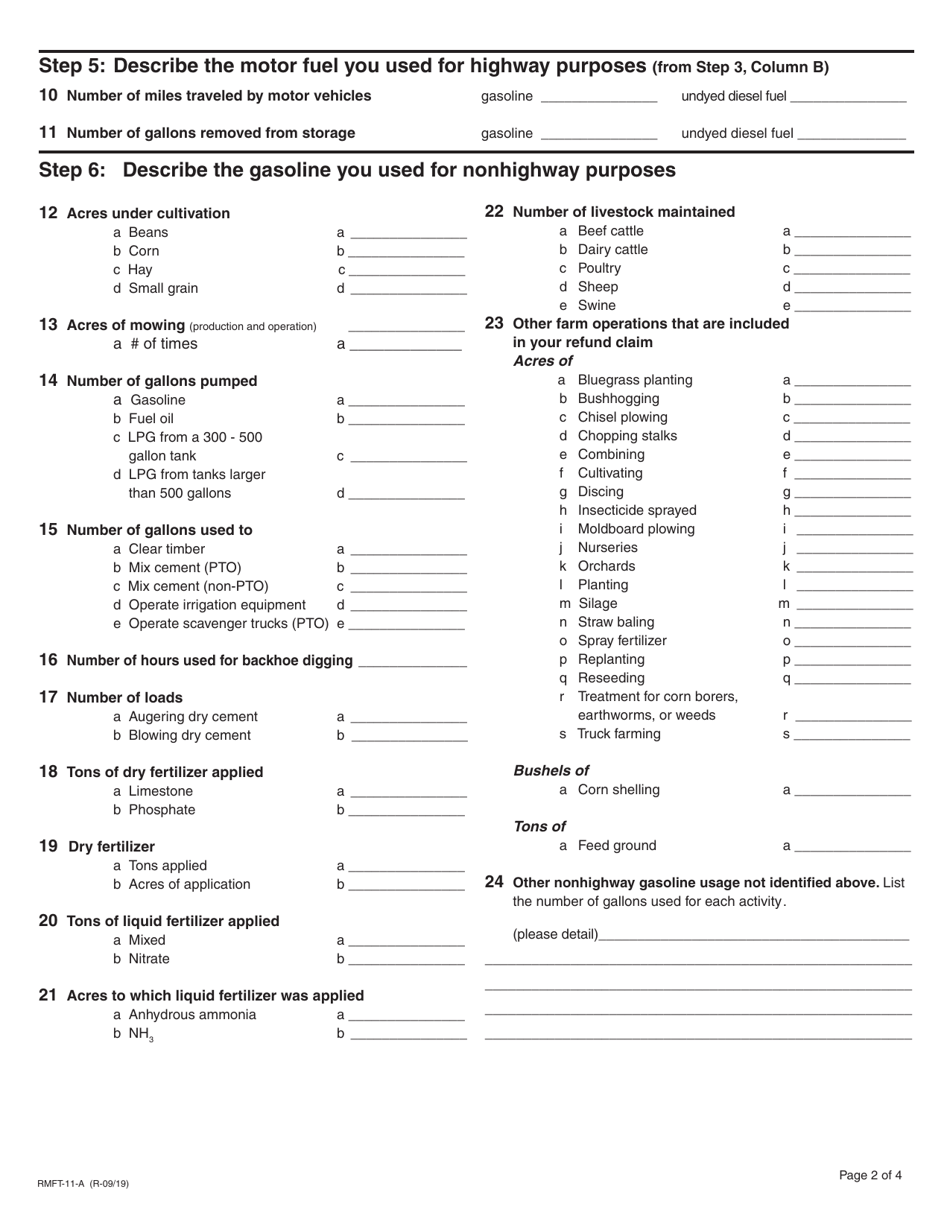

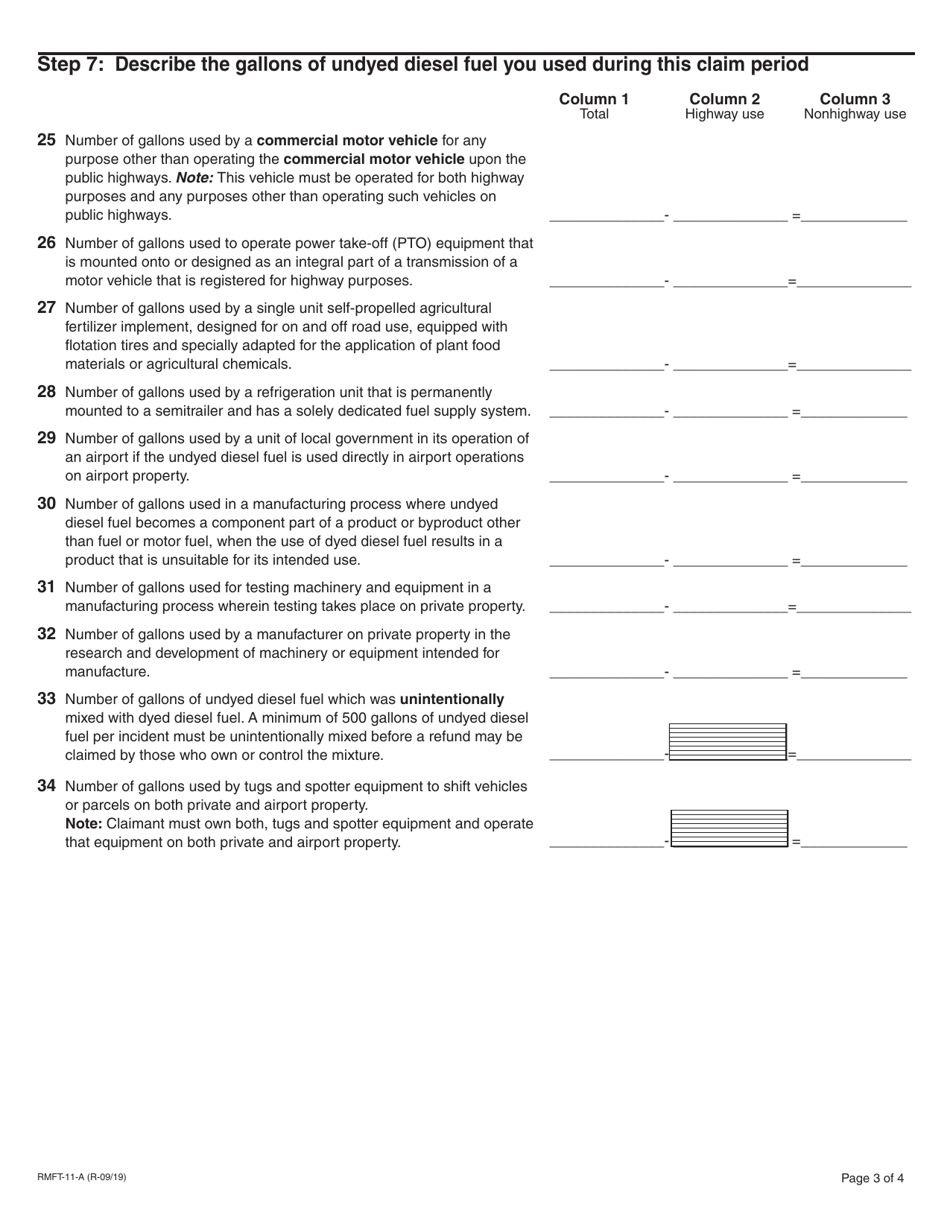

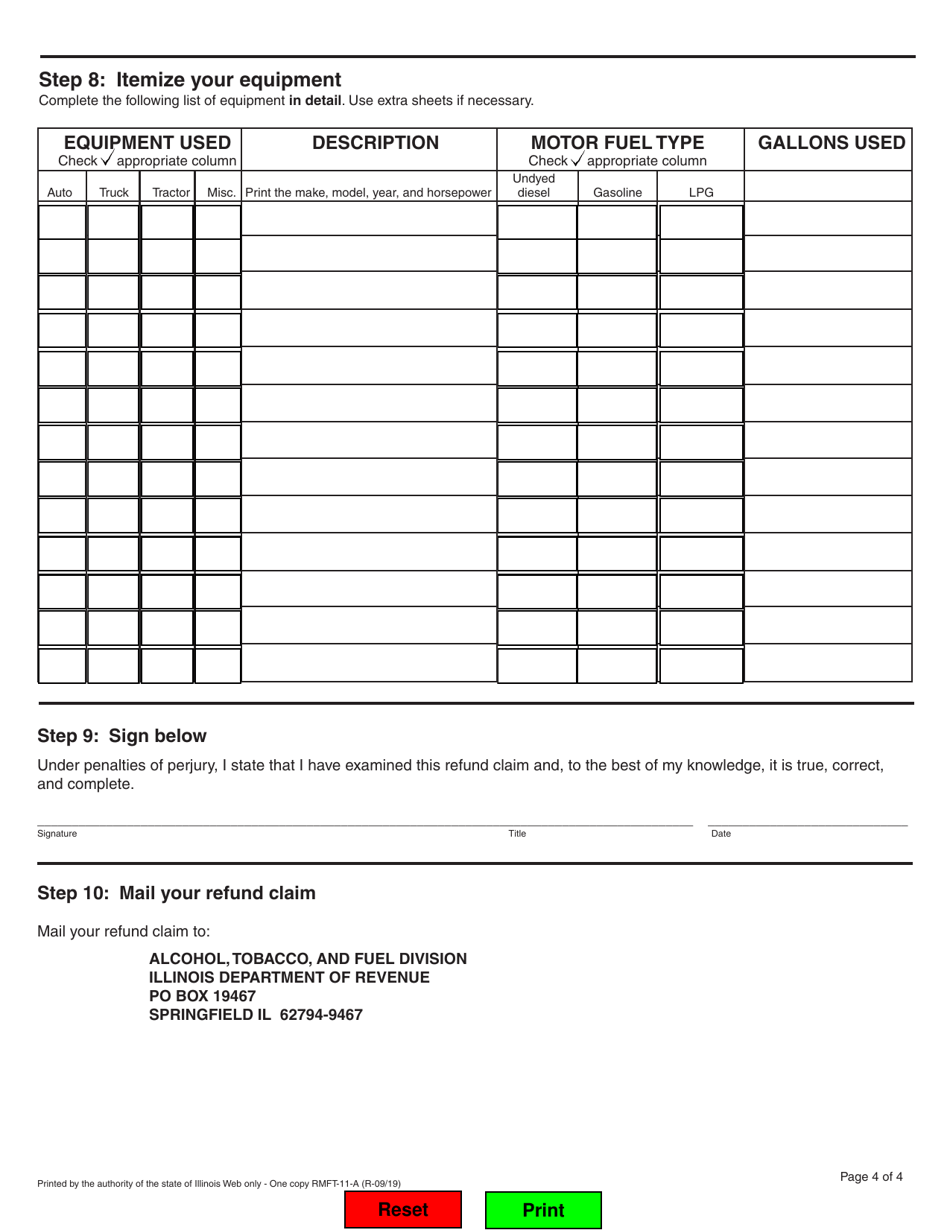

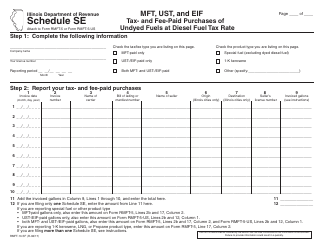

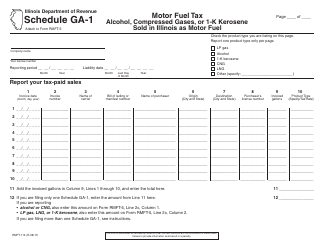

Q: What information do I need to provide on Form RMFT-11-A?

A: You will need to provide information such as your name, address, tax identification number, details of the fuel purchases, and supporting documentation.

Q: How do I submit Form RMFT-11-A?

A: You can submit Form RMFT-11-A by mail to the Illinois Department of Revenue, Motor Fuel Refunds Section.

Q: When is the deadline to file Form RMFT-11-A?

A: The deadline to file Form RMFT-11-A is within three years from the date of purchase of the fuel.

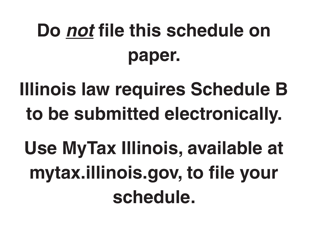

Q: Can I e-file Form RMFT-11-A?

A: No, currently e-filing is not available for Form RMFT-11-A. It must be filed by mail.

Form Details:

- Released on September 1, 2019;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RMFT-11-A (REV03) by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.