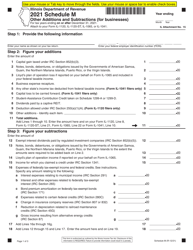

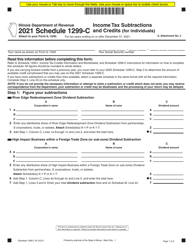

Instructions for Form IL-1040 Schedule M Other Additions and Subtractions for Individuals - Illinois

This document contains official instructions for Form IL-1040 Schedule M, Other Additions and Subtractions for Individuals - a form released and collected by the Illinois Department of Revenue. An up-to-date fillable Form IL-1040 Schedule M is available for download through this link.

FAQ

Q: What is Form IL-1040 Schedule M?

A: Form IL-1040 Schedule M is a schedule that accompanies the Illinois Individual Income Tax Return (Form IL-1040).

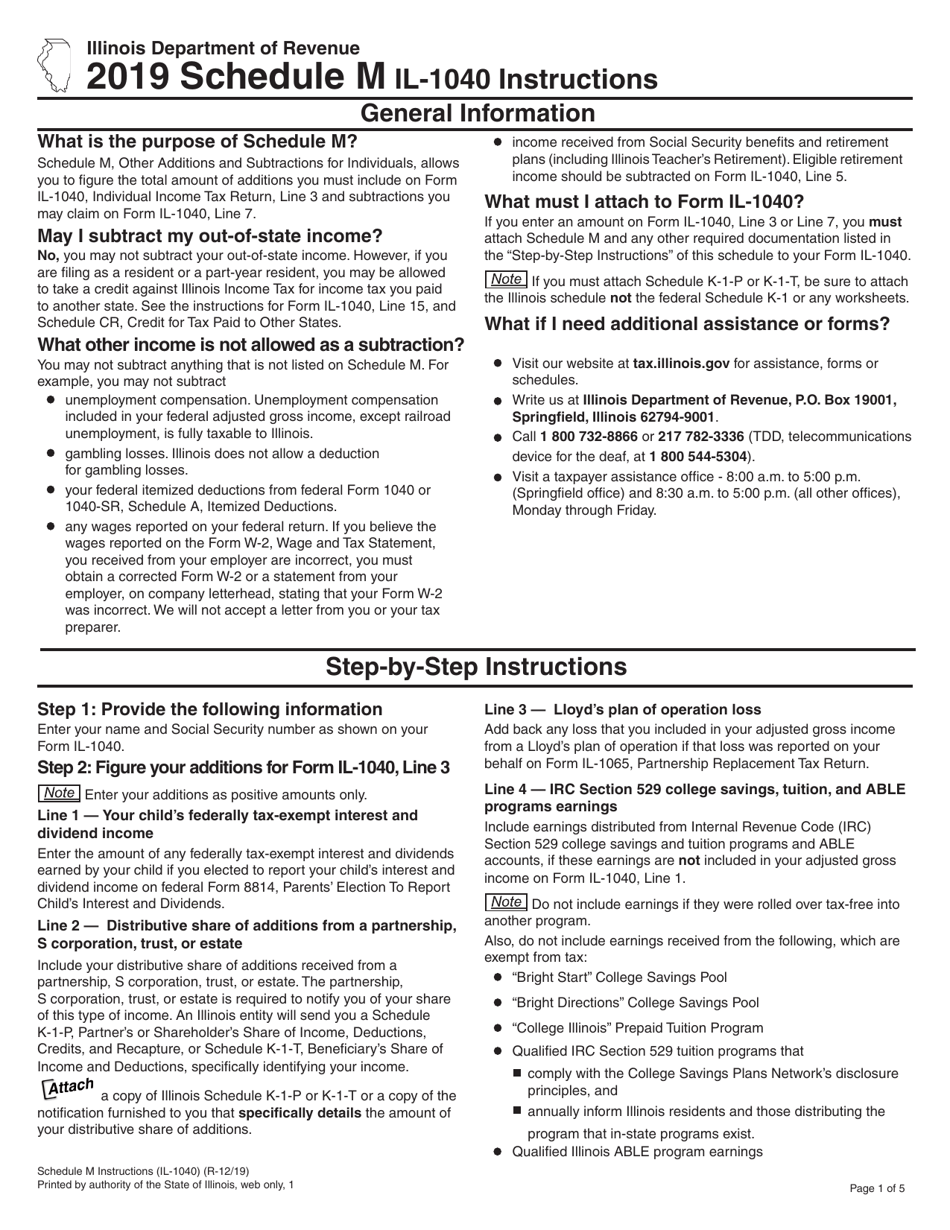

Q: What is the purpose of Form IL-1040 Schedule M?

A: Form IL-1040 Schedule M is used to report any other additions and subtractions that need to be made to your Illinois taxable income.

Q: Who is required to file Form IL-1040 Schedule M?

A: Anyone who needs to make additional additions or subtractions to their Illinois taxable income must file Form IL-1040 Schedule M.

Q: What types of additions can be reported on Form IL-1040 Schedule M?

A: Examples of additions that can be reported on Form IL-1040 Schedule M include taxable interest from U.S. obligations, net operating loss deductions, and certain retirement income.

Q: What types of subtractions can be reported on Form IL-1040 Schedule M?

A: Examples of subtractions that can be reported on Form IL-1040 Schedule M include certain retirement income, Social Security benefits, and certain contributions to retirement plans.

Instruction Details:

- This 5-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Illinois Department of Revenue.